See the Brand Finance Football Annual 2020 here

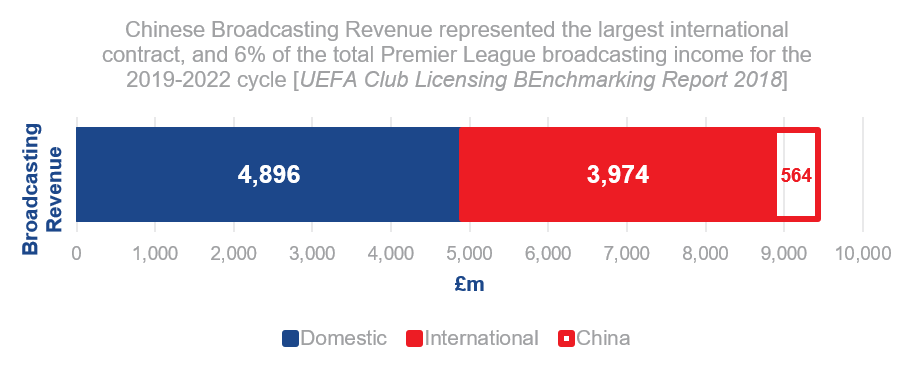

The deal was worth £564m for 2019-2022, equating to £9.4m per Premier League team per year. The impact of losing this on the total Brand Value of the Premier League’s 20 clubs would be a loss of £248m, or 7.2%, through the broadcasting revenue alone.

This will also have a knock-on effect for clubs’ merchandising and sponsorship revenue streams, which are more crucial than ever while matchday revenue is impacted by COVID-19. Ten of last season’s Premier League had Chinese sponsors front of shirt, bringing in over £100m in commercial revenue. Chinese secondary sponsors and partners will also be affected, and other international sponsors will be negatively influenced by a lack of Chinese market exposure too. The brand value impact of this lost revenue stream would be over £250m.

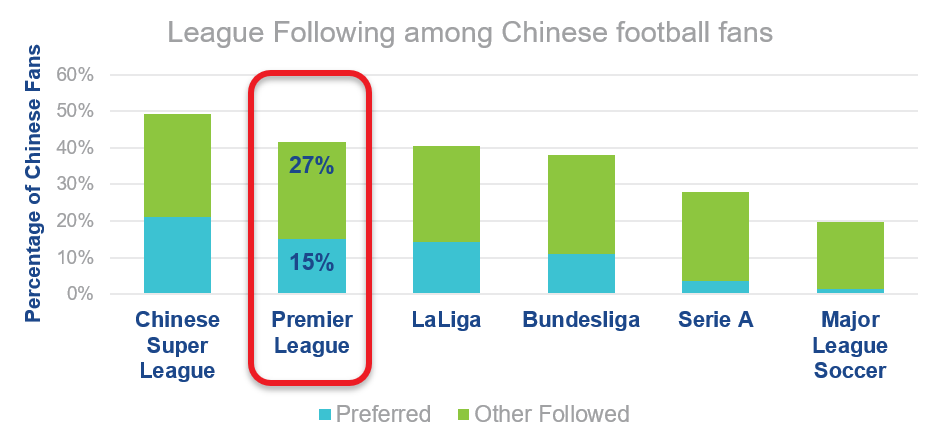

Brand Finance’s Global Brand Equity Monitor research from late 2019 showed 46% of Chinese respondents follow football to some degree, and Brand Finance’s 2020 Football Fan Research had the Premier League as the preferred competition of 15.1% of Chinese football fans. Furthermore, a further 26.5% of Chinese respondents follow the Premier League as a secondary league. Based on a population of 1.4 billion of which 610m are an engageable audience covered by our online research, this suggests at least 117m Chinese fans are following the league to some degree, with 42m indicating it is their preferred league. This market is essential for future growth for Premier League clubs, as foreign commercial deals and merchandising are the most actionable strategic options for football club brand managers.

Furthermore, of the top 10 most popular clubs in China, both Manchester United and Liverpool featured from the Premier League. Through the termination of the deal, these clubs may lose share of preference within the market due to lack of accessibility for fans. With the Onset of Covid, major European teams are not able to conduct their usual pre-season tours of Asia causing further disruption.

