View the full Brand Finance Commercial Services 100 report here

The world’s largest commercial services brands are beginning to recover from the COVID-19 pandemic – but four of the top five most valuable commercial services brands have not yet recovered to pre-pandemic value, according to a new report from Brand Finance, the world’s leading brand valuation consultancy. Over the past year, most brands in the industry have returned to growth, with 85 of the top 100 brands growing in value this year. This a clear indication that the industry has turned the corner after widespread disruption over the last two years.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. The commercial services industry’s top 100 most valuable and strongest brands in the world are included in the annual Brand Finance Commercial Services 100 ranking.

Alex Haigh, Director of Brand Finance, commented:

“The commercial services industry is reenergised as the economy bounces back from the impact of COVID-19. The diversity in the sector spanning across FinTech, business support, security and human resource services is key to the growth of the industry as a whole.”

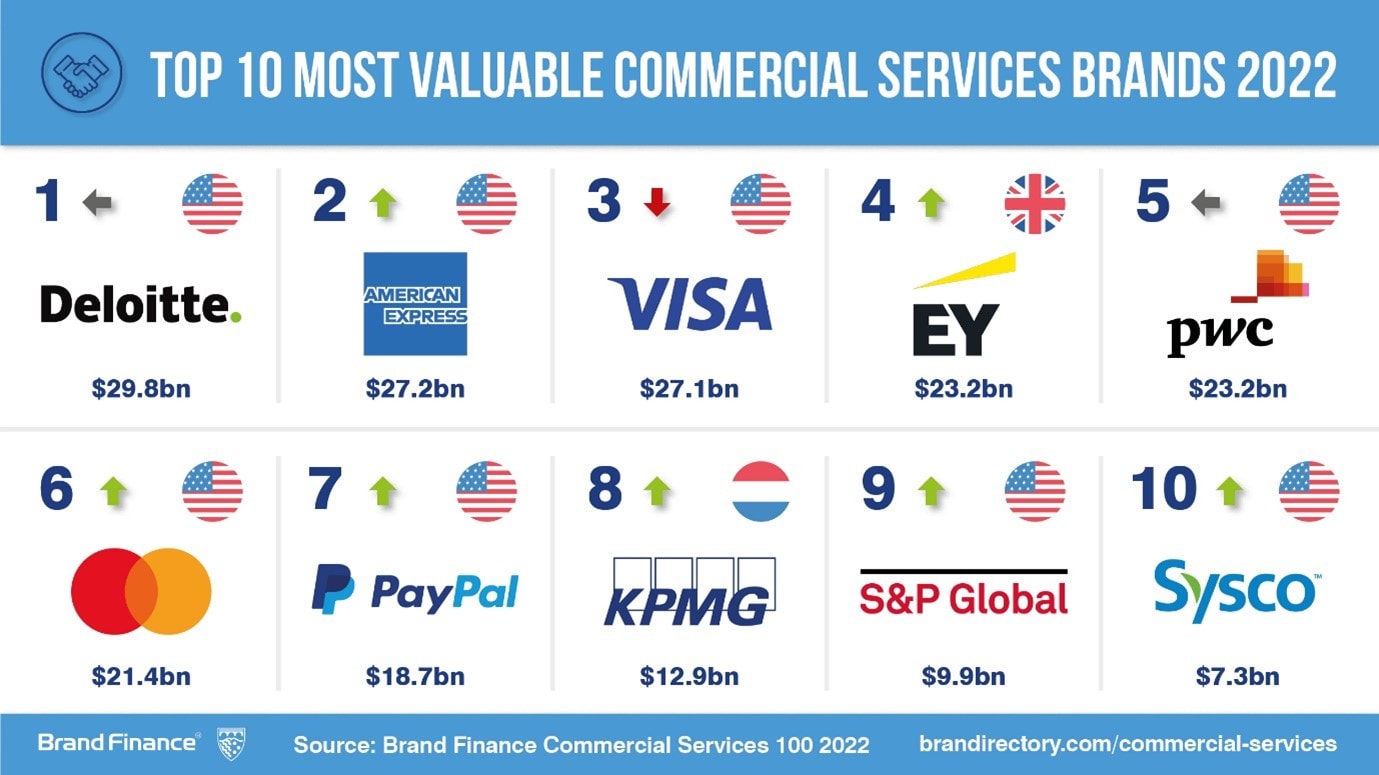

Deloitte retains title of most valuable & strongest commercial service brand

Deloitte (brand value up 12% to US$29.8 billion) sits at the top position in the Commercial Services 100 ranking with a 12% year-on-year brand value growth at US$29.8 billion, but is still below its pre-pandemic value of US$32.4 billion. Despite the impact of the pandemic, in 2021 Deloitte exceeded the US$50 billion revenue mark. Since the outbreak of the pandemic, the demand for consulting services has been disrupted as many brands undertook significant transformation.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors. Deloitte is also the strongest brand in the ranking with a Brand Strength Index (BSI) score of 90.2 out of 100 and a corresponding brand rating of AAA+.

A key brand driver as Deloitte’s customers increase environmental, social and governance considerations has been Deloitte’s strengthening commitment to meeting its net zero carbon targets. The consulting giant has pledged to achieve a net zero status by 2030 by deploying many internal policy changes, including a dedicated carbon offset strategy to offset emissions which assist in transformation from fossil fuel reliant models to renewable energy.

New entrants into the ranking hail from diverse sectors

The commercial services sector is expanding its scope as the new entrants into the Commercial Services 100 ranking belong to diverse sectors spanning across IT consulting, FinTech, technical support services and data providers. The increasing diversity of brands is a testament to the growth of the sector over the pandemic and its importance to business partners and stakeholders.

