This article was originally published in the Brand Finance Global Soft Power Index 2025

Place Branding Associate

Director,

Brand Finance

Place Branding Associate

Director

Brand Finance

Brand Finance is proud to present the 2025 Nation Brand Value ranking – marking the 21st edition of this landmark study.

Nation brand value represents the monetary worth of a country's reputation and image, shaped by its economic performance and global standing.

Assessing a nation’s brand value requires analysing its financial strength and influence in the global marketplace. A key component of this evaluation is the Global Soft Power Index (GSPI), as nation brand perceptions drive economic benefits and enhance nation brand value.

To assess the financial strength of a nation brand, Brand Finance utilizes publicly available, reputable data sources, including the IMF, World Bank, and UN. This year, Brand Finance has incorporated Oxford Economics as a key data provider in order to offer a more refined and segmented analysis of nation brand values. Moving beyond broad overviews, we have examined over 40 key sectors contributing to GDP across more than 70 leading nations. This approach offers a deeper and more precise understanding of the forces shaping a nation’s brand value. For nation brand managers and policymakers, this translates to a game-changing level of insight: the ability to identify high-potential sectors, target investment effectively, and craft data-driven strategies to elevate your nation's brand globally.

Before exploring the results of the leading nation brands in 2025, let us first examine the broader trends shaping the global economy.

A world of divergence and uncertainty

The IMF’s World Economic Outlook (WEO), which was released in January 2025, identifies the theme for the year to be “Divergent and Uncertain”. The global economy is projected to expand by 3.3% in both 2025 and 2026.

While this figure remains unchanged since WEO’s last update, the stability masks underlying shifts, including an upward revision for the United States offsetting downward revisions in other major economies. Global headline inflation is expected to decrease to 4.2% in 2025 and 3.5% in 2026, with advanced economies returning to their inflation targets sooner than developing economies.

The IMF identifies that the near-term economic outlook faces varied risks. The United States economy might surpass expectations, while other countries face potential setbacks due to policy uncertainty. Medium-term risks are "tilted to the downside," meaning there is a greater probability that the actual economic outcomes will be worse than the baseline projections. Managing these risks requires careful policy decisions to balance inflation and economic activity, strengthen financial resilience, and implement structural reforms.

Shifting fortunes in the top 20: Nation Brand dynamics in 2025

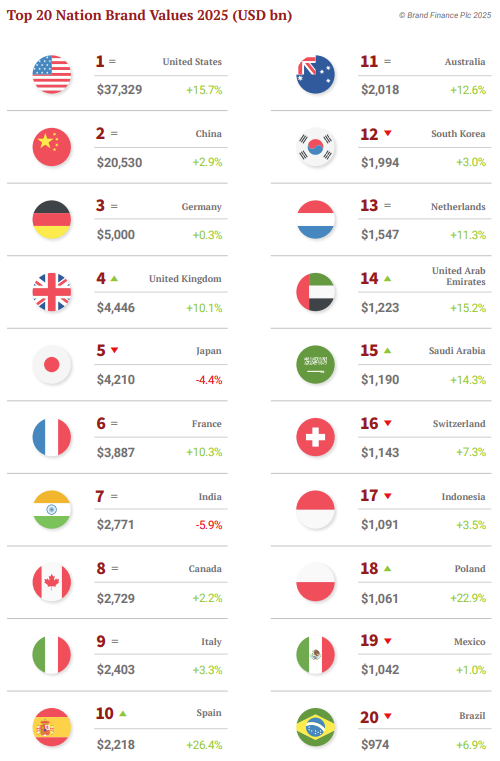

The United States continues its reign as the world's most valuable nation brand. In 2025, its brand value reached a staggering $37.3 trillion, a 16% increase. This impressive growth is underpinned by the nation's strong economic performance in 2024, during which the United States achieved a real GDP growth of 2.8%. The United States’ economic vitality, fuelled by robust consumer spending and innovation, translates directly into global Influence, enhanced nation brand perceptions and attractiveness for investment and talent.

China retains its position as the second most valuable nation brand, with marginal uplift in brand value by 3%. Despite economic challenges, including a property market slowdown and weak consumer confidence, Chinese corporate brands and the nation brand continue to expand their global influence through rising Soft Power. This highlights the increasing importance of nation brands as strategic assets, with China actively leveraging Soft Power to sustain and enhance its global standing amid economic pressures.

Whilst Germany retains its rank as the third most valuable nation brand, Japan's sluggish economic growth has allowed the United Kingdom to overtake it, now securing fourth place. The IMF forecasts the UK’s GDP to grow in 2025, making it the third-fastest growing economy in the G7. However, uncertainty remains. While the UK is set to outpace major European economies like Germany, France, and Italy, several other European countries, including Poland and Spain, are expected to grow at a faster rate.

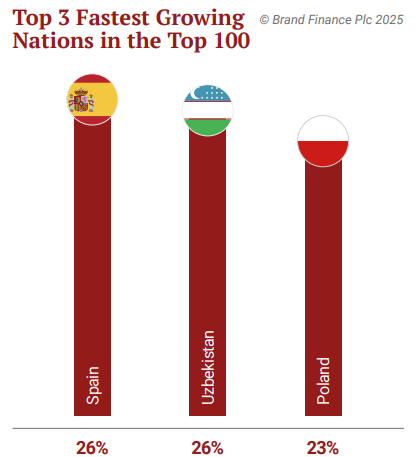

Reflecting this momentum, both Spain and Poland have climbed two places in the ranking, with Spain entering the top 10 in the Nation Brand Valuations.

