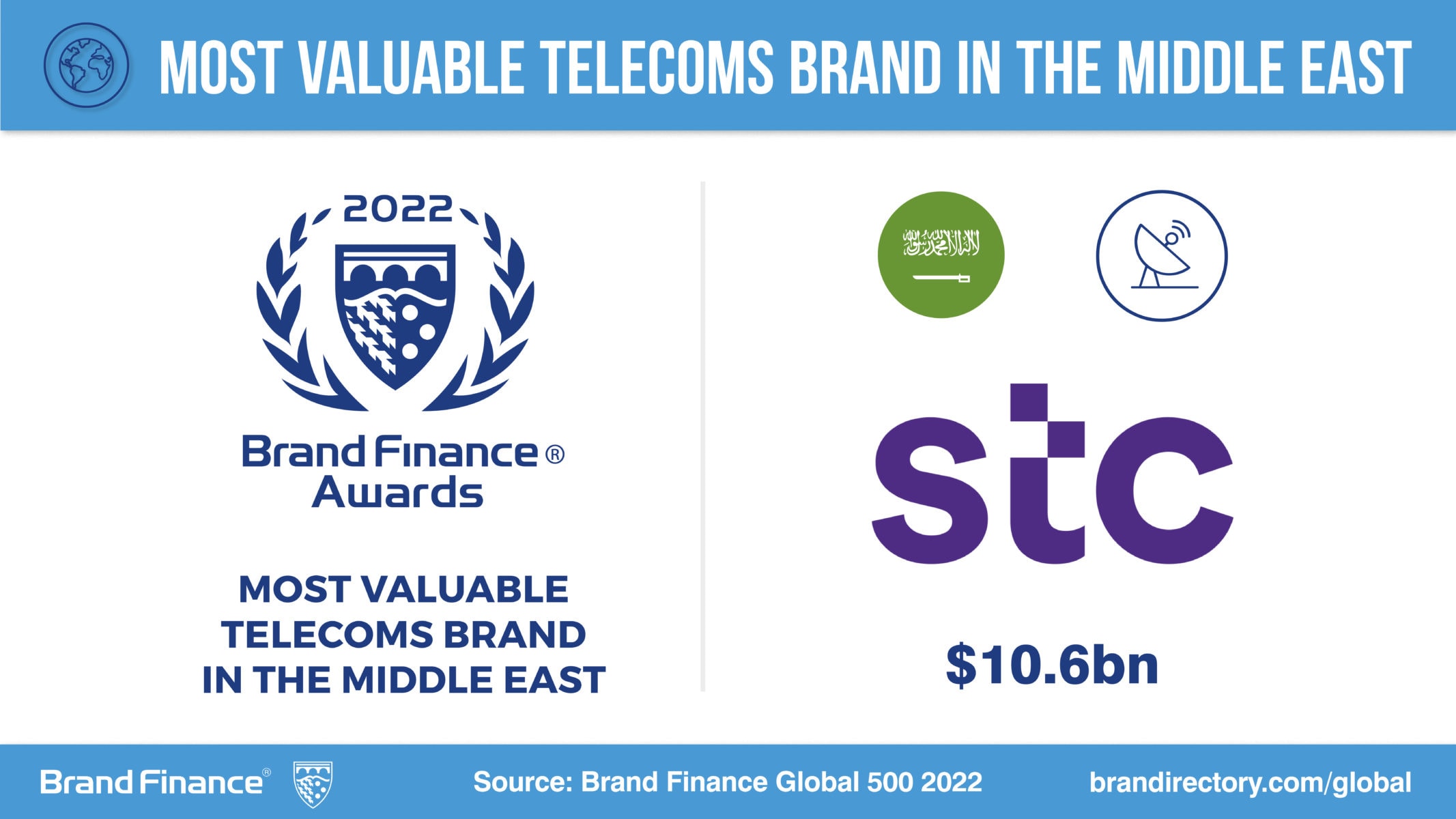

This article was originally published in the Brand Finance Global 500 2022, the Brand Finance Telecoms 150 2022 and the Brand Finance Middle East 100 2022 reports.

stc continued to see good growth this year, with its brand value increasing by 16% to US$10.6 billion. Over the course of the pandemic, stc has been the fastest-growing brand in the region in the Brand Finance Global 500, with a brand value increase of 32% over the last two years – with its successful rebrand playing a key role.

