This article was originally published in the Brand Finance Global Soft Power Index 2026

Sport remains one of the most impactful ways nations project their identities, values, and capabilities.

Sports Services Manager,

Brand Finance

The Paris 2024 Olympic & Paralympic Games reimagined urban mega-events with a focus on sustainability and inclusivity, and EURO 2024 in Germany advanced ESG practices at scale. The Copa América 2024 and the ICC Men’s T20 World Cup 2024 brought top-tier football and cricket to new audiences, including matches on US soil, while Saudi Arabia’s sports investments highlighted its importance in economic strategy, tourism strategy, and geopolitical influence.

These collectively affirm that sporting events have evolved beyond a standalone driver of soft power into a powerful platform for nations around the world to showcase their best qualities.

Global interest and why it matters

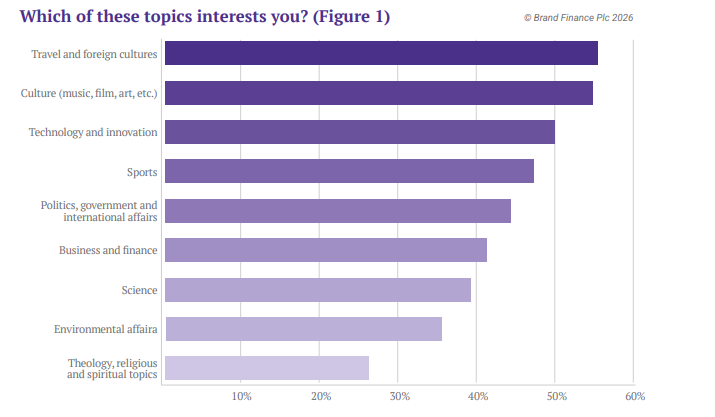

According to Brand Finance’s Global Soft Power Index research, sport continues to rank among the most engaging cultural domains globally. Nearly half of respondents (47%) indicated they are interested in sport in this year’s study (Figure 1).

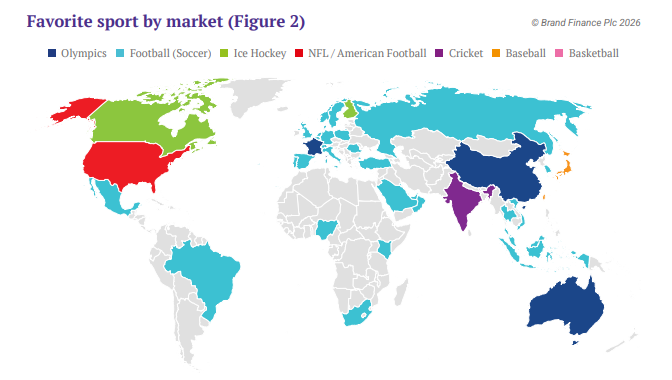

Within sports, football is the world’s common language, while regional preferences – for instance, cricket in India and South Asia, basketball in China, and the NFL in the US - create bridges to specific audiences (Figure 2). This universal appeal means sport offers unparalleled reach for countries seeking to project identity and values, as evidenced by the Argentina Football Association (AFA).

