This article was originally published in the Brand Finance Football Annual 2020.

Football’s reach stretches further than ever before, as the shirts of the premier league’s clubs carry the logos for Japanese tyres, Middle Eastern airlines, American cars, multiple Asian bookmakers and more. It is not always clear how partnerships deliver value to brands through their various influences and interactions, and so negotiating an appropriate price can be difficult.

Sponsorship decisions are too frequently made either qualitatively by looking at subjective ‘alignment’ of brand values or based on shallow quantitative measures such as advertising value equivalents. These fail to capture the full value delivered by a partnership through changes in stakeholder perceptions, sentiment, shifts in stakeholder behaviours towards the brand, and ultimately the impact on the financial performance of the underlying business.

Without appropriate methodologies for sponsorship evaluation and valuation, properties are undersold by clubs, leagues, and competitions, and brands are unable to appreciate the full suite of benefits that are possible from an engagement.

We have developed methodologies to express the return on sponsorship investment in a way that makes sense to both brand and financial audiences;

Head over to our Football Research page to learn more about the perceptions of football fans around the world.

'Bang for Buck' Analysis

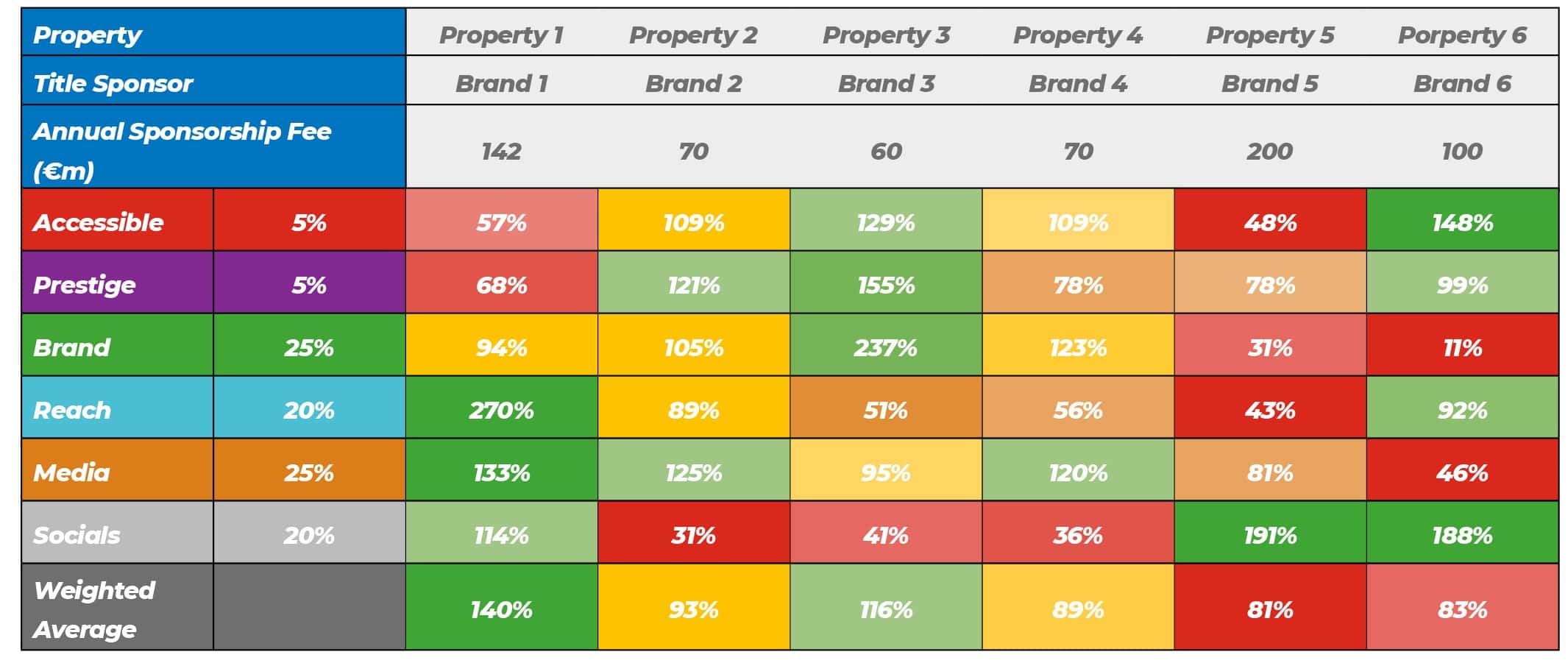

The Market Approach is the simplest method of determining a price for a sponsorship – simply comparing the property on offer to similar opportunities and setting a relative price. The weakness in this method is that it doesn’t consider the fit of the particular sponsorship to the brand objectives, which is what creates the difference between a short unsuccessful expense and a long mutually beneficial relationship.

Brand’s looking to use sports sponsorship as a marketing channel should first have an outline of what they aim to achieve – a set of attributes and their importance. This can then be used to create a structure to benchmark the value for money against the market, by determining the return each property delivers per £/€/$ spent.

The example here shows how Property 1 will deliver the best weighted average return because it has the strongest focus on the key objectives of a strong brand, wide reach, and positive media exposure opportunities. The key objectives are given significance by applying a weighting to the attribute categories, allowing potential partners to select based on their desired outcomes.

Using quantitative analysis to make the decision ensures that the right sponsorship activity is undertaken. Appropriate sponsorship fees can be determined by setting a target for the weighted average return relative to competitors’ properties. With almost €5.5bn in commercial revenues across Europe’s top 5 leagues, it is essential for brands to ensure they are getting ‘Bang for their Buck’ and understand the numbers behind the qualitative attributes that attracted them to sports sponsorship in the first place.