The strong results come off the back of the brand continuing to invest and diversify. This year it announced it would be investing US$400 million to build the region’s largest cloud-enabled data centre, and saw its subsidiary stc pay awarded one of the first digital banking licenses in Saudi Arabia.

The group has also made a success of the IPO of solutions by stc. The company’s market value reached, upon listing, SAR 18.1 billion (USD 4.8 billion). The total size of the offering increased to SAR 3.624 billion (USD 966 million), which represents 20% of the company's capital. Based on this offering, stc group seeks to diversify the Saudi stock market and raise its value. solutions attracts a large number of the international and local investors who are interested in the digital transformation, which represents stc group’s vision to be the world's leading digital company. The successful IPO reflected the diversity of the Saudi economy.

In 2021, stc also launched the Advanced Technology and Cyber Security Co. (sirar by stc) - a company focusing on security advisory, advance security professional service, providing cybersecurity platforms (i.e threat intelligence), and managed security services.

Interview with Mohammed Abaalkheil.

For the second year in a row, stc is the most valuable telecoms brand in the Middle East. What have you done over the last year to maintain the lead and how will you make sure to maintain this status going forward?

The digitisation of the world accelerated over the last year as the world got to grips with covid-19.

stc was determined that it would continue to lead in this digital transformation and ensured that the scale and pace of its work did not let up as the company’s strategy to deliver a better digital world for all was delivered.

We continued, at pace, to expand our scope of transformation as we launched the Advanced Technology and Cyber Security Co. sirar by stc; Cyber Security company focusing on security advisory, advanced security professional service, providing cybersecurity platforms (i.e., threat intelligence) and managed security services. sirar by stc helps enterprises and government entities to protect and secure digital assets as they embark on their digital transformation. We also launched stc Play, our eSports and gaming platform that provides casual and professional gamers access to online tournaments, content, and gaming merchants in one platform.

At the same time, we are reinforcing our technology leadership position in the region. stc connected more than two million households with high-quality fiber optic technology. We also invested heavily in IoT, cloud services, and data analytics capabilities — all of which are strategic growth areas for stc, and each area will continue to power the digital transformation of public services and industry applications such as utilities, transport and logistics, security, manufacturing, retail, health, and education.

Last year, the Solutions IPO for stc was a great milestone for its development in the ICT space. Can you tell us how this will help consolidate your brand further and solidify your presence in the local growing ICT market?

The digitisation of the world has accelerated over the last year. stc has matched that speed with a scale and pace that reflects the company’s vision and strategy to become a leading digital company of the future. After the success of the solutions by stc IPO, the company’s market value reached, upon listing, SAR 18.1 billion (US$4.8 billion). The total size of the offering increased to SAR 3.624 billion (US$966 million), which represents 20% of the company's capital. Based on this offering, stc group seeks to diversify the Saudi stock market and raise its value. Solutions attracts a large number of the international and local investors who are interested in the digital transformation, which represents stc Group’s vision to be the world's leading digital company. The successful IPO reflected the diversity of the Saudi economy, the investors’ high confidence and the external funds’ interests in the Kingdom’s information technology sector and the emerging technologies.

stc has expanded to more than telecom service , tell us more about your fintech experience with stcPay ?

An excellent example for one of our most successful digitised products is stc Pay, our new fintech service. stc pay became the first unicorn in the Kingdom of Saudi Arabia and the first fintech unicorn in the Middle East when Western Union acquired 15 percent stake for US$200 million this past November, creating a valuation of over $1.2bn. stc Pay is changing consumer behaviour regarding financial control and making it easier and simper to use. Basically, we are enabling the customers to “simply take control”. stc Pay enables customers to transfer funds from an app on their mobile device, also through the Western Union partnership, users can now send money to over 200 countries. stc Pay has already attracted more than 6 million registered users in just two years, which is a great example of how our payment platform is evolving.

These kinds of figures will reduce dependence on cash as the economy becomes increasingly digital. We’re already looking to roll out the service to other countries, with stc Pay currently discussing with regulators to expand services into new territories.