This article was originally published in the Brand Finance Marathons 50 2025 report.

Sports Services

Senior Consultant,

Brand Finance

Since the first modern marathon at the 1896 Athens Olympics, organised races—especially marathons—have turned running into a global phenomenon, deeply embedded in sports culture and bringing together participants of all backgrounds and skill levels. Marathons have become a staple of the global sporting calendar, but what defines the modern marathon runner?

Brand Finance’s research into the world’s top marathon brands and their impact reveals detailed data on runners—their age, background, behaviours, and preferences. By analysing these factors, we can begin to uncover the key drivers behind the success of leading marathon brands and what makes them resonate with runners worldwide.

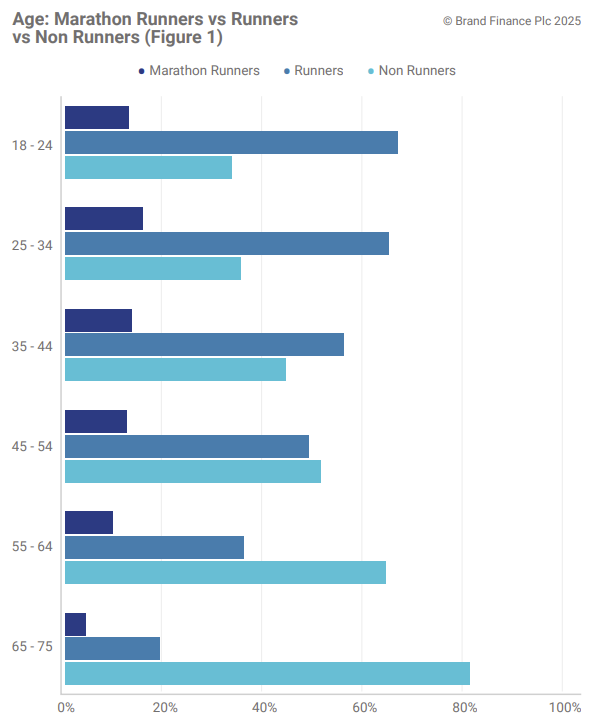

Is running a young person’s sport?

Our data indicates that younger individuals are more prominent in running, especially in long-distance events like the 26.2-mile marathon. As age increases, the proportion of runners decreases, while non-runners become more common. Younger people typically find endurance running more accessible due to higher physical fitness, faster recovery times, and greater stamina, giving them an edge in training and performance. While many older runners do embrace the challenge, factors such as slower recovery and a higher risk of injury make long-distance running more demanding with age.

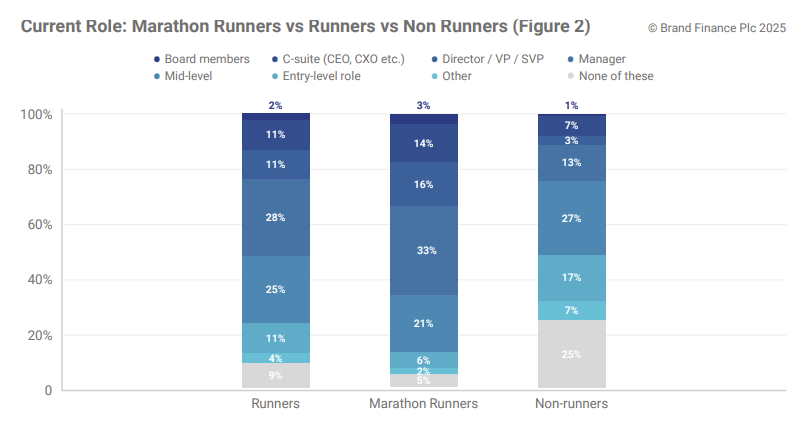

Running with the leaders: The link between marathon participation and executive roles

Senior business leaders are over-indexed among marathon runners. Fourteen percent of marathon runners occupy C-suite executive positions, surpassing the 11% of general runners in similar roles. This trend continues among board members and senior vice presidents/vice presidents, where marathon runners outnumber their general counterparts 3% to 2%.

The most common role for both runners and marathon participants is managerial, with marathon runners represented at 33% compared to 28% of general runners. This higher proportion of marathon runners in managerial positions likely reflects the personal qualities honed through marathon training—time management, discipline, and motivation—skills that align well with effective leadership.

There is a clear decline in entry-level professionals among marathon runners, with just 6% of participants in this category compared to 11% of all runners. This discrepancy highlights the challenges faced by many individuals at the start of their careers—financial constraints, time limitations, and competing priorities—making marathon participation less feasible. This gap presents an opportunity for organisers to engage entry-level professionals through targeted initiatives and incentives, encouraging them to join the ranks of future marathon runners and leaders.