Sponsorship Uplift and Return on Investment

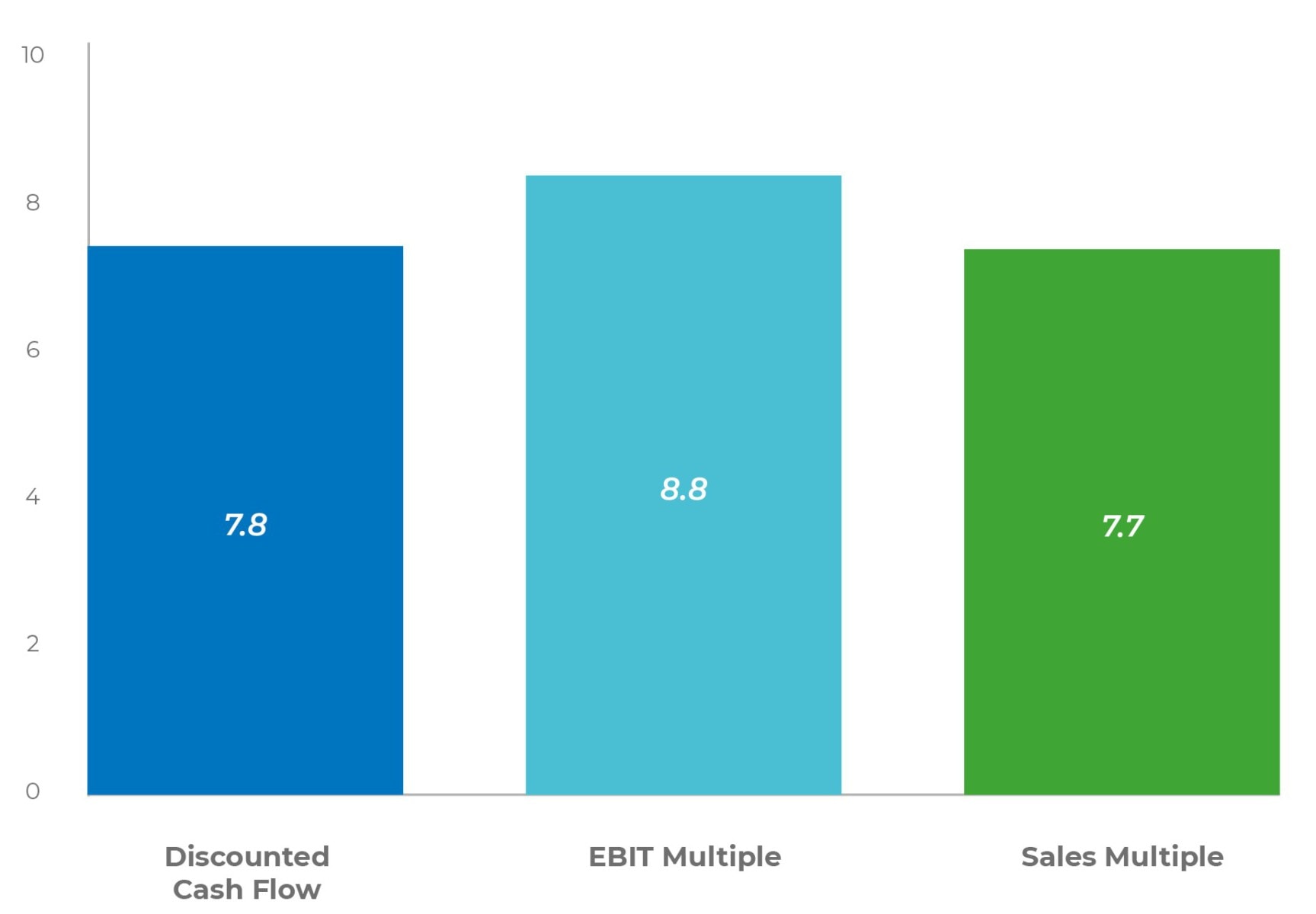

The next level of sponsorship analysis is to determine the financial return and uplift to business metrics that is resulting from the investment and to be able to express this in a way that allows a brand team to communicate the partnership benefits to the CFO, CEO, and Board. This requires determining the bottom line effect, and asking the questions that would be asked if investing in a new factory or machinery asset:

- How does this investment pay back over the short and long term?

- Has this investment increased the value of the business for the shareholders?

- Are we getting good value for money?

A valuation-based approach to sponsorship evaluation provides a practical, logical, and commercially driven basis for assessment. Through an approach that establishes linkages between changes in brand equity, stakeholder behaviour, and ultimately business and brand value, it provides a solid platform of insight to inform future sponsorship decision making.

A five-step approach is taken to understand the impact of a sponsorship on a business value, and the cash delivered since its inception:

1. Branded Business Valuation

Adaptable financial model of the business to allow for scenario modelling.

