The role of the banking industry in the financial crisis of 2008/09 cost banking brands and their reputation dearly. Now, for the first time since the Great Recession, banking brands’ reputation is on the rise once more.

From Villain to Hero

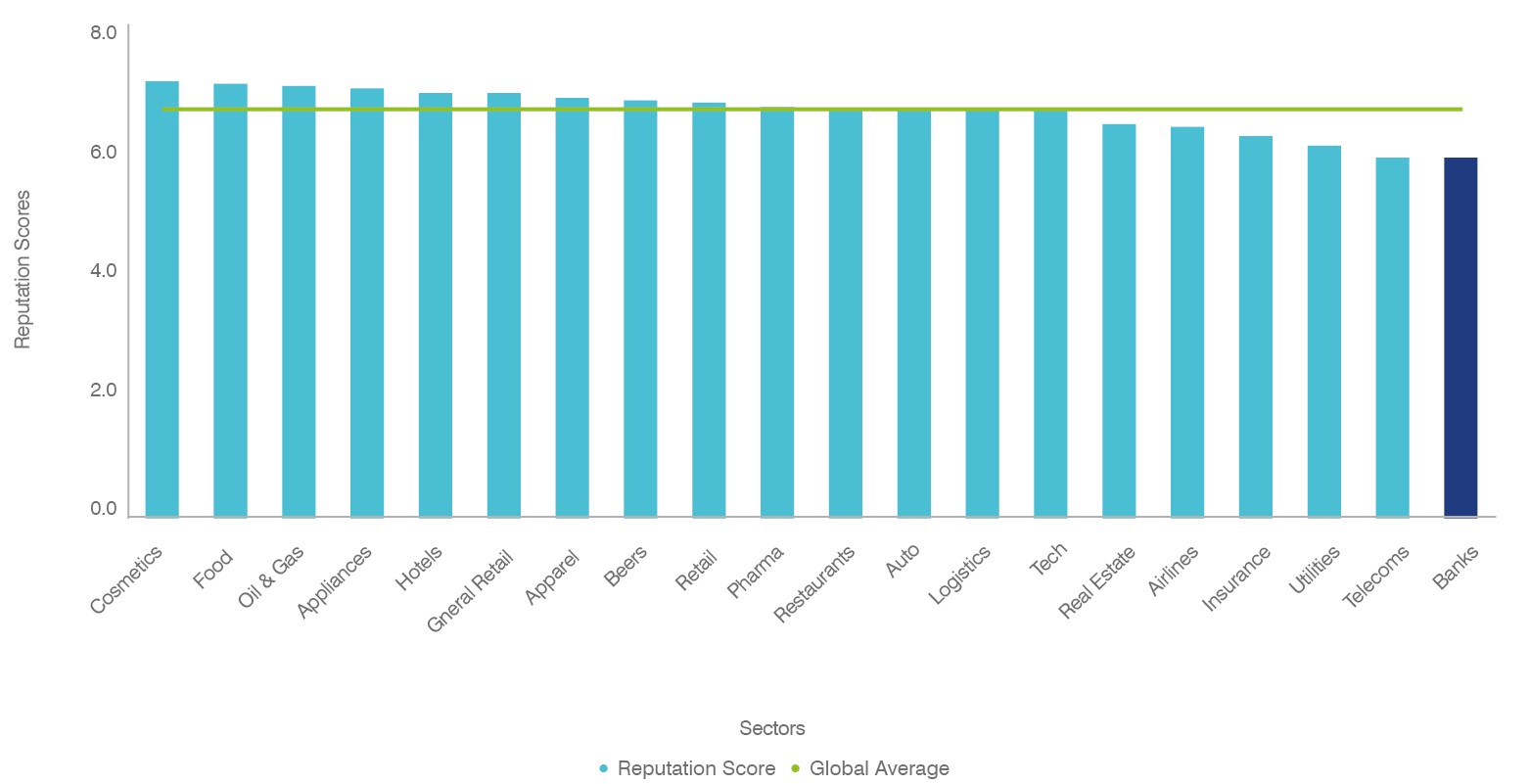

Banking brands are by no means reputational leaders. In fact, according to research conducted by Brand Finance in 2020, the banking industry on aggregate ranks joint last out of 20 industries surveyed globally:

Since 2008-09, banks have not done themselves any favours. From fictitious-accounts1 to money-laundering2 there have been numerous instances of some of the largest banks in the world behaving in a less than flattering manner.

