This article was originally published in the inaugural Brand Finance US City Index 2024.

Place Branding Manager,

Brand Finance

In last year's Brand Finance Global City Index, nine American cities achieved an impressive position within the top 50 best-perceived cities out of 100 global cities ranked.

The index, however, only looks at perceptions of non-domestic audiences. It is widely believed that the views of domestic respondents tend to differ from the perceptions of the outside audience. In this article, we will uncover how domestic perceptions of American cities differ from international perceptions and why matching internal and external perceptions should be one of the top priorities of city-branding strategies.

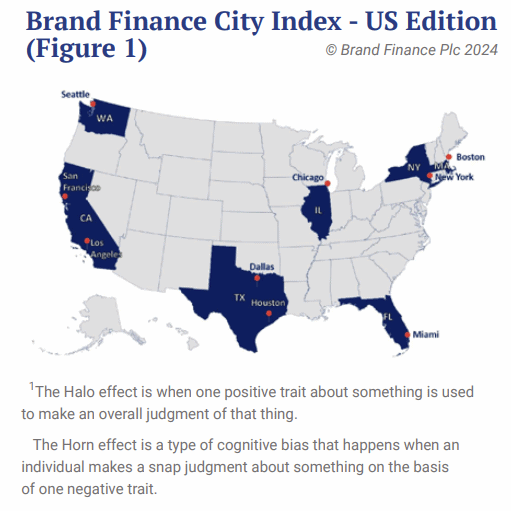

Figure 1 shows the geographical distribution of the cities, ranging from the East Coast to the West Coast. The following cities were covered in the research: Boston, New York, Miami, Chicago, Houston, Dallas, Los Angeles, San Francisco, and Seattle.

The Largest and the Smallest Perception Gaps

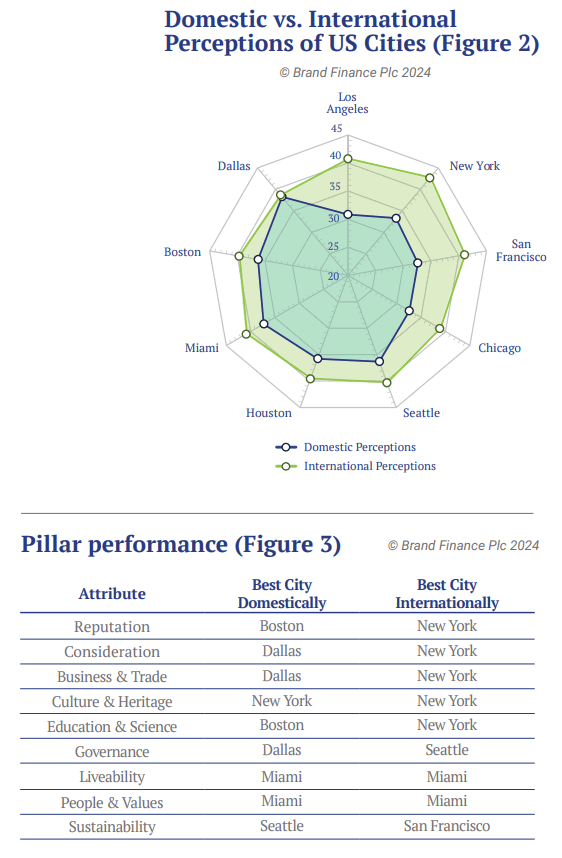

According to a weighted average of 59 attributes, the highest perception gap currently exists for Los Angeles, New York, and San Francisco (see Figure 2). International audiences see these cities as more appealing for studying, working, investing, retiring, visiting, and permanently relocating than domestic respondents. This is great news for Los Angeles, which will be hosting the 2028 Olympic Games. By leveraging the attributes where Los Angeles outperforms, such as diverse and multicultural (40%), great shopping, restaurants, and nightlife (39%), and appealing lifestyle (38%), global communication campaigns can be tailored to achieve a higher number of visits. The smallest perception gap observed is in Dallas, Boston, and Miami. This outlines that the views, on average, are quite similar. Although, after a thorough analysis, domestic audiences tend to have stronger opinions on Culture & Heritage, Livability, and People & Values.

Pillar Performance

When it comes to pillar performance, New York leads among 5 pillars according to the international audience, while Dallas is the leading city across 3 pillars according to the domestic audience. San Francisco is considered the most sustainable US city, according to respondents from 20 countries, while domestically it is believed to be Seattle.

Local Work

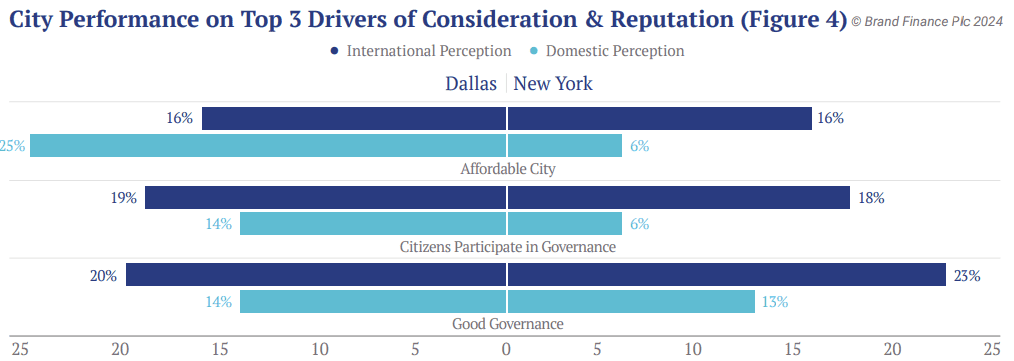

Using regression analysis to identify the drivers of consideration and reputation to work locally, US respondents perceive affordability, participation in governance, and good governance as the top 3 drivers.

When we plot (Figure 4) the performance of Dallas and New York domestically and internationally, the perception gap is tilted towards the international views.

The only significant difference is the views of affordability of Dallas according to domestic audience, which perceives Dallas as more affordable compared to the international audience. This is an important finding, as cities that strive to attract businesses and talent from abroad must ensure that perceptions of ‘outsiders’ align with the factual reality of their city. Once such issues are identified, the next step is to work on informational campaigns aimed at correcting those biases.

Conclusion

Domestic respondents are brand ambassadors of their own nations as well as the cities in which they live, study, or visit. Perception gaps, left unmanaged, create potential reputational risks for such cities abroad, and their management should be one of the top priorities among the Destination Marketing Officers. To find out more about what attributes your city might have a significant perception gap on, request your own City Perceptions Report by emailing enquiries@brandfinance.com.