The growth in intangible assets and the changing role of marketing compels boards to better understand how brands create business and shareholder value.

Brand equity and brand value are indicators of future income earning capacity, unlike traditional accounting which takes a more historical perspective of an organisation's performance. It is the marketing asset-related measures that are increasingly sought by financial analysts and investors to help understand the future health and prospects of a business.

Make strategic branding decisions using hard data. See our consulting services to find out more about what we do to help brands succeed. Or contact us directly. We love to talk.

Brand in the Boardroom

The key role of the board can be summarised as oversight of the organisation's governance and performance, with the objective of maximising prosperity, while acting in the interests of shareholders and stakeholders.

Ultimately the board is responsible and accountable for the company's results. This includes ensuring the organisation's assets are leveraged to maximise returns to create business and shareholder value while safeguarding against risk and impairment. The complexity of this task has been magnified through the increasing role and growth of the intangible assets of a business, which can account for the majority of an organisation's value.

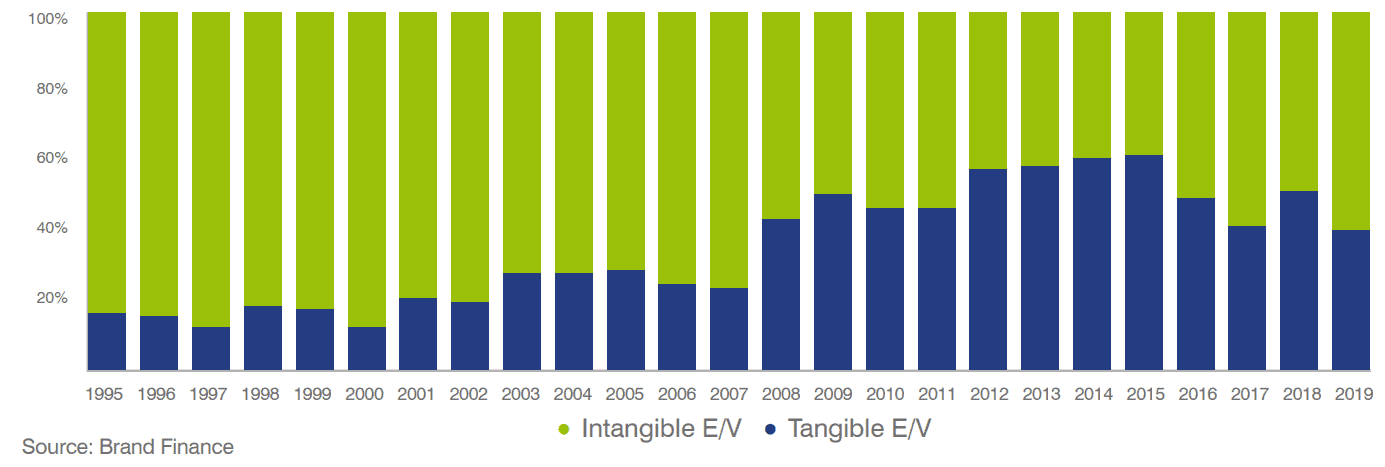

The past 30 years have witnessed a dramatic shift in the sources of value creation from tangible assets (e.g. property, plant, equipment, and inventory) to intangible assets (e.g. skilled employees, patents, business systems, and the focus of this article - brands). This is best reflected in the growing divergence between the net asset value of companies and their market capitalisation.

In the knowledge economy, intangible assets have become the key drivers of shareholder value, yet accounting rules have not kept pace.

While this is an ongoing issue for the accounting profession, from a commercial perspective, boards need to adapt their agenda to capture the value their organisation’s intangible assets generate, with specific reference to the brands they own and manage. The ISO Standard 106681 for brand valuation states that: “Intangible assets are recognised as highly valued properties. Arguably the most valuable, but least understood intangible assets are brands.”

Brand Finance’s 2019 edition of GIFT™ reports that intangible assets now account for 48% of overall enterprise value.