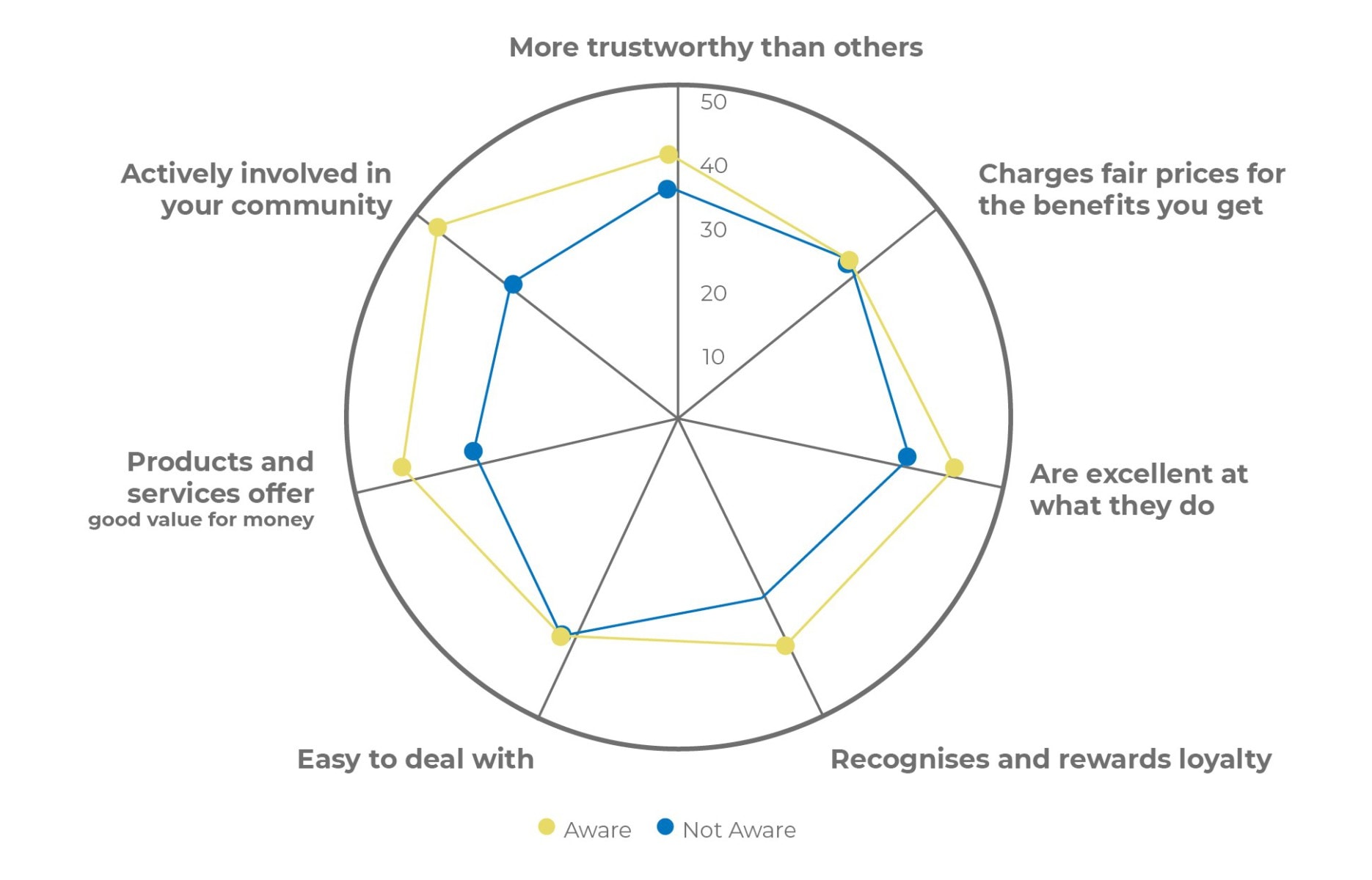

2. Effect of partnership on customer consideration and perceptions

Understand brand perception differences between those aware and not aware of the sponsorship.

