View the full Brand Finance Banking 500 2023 report here

QNB (brand value up 9% to US$7.7 billion) remains the most valuable banking brand in the Middle East with a brand value of US$7.7 billion. It has seen a 9% year-on-year growth and retained its position (45th globally) firmly within the top 50 most valuable banking brands in the world. This reflects the success of the bank’s continued efforts to expand its international presence and offering to an increasingly diverse customer base.

Every year, leading brand valuation consultancy Brand Finance puts thousands of the world’s biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 500 most valuable and strongest brands in the banking industry are included in the annual Brand Finance Banking 500 2023 ranking.

QNB’s sponsorship of the 2022 FIFA World Cup in Qatar provided the chance for the bank to gain considerable exposure among the millions of viewers who tuned in during the month-long event from around the world. This has likely raised its awareness and familiarity amongst consumers and may in turn help to boost its current brand strength of 85 out of 100 (AAA) further in the future.

The Brand Finance Banking 2023 report finds several key trends in the banking industry. Rising interest rates in many markets have led to short term increases in net revenues and profitability and in addition to this, brand equity research metrics have improved, with the average reputation for the sector increasing by 0.1 points year-on-year.

Saudi Arabian, Riyad Bank saw an impressive brand value increase, up 42% this year to a brand value of US$1.8 billion, well above the overall average for Saudi banks. Riyad bank undertook a rebranding effort in September 2022 reflecting its commitment to becoming a bank for a new generation that will focus on technology and innovation in line with Saudi Vision 2030.

Its new identity reflects its updated vision and mission to be "the most innovative and trustworthy financial solutions partner". This new customer-centric identity signals opportunities for brand strength growth, which is currently 74 out of 100 with a corresponding AA rating.

Dubai based Mashreq (brand value up 35% to US$1 billion) also launched a new brand identity in 2022 as part of a wider strategy to realign its offerings as a digital-first financial institution. The move saw Mashreq adopt a challenger brand status as it looks to achieve social and economic impact by supporting the aspirations, dreams and needs of every customer. The phrase ‘Rise every day’ was used as the slogan for its new identity. This is said to exemplify the bank’s own history and future growth plans, which will be centred on a transition to a more digital and customer-centric world.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 150,000 respondents in 38 countries and across 31 sectors.

Saudi Arabian Al-Rajhi Bank (brand value up 32% to US$5.7 billion) is the strongest banking brand in the Middle Eastern region with a brand strength index (BSI) score of 85.5/100 and corresponding AAA rating. Al-Rajhi Bank saw record net profits in 2022, attributing its success to its growth strategies based on customer loyalty, investor confidence and the professionalism of its employees.

Reflecting wider industry trends, the bank has also particularly emphasised its online banking offering, to provide the best experience to retail and corporate customers. The success and popularity of this is highlighted by the fact that 94% of all accounts opened in 2022 made use of the Bank's mobile application. Al-Rajhi also continues to diversify its workforce. 2022 saw a 109% increase in the number of female workers at the Bank and its subsidiaries, demonstrating a positive step for Al-Rajhi in this field.

The UAE saw impressive overall results in the ranking, accounting for 9 brands, all who achieved year-on-year brand value growth. Across the region the brand value growth averaged at 14%, taking the total brand value for UAE banking brands to US$13.8 billion.

FAB (brand value up 19% to US$3.9 billion) is the most valuable banking brand in the UAE after seeing a jump in annual profits and exceeding estimates. The bank has looked to advance its customer experience by expanding its offerings and leveraging strategic partnerships to drive value creation across the business. It has also set targets to become a pacesetter for the regional energy transition and help deliver the UAE’s sustainable finance agenda.

Emirates NBD (brand value up 9% to US$3.8 billion) is the second most valuable brand in the UAE. The Group’s diversified business model and strong regional economic performance has facilitated this growth, with the bank optimistic about future growth in favourable conditions in the region. They also had the highest BSI in the UAE with a score of 80/100 and corresponding AAA- rating. This high score reflects its leading status amongst stakeholders in the region and continued contributions towards making Dubai a leading international destination for tourism and business.