Apart from the widespread scandals, anecdotally everyone has a story about long queues in branches, less than satisfactory customer service levels, and pain points around loan applications.

However, over the past 12 months, and since the onset of the COVID-19 pandemic globally, we have seen banking brands play a hugely significant role in helping businesses and consumers overcome the effects of the virus - distributing government-mandated funds, extending credit, reducing fees, and being considerate to customers. The net result is a greater feeling of goodwill for banks among consumers. We have measured an average increase in the reputation of banking brands in 27 of the 29 countries surveyed by Brand Finance 3

Due to strong regulatory measures put in place by governments, central banks, and the Basel Committee on Banking Supervisions (BCBS), the global banking industry is far better equipped to provide the necessary support to the economies in which they operate than during the Global Financial Crisis.

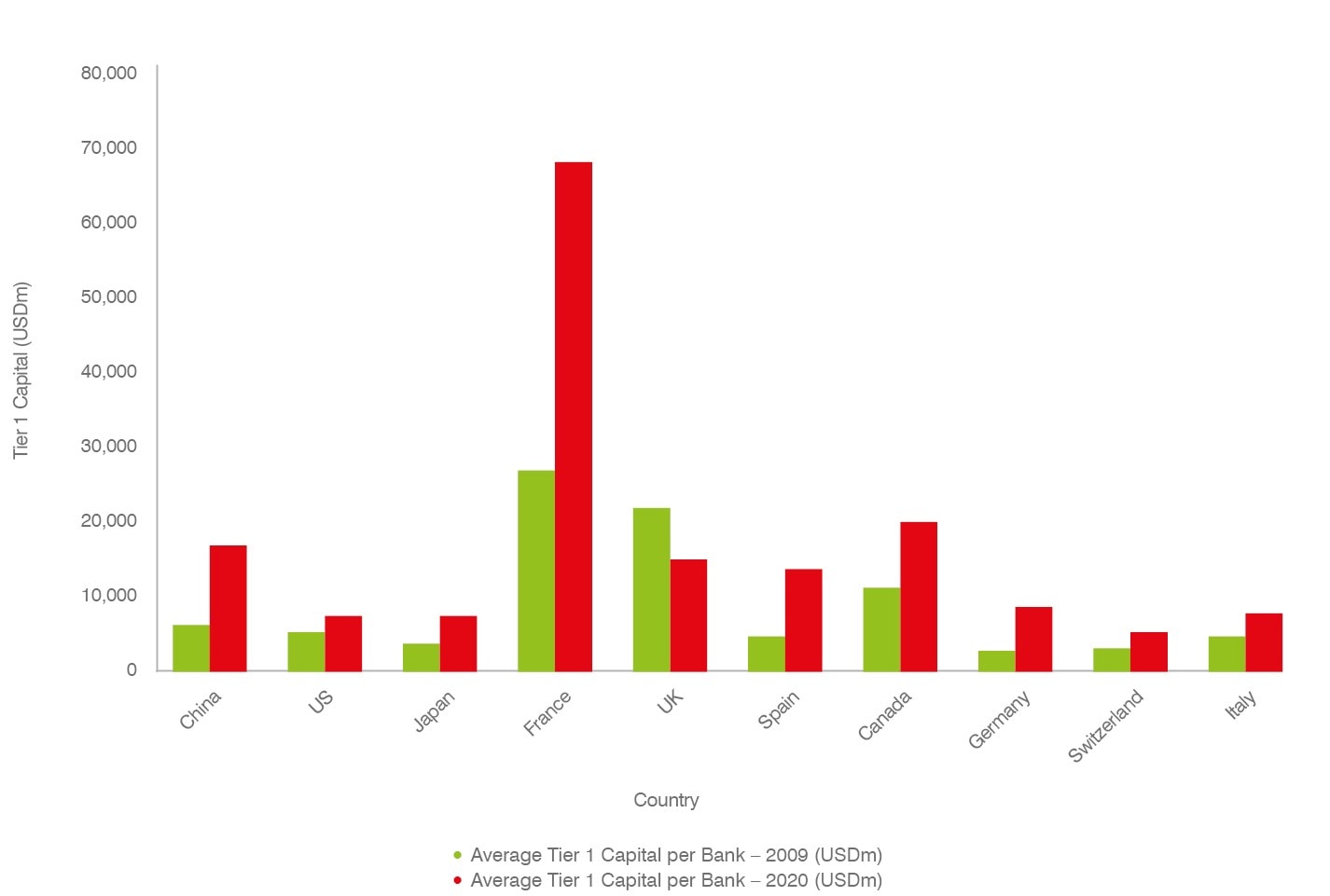

For example, looking at the average Tier 1 Capital (which is a core measure of a bank’s financial strength) and focussing on the countries with the largest banking industries in the world, we can see the banks operating in each country have increased Tier 1 Capital substantially since 2009 (except for the UK):

Reputational Threats

Despite being better equipped financially to deal with the current crisis, banking brands do face a large threat posed by the onset of COVID-19 and the consequences of the pandemic in various ways including:

- Persistently low-interest rates

- Stronger regulation

- Increased competition from fintech and challenger banks

- Overhauling expensive legacy systems.