Intangible Assets and Financial Reporting

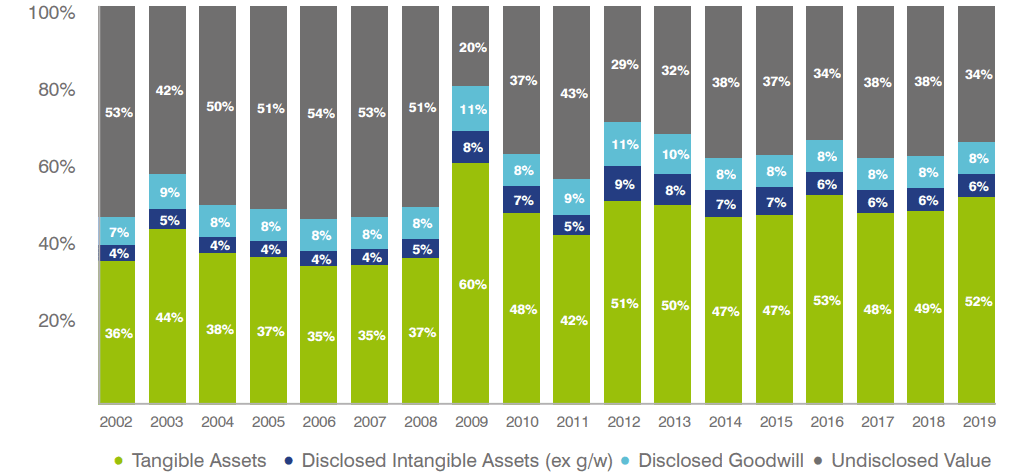

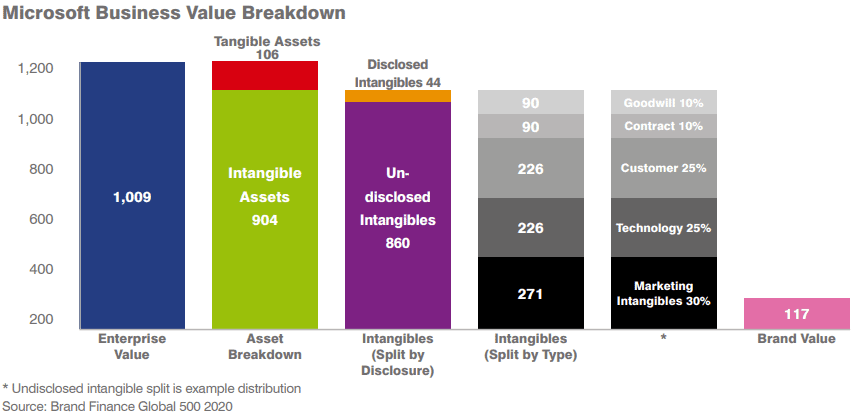

As a consequence of accounting rules, this intangible value doesn’t appear on balance sheets unless there has been a separate purchase for the asset in question or a fair value allocation of an acquisition purchase price because their valuation, having been validated through an arms-length transaction, is viewed as objective and reliable.

International Accounting Standards define an intangible asset as an “identifiable non-monetary asset without physical substance” (IAS 38). It must also:

- Be identifiable;

- Result in a flow of future economic benefits;

- Be controlled by the entity (demonstrated by the power to obtain the future economic benefits from the asset or restrict the access of others to those benefits).”

Further an intangible asset meets the identifiability criterion only if it:

- “Is separable, i.e. capable of being separated or divided from the entity and sold, transferred, licensed, rented or exchanged, either individually or together with a related contract, asset or liability;

- Or arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights and obligations.” (IAS 38)

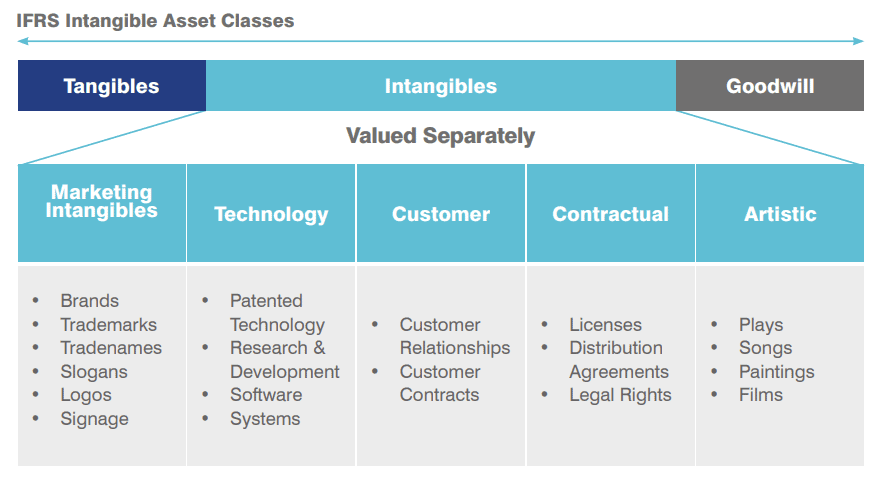

IFRS 3 lists the categories of intangible assets as being:

IAS 38 specifically prohibits the following internally generated intangible assets from being recognised:

- Goodwill

- Brands

- Mastheads

- Publishing titles

- Customer lists

- Item similar in substance cannot be distinguished from the cost of developing the business as a whole

- Intangible assets arising from research (or from the research phase of an internal project)

Therefore, under IAS 38 expenditure on an internally generated brand cannot be distinguished from the cost of developing the overall business. The implication is that the value of the brand is hidden from the balance sheet of a company, making it difficult for shareholders to assess the true value of the company, while other stakeholders cannot protect their interests. Yet the aggregate market-to-book ratio of the S&P 500 rose steadily from an average of around 1.4 at the beginning of the 1980s to around 3.5 in the mid-1990s.

Has this caught your interest? Read about the importance of disclosing intangible assets here: What Went Wrong With Carillion? The Accounting Treatment of Goodwill.

It accelerated rapidly in the late 1990s, during the onset of the knowledge economy, to reach a peak of 5.1 at the height of the dot.com bubble in early 2000, before falling back to its current level of 3.3, after dropping as low as 2 after the 2008 financial crisis.

A market-to-book ratio of 3.3 implies that the tangible assets of a business account for only 30% of the value that investors are placing on a company. Intangible assets account for the remaining 70% of market value.

Even where the brand is acquired from an external entity, the value placed on the balance sheet is at cost. Therefore, the brand’s value becomes moribund with no ability to restate its value, if its performance has improved. Over time it is more than likely the book value will be inaccurate, if not misleading.

As an example, after the restructuring of Porsche and Volkswagen AG in 2011, the Porsche brand appeared on the balance sheet valued at €13,823m. However, while Volkswagen’s market capitalisation has continued to rise by €65bn and fall back by €35bn in the period since the brand value has remained moribund. The inference that could be drawn, from reviewing the company’s accounts, would be that the Porsche brand has made no impact on business performance after 2011.

These developments make a compelling case for boards to consider how they measure brand value and performance to ensure such a critical value-creating asset is managed effectively. The business mantra applies: if you can’t measure it, you can’t manage it.

Valuing Brands

By valuing brands and understanding the drivers of value, the contribution of marketing can be measured beyond conventional metrics e.g., market share, attracting customers, and building loyalty, to how this strategic investment adds to the bottom line in terms of business performance, maximising profits and increasing shareholder value.

The benefits of valuing a brand are:

- Attribute a financial value to the brand to determine the role it plays in driving business performance

- Articulate brand performance to boards in a language that is familiar to them – assets and cash, not just percentages

- Determine what parts of the business are adding or detracting from the economic value of the brand

- Demonstrate how the brand is driving value and how it can be leveraged across the business

- Establish a solid basis for comparison of brand performance – by market and audience – over time

- Understand the relationship between brand equity and key value drivers in the business model

- Steering of brand resources

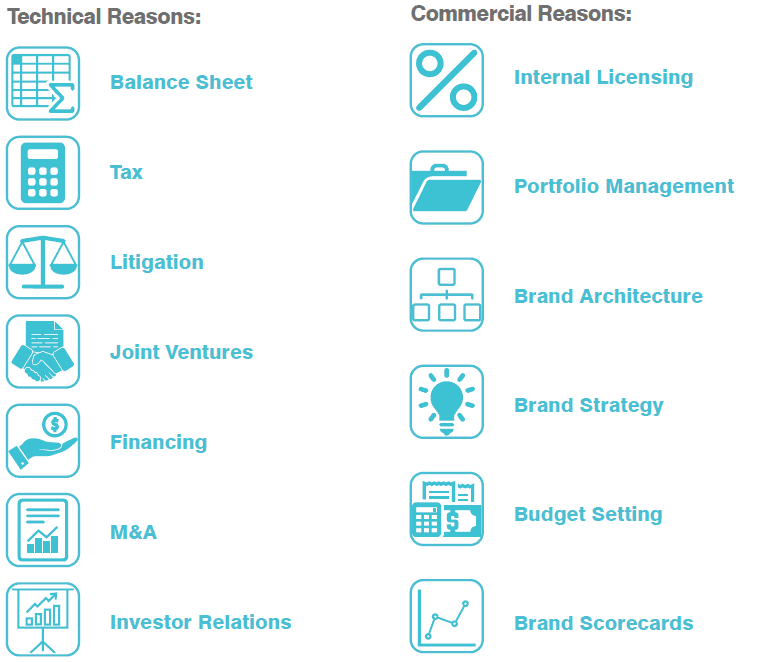

There are many reasons for valuing brands, and they fall largely into two categories:

The formal recognition of the discipline of valuing brands has also been enhanced by the creation of two International Standards Organisation (ISO) standards:

ISO 10668 Brand Valuation - specifies requirements for procedures and methods of monetary brand value measurement, while requiring three types of analysis:

- Legal

- Behavioural

- Financial

The standard also defines a brand as “a marketing related intangible asset including, but not limited to, names, terms, signs, symbols, logos and designs, or a combination of these, intended to identify goods, services or entities, or a combination of these, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits/value”.

