This article was originally published in the Brand Finance NFL 32 2025 report.

Senior Analyst,

Brand Finance

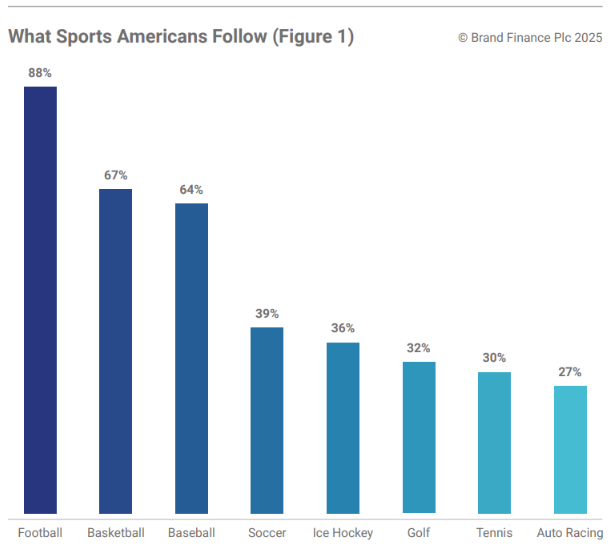

Every year, Brand Finance surveys American sports fans to understand where sponsorship value lies across the country’s most followed sports and leagues. Unsurprisingly, football dominates the landscape, with 88% of American sports fans following the sport. Basketball comes next at 67%, while soccer lags behind at 39%. Yet, beneath these broad statistics lies a more complex picture, one that reveals a growing mismatch between how fans perceive leagues and how they actually engage with them.

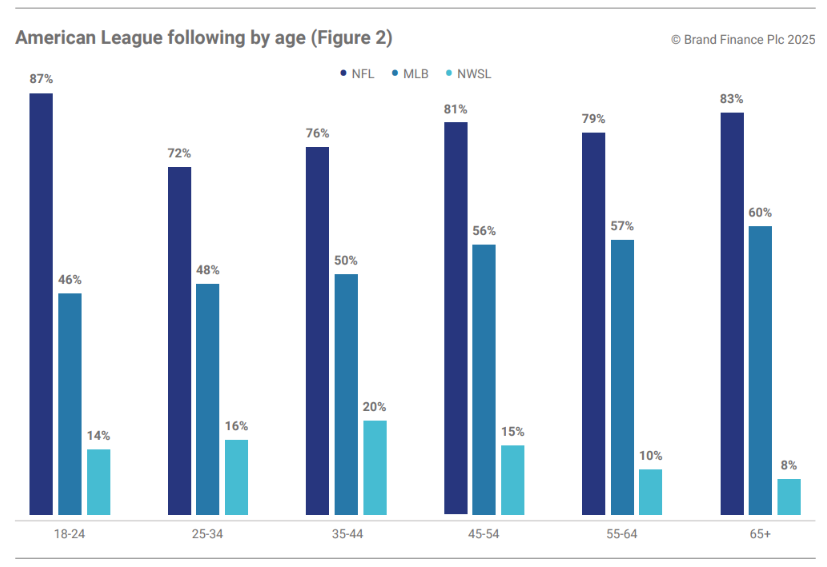

At the heart of this divide is generational behavior. The most followed league in the US is the National Football League (NFL), with 79% of Americans claiming to follow it, accounting for 90% of all football fans. What makes the NFL particularly unique is its reach across all age groups. From Gen Z to senior citizens, engagement remains high with 87% of 18–24 year olds following the league and 83% of those aged 65 and older. This unique consistency illustrates the NFL’s near-universal appeal.

In contrast, legacy leagues like Major League Baseball (MLB) are struggling to maintain relevance among younger generations. While the league retains a strong following among older fans (60%), there is a clear drop-off as age groups get younger, with a 14% difference in between the oldest and youngest brackets. Meanwhile, newer leagues such as the National Women’s Soccer League (NWSL) are seeing the opposite trend. 14% of 18-24-year-olds now follow the NWSL, but that figure drops to just 8% among those over 65.