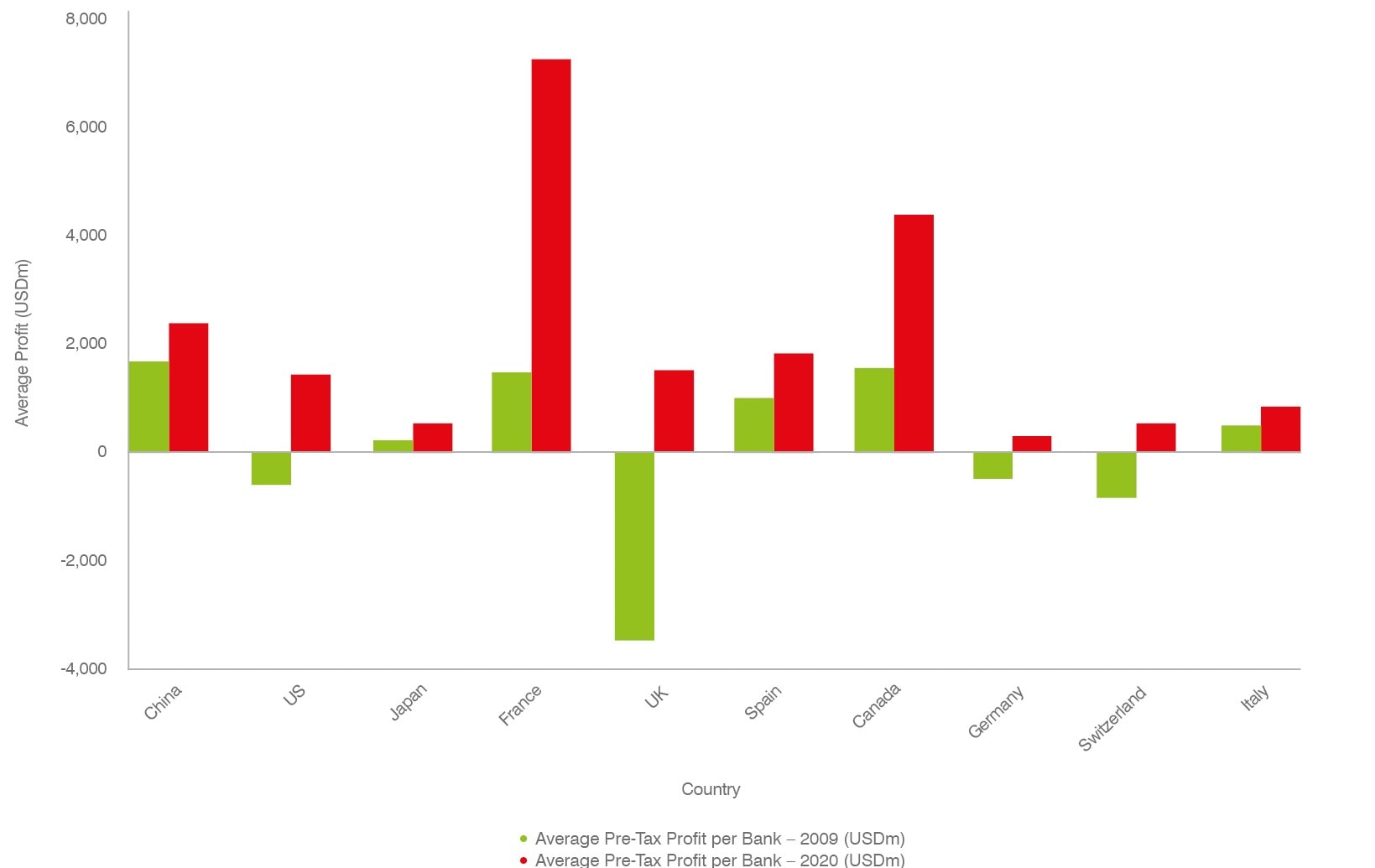

Banking brands have been operating in a much more challenging environment in recent years. Although the average profit per banking brand has recovered since immediately after the Global Financial Crisis, there are still many significant external pressures.

