On 5 June 2025, Brand Finance and the International Advertising Association (IAA) unveiled the third annual Sustainability Perceptions Index (SPI) 2025 at a Brand Exchange Club event in London. Against a backdrop of rising ESG scepticism, fuelled by policy rollbacks in the US and regulatory revisions in the EU, the SPI quantifies how much of a brand’s value is underpinned by consumer perceptions of its environmental, social, and governance (ESG) commitments, and pinpoints where reputational gaps present both risk and opportunity.

Read the full analysis in the Sustainability Perceptions Index 2025 report.

Methodology

The SPI 2025 combines:

1. Consumer Survey (Perception)

Over 150,000+ respondents in 41 countries assess brands across sector-specific attributes, including “acts sustainably and ethically” and “supports causes I care about”. Brand drivers analysis then correlates each attribute with purchase consideration, isolating the role of sustainability at sector level.

2. Valuation of Perceived Sustainability

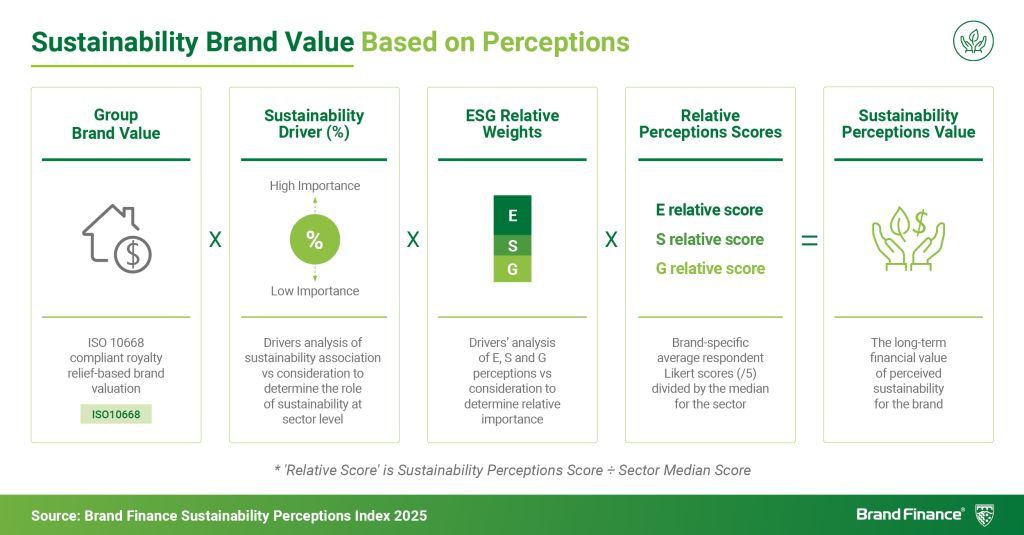

Brand value, driver score, and brand-specific perception scores (environmental, social, governance) weighted by their explanatory power in the sector are combined to calculate Sustainability Perceptions Value (SPV). This is the proportion of total brand value tied to sustainability reputation.

3. Gap Value Analysis

Using CSRHub’s database, which provides a comprehensive assessment of brand sustainability performance, the calculation is repeated to give each brand a Sustainability Performance Value.

In some cases, a brand’s performance is better than consumers perceive. This is a case of “greenhushing” – brands have an opportunity to credibly build value by communicating more about their sustainability efforts.

In other cases, customers perceive a brand to be more committed to sustainability than its true performance suggests. These are cases of reputational risk and even “greenwashing” – brands must manage the alignment between perceptions and performance, otherwise stakeholders may realise that the brand is not as strong on sustainability as they believed.

Sustainability’s Influence Across Sectors

Brand Finance research finds that sustainability remains a meaningful purchase driver across all categories, and that it varies by sector.

- Luxury Automotive: Perhaps surprisingly, luxury automotive customers care deeply about sustainability issues. This is because many luxury automotive purchasers purchase vehicles as a status symbol that reflects their social status.

