This article was originally published in the Brand Finance Banking 500 2025 report

Despite facing challenging domestic, regional and international operating environments, African banking institutions and their brands continue to make a significant global impact. The performance of African banking brands in the Global 500 rankings reflects the strength of Africa’s financial services sector and the role these institutions play in fostering a sustainable, inclusive economy across the continent.

Although much work remains to be done to realise Africa’s development goals, the success of these home-grown brands sets the tone for other sectors. It demonstrates what is possible when strong business performance is paired with strong brands, creating some of the most loved brands in the world.

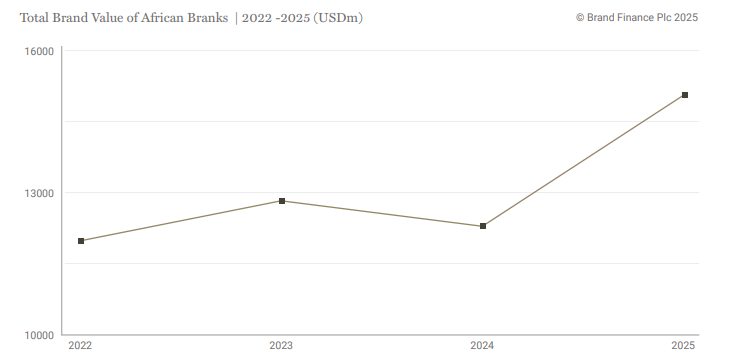

US$15.2BN IN VALUE CREATED THROUGH AFRICAN BANKING BRANDS IN 2025

Overall, African banking brands performed extremely well in 2025, with an average Brand Value growth of 22% across the markets surveyed (in common USD currency terms). The regional growth in Brand Value masks some impressive individual country performances. Kenya (+49%) and South Africa (+ 24%) saw above average growth while West and North African markets lagged slightly.

Morrocco grew by 21%, Nigeria by 16% (despite the decline of the Naira) and Egypt by 8%. South Africa’s growth was notably driven by Capitec Bank with a remarkable 100% increase in Brand Value compared to the previous year.

This growth resulted from a combination of factors: significant profitability improvements; continued diversification of its business lines; and consistent brand equity growth.

Capitec earned perfect scores (10 out of 10) on key metrics like “brand I love”, “brand consideration” and “brand engagement”.

Other noteworthy brands with increased Brand Value in 2025 include South Africa’s Nedbank (+37%) and Rand Merchant Bank (+31%); Kenya’s Co-Operative Bank (+36%) and Equity Bank (+23%); Nigeria’s GTCO (+32%), and Morocco’s Attijariwafa Bank (+27%).

Despite these impressive gains, no African banking brands make the Top 100 due to weak domestic currencies and high regional risk. The highest-ranking African brands are all from South Africa, with Standard Bank at 134 (up four places since 2024), First National Bank at 158 (up 11 places since 2024) and Absa Bank at 170 (up two places since 2024).

Nigerian banks saw the largest declines in Brand Value and global ranking, largely driven by domestic fiscal challenges. Zenith Bank dropped 42 places to rank at 472, with a 16% decrease in brand value, and UBA dropped 58 places to rank 472, losing 26% in brand value.

AFRICAN BANKING BRANDS ARE SOME OF THE STRONGEST IN THE WORLD

Africa boasts two brands in the Global Top 10, and four more in the Global Top 20, positioning the region among the leaders in Brand Strength performance.

A third of African banks rank highly in Brand Strength.

Africa is part of a broader trend of emerging market banks leading in brand growth. Africa has the highest average Brand Strength score globally, at 80, meaning African banking brands typically achieve a AAA rating. The Middle East follows with an average Brand Strength score of 67, while South America has an average Brand Strength score of 62.

Given that Africa has only had formal banking since the mid-19th century, African banks cannot compete by relying only on their underlying business size and must be extremely strong to be featured in the Global top 500 banks.

This makes for a particularly dynamic market, and financial services remains one of the most competitive categories for African brand custodians and marketers. With limited marketing investments relative to business size, the pressure on marketers and brand custodians to efficiently manage resources and sustain brand value will continue to grow.

DIGITAL BANKING CAPABILITY IS NO LONGER A COMPETITIVE ADVANTAGE, BUT A MUST-HAVE FOUNDATION FOR MODERN AFRICAN BRANDS

Africa leads the world in mobile banking and is home to nearly half of the world’s mobile banking accounts, according to the World Economic Forum.

New players do not need expensive, cumbersome physical infrastructure to reach highly distributed audiences, and Africa’s widespread digital adoption has driven financial inclusion, at scale, in ways that traditional banking could not.

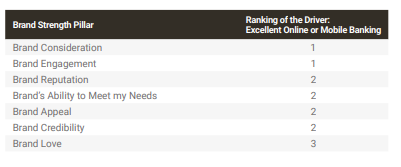

According to the 2025 Brand Finance Global Brand Equity Monitor research, a strong digital banking offering (online and/or mobile) is crucial for building brand strength. It is no longer just a functional feature or a competitive advantage; it has become an essential part of any banking offering and key to building brand love, brand reputation and credibility.

The relatively high importance of a great digital banking offering in driving consideration is unique to the African region – and even more important than traditional drivers of choice such as trust, value or even ease of use.

Without effective digital banking, traditional banks will struggle to grow. Although pure-play digital banks in the region are still small and emerging, their ability to disrupt the traditional banking landscape across the continent should not be underestimated.

So while the big banks continue to dominate, as affordable digital access continues to expand, it is likely that many of these new generation digital banks will start to make their presence felt in a meaningful way.

DIGITAL BANKING BRANDS TO WATCH

Unlike Europe, the Middle East and Brazil, Africa has not yet seen any digital native challenger brands break into the Global 500 ranking. While fintech platforms such as Safaricom’s M-Pesa and MTN’s MoMo (Mobile Money) pioneered mobile payments, the African market is now crowded with fintech startups offering a range of payment and lending services to previously under-served and younger customers.

In the transactional banking realm, full scale digital banking offerings have been slower to market because the regulatory and financial barriers to entry are significantly higher than for mobile money platforms. Meanwhile, a growing number of digitally native banks are emerging, poised to further disrupt Africa’s traditional banking landscape.

Relative Importance of Digital Banking Offering on Building Brand Strength

Notable African brands to watch include TymeBank (South Africa), Discovery Bank (South Africa), Moniepoint (Nigeria), and Selcom Pesa (Tanzania). North Africa is yet to launch a full-service digital-native bank, though most banks in the region are heavily investing in digitising their banking channels and services to meet growing consumer demand.

TymeBank is part of the Tyme Group and recently became one of Africa’s unicorns when it reached a US$ 1.5 billion valuation at the end of 2024, after securing US$ 250 million in a Series D capital raise. Nubank (Brazil), ranked 90th in the Banking 500, led the round with a US$ 150 million investment. It will be interesting to see how Nubank leverages its own brand building know-how to influence and shape TymeBank’s brand growth in Africa.