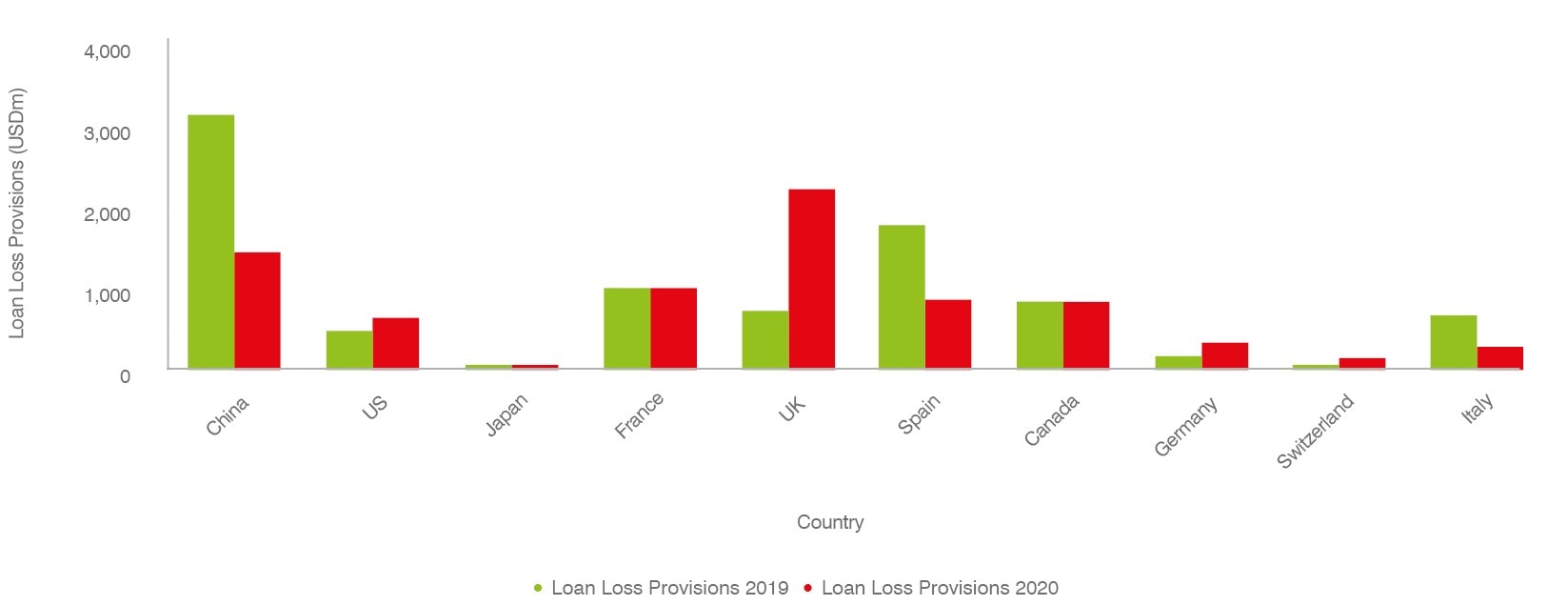

This squeeze on profits is exasperated by the role the industry has played in supporting local economies. Because many banking brands have extended large lines of credit to distressed consumers and businesses, they are at risk of loan repayments not being made.

For example, within the Brand Finance Banking 500 2021 report, on average US banks have increased loan loss provisions by 130% year-on-year:

Why is reputation improving?