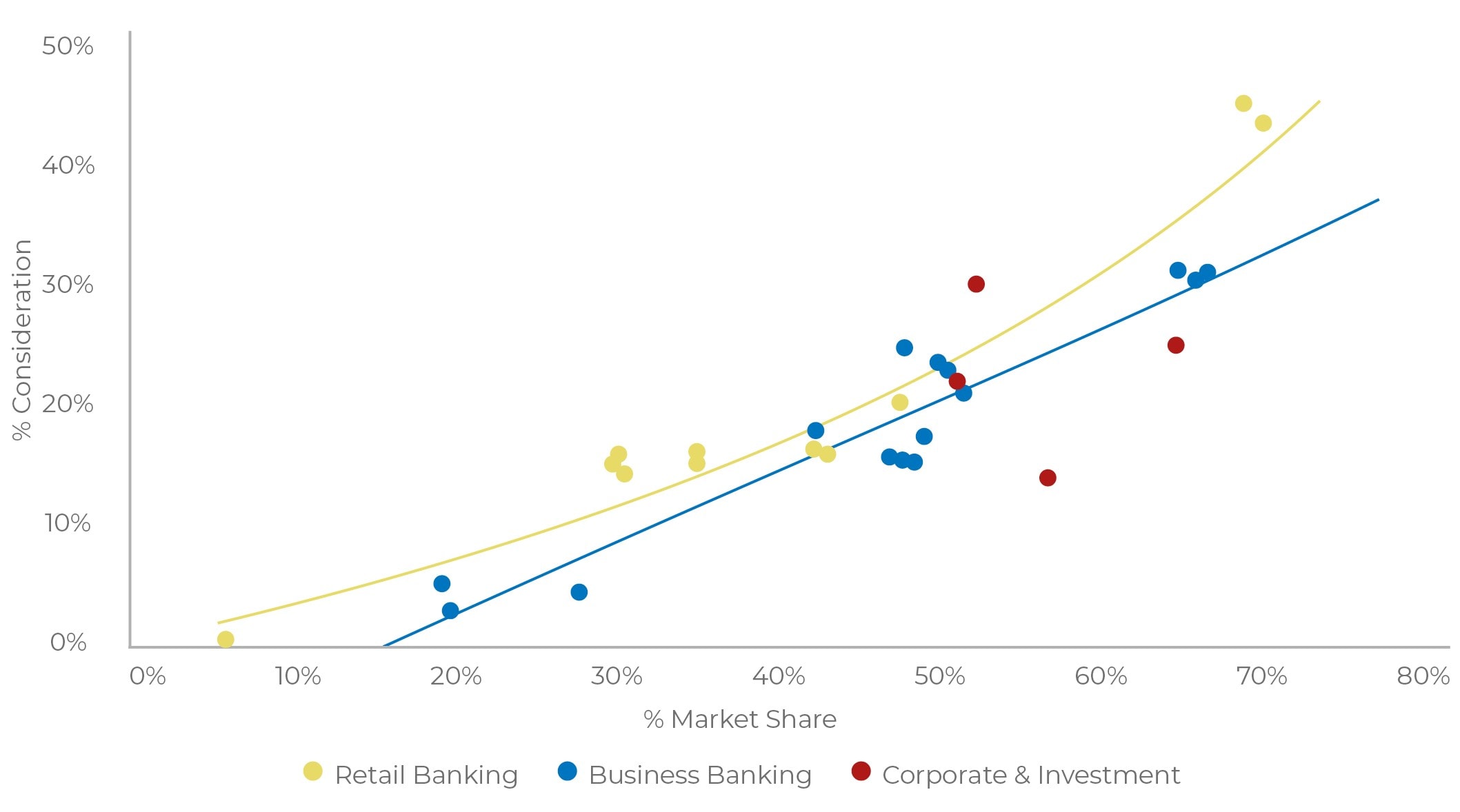

3. Linking brand perceptions to business value drivers

How the customer numbers, acquisition, retention and churn are affected by the sponsorship.