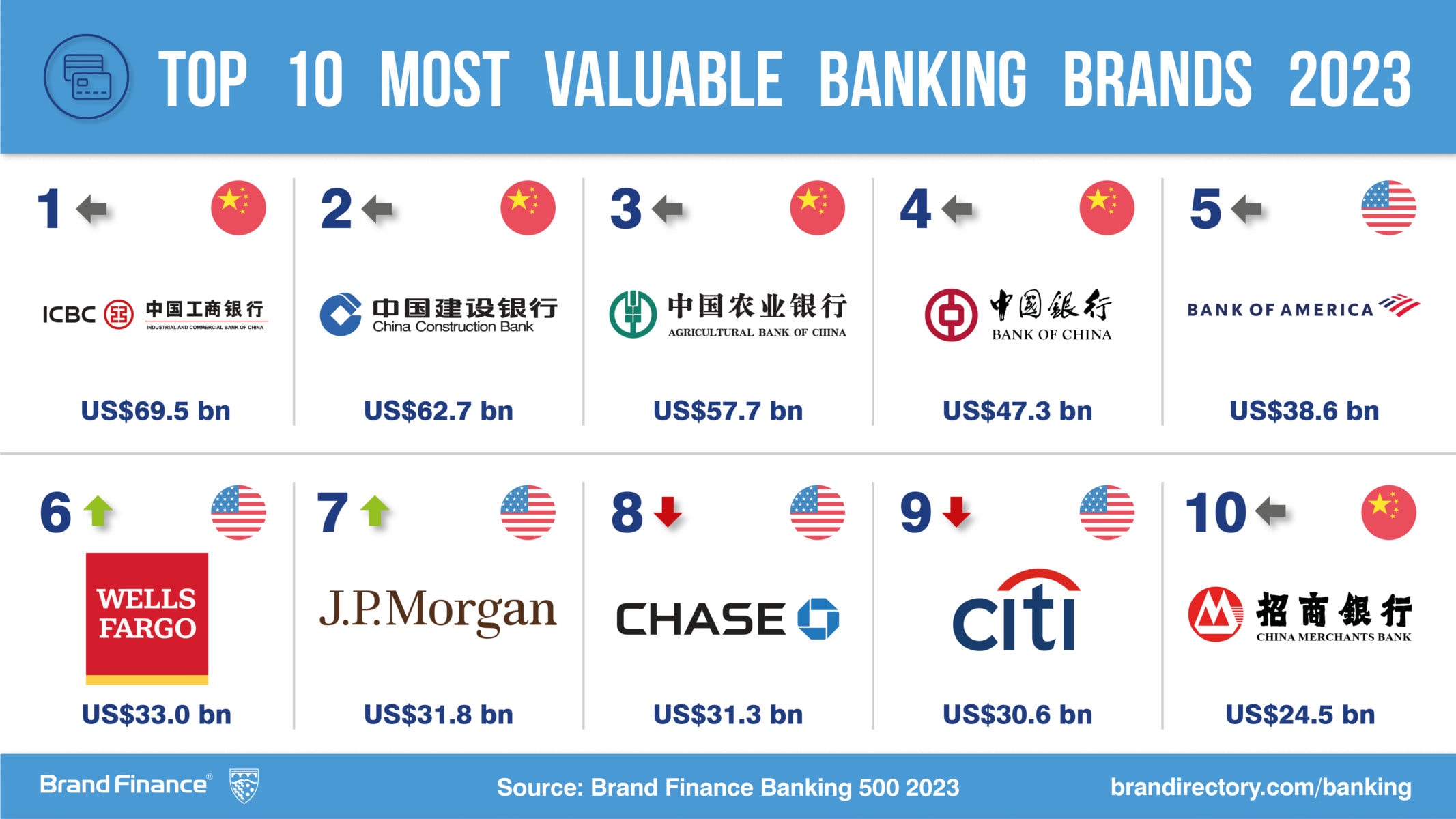

Chinese banking brands in the ranking are subsiding in brand value with American brands quickly closing the gap. ICBC (brand value down 7% to US$69.5 billion) is the most valuable banking brand in the world, followed by China Construction Bank (brand value down 4% to US$62.7 billion) and Agricultural Bank of China (brand value down 7% to US$57.7 billion).

Another important trend in the sector is that neo/digital banks, such as Revolut (brand value up 57% to US$194 million), have made a significant impact in the industry, entering the top 500 most valuable banking brands for the first time, with a brand value increase of 57% year-on-year.

According to a new report from leading brand valuation consultancy, Brand Finance, ICBC (brand value down 7% to US$69.5 billion) is the most valuable banking brand worldwide. The company has several subsidiaries globally and serves over half a billion individuals and several million business clients. ICBC is outperforming its competitors, maintaining a strong lead in brand value over China Construction Bank (brand value down 4% to US$62.7 billion) and Agricultural Bank of China (brand value down 7% to US$57.7 billion), which are the second and third most valuable banking brands globally, respectively. Brand values in the sector have possibly declined due to the general slowdown of the Chinese economy caused by strict lockdown mandates and an ongoing housing crisis.

Declan Ahern, Director of Brand Finance commented:

“Banking brands across the globe have continued to recover significantly post COVID-19. There has been an improvement in digital banking services, government stimulus measures have been relatively successful, and the rise of mobile banking and online platforms have contributed to the sectors positive performance. Accelerated by the strict global lockdowns, banking and fintech brands have innovated to create user friendly mobile application-based banking services that have led to an increase in customer satisfaction and acquisition.”

