This article was originally published in the Brand Finance Global City Index 2024.

Place Branding Manager,

Brand Finance

Travel Industry Overview

The global travel industry in 2024 continues to adapt to the challenges posed by inflation and high interest rates. According to the International Air Transportation Association (IATA) there has been a convergence in key measures - Revenue Passenger Kilometre (RPK) and Available Seat Kilometre (ASK)1.

The former one measures the number of kilometres travelled by paying passengers, while the latter focuses on the total number of seat kilometres available. Convergence in these two indicators points that supply and demand are moving in tandem and airlines efficiently fill their available seat capacity. More importantly, we are witnessing an upward trend in both indicators reflecting the expanding market.

Demand for travel remains resilient in regions like Europe, the Middle East, and the Americas. In Europe, a drop in inflation to a three-year low has led to increased affordability for tourists.

The European Central Bank implementing further interest rate cuts earlier in October 2024 should further improve the overall economic outlook for the tourism sector. Some European destinations are already benefiting more than others as airlines expand their routes, increasing competition by covering more of the same destinations, which consequently leads to lower fare prices2.

The Middle East, particularly Saudi Arabia, has emerged as a tourism powerhouse, with the region surpassing pre-pandemic levels. The influx of visitors is fuelled by robust investments in the tourism sector and the region's efforts to diversify its economy. Saudi Arabia, for instance, has seen international tourist arrivals grow by 156% compared to 2019, supported by policies aimed at economic diversification3.

In the Americas, tourism has nearly fully recovered, with international arrivals reaching 99% of pre-pandemic levels by early 20244. However, inflation and rising interest rates have driven travellers to focus on domestic trips or budget-friendly options. Despite these challenges, high-income travellers continue to drive demand for luxury travel experiences, maintaining resilience in the sector.

Asia is still experiencing a slower recovery in the first quarter of 2024, with international tourism returning to 82% of pre-pandemic levels5. Yet, with inflation easing and China's full reopening, the region is expected to rebound strongly, particularly as air connectivity improves.

These regional trends underscore how economic conditions are influencing global travel patterns, with affordability and strategic government policies playing key roles in sustaining demand amidst broader economic challenges.

In order to sustain this tourism growth, it is essential for destination marketing organisations, local policymakers, travel agencies, and the industry in general to understand who their target customer is and, more importantly, how that ‘ideal traveller’ profile changes over time.

Answers to these questions can be found in the second iteration of the Brand Finance Global City Index, surveying over 15,000 respondents from 20 markets on their perceptions of the top 100 global cities. This article aims not only to provide readers with the demographic profile of the respondents but also to shed light on the key global drivers influencing the consideration to visit a particular city.

Carefully examining these drivers, alongside individual city brand results, will offer decision-makers a powerful tool for assessing whether their destination is equipped to welcome the travellers of tomorrow.

Age & Demographic Shifts in Travel Intent

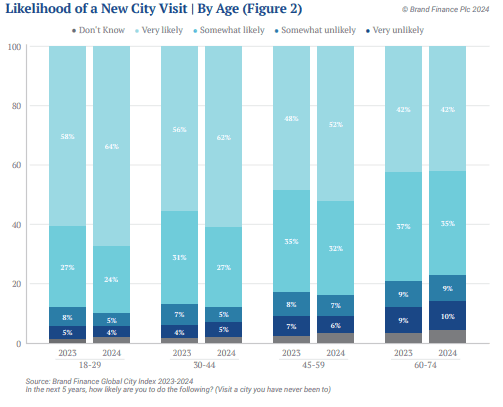

In 2024, there has been a subtle yet meaningful shift in travel intentions among respondents aged 18 to 59. The youngest group, aged 18-29, is 3% more likely to travel in the next five years compared to 2023.

Similarly, respondents aged 30-44 and 45-59 are 2% and 1% more likely, respectively. This modest increase in travel intentions suggests a renewed optimism among younger individuals, despite recent years' inflationary pressures and political volatility.

At a more granular level, we are seeing a significant increase in individuals who are 'very likely' to travel, as opposed to those who are 'somewhat likely.' This is great news for the overall tourism industry. In contrast, older respondents aged 60-74 show more stable travel patterns, reflecting either greater financial security or fewer possibilities to travel.

