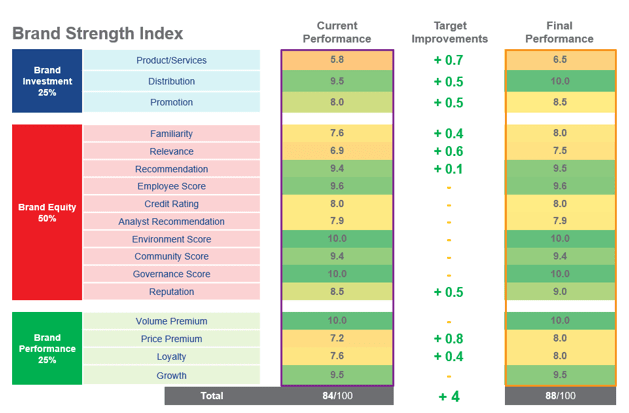

Our version of a brand strength scorecard is what we call the Brand Strength Index ™ . The Brand Strength Index is a scorecard of metrics that underpin a brand's strength. These metrics can include but are not limited to: marketing spend, awareness, consideration, reputation, NPS, acquisition, retention, market share, volume, and price premium. This allows us to understand the relative strength of the brand in the market, which plays a crucial role in turn in calculating the value of a brand.

Brand Strength Index™ benefits, and its roots in the brand value chain

Analytical rigour and transparency are at the heart of our approach to brand measurement at Brand Finance. This demands responsiveness to key best practices and empirical evidence, which we pull from academic theory. In the spirit of academia, we also open our doors to peer review. We do use specific methods in our measurement, but we don’t restrict others from using them either. It also means we never have black boxes in our approach, and instead rely on the quality of our research data, and the skill of our team, to identify and improve brand value.

One area of academic theory that we have both influenced and been influenced by has been the idea of the ‘Brand Value Chain’. As with any good idea, it was influenced by previous theories and it was in practice already at the time, including in our own approach – Brand Finance having been set up in 1996.

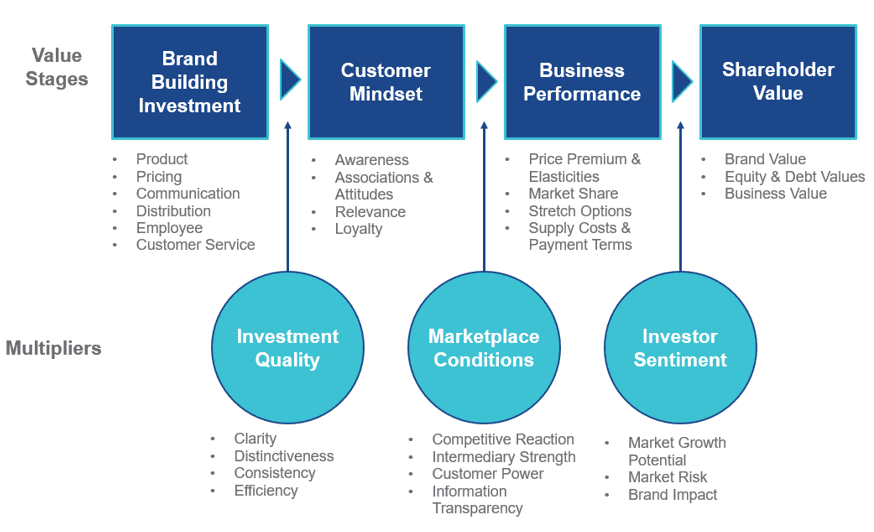

We have visualised the ‘Brand Value Chain’ as we have interpolated for our own use:

Source: Brand Finance

This process starts with:

- Strong, well-managed investment leading to changes in -

- Customer perceptions, which in turn lead to improved -

- Business performance and therefore shareholder value.

In the Brand Strength Index™ model we call these stages:

- Inputs or Brand Investment

- Brand Equity

- Outputs Brand Performance

The structure of the Brand Strength Index™ is designed to mirror the brand-building process. It naturally follows, that if you invest in your brand, you expect to see a return in brand equity, and ultimately an uptick in business performance. What's more, by maximising the performance across the chain, the owner or manager of a brand can maximise its positive impact on business performance and therefore its overall brand value.