ISO 20671 Brand Evaluation - aims to standardise the technical requirements and evaluation methods involved in brand valuation. This standard will provide much greater direction for brand valuers in their understanding of the elements, dimensions and indicators of brand strength underpinning the behavioral analysis required by ISO 10668.

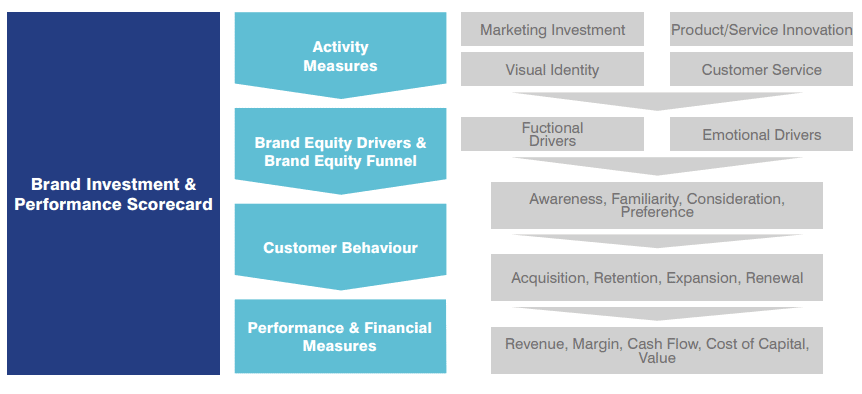

Brand Finance defines brand strength as the efficacy of a brand’s performance on intangible measures, relative to its competitors. In order to determine the strength of a brand, we look at marketing investment, stakeholder equity, and the impact of those on business performance.

ISO 10668 represents global consensus on brand valuation in respect to:

- Brands are hugely valuable corporate assets

- Brands affect all stakeholder groups

- Brands create economic benefits

- Brands need active strategic management

- Brands are legal assets which can be bought, sold and transferred

- Brands can be valued like any other assets

In many respects, brand equity and brand value are indicators of an organisation’s future income earning capacity, as opposed to traditional accounting which takes a more historical perspective of an organisation’s performance. It is the marketing asset related measures that are increasingly sought by financial analysts and investors to help analyse the future health and prospects of a business.

The Role and Influence of Marketing

The necessity for boards to understand the value of their brands has converged with the demand for greater accountability of how marketing’s contribution adds to shareholder value.

The ability to demonstrate value also provides an opportunity for marketing to be recognised as the organisational lead in the creation and management of marketing-based assets, with brand being the most important.

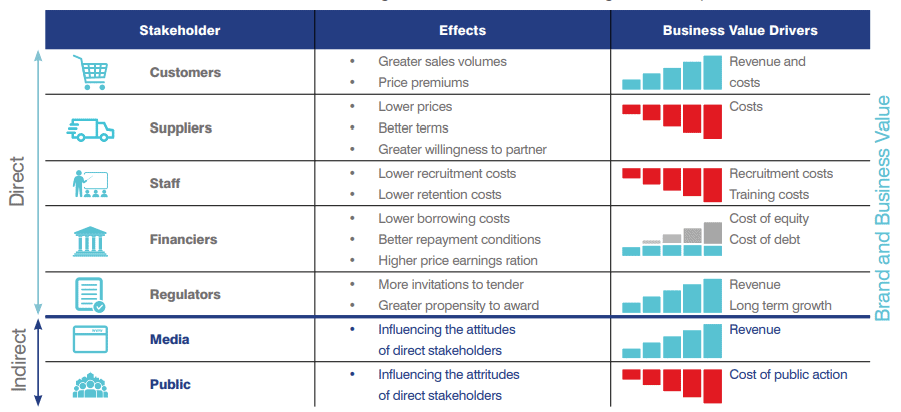

This coincides with the widening of the role and influence of marketing, given the way in which brands can influence stakeholders beyond customers including employees, suppliers, partnerships, providers of capital, media and government. The benefits of a performing brand are not only increased demand and distribution, but also lower costs of materials, personnel, debt and equity.