The new entrants in the ranking include Booz Allen an IT consulting firm (valued at US$3.5 billion), Global Payments a FinTech service provider (valued at US$3.2 billion), Synchrony a consumer financial services brand (valued at US$3.0 billion), Refinitiv a financial market data provider (valued at US$1.7 billion) and Teleperformance a technical support services provider (valued at US$1.4 billion). Commercial services brands are successful in employing their existing expertise in adjacent markets and providing services that are in high demand.

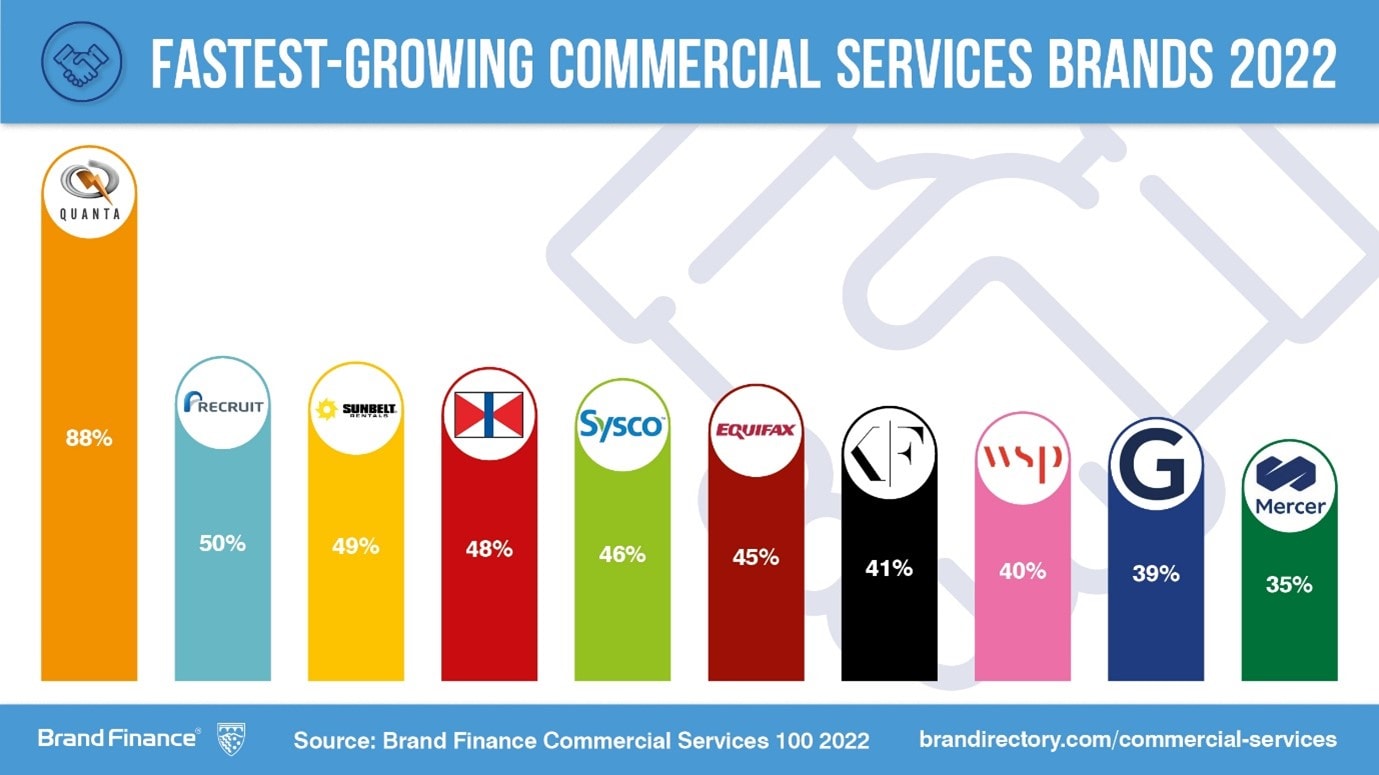

Human resources brands Randstad and Recruit dominate fastest growing commercial services brands

Recruit (brand value up 50% to US$2.5 billion) and Randstad (brand value up 28% to US$4.3 billion) provide services including human resource consultancy, job boards staffing services, job advertisements and employer review platform. Through the course of the pandemic working models have been questioned and businesses are starting to recognise the power of the global talent pool.

There has been an incremental growth of human resource services as businesses began to actively hire global talent in the past year. Human recourse service providers play an instrumental role in enabling employment opportunities worldwide and are growing in scale and service offerings. The impact of global lockdowns, new and flexibility in working models has enabled the Great Resignation wherein employees chose to move to jobs that provide a higher pay and more favourable benefits. Online services provided by human resources services such as Randstad and Recruit are well positioned to meet growing demands in the sector.

Top 100 commercial services brands average 12% growth this year

The top 100 brands in the commercial services sector have been growing for the past year with innovation in the sphere of payment gateways, online banking and accounting. Consistent with the upward trend in the market, two the parent companies of two brands in the ranking - S&P Global (brand value US$9.9 billion, up 14%) and IHS Markit (brand value US$2.2 billion, up 27%) closed a merger earlier this year to join forces. The combined entity will need to manage the two brands to maximise value in the years ahead.

View the full Brand Finance Commercial Services 100 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s top 100 most valuable and strongest commercial services brands are included in the Brand Finance Commercial Services 100 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Commercial Services 100 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.