The demographic profile of marathon participants, particularly the significant presence of senior professionals such as C-suite executives, directors, and managers, creates a valuable opportunity for B2B sponsorships. Targeting this group, which includes senior decision-makers and high-level professionals, offers high potential for brand visibility and engagement. Brands offering products and services related to corporate wellness, leadership development, and professional services could particularly benefit from aligning with this audience, leveraging the marathon platform to connect with influential figures in the business world.

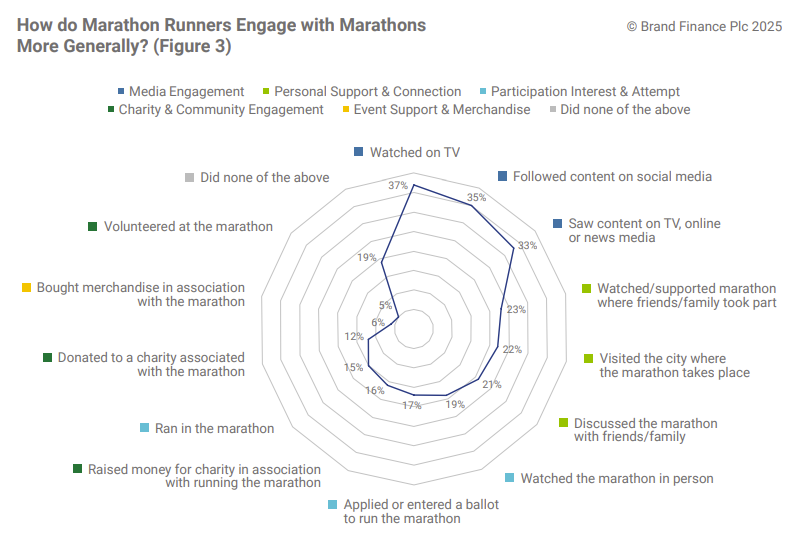

More than just a race: Marathon runner engagement

Marathons bring together a diverse range of stakeholders, each engaging with the event in unique ways based on their priorities and preferences. Whether through direct participation, media consumption, or tourism, these interactions are shaped by cultural influences, accessibility, and the broader economic and social impact of marathons. For event organisers, sponsors, and host cities, understanding these engagement patterns presents valuable opportunities to expand outreach, strengthen community involvement, and maximise the economic benefits associated with marathons.

Media engagement

Marathon runners show strong engagement with media platforms linked to marathon events. Our research found 37% of marathon runners watch marathons on TV, and 34% see marathon-related content through online or news media. Additionally, 35% engage with marathon content on social media. As with sports media in general, digital platforms are now essential in keeping marathon runners informed, engaged, and connected to the running community.

This highlights the opportunity for sponsors and organisers to further connect with the marathon-running community by harnessing media coverage and digital content. By leveraging targeted media campaigns, they can expand their reach, enhance engagement, and maximise visibility among this highly engaged audience.

Charitable involvement

Marathons have significant ties to charitable initiatives, for many runners, providing the dual appeal of personal accomplishment and community support. Notably, 16% of marathon runners said they have raised money for charity through marathon involvement. 12% have donated to charities linked to marathons, highlighting the broader social impact of these events.

Merchandise and volunteering

Despite high engagement through media and direct participation, areas like buying merchandise (7%) and volunteering at events (5%) see much lower levels of engagement amongst spectators and non-runners who engage with the marathon. This gap presents an untapped opportunity for organisers and sponsors to enhance involvement. Offering exclusive merchandise deals or integrating products into charity initiatives could drive sales, while positioning volunteering as a meaningful way to give back and experience the event firsthand could boost participation. Strengthening these engagement channels could create a more immersive marathon experience for runners and supporters alike.