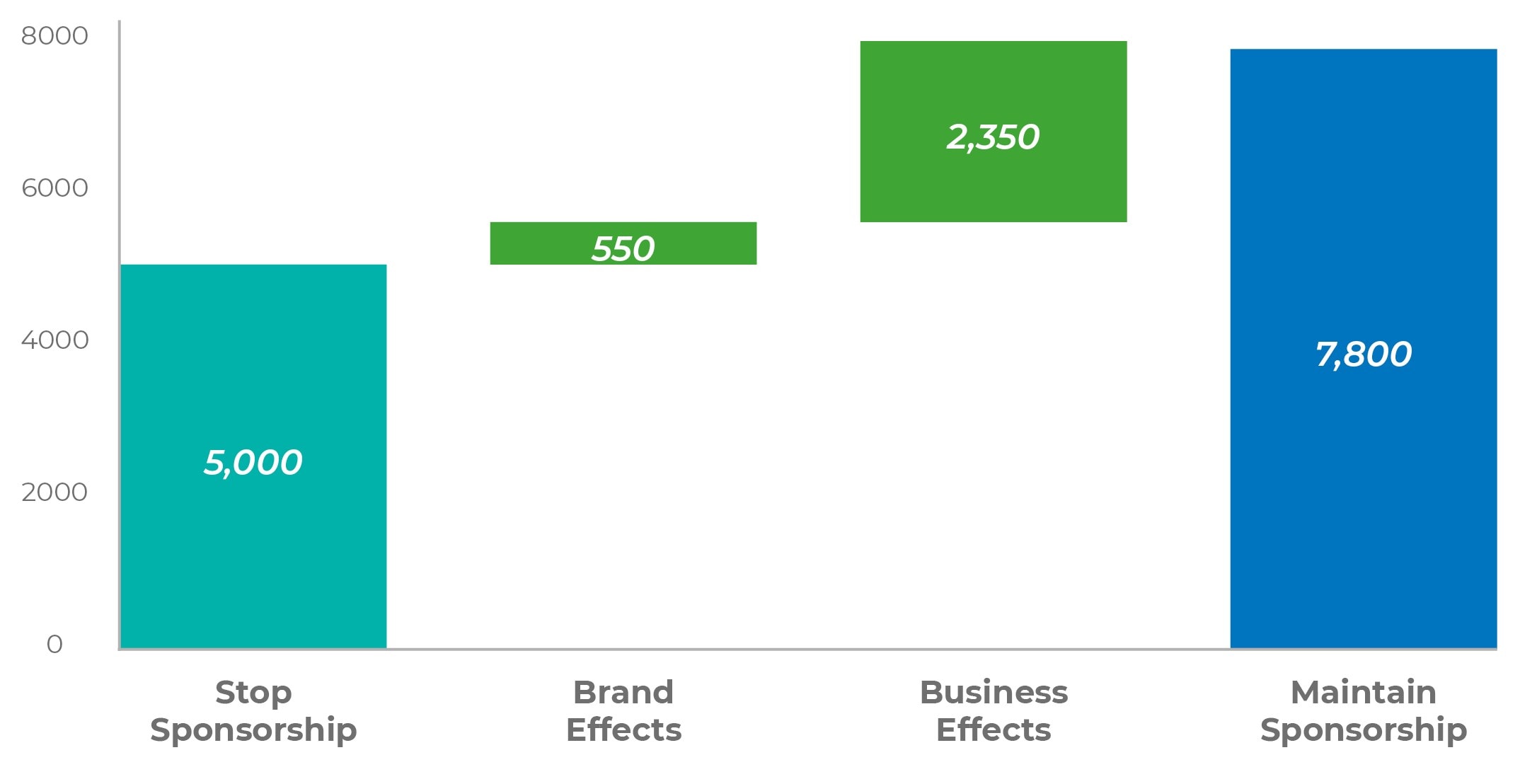

4. Sponsorship Valuation (Business Value Impact)

Apply adjusted customer numbers to the business model to find the financial impact.