First National Bank is world’s strongest banking brand, earning AAA+ rating

First National Bank (brand value down 3% to US$1.5 billion) is the strongest banking brand in the ranking with a Brand Strength Index (BSI) score of 93 out of 100 and a corresponding AAA+ rating. It is one of the oldest and largest banks in South Africa, with a history dating back to 1838. FNB has a strong presence in South Africa, with branches and ATMs in many cities and towns across the country. The bank has also been consistently ranked among the top banks in South Africa in terms of customer satisfaction and trust.

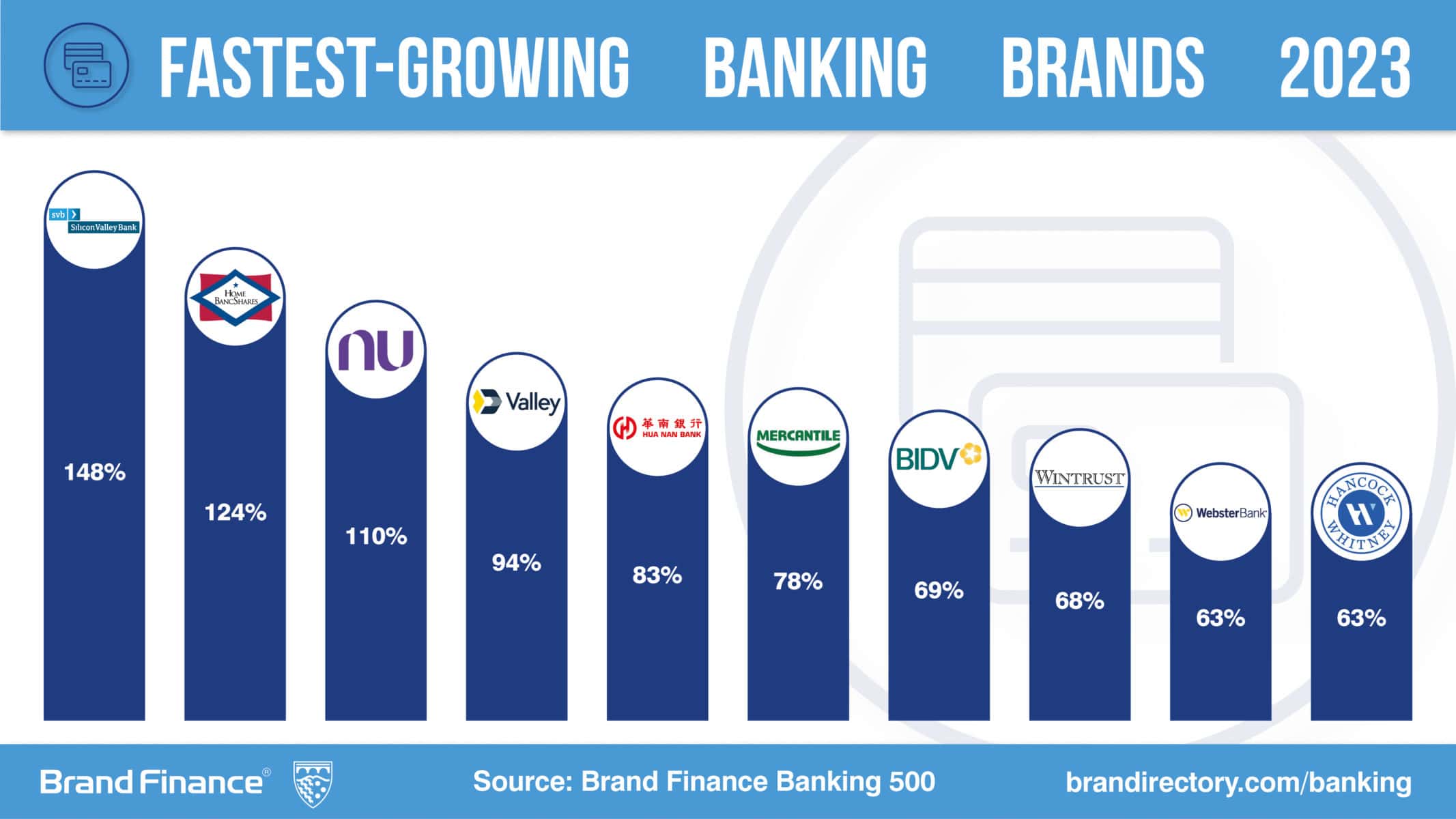

Silicon Valley Bank is fastest-growing banking brand, more than doubling to US$2.8 billion

SVB (brand value up 148% to US$2.8 billion) is the fastest-growing banking brand in the world, more than doubling in brand value this year. The bank specialises in providing banking services for venture capital firms to support the start-up ecosystem. In 2021, the bank completed a merger with Boston Private and has rebranded to be called SVB Private. SVB actively invests in entrepreneurial ventures including fintech firms like Wise and new healthtech ventures that are disrupting the industry.

View the full Brand Finance Banking 500 2023 report here

ENDS

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.