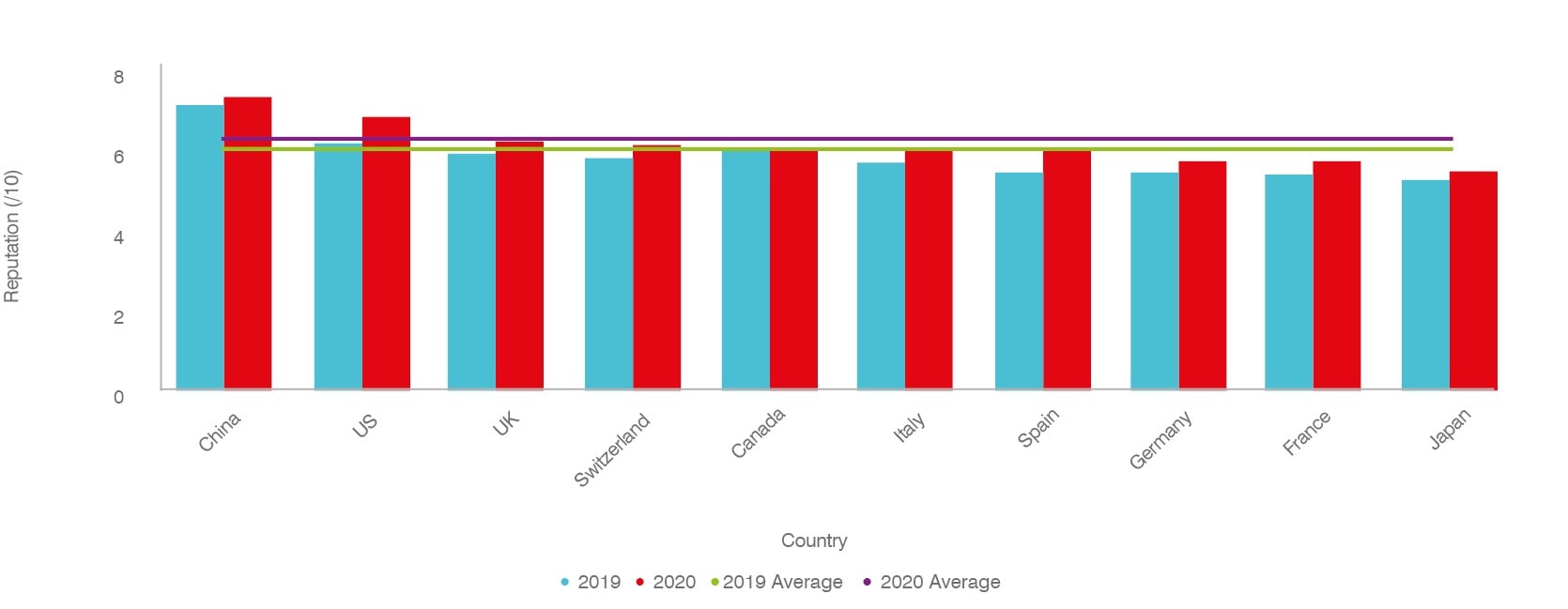

Reputation across the banking industry is rising for the first time since Brand Finance begun its Global Brand Equity Monitor. Assessing the same 10 countries as above, Reputation scores have increased by an average of 4%. It may be argued that this is not a significant increase, yet what is significant is that of the 29 countries researched by Brand Finance, 27 are experiencing reputational increases in the banking industry.

Using research across more than 500 brands worldwide, Brand Finance has used statistical analysis to identify 3 key areas that determine reputation among banking brands, these are:

- The ability to meet the customer’s needs

- Practising ethically and sustainably

- Innovation

Research scores within each of these categories have improved year-on-year on average across the entire industry.

So, what does the ability to meet the needs of the customer entail? According to the research, the following attributes are crucial among consumers when selecting a banking brand:

- Being easy to deal with

- Having a good website and app

- Accessibility

- Good levels of customer service

- Good product range

- Good value for money

These are all relatively intuitive when thinking about what the customer desires and it appears banking brands (spurred on by the pandemic) are performing better in this regard.

Ethical practices are a natural fit in determining reputation and consist of caring about the wider community in which the bank operates in, being transparent, being committed to sustainability, and being fair to all people. Again, government-mandated or not, banking brands are scoring better in this regard because of the pandemic.

Innovation has been the major buzzword in the banking industry in recent years (and in many other industries). However, innovation for innovation’s sake can be counterproductive.

The reason digital banks perform exceptionally well in Brand Finance’s Global Brand Equity Monitor is that their innovations enable them to meet the customers’ needs in an efficient and effective manner. This ability has come to the fore throughout the pandemic, where banks with greater digital capabilities are better placed to serve customers through innovation.

Indeed, the onset of the pandemic has forced brands that were previously falling behind in digitalisation and innovation to invest and act at speed or risk losing market share.

DBS bank (6th strongest banking brand in the world4) reacted extremely quickly when the virus first began spreading in Singapore, by launching a digital relief package, enabling many retailers to set up on online marketplace in just three days.

As another example, Maybank (8th strongest banking brand in the world) launched an entirely digital 10-minute approval process for SME financing during the pandemic, and to date has approved 99% of all its processed loan repayment extensions.