Spain's strong economic performance is fuelled by a booming tourism sector, a resilient labour market, and effective deployment of EU recovery funds. Poland, meanwhile, is benefiting from rising wages, government support for families, and easing inflation, all of which are driving increased private consumption.

India’s nation brand value has declined by 6%, with GDP growth expected to slow due to a combination of domestic and global factors. Weakness in manufacturing and services, along with reduced government spending, is contributing to the slowdown.

Additionally, global trade disruptions and subdued global growth are impacting India’s exports. However, despite these challenges, the economy is still projected to expand at a steady pace, supported by strong domestic demand and a resilient financial sector, allowing India to maintain its position among the top 10 nation brands.

Regional leaders in Nation Brand Value

Europe

Europe saw moderate economic growth in 2024, fuelled by rising employment and growing household disposable income, yet the overall outlook remains cautiously optimistic.

Germany retains its position as the region’s most valuable nation brand, despite facing considerable economic challenges that led to a contraction in 2024.

While a modest recovery is anticipated in 2025, persistent structural issues and global economic uncertainties continue to temper expectations. Germany also records a decline in global Reputation and Influence, as reflected in the Global Soft Power Index. United Kingdom and France record an uplift in brand value led by improving economic outlook in comparison to 2023.

Asia

Asia's economic growth is expected to slow in 2025, with various sources pointing to a lower growth compared to 2024. Escalating geopolitical tensions and trade disputes present risks, particularly for the region's three largest economies – China, Japan, and India. China sees a slight increase in its nation brand value, while Japan and India experience declines. Despite the more subdued economic outlook, China, Japan and India maintain their dominance in the Nation Brand Valuations led by strong Soft Power perceptions.

Americas

As the United States stands in a league of its own, Canada and Mexico remain the second and third most valuable nation brands in the Americas. Canada experiences a positive outlook in its economic growth due to easing monetary policy, stimulating household and business spending. This, combined with the stable performance in the Global Soft Power Index, results in an upward movement in its brand value by 2%.

Mexico records stable nation brand value led by subdued economic outlook, with economic growth expected to be lower than in previous years.

Middle East

In 2024, the Middle East's economy saw modest growth, though uncertainty lingered. The World Bank projected a GDP growth rate of 2.2% for the region, but this was tempered by ongoing conflicts and oil production cuts that have slowed many regional economies. Despite these challenges, countries not directly affected by conflict have seen positive economic outcomes.

The United Arab Emirates stands out with substantial progress, while Saudi Arabia also demonstrates strong economic performance. Our GSPI research underscores that both nations have made significant strides in science and technology, contributing to their overall growth. The UAE's comprehensive policies focused on AI, renewable energy, and space exploration have been key drivers of its economic development. Meanwhile, Saudi Arabia continues to make strategic investments under Vision 2030, prioritizing digital transformation and renewable energy.

Africa

Despite global economic challenges, African nations continue to demonstrate resilience. South Africa remains the region’s most valuable nation brand, retaining its position from 2024. Our research highlights that its overall strength is supported by improvements in Education & Science, reflecting the country's commitment to innovation and the development of a knowledge-based economy.

A spotlight on the fastest growing nation in the top 100

As mentioned earlier, this year’s Nation Brand Value ranking introduces a more detailed segmentation of a nation’s brand value, looking at over 40 sectors that contribute to a nation’s GDP. What does this mean for nation brand managers and policy makers? It highlights the importance of identifying high-potential sectors, directing investment effectively, and developing data-driven strategies to enhance your nation's global brand.

Spain stands out as one of the fastest-growing developed nations, with an impressive 26% increase in its nation brand value. This growth is driven by several key sectors—retail, healthcare, real estate, and professional services—which together account for over 50% of Spain’s nation brand value. Notably, utilities and technology sectors are emerging as the fastest-growing areas, indicating a broader diversification of Spain’s economic strength.

Spain’s rising brand value is also bolstered by the presence of leading corporate brands, such as Santander, Zara, BBVA, Iberdrola, and Movistar. These influential global brands play a pivotal role in shaping global perceptions of Spain, contributing significantly to its reputation as a competitive and innovative nation. Their international success reinforces Spain’s image and strengthens its position on the global stage, particularly in the areas of fashion, finance, telecommunications, and energy.

This refined segmentation of nation brand value highlights how a nation’s economic sectors, corporate leaders, and global perceptions are interconnected. By leveraging these insights, nation brand managers can more effectively shape strategies that foster international recognition and drive sustained growth in the global market.

Nation Brand valuations - a tool for maintaining and measuring global influence

As global trends evolve, understanding how specific sectors contribute to a nation’s reputation and brand value is more important than ever. Despite the uncertain economic outlook, measuring nation brand value remains a vital tool for identifying opportunities, directing investments, and shaping strategies to enhance a nation's standing on the global stage. This ongoing assessment ensures that nations can effectively navigate challenges, build competitive advantages, and foster sustainable growth in a dynamic global economy. Additionally, as Soft Power continues to play an increasingly significant role in shaping perceptions, measuring and managing nation brand value is essential for maintaining global influence and resilience in an interconnected world.