- IT Services: B2B decision-makers increasingly factor in supplier ESG performance criteria.

- Food & Beverage, Telecoms: Lower absolute impact than other sectors, but higher in premium and Western markets.

Three years of Brand Finance research indicate that the role of sustainability has remained largely stable, suggesting resilience rather than erosion.

Perceptual Leaders

Brand Finance highlighted category frontrunners in perceived sustainability:

- Soft Drinks: Naked Drinks, Innocent

- Cosmetics: The Body Shop, L’Occitane, Neal’s Yard Remedies

- Apparel: Patagonia, The North Face

- Supermarkets: Planet Organic (UK), M&S, Waitrose

- Electric Vehicles: Polestar, BYD (Tesla has slipped due to polarising controversies) .

In non-Western markets, strong overall brand reputations (e.g., Emirates in the UAE, TSMC in China) can create halo effects, boosting sustainability perceptions even without strong ESG programmes.

Value at Stake: Sustainability Perceptions Value

While small brands can gain from perception shifts, mega-brands face the greatest risk:

Brand Finance has identified the five brands with the greatest amount of brand value linked to sustainability perception, in order: Apple, Microsoft, Amazon, Google, and Coca-Cola.

Their large brand valuations mean even marginal perception changes translate into large swings in value. Regardless of sector, every global brand needs to manage its ESG reputation or risk material devaluation.

Gap Analysis: Risk and Opportunity

Greenhushing (Under-Communicating)

Microsoft: Largest positive gap. Consumers are often unaware of the significant efforts underway to mitigate carbon and procure renewable energy.

Red Bull, Banyan Tree: Strong performance hindered by incongruent brand narratives.

These brands have an opportunity to unlock latent value by weaving authentic ESG achievements into their core storytelling, including regional case studies, employee ambassadors, and strategic partnerships.

Potential Greenwashing (Over-Promising)

Tesla: While it has played a leading role in carbon transitions away from internal combustion engines, Brand Finance data has identified a consistent negative gap since 2023, in relation to labour practices and supply-chain transparency.

Brands can take action now

Speakers at the event discussed how brands can take action to improve their perception-performance gap.

1. Better Align Perceptions and Performance

‘Greenhushers’ (brands with perception lagging performance) can launch targeted marketing and communications campaigns showcasing their sustainability progress and achievements.

‘Greenwashers’ (brands with perceptions levels exceeding performance) can sync internally about how sustainability is being communicated and diagnose the mismatch between perceptions and performance. If action is being taken to improve ESG performance, brands in this situation can eventually seek third-party sustainability certifications, publish remediation roadmaps or external-facing sustainability updates and invite stakeholder dialogue.

2. Empower CEO Stewardship

Brands that are serious about improving their performance – and perceptions – on sustainability issues can link executive compensation to ESG milestones. Informally, brands can tap into their corporate leaders to champion sustainability and topics that they are passionate about, amplifying it through thought-leadership and media engagement.

3. Plan for Political & Regulatory Volatility

Continued regulatory volatility is likely in corporate sustainability reporting, particularly across framework-aligned disclosure and oversight of brand communications. Consequently, brands should prepare to respond to diverging regulatory landscapes and stakeholder expectations by developing market-specific sustainability communications strategies.

This could include ESG messaging playbooks for divergent policy environments or stakeholder engagement research to better understand topics of interest and concern. This will enable brands to maintain a core sustainability narrative that remains consistent despite short-term political shifts.

Sustainability perceptions drive brand consideration and brand value

Brand Finance’s SPI 2025 highlights that, even in an era of scepticism, sustainability perceptions drive brand consideration and value. By diagnosing greenhushing and greenwashing, and by implementing targeted, authentic ESG communications, brands can both safeguard and unlock value.

In a world where many stakeholders look to brands for leadership on sustainability, aligning perception with performance is no longer a nice-to-have, but a business imperative.

Read the full analysis in the Sustainability Perceptions Index 2025 report.