Why Reputation is Important

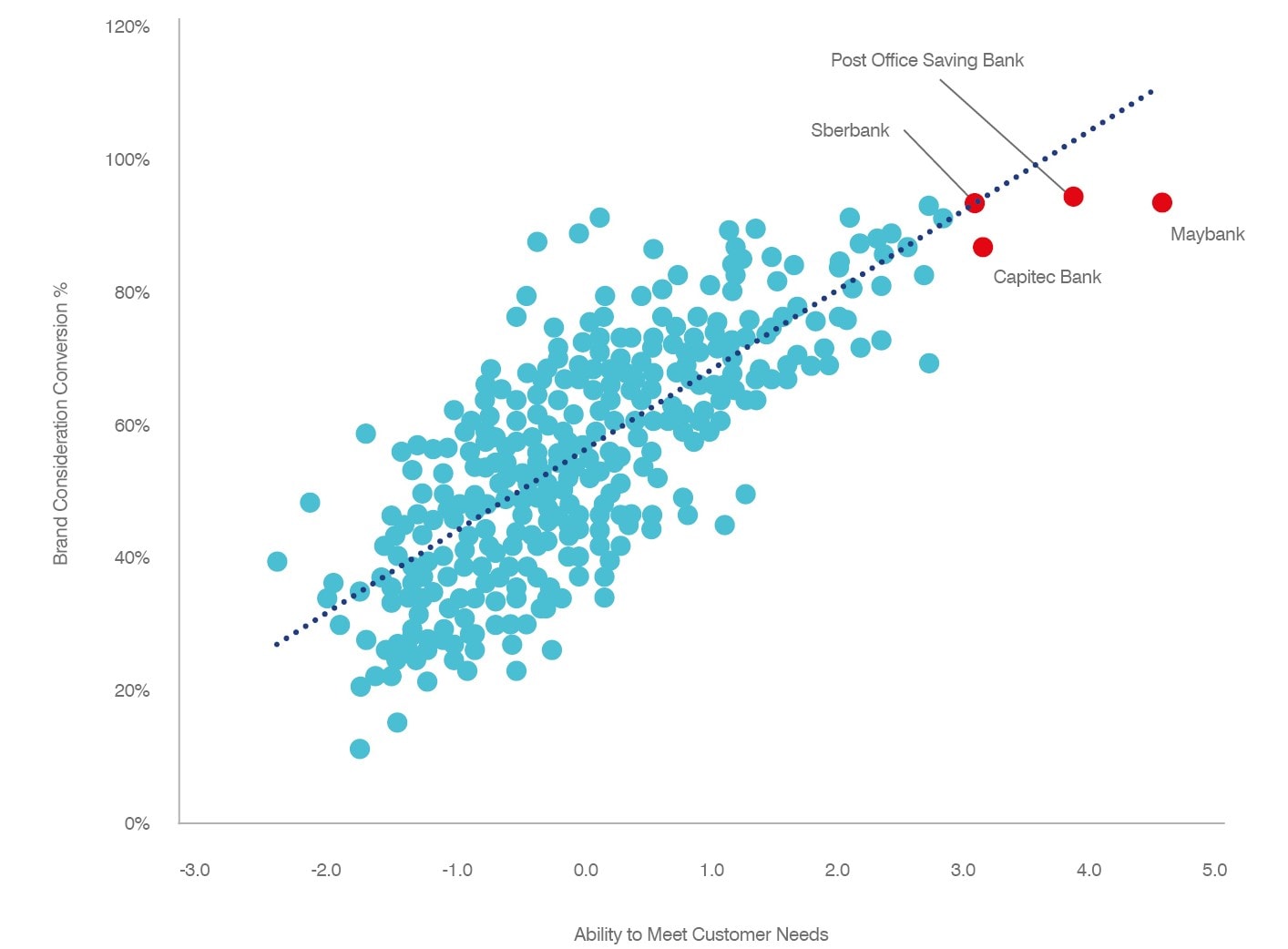

The five most reputable banking brands indicated by the research are: Revolut (UK), DBS bank (Singapore), Post Office Savings Bank (Singapore), Maybank (Malaysia) and Capitec Bank (South Africa). Each of these banking brands are among the strongest brands in our study. According to Brand Finance research, Reputation (and the main drivers of Reputation) is highly correlated with brand consideration.

Examining the ability of a bank to meet customer needs, we can see that the banks that outperform in reputation also outperform in brand consideration:

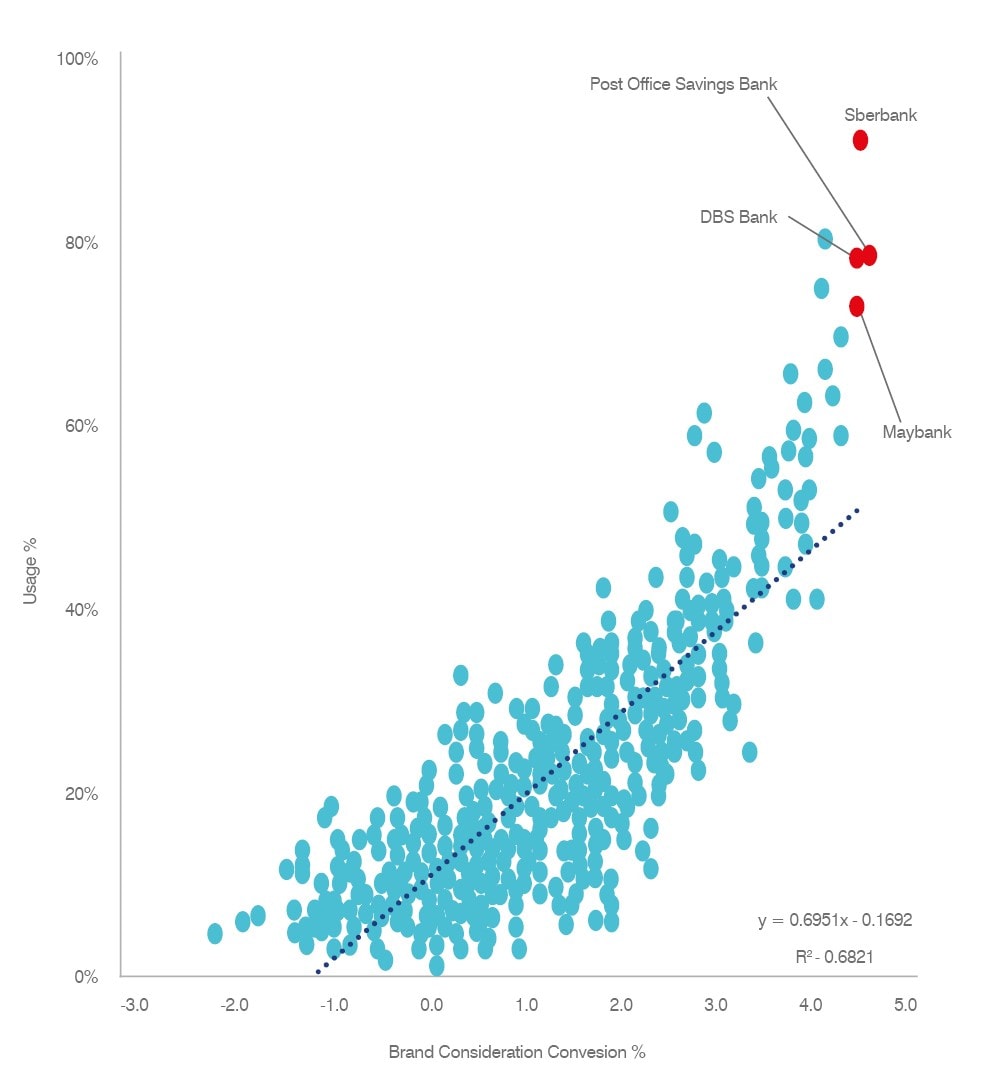

Why is brand consideration important? Brand consideration is highly correlated with brand usage (market share), where increased consideration is a lead indicator of usage:

Our research shows that while building brand reputation is important for any brand (not least those in the banking industry), in the banking sector, focusing on the core offering of identifying what the customer needs and continuing to service those needs, is one of the main avenues to do so. However, a more important KPI is building brand consideration, which is driven primarily by meeting the needs of the consumer.

Brand consideration can be aided by innovation, which is not in itself a key driver of brand consideration but plays a crucial role in the ability of a bank to connect with its customers during a pandemic. If a banking brand is to come out of the other side of the pandemic in a stronger position in the market, it should use similar research, analysis, and data points in order to help guide key decision making, not just in the marketing department, but throughout the entire business.

- 'The Wells Fargo Fake Account Scandal', https://www.nytimes.com/2020/02/21/business/wells-fargo-settlement.html[↩]

- Royal Commission into the behaviour of Australia’s biggest banks, https://financialservices.royalcommission.gov.au/Pages/default.aspx[↩]

- Brand Finance Global Equity Monitor 2020.https://brandirectory.com/consumer-research[↩]

- https://brandirectory.com/rankings/global/[↩]