View the full Brand Finance Apparel 50 2023 report here

Nike (brand value down 6% to USD31.3 billion) retains its title as the world’s most valuable apparel brand, despite losing brand value, according to a new report from leading brand valuation consultancy, Brand Finance.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 50 most valuable and strongest apparel brands are included in the annual Brand Finance Apparel 50 2023 ranking.

Annie Brown, General Manager of Brand Finance UK, commented,

“From its relentless commitment to innovation, ability to stay ahead of market trends, and extensive partnerships with athletes worldwide, Nike has firmly cemented its place at the top of the apparel industry. In 2023, the brand is continuing to leverage its enormous global influence and reputation to empower positive change in the sporting world and beyond.”

New Balance (brand value up 11% to USD1.8 billion) has entered this year’s ranking as one to watch. The brand’s reputation and popularity are set to soar following the recent triumph of tennis sensation Coco Gauff at the US Open, where she and her family proudly donned her custom-made 'Call me Champion' shirt. The star also unveiled her signature New Balance shoe, the CG1 Vintage, in 2023. Her win is expected to trigger a surge in shoe sales, positively impacting New Balance's brand value and bolstering its positive reputation in the sporting industry.

The apparel industry has played a crucial role in China's rapid modernisation and is experiencing robust growth. China’s largest down-clothing brand, Bosideng, (brand value up 12% to USD1.9 billion), has successfully overcome the common challenges faced by Chinese brands in the global market by connecting with consumers and establishing itself as a distinctive player. Bosideng’s ability to penetrate the Western market, while also showcasing its Chinese heritage, has bolstered its success and brand strength this year. Bosideng has opened more stores across Europe, collaborated with renowned designers, including former Hermès creative director, Jean Paul Gaultier, and participated in international fashion shows to enhance its global brand profile.