While extending marketing’s responsibility, it also requires marketers to engage with the whole organisation and empower everyone with how the brand should consistently communicate with all internal and external audiences, not just customers. Therefore, in many respects the call for the CMO title to be now known as the Chief Customer Officer is perhaps too limiting.

Foresters 2020 Predictions Report noted that for marketing, “Its status quo has been fundamentally disrupted by the dynamics of the age of the customer. Customers are empowered. Brand has been atomized across numerous channels, many of which are beyond a company’s scope of control. The result is a radical shift in how companies establish brand, build affinity, and generate loyalty.”

Marketing can increasingly be positioned as the custodian of the organisation’s most important value creating asset with the responsibility of overseeing growth. The dimension of marketing’s role takes on far greater importance when it is seen as directly responsible for such a valuable asset, as opposed to being narrowly viewed according, for example, to size of budget and number of FTE’s under their remit. By placing more emphasis on the marketer’s role on increasing brand value, the focus moves to being a growth engine of the business, as opposed to being viewed through the prism of a budget expense.

It also puts marketing firmly in the lens with which a board views its organisation. This will ultimately increase the need for directors with marketing expertise and experience.

The Boardroom View

It is instructive that AON’s 2019 global risk survey of managers has in recent years constantly placed damage to reputation and brand as the first or second on its list of ‘top of mind’ concerns and risks.

In respect of managing this risk, “only 24 percent of respondents said they quantify their top 10 risks. Only 20 percent use risk modeling and 10 percent said they have no formalised process in place to identify risks.”

The survey also identified the loss of intellectual property/data as an underrated risk. Intellectual property rights or IP rights cover four main areas:

- Trademarks

- Copyrights

- Rights patents

- Trade secrets

In the United States, the Commission on the Theft of American Intellectual Property estimates the annual costs from the loss of intellectual property ranges from USD 225 billion to USD 600 billion.

It is the need for boards to mitigate these risks and maximise returns on an organisation’s assets, that Brand Finance has developed key questions to guide brand governance structures. This approach enables a board and senior management to understand and grow brand equity and brand value by effectively managing the brand as an asset with a financially quantified focus.

The key questions boards should be asking are:

- Is your brand(s) being effectively managed and utilised in decision- making right across the business?

- Is the brand managed consistently and holistically?

- Is there high awareness of the role of your brand (s) as a key enabler and value creating business asset?

- Is brand the responsibility of every single individual in the organisation, not just the marketers or the people directly involved in the marketing function i.e., policing vs. organisation wide understanding of the brand?

- Is the value and strength of your brand(s) being effectively measured and tracked?

- Are there effective measurements and tracking of your brand to ascertain the strength, value and contribution to the overall business?

- Is brand equity and brand value shared with the board?

- Should the value of your brand(s) be reported?

- Is there a brand scorecard in place for reporting to various levels within the business and to the board?

- Is there a clear common agreed language on how brand (s) performance is reported from both a marketing and financial perspective?

- Are directors aware of brand value relative to mitigating risk in terms of legal or regulatory exposure and market capitalisation?

- Are shareholders and other stakeholders provided with a periodic overview of brand performance?

- How do we implement an improved brand governance culture across the business?

There are some basic principles for good brand governance, and these serve as a useful checklist for directors:

- Know the brand’s value and what drives it.

- Conduct analysis to understand this at a detailed level, including what factors drive the brand value and how it varies across different customer segments, different geographies and different products and services. Establish a monitoring system so results are regularly communicated to the board.

- Ensure that this knowledge is being applied to corporate strategy.

- It should inform decisions on where to invest in growing the brand, where to take advantage of the brand to maximise the return on this important asset, and where to divest or bring in a partner because the brand does not provide a strong enough platform to build the business on.

- Incentivise senior executives & the board to grow value of the brand.

- Include brand value growth and relative brand value performance in performance objectives, or as a vesting criterion in a long-term incentive plan.

Conclusion

The complexity and expanding responsibilities of the role of directors is no better illustrated by the need to account for the value of their organisation’s intangible assets. In particular, brand as the most important value creating asset, requires a clear understanding of how it is being managed to drive business growth and to mitigate against the risk of impairment.

The way in which business communicates with its customers and other stakeholders has become multi-faceted. The brand is pivotal to how business successfully manages these relationships. Therefore, a brand’s value needs to be clearly understood by boards to ensure appropriate investment is made in leveraging its strength to maximise business growth and shareholder returns.

Accordingly, boards must have in place a comprehensive brand governance structure that clearly delineates the roles and responsibilities of everyone within an organisation.