The European Super League (ESL) is set to be a €2.5bn own goal. Brand Finance has been tracking the financial value of football brands for 15 years and this proposition is potentially the biggest shakeup to the game seen in that time. We calculate that the ESL Founding Clubs are likely to lose a combined brand value of €2.5bn, but that number could potentially be as high as €4.3bn.

Richard Haigh, Managing Director of Brand Finance, commented:

“For the ESL ‘Founding Clubs’ the prize seems obvious - more money - but this ignores the huge risk that fans won’t follow and neither will the money. There is outrage in the home markets from both fans and leagues alike, but it is not clear yet what the repercussions will be. Will fans vote with their feet and leave the clubs many have supported their entire lives? Will the leagues impose fines, or point deductions leading to relegation and further financial loss?”

In the most likely scenario, we estimate that the annual loss for the Founding Clubs will be €1.1bn in revenue a year and the brands will all suffer significant reputational damage, leading to a drop in brand value of €2.5bn. This loss is a combination of lower broadcasting, commercial, and matchday revenue. It assumes that the UEFA will not allow the teams to compete in Champions League and the national leagues also remove the teams from their rosters.

Our analysis indicates that not only would the move inflict financial damage on the Founding Clubs themselves, but also on the other clubs in their leagues, which may lose up to 25% of their brand value.

Hugo Hensley, Head of Sports Services at Brand Finance, commented:

“In our view the result will be damaging for the clubs involved. The sentiment of fans online is overwhelmingly negative, with negative posts outweighing positive ones 3 to 1. Negative sentiment like this will inevitably lead to lower matchday spend and commercial revenue in the clubs’ home nations, which is still the lion’s share of any European club’s income.”

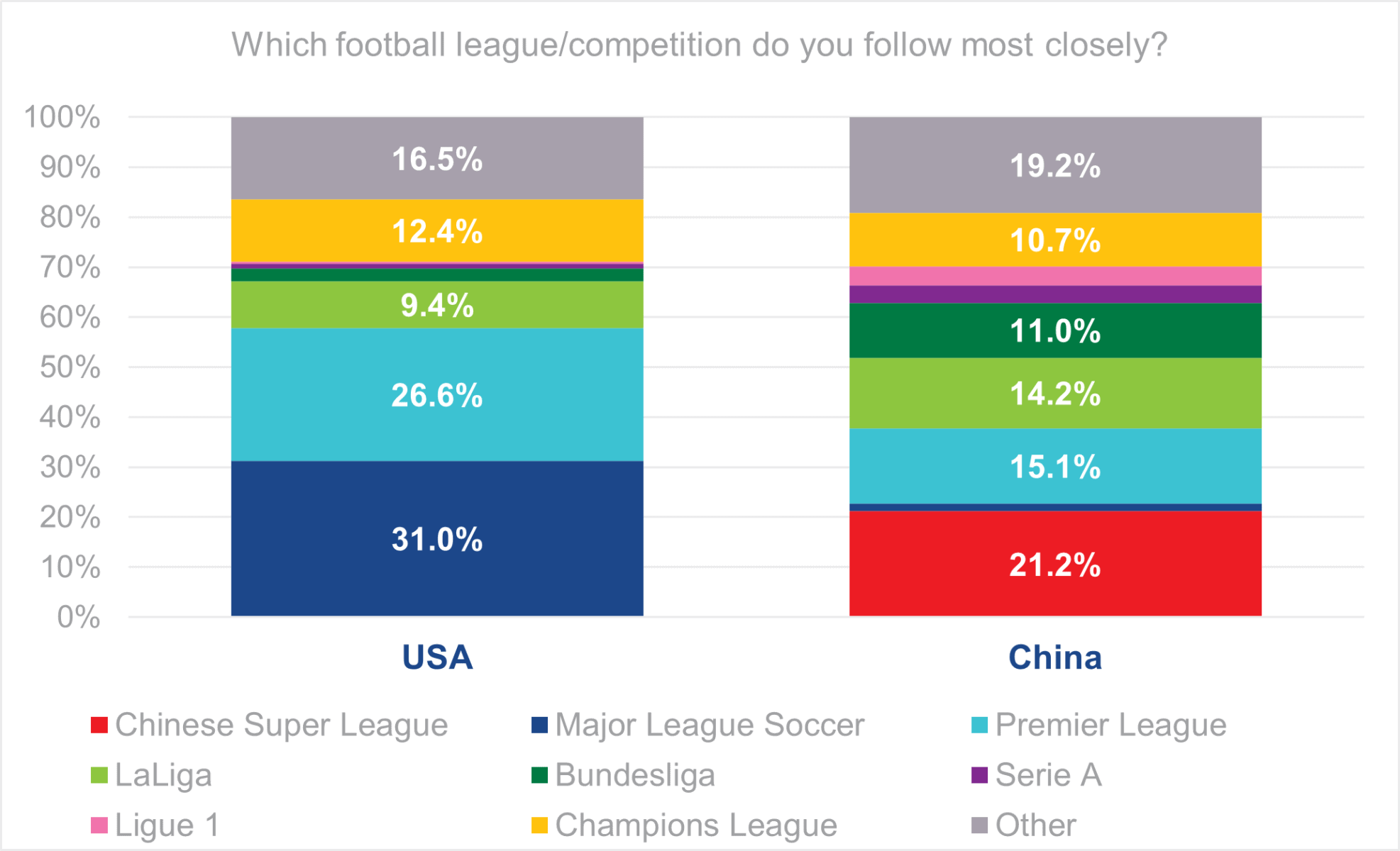

If not from the domestic markets, then the revenue will have to come from the US or China, but an uplift in either of these geographies seems unlikely. In both the US and China, the domestic leagues are by far the most popular as measured in Brand Finance’s Football Fan Survey. 31% of US fans prefer Major League Soccer and 21% of Chinese Fans prefer the Chinese Super League – and these numbers are already strengthening year by year. Both are countries that will more readily put their resources behind home grown team brands than foreign ones if the opportunity presents itself.

China is no longer an undeveloped market for European and North American football brands to grow. As we have seen in our studies of other industries, Chinese brands are growing fast. Many of these brands, like Evergrande, are starting to become household names in Europe and it is only a matter of time before we start hearing about Chinese Football clubs more regularly. The European Super League launch plays into their hands.

David Haigh, Chairman of Brand Finance, commented:

“In 2011, President Xi Jinping announced his dream to see China win the World Cup, a dream many thought impossible, but as a result the game has received investment at all levels in the country. If the ESL Founding Clubs think that the Chinese market is a vacuum available for them to fill, they are in for a nasty shock when they discover there’s only one true ‘super league’ in China.”

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.