This article was originally published in the Global Soft Power Index 2022.

The Global Soft Power Index is a classic example of the ‘balanced scorecard’ approach to evaluating brand equity and strength, in this case that of nation brands. The key word here is ‘balance’, as it acknowledges a key truth: growing a brand – any kind of brand – is made easier if it can perform strongly across a range of dimensions or metrics.

It is difficult to build soft power solely through being seen as a model society with a great reputation – the stark reality is that ‘power’ encompasses elements of visibility, influence, weight.

Let’s look at our definition of soft power:

“A nation’s ability to influence the preferences and behaviours of various actors in the international arena (states, corporations, communities, publics etc.) through attraction or persuasion rather than coercion.”

From this it might appear that building nation brand equity is simply a matter of making your country’s products, people, and values as attractive as possible. But that cannot be sufficient in its own right – your nation may have many attractive qualities, but if the world is unaware of them, they are wasted talents. In a ‘party of nations’, are you someone working the room, talking confidently to everyone – or huddled in the corner waiting to be spoken to? Hence in our view effective soft power has three key dimensions, which form the three KPIs in our index:

- Familiarity: A hygiene factor – if people know more about your country, its talents, businesses, and resources, then soft power is enhanced.

- Reputation: For a nation to be attractive and a role model for others, its overall reputation must be strong and positive.

- Influence: A direct measure of the perceived presence and impact that your country has in other countries. It is also a way of assessing whether soft power really plays out globally, or whether some nations’ soft power is restricted to certain regions or cultural affiliations.

The Importance of Familiarity and Mental Availability

Marketing guru Professor Byron Sharp outlined the importance of mental (and physical) availability in driving the growth of commercial brands. Put simply “the better a consumer knows a brand, the better they tend to feel about it – familiarity breeds contentment”. Mental availability is more than mere ‘brand awareness’ – it is the extent to which the brand and its features are accessed in memory in relevant situations.

For nation brands, similar (though not identical) patterns are evident. Awareness and Familiarity are important – clearly, it is beneficial that as many people as possible (consumers, business decision-makers, media, influencers) think about your country, its values, key strengths and attractions. But it is the broader extent to which that country touches your life in some way that makes the difference.

Our data shows that large countries hold a clear advantage – smaller nations, especially more geographically remote ones – struggle for visibility and attention. Big nations attract more media attention, bigger budgets to promote themselves, bigger diplomatic footprint, and have more people and companies out in the world. But it is not sheer size alone of course – Indonesia is the 4th largest country in terms of population and is in the top 20 for GDP, but for many people it does not affect their lives in any significant way (it ranks only 46th for Familiarity in our measures, for example).

What, beyond size, drives salience and mental availability? Accessibility helps – and in this regard English-speaking nations have an in-built advantage, especially those with strong reach via traditional and digital media and entertainment. There is also the less tangible (but equally important) dimension of relevance – do you care about this country, pay attention to what is going on there?

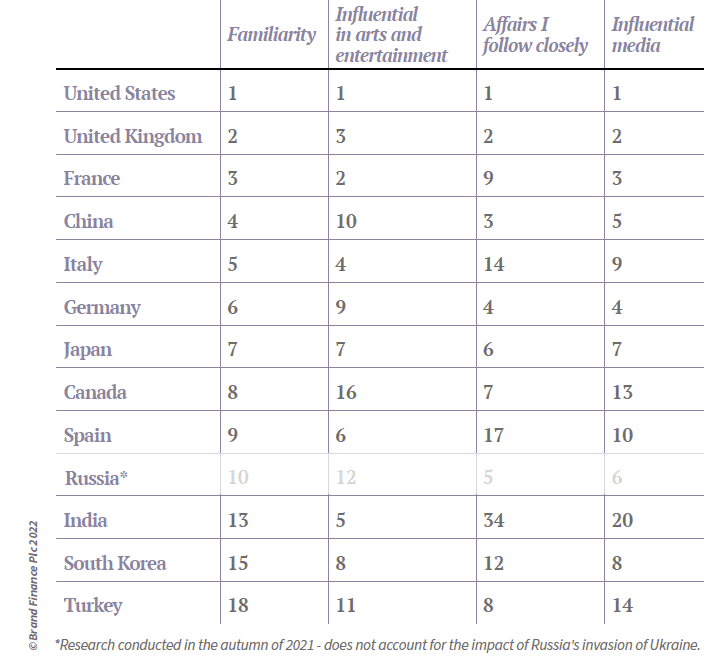

Putting various elements of ‘mental availability’ together, the strong performance of the United States is very apparent.

Everyone ‘knows’ the US, and there is a huge appetite for its popular culture and entertainment, even among those who have concerns about American influence or overreach (Kim Jong Un is believed to be a big fan of the NBA). The US matters to people, and US culture and products touch most people’s lives literally every day.

The UK may not quite have the same presence, but nonetheless enjoys high salience and accessibility, with a language advantage that is near-impossible to replicate.

No doubt that China aspires to reach a similar level of mental availability, and clearly the world now sits up and takes notice of events in China more than ever before. But the softer, cultural elements of soft power are harder work, and this acts as something of a brake.

Overall, the same cluster of larger, more familiar nations occupies the top rankings on all four metrics, even though three of these are based on scores among those who are already familiar with that nation. This is a variation on another general law of branding, Andrew Ehrenberg’s well-known ‘double jeopardy’ law, whereby bigger brands enjoy higher levels of interaction among their brand users.