Creating a Brand Strength Scorecard from the ‘Brand Value Chain’: The Brand Strength Index

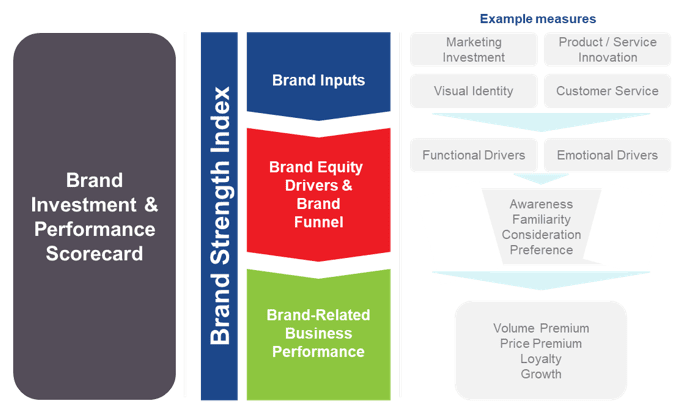

To manage the ‘Brand Value Chain’ process effectively we suggest creating and using a “Brand Strength Index”. This index is essentially a modified Balanced Scorecard split between the three core pillars of the ‘Brand Value Chain’: Brand Inputs, Brand Equity and Brand Performance.

Source: Brand Finance

Brand evaluation using a Brand Strength Index, is primarily a quantitative analysis, where scores for the independent measures are informed by market research (functional and emotional drivers), and financial data (marketing investment, price premium, revenue growth).

However, it is important to incorporate qualitative research and interviews to ensure that the brand strength index is capturing the relevant metrics that drive a brands strength. A brand strength index for a luxury apparel brand will differ in structure from an index designed for a telecommunications brand.

An index for luxury apparel brand may emphasize the brand funnel, and price premium, whereas an index for a telecommunications company may emphasis customer service and ARPU as important metrics. The number of metrics needed in the index depends on the requirements of the business, including the sophistication of marketing as a discipline, as well as the ability to source relevant data in a timely manner.

How do you choose what attributes should be included under the pillars?

Brand Strength Index: Brand Outputs

Creating an index, we start with Brand Performance since the purpose of the index is to understand how brands and marketing impact financial value. Selection should be based on proximity to core financial performance driving value (cash flow) but also responsiveness to changes in branding or marketing. Traditionally useful measures include:

- Number of leads

- New customer additions

- Customer churn/retention

- Volume and price premiums

- Product margins

- Price elasticity

- Market share

The measures used depend on sector and data availability and should represent a mixture of both current performance and growth potential. Crucially, these attributes should be established with input from a company’s financial forecasting team and weighted according to their importance in driving profitable growth. This will ensure that financial, and financially minded, audiences will buy into how you are measuring a brand’s effect on the bottom line.

Brand Strength Index: Brand Equity

In our BrandBeta study, Brand Finance’s extensive statistical analysis of research data in over 27 sectors in 39 countries identifies that brands impact customer choice as a result of their familiarity and their relevance. Our analysis shows that together, familiarity and relevance, accurately predict market share growth in the ratio of approximately 65% importance for familiarity and 35% for relevance.

Brand Reputation attributes, which can explain differences in relevance, are also relevant measures at this stage. Recommendation and NPS can also be useful given their impact on both familiarity and relevance. The views of other stakeholders (for example staff, investors, media) can also be incorporated. These other stakeholders might include:

- Staff

- Investors

- Media

- Regulators

- General Public

Attribute selection and weighting should be based on relative importance for driving brand performance and completed in collaboration with a company´s brand insights team.

Brand Strength Index: Brand Inputs

Brand Inputs are generally the final step in the creation of a Brand Strength Index since they are selected on the basis of impact on Brand Equity. The attributes included need to represent all of the levers that a business can pull in order to influence brand equity. These may include:

- Advertising spend

- Sponsorship spend

- Earned media coverage (including word of mouth and social media)

- CSR spend

- Visual identity quality

- Customer service quality

- Product investment and innovation

- Distribution quality

- Value for money.