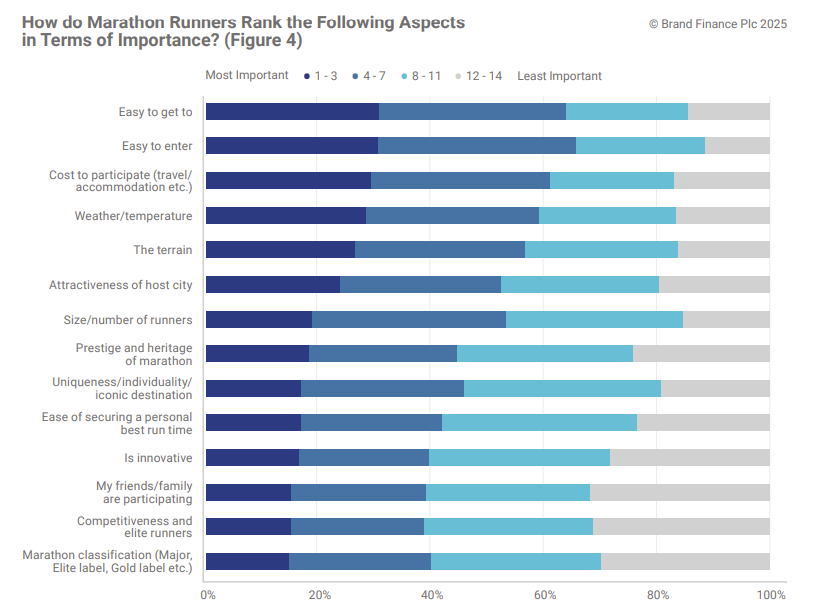

Shifting priorities: What drives marathon participation

Understanding what motivates marathon runners to participate allows race organisers, marketing teams, and event planners to tailor their offerings to align with participant priorities. This not only enhances the overall race experience but also drives greater engagement and participation.

Easy entry and accessibility

Accessibility and ease of entry are the most important factors influencing a participant’s decision to enter a marathon. Cost to participate is another key priority. Participants seek marathons that are both financially accessible and easy to reach. This underscores the importance of investing in logistics and accessibility, including transportation options, nearby accommodations, and seamless registration processes. At the same time, keeping entry fees affordable is important for preserving the spirit of marathons, ensuring mass participation and a diverse field of runners.

Location, location, location

External factors such as weather, temperature, and terrain are crucial for most marathon participants, as they directly impact the running experience. Additionally, the appeal of the host city influences decision-making, though it remains secondary to logistical considerations. To attract specific runners, organisers could emphasise favourable weather conditions and unique, well-balanced terrain profiles in their marketing efforts, making their event more enticing to potential participants.

Ease of access over status

While factors like prestige and uniqueness — such as the heritage of a marathon (important to 18% of runners) and iconic destinations (17%) — hold some appeal, they are less critical than practical considerations like accessibility. Similarly, competitive elements, including the presence of elite runners and marathon classification, rank lower in importance, with only 15% of marathon runners listing them among their top three priorities.

Practical and personal factors, such as ease of access, favourable conditions, and cost considerations, now have a greater influence on decision-making than traditional markers of prestige or competitive status. Marathon runners are now more focused on how a race fits into their lifestyle rather than its elite reputation. This is particularly relevant in an era where fitness and well-being are prioritised over competitive performance for many marathon runners, marking a cultural shift in the global running community. It underscores the importance of adapting marathon offerings to the evolving preferences of modern participants.

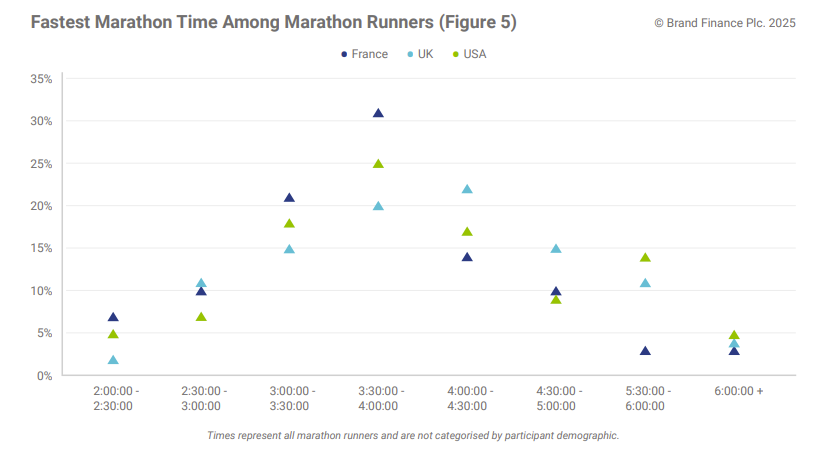

Marathon completion times: A comparative look at France, the UK, and the USA

Respondents’ marathon completion times shed light on the running cultures and performance trends across France, the UK, and the USA, offering a deeper understanding of how marathon participants approach marathons.

In all three nations, most participants report finishing times in the 3 to 4-hour range, highlighting a shared focus on mid-level performance. France stands out for having a larger proportion of faster runners, with 7% of participants completing the marathon in 2 to 2.30 hours, compared to only 2% in the UK and 5% in the USA. This indicates that France may have a more competitive marathon culture, where a greater percentage of runners aim for faster completion times.

UK runners are more likely to fall into slower time brackets, with a higher proportion finishing between 4 to 5 hours than their counterparts in France and the USA. This trend likely reflects the significant charitable participation in UK marathons, where many runners, not necessarily seasoned athletes, participate for charity purposes.