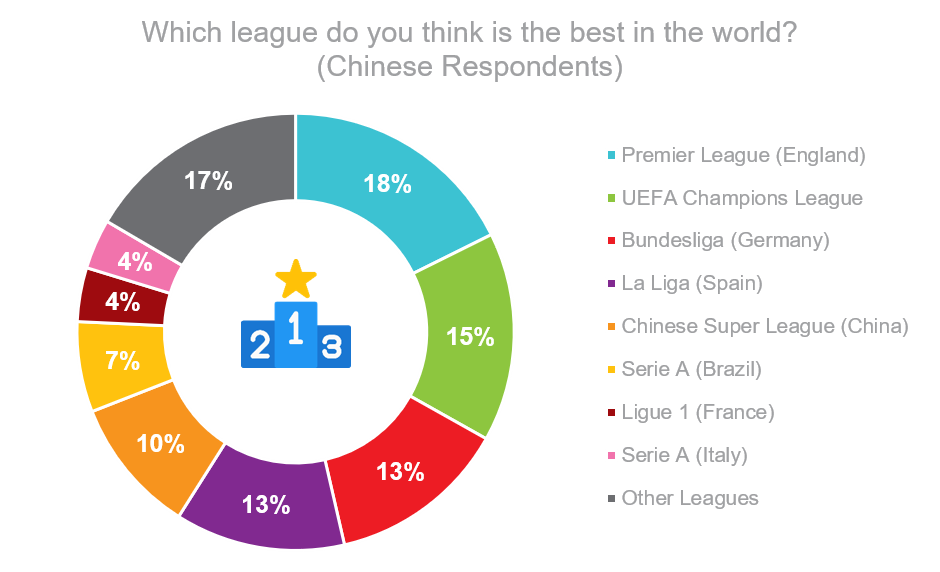

The Premier League was also perceived to be the best club football league/competition in the world by 18% of Chinese football fans, which was higher than any other competition. The UEFA Champions League ranked 2nd (15%) and the Bundesliga ranked 3rd (13%). For the Premier League to maintain pole position, it may be crucial for the league to find an alternative entry point into the Chinese market for the 2020/21 season.

Extrapolating the effects of losing the Chinese market on the broadcasting, sponsorship and commercial revenues indicates a potential £2.5bn loss to the business values of the Premier Leagues’ clubs.

ENDS

Note to Editors

Every year, the world’s leading independent brand valuation consultancy Brand Finance values 5,000 of the world’s biggest brands. The latest ranking of the 50 most valuable football club brands is included in the Brand Finance Football Annual 2020.

The 150-page long second edition of the Brand Finance Football Annual features detailed club profiles and provides in-depth analysis on football club brand values, brand strength, enterprise values, sponsorship effectiveness, league reputation, stadia performance, and the role of esports. It includes special contributions by LaLiga, PSG, and ABSA, among others. The Annual builds on the findings of the Brand Finance Football 50 study on the world’s most valuable and strongest football club brands, and includes the methodology and results of the Buro Happold Venue Performance Rating framework.

Downloads

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations make strategic decisions.

Headquartered in London, Brand Finance operates in over 25 countries. Every year, Brand Finance conducts more than 6,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on 6,000 brands, surveying more than 175,000 respondents across 41 countries and 31 industry sectors. By combining perceptual data from the Global Brand Equity Monitor with data from its valuation database — the largest brand value database in the world — Brand Finance equips ambitious brand leaders with the data, analytics, and the strategic guidance they need to enhance brand and business value.

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics, compliant with ISO 20671.

Brand Finance is a regulated accountancy firm and a committed leader in the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Brand Finance evaluates brand strength in a process compliant with ISO 20671, looking at Marketing Investment, Stakeholder Equity, and the impact of those on Business Performance. The data used is derived from Brand Finance’s proprietary market research programme and from publicly available sources.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+ in a format similar to a credit rating.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668. It involves estimating the likely future revenues that are attributable to a brand by calculating a royalty rate that would be charged for its use, to arrive at a ‘brand value’ understood as a net economic benefit that a brand owner would achieve by licensing the brand in the open market.

The steps in this process are as follows:

1 Calculate brand strength using a balanced scorecard of metrics assessing Marketing Investment, Stakeholder Equity, and Business Performance. Brand strength is expressed as a Brand Strength Index (BSI) score on a scale of 0 to 100.

2 Determine royalty range for each industry, reflecting the importance of brand to purchasing decisions. In luxury, the maximum percentage is high, while in extractive industry, where goods are often commoditised, it is lower. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database.

3 Calculate royalty rate. The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4 Determine brand-specific revenues by estimating a proportion of parent company revenues attributable to a brand.

5 Determine forecast revenues using a function of historic revenues, equity analyst forecasts, and economic growth rates.

6 Apply the royalty rate to the forecast revenues to derive brand revenues.

7 Discount post-tax brand revenues to a net present value which equals the brand value.

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance's proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.