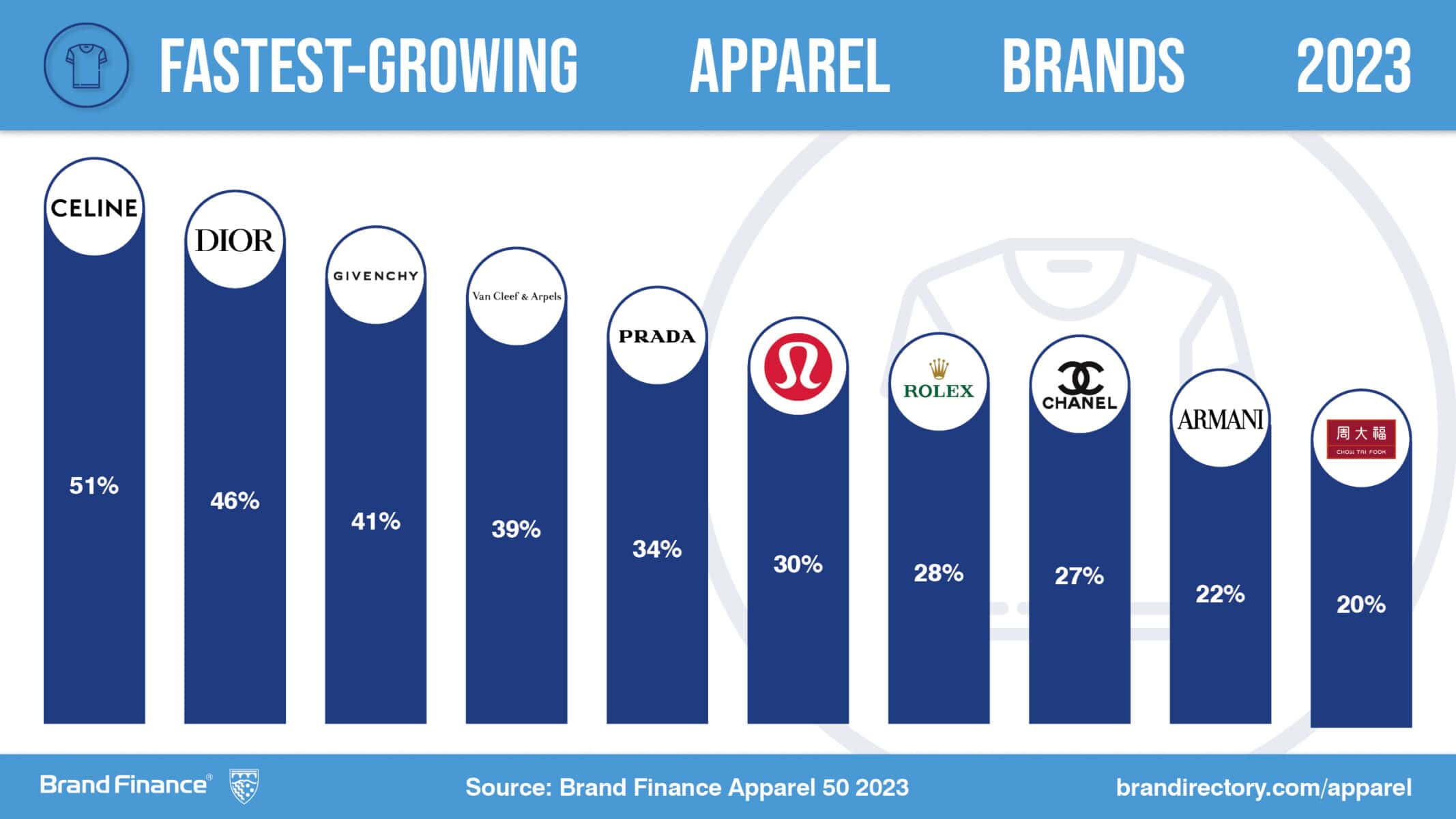

Celine (brand value up 51% to USD2.9 billion) has experienced remarkable growth under the creative direction of Hedi Slimane, appointed to the brand in 2018, and overseen by Celine’s chief executive Séverine Merle. Slimane's innovative vision and brand revitalisation efforts, boosted by social media marketing and advertising campaigns, have played a crucial role in Celine's growing brand value. The brand provides yet another case study in the power of the LVMH luxury superpower in its ability to breathe new life into luxury heritage brands.

Luxury apparel has faced challenges and transformations in the post-pandemic era, with e-commerce and social media reshaping the landscape while streetwear and athleisure gain popularity. However, renowned luxury brands like Dior (brand value up 46% to USD13.2 billion), Louis Vuitton (brand value up 12% to USD 26.3 billion), and Chanel (brand value up 27% to USD19.4 billion) have thrived, thanks to promising sales growth and their enduring brand strengths, upholding their iconic status in the post-pandemic world.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Rolex’s (brand value up 28% to USD10.7 billion) has become synonymous with luxury and timeless elegance. It is this combination of heritage, craftsmanship and reputation for excellence that drives the enduring brand strength of Swiss watchmakers, with other strong performances from Omega (brand value up 13% to USD4.5 billion) up to 20th position and TAG Heuer (brand value up 6% to USD2.6 billion) up in 36th position.

As sustainability becomes an increasing driver of choice between apparel brands, global fast-fashion houses like H&M (brand value down 26% to USD9.4 billion) and Zara (brand value down 15% to USD11 billion) are taking a hit to their brand strengths and reputations. Their weaker brand strengths can be attributed to vague communication and a lack of transparency regarding sustainability. For example, H&M's Conscious Collection was found to extensively use synthetic materials derived from fossil fuels. This case reflects a larger trend in the industry, whereby such retailers engage in ‘greenwashing’ to mask cost-saving initiatives.

Nike has the highest Sustainability Perceptions Value in the 2023 apparel ranking, at USD2.3 billion. The brand’s ‘Move to Zero’ sustainability campaign has garnered global attention and enhanced global perceptions of the brand’s sustainability commitment. Nike is also actively involving athletes in its sustainability efforts in a bid to enhance consumer awareness about sustainability. The brand continues to leverage its enormous global influence to promote ESG practices company-wide, supporting its mission to ‘move the world’ forward through sport and empower positive change for communities across the globe.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.