These attributes should be decided in collaboration with the company’s marketing team. The attributes should be grouped between their impact on familiarity versus relevance improvements and each group should be weighted according to the importance of each side of the brand equity pillar.

The Brand Strength Index as a Measurement Tool

We typically advise that these models can be point-in-time – giving a snapshot, perhaps biannually, of brand strength – or they can be dynamic scorecards – regularly updated to give real-time results from changes in spend or strategy.

In all cases, it is usually good practice to provide summary results as an average over a longer period in order to provide a view of long-term brand strength rather than reveal fleeting changes that have little long-term effect on the business.

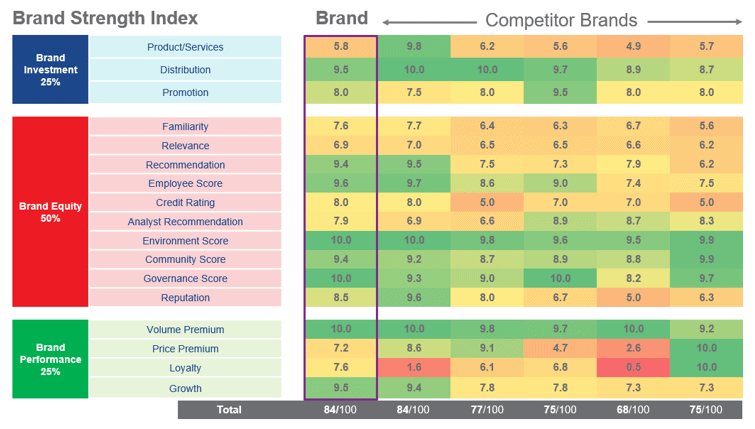

The core reasons for using Brand Strength Index as a measurement tool are:

- Summarising brand KPIs: Many teams have large numbers of data points that they struggle to bring them together to see whether things are getting better or worse. By summarising as a coherent single figure, the BSI allows brands to do that.

- Clearly comparing competitors: It is important to benchmarking how you are performing against your competitors along the same key measures. Our database of over 5,000 brands yearly also allows comparison within category and without. A clear structure enables new brands to be incorporated too as necessary.

- Tracking over time: Whether there is a big change to strategy or simply a need to monitor performance, setting a Brand Strength baseline and tracking from that can help management take decisive action.

- Diagnosing issues in the Brand Value Chain: The Brand Strength Index scorecard benchmarks brands on various attributes in order to standardise units of measurement across them. As a result, underperformance of certain attributes both against competitors and against other of the brand’s own scores can be identified and addressed.

Source: Brand Finance

The Brand Strength Index as a Management tool

By having this dashboard, trackable over time, against competitors and against different business-relevant attributes, business managers can use the Brand Strength Index to manage their brands more effectively.

To do this, it is important to make sure that these scorecards are made at as granular a level as possible. For example, focussing on a business division within a country or even at a customer segment level. This provides the specificity to align marketing, service and other actions with the attributes within the Brand Strength Index.

As a result – and after reviewing current capabilities, staff resources and marketing investment available – management teams can make reasonable targets for different attributes matched with specific actions. For example, these actions might include changing marketing mix, new communications activities, product improvements or other types of investments or strategies.

Source: Brand Finance

These targets can be made even more relevant and reasonable by comparing against the performance of similar brands in our database of over 5,000 brand values a year and calibrating a growth rate that seems reasonable. Provided that the attributes are well selected and weighted according to their importance, the effects of these changes in attributes on financial value can be found and an ROI calculated.

However, it is not only incremental changes to activities that can be tracked or planned for. Similarly, changes in strategy like removing a brand and changing brand architecture or updating a brand’s positioning can be reviewed through a brand strength framework. This identifies potential improvements in performance and value compared against a base case explaining whether it is worthwhile to pursue the change in strategy.