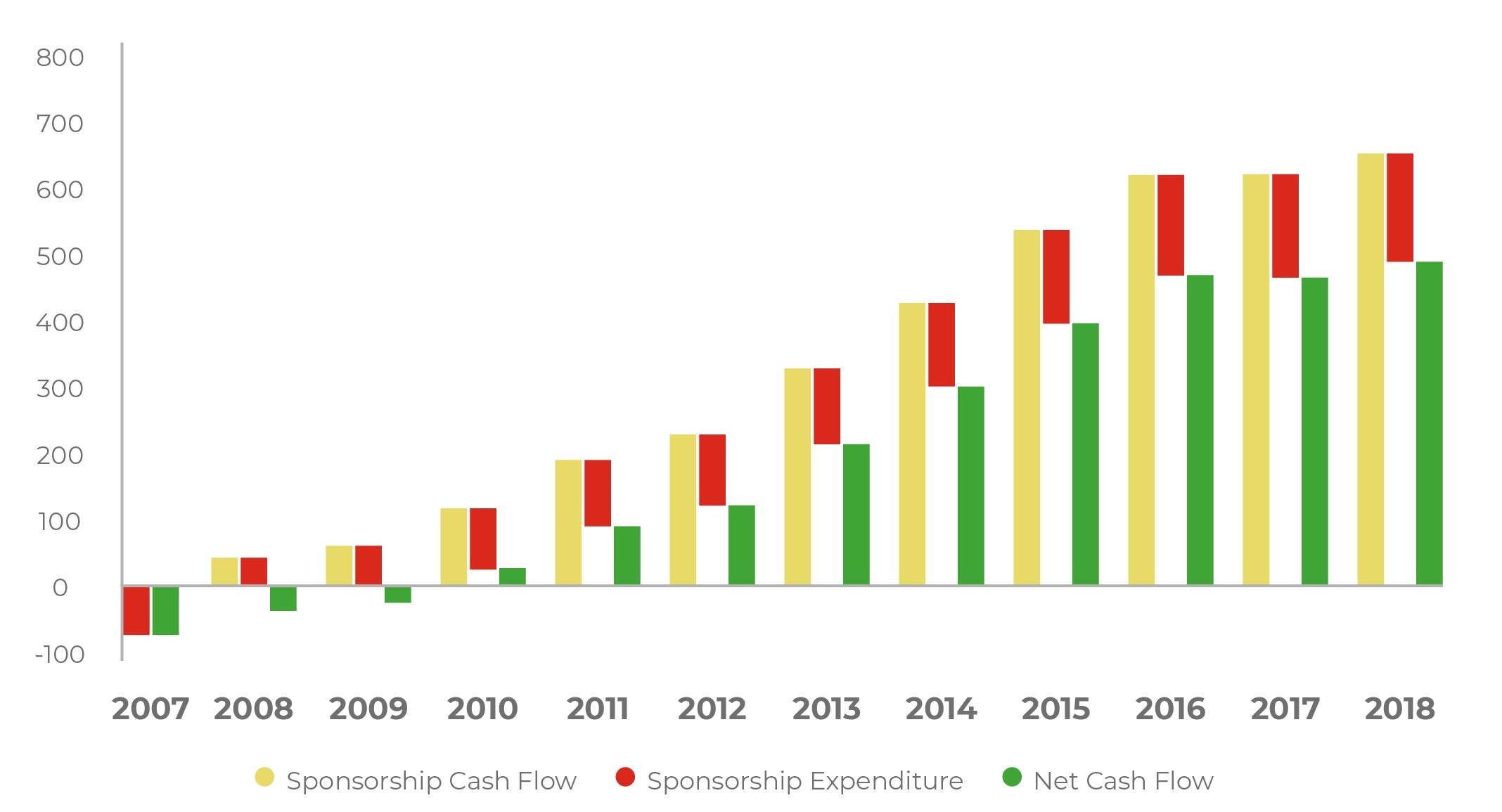

5. Return on Investment Analysis

Comparing total expenditure since the start of the sponsorship to the cash flow advantage delivered.

When embarking on a new sponsorship, or considering the renewal of an existing sponsorship, whether you are a rights holder or a corporate brand, one must ask themselves ‘Do I have a framework in place to quantify the ROI dollar value to maximise effectiveness, inform decision making and increase negotiation leverage.’

With such high levels of investment in sports sponsorship, a lot of money can be left on the table. As such, there is a requirement to improve the sophistication of sponsorship valuation, to provide a basis of valuation in the language of the CFO, CEO, and Board who are often the key decision makers.

Brand Finance Football Annual 2020

What are the world's most valuable football brands? The 150-page-long second edition of the Annual provides in-depth analysis of brand and enterprise values, sponsorship effectiveness, league reputation, stadia performance, and the role of Esports.