Sports teams drive a nations soft power

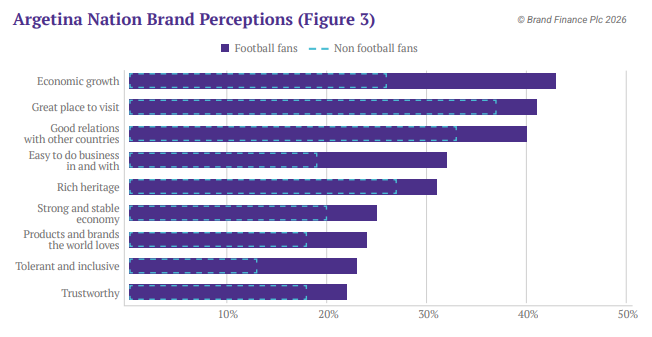

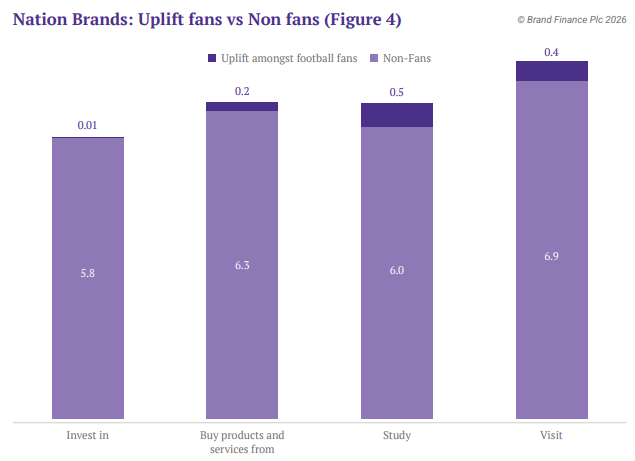

Brand Finance analysis of the AFA demonstrates how the nation’s football success, which is anchored by deep cultural heritage and iconic talent, translates into measurable improvements in perceptions across key dimensions of nation brand strength (Figure 3). Football‑engaged audiences associate Argentina more positively on attributes like economic growth, heritage, trustworthiness, ease of doing business, and good relations with other countries than non‑fans do. Those perception uplifts translate into increased willingness to visit, invest, study, and buy, which are important outcomes for policymakers and businesses (Figure 4).

This effect extends to the private sector. The AFA’s brand strength and global reach raise awareness and consideration for commercial partners (e.g. financial services and FMCG partners), illustrating how nation‑team‑sponsor ecosystems share and multiply value. This is soft power in action: a virtuous circle where emotional affinity fuels economic impact, which in turn funds better programmes and broader reach. It also shows that countries do not need to host to benefit. Sustained excellence by a national team paired with coherent storytelling and partner activation can deliver measurable gains in nation brand equity and commercial value.

Leaders in sports

The Global Soft Power Index ‘Leaders in Sports’ ranking offers another lens on how sport intersects with soft power. Brazil and Argentina remain at the top, reflecting their deep-rooted football heritage, while the United States holds third place, driven by the global reach of its sports leagues and consistent Olympics table-topping success. The most striking 2026 result is Saudi Arabia, which has climbed seven places, as the Kingdom invests heavily in football, golf, and other marquee sports (Figure 5). This surge underscores a key insight, while hosting events or acquiring star talent can buy attention, lasting influence depends on what that attention reveals. If the experience aligns with values like accessibility, inclusion, and sustainability, the reputational gains endure. If not, the effect risks being short-lived.

Sports investment as a soft power strategy

Saudi Arabia’s rise in the Leaders in Sports ranking is the result of a deliberate nation branding strategy. Over the past two years, the Kingdom has invested significantly into sports as part of its Vision 2030 diversification agenda. Investments in football, LIV Golf, boxing, and Formula 1 have positioned Saudi Arabia at the centre of global sports headlines. These moves have expanded tourism, attracted international talent, and secured major broadcasting deals, creating a perception of dynamism and ambition. The strategy demonstrates how sport can serve as a lever for economic development and nation branding, but it also highlights the importance of credibility. For these efforts to translate into enduring soft power, Saudi Arabia must pair investment with delivery across the values that sport embodies, or it risks being seen as transactional rather than transformational.

Why measurement matters

Sport’s impact on soft power is certainly real, but it is mediated through other drivers. That is why measurement is essential. Tracking the chain from exposure to perception to behaviour allows governments to justify infrastructure investments and helps sponsors quantify ROI. Our data shows that the strongest predictor of influence remains whether people follow a country’s affairs closely, a metric that mega-events and elite teams can dramatically boost. However, attention alone is not enough to increase soft power - nations must convert visibility into trust through competence and values.

Sport is the world’s most effective attention engine. Countries that pair this attention with substance, including sustainable infrastructure, cultural depth, and transparent delivery, will find sport a long-term asset for reputation, influence, and economic growth. Those that treat it as a shortcut risk fleeting gains and heightened scrutiny.