Education and Family Dynamics

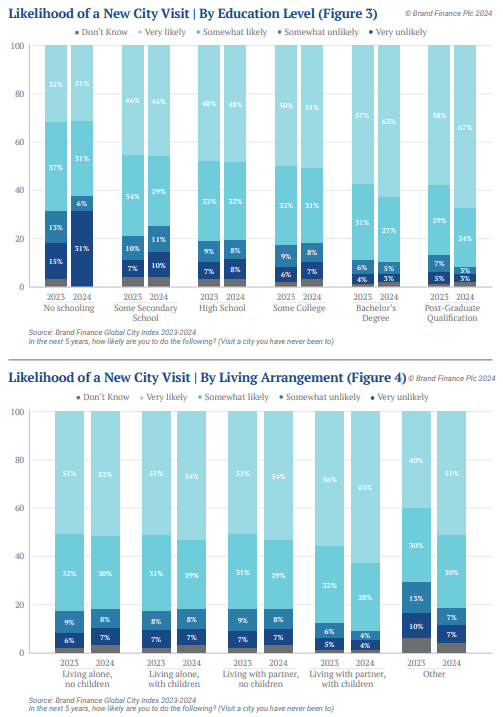

Interestingly, those with bachelor’s degrees and above show a similar optimism trend. Previously being less enthusiastic about exploring new destinations, many have shifted their stance from 'somewhat likely to visit' to 'very likely to visit'. The same caution applies to respondents living with children, who express more certainty about travelling than those living without children.

Drivers of Consideration: What Matters Most in 2024?

As discussed earlier, understanding the key factors that drive travel decisions is essential for destination marketing organisations, local policymakers, and travel agencies to capture a greater market share of the growing tourism sector. Applying statistical regression analysis to the findings of the Brand Finance Global City Index 2024, we have identified the key attributes influencing consideration to visit a city among all 45 city brand attributes in the study:

- Beautiful architecture

- Appealing lifestyle

- Strong and stable economy

- Great shopping, restaurants, and nightlife

- Rich history and heritage

These five attributes account for nearly 30% of the decision-making process, which has grown by six percentage points compared to last year.

Additionally, future growth potential as well as great theatres and music venues have become more influential year on year, reflecting a renewed interest in cultural and experiential travel. Consistently though, respondents are more likely to consider a city that is stable economically, reflecting the importance of perceptions around affluence and governance.

Real-World Examples of Top Performers

The top 5 city brands for consideration to visit are all European destinations:

- Rome

- London

- Paris

- Vienna

- Madrid

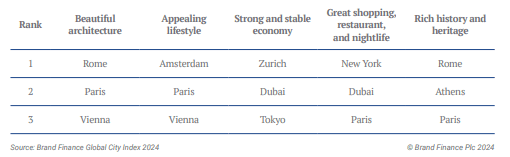

When we zoom-in, however, on the key driving attributes of the consideration to visit, the picture slightly changes. We can see Prague, Amsterdam, Dubai, Tokyo, Zurich, New York, and Athens among the leaders too.

- Paris: Long hailed for its beautiful architecture, it is hard not to think of the Eiffel Tower and Notre-Dame Cathedral when discussing iconic structures that have defined Paris for centuries. Additionally, perceptions of Paris are likely to benefit from the showcase offered by hosting the Olympic Games in the summer of 2024.

- Amsterdam: Known for its unique work-life balance, Amsterdam’s cycling culture, green spaces, and relaxed attitude toward leisure have cemented its status as one of the most appealing lifestyle cities globally.

- Dubai: With its strong and stable economy, Dubai’s resilience stems from its diversified sectors, including tourism, finance, real estate, trade and transport.

- New York: As an epicentre for shopping, dining, and nightlife, New York offers an unmatched vibrancy, from Times Square to the hidden gems of Greenwich Village.

- Rome: Often described as an open-air museum, Rome’s rich history and heritage make it a perennial favourite. The Colosseum and Pantheon are just two historical landmarks that fascinate travellers.

While scoring strong for one key attribute is indeed a great achievement, only a city brand that encompasses all or most of the relevant drivers can really get ahead of others. Among the five leading cities in terms of consideration to visit, Rome, Paris, and Vienna feature on the podium across several of the key driving attributes. While London and Madrid are not in the top 3 for these key metrics, they are not far behind and take high positions on others.

It is therefore worth taking a step back from your core positioning to consider the wider picture and analyse where you stand versus key competitors. This can help you determine if adjustments to your core brand strategy can be made to put you on a straight path to become a leading tourist destination.

Conclusion

As we move through 2024, the data highlights the ever-evolving nature of travel preferences, driven by macroeconomic factors and changing consumer behaviours alike. Cities that invest in understanding and adapting to these changing preferences, emphasizing their key strengths, and addressing concerns, will be better positioned to attract and retain visitors in the years ahead. The Brand Finance Global City Index provides invaluable insights to sustain and enhance their appeal in a competitive industry landscape.

Source:

1https://www.iata.org/en/iata-repository/publications/economic-reports/air-passenger-market-analysis-august-2024/

2https://www.oag.com/blog/summer-2024-airfares-reduced-as-capacity-increased-on-these-european-flight-routes

3https://www.unwto.org/news/un-tourism-applauds-saudi-arabia-s-historic-milestone-of-100-million-tourist-arrivals

4https://ftnnews.com/travel-news/tours/tourisms-comeback-nearly-full-recovery-seen-in-first-quarter-of-2024/

5https://www.unwto.org/news/education-and-diversification-recognized-as-key-to-future-of-tourism-in-asia-and-the-pacific