This presents a challenge for smaller nation brands. They can punch above their weight in terms of mental availability, and some do – notably Switzerland, the UAE, and New Zealand. But there is a limit to what can be achieved, at least on a global level.

Smaller nations which struggle to achieve global salience may have to prioritize. They can aim for regional influence perhaps, focusing on near-neighbours. Alternatively, focusing efforts on major source markets has clear logic.

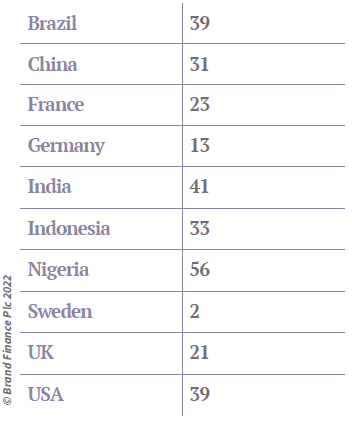

Getting the balance right is tricky, and our data suggests that some smaller European nations are in danger of eroded salience and mental availability, because they lack presence in parts of the world which are fast-growing. Consider Denmark’s familiarity levels and ranking, for example.

Denmark has good presence in Western Europe, but many smaller EU nations face a strategic challenge in building salience and relevance in places like Brazil, China, India, and Nigeria – markets of increasing importance in the global mix.

Reputation still counts

Salience and familiarity are clearly import foundations of soft power. But soft power concerns the power of attraction, and for that to be maximised, stakeholders need to see something desirable in your actions, governance, values, culture, or products.

Hence the need to measure overall reputation and nations’ perceived excellence and leadership on the various pillars of soft power. But this begs the question: can a country with a negative or mixed reputation really fulfil its soft power potential?

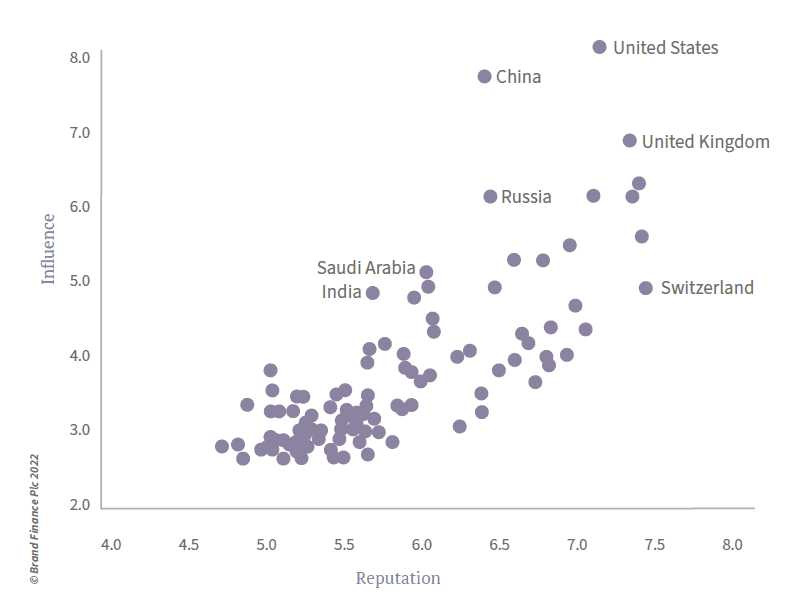

Clearly, there is a high correlation between perceived Reputation and Influence – a 0.8 correlation statistically, in fact. It is fundamentally impossible to achieve Influence on any scale if a nation’s Reputation is poor – powers of attraction will be severely limited, and specific strengths are undermined by bigger and broader weaknesses. For example, significant numbers acknowledge the cultural influence and friendliness of the people of Nigeria, but wider reputational issues around governance, economic stability, and technological skills make it very difficult for Nigeria to capitalise on these strengths. As a result, Nigeria’s influence is well below where a country of its size and strategic position might be.

Reputation, therefore, matters – but the graph above shows Influence (and ultimately, soft power) is not purely a function of Reputation. Countries such as Russia and China all have Influence well above what one might expect given their somewhat mixed reputations – reflecting to some extent their ability to apply hard power to soft power objectives.

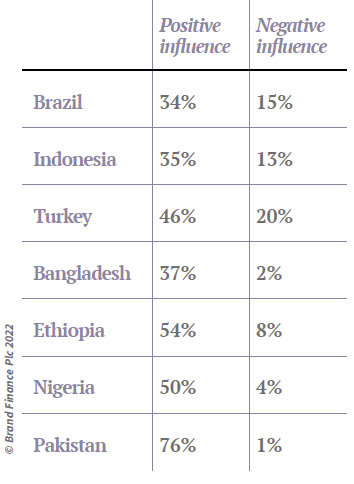

However, the key here is that these countries have mixed or moderately positive reputations: Russia ranks 23rd (pre-invasion of Ukraine), China 24th – not great, but both close to the top of the table. These rankings might surprise some, especially those based in Europe or North America. But outside these regions, attitudes towards Russia or China are far from negative. An additional question asked (not part of the Index calculation) is whether a country’s Influence is a positive or negative force, and that sheds more light on China’s Influence in a number of large markets beyond Europe and North America.

However, our data (and common sense) indicates that a more positive Reputation would nonetheless improve any nation’s Influence and overall soft power. The power of attraction requires more than simply a loud voice and eager networking at the soft power party. Knowing when and how to put others at ease and make friends are an asset socially, as well as in the world of nation branding.