This article was originally published in the Brand Finance Ireland 25 2025 report and updated in the Brand Finance Alcoholic Drinks 2025 report.

Senior Analyst,

Brand Finance

Baileys remains the strongest Irish brand in 2025, and is the strongest spirit brand in Europe, with a Brand Strength Index (BSI) score of 87.9 out of 100 and an AAA+ rating – the highest awarded by Brand Finance. Its brand value has risen by 20% to EUR1.2 billion, marking its highest valuation since Brand Finance began tracking it in 2011.

Once primarily associated with the festive season, Baileys has successfully repositioned itself as a versatile indulgence. Its growing popularity now extends across various settings, from Christmas to everyday moments – poured over ice cream, mixed into coffee, or enjoyed as a Baby Guinness shot. Brand Finance research highlights this shift, with 96% of UK consumers now aware of Baileys. Usage has also increased from 43% in 2023 to 49% in 2025. This is the highest reported usage of any spirit brand in the UK, according to Brand Finance data.

Baileys also notes strong growth across key brand strength metrics among UK consumers. Consideration has increased from 56% in 2022 to 70% in 2025, and perceptions of Baileys as an affordable luxury have strengthened, with 34% of UK adults now viewing it as “expensive, but worth the price”. Baileys’ brand value growth aligns with broader trends occurring in the cream liqueur category. Hazan Aydın Yeşilova, head of Baileys, Diageo GB, emphasised that on-trade sales grew almost 30% among cream liqueurs in 2024. Both Baileys and Brand Finance largely attribute this growth to the rising popularity of Baby Guinness – a shot made with coffee liqueur and Irish cream, often using Baileys. Moreover, online interest in Baby Guinness has surged in popularity, with over 41,000 monthly searches and widespread social media engagement.

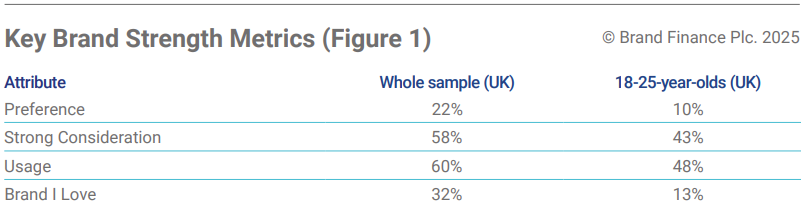

However, Brand Finance data reveals that when analysed across key brand strength metrics like Preference, Consideration, Usage, and Brand I Love (Figure 1), Baileys’ performance is weaker among younger audiences (ages 18-25), indicating that younger drinkers are often failing to associate Baby Guinness with the Baileys brand itself. Most notably, Baileys is ranked 20th for Brand I Love by this demographic, compared to fifth across the broader sample.

Ultimately, younger consumers have not yet connected the popular shot with the Baileys brand, which limits brand equity among this group. Therefore, despite the growth in sales and consumption fuelled by Baby Guinness and the brand’s expansion beyond the traditional Christmas season, Brand Finance research highlights an opportunity gap. Establishing a strong connection between Baileys and Baby Guinness presents a significant opportunity for the brand. By reinforcing this link, Baileys could enhance its appeal to younger drinkers, addressing a key perceptual gap. This strategic alignment could not only shift consumer perceptions but also position Baileys for sustained future growth.