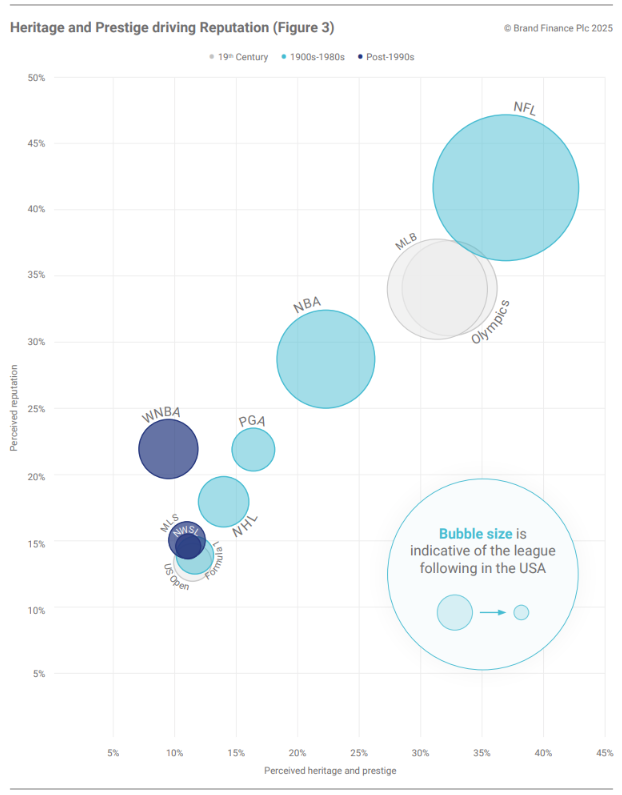

These patterns show how league appeal is tightly linked to when a league was founded and how long it has had to build cultural visibility, which in turn influences how fans perceive these leagues.

This generational divide is further reflected by surveying Americans on how they rate 71 different leagues across 13 emotional and functional perceptions. Older leagues such as the MLB and PGA Tour still score well on reputation, with 34% and 22% of respondents considering these leagues to have a strong reputation.

A similar pattern appears in perceived heritage and prestige where 31% of fans associate the MLB with heritage and 16% for the PGA Tour. In contrast, only 11% associate the MLS and NWSL with strong heritage, and just 15% consider them to have strong reputations. This matters because perceived heritage plays a key role in shaping overall reputation, which directly impacts a league’s ability to attract sponsorship and deliver return on investment, even if fan engagement is limited.

There is a general correlation between league age, perceived heritage, and reputation, but with important exceptions. The WNBA, despite being only 30 years old, outperforms many newer leagues in reputation, a testament to the ‘Caitlin Clark Effect’ - named after Caitlin Clark, the record-breaking guard who starred at the University of Iowa before turning professional and sparked unprecedented growth in women’s basketball. The league recently hit a 27 year high, averaging 969,0001 , while digital engagement surged with a 322% increase in online traffic2 and total revenue is estimated to have doubled over the past 6 years to reach USD200 million3 . Its relatively high perception levels suggest growing interest in women’s sports and a shifting cultural narrative around who is recognized as a mainstream league. This proves that while league longevity can build credibility, it is not the sole factor.

The US Open, despite being one of the oldest competitions (founded in 1881), scores among the lowest on both heritage and reputation, showing that longevity alone does not guarantee prestige in the eyes of the American public. In contrast, the Olympics scores high on both heritage and reputation, despite not being a traditional league or having consistent domestic presence. While heritage can influence reputation, it is insufficient by itself. To sustain perceived prestige, leagues must also remain culturally relevant, high-profile, and emotionally resonant with the public.

Perception alone does not drive revenue, engagement does. When it comes to actual fan behavior, the numbers tell a different story. For example, only 24% of MLB fans have attended a live game, 20% have purchased team merchandise, and just 18% have bought from league-affiliated brands, compared to significantly higher figures for the NFL which leads with 45%, 43% and 42%, respectively.

The PGA Tour fares even worse, with only 11% attending, and just 6% engaging through merchandise or sponsorship, figures that reflect the tour’s poor 2024 viewership which dropped 19% due to persistent weather delays and viewer fatigue over the unresolved LIV Golf controversy. However, the recent 22% rebound in 2025 viewership may help set the stage for a delayed recovery in golf fan engagement4 . Meanwhile, leagues gaining traction with younger fans such as the MLS and NWSL often show higher engagement in these areas despite scoring lower on the perceived reputation metric. Younger fans are more likely to attend games, buy merch, and support sponsor brands, pointing to a more active, commercially valuable fan base.

This disconnect between perception and engagement is a missed opportunity for many leagues. Those with strong reputations but declining fan activity must find ways to re-energize their base, especially among younger demographics. Meanwhile, newer leagues should focus on building emotional connections and perceived legitimacy among older audiences to expand their footprint beyond youth-driven growth.

One league that has managed to bridge this gap almost perfectly is the NFL. It leads in 11 of the 13 emotional and behavioral attributes measured in Brand Finance's study. Its fans do not just admire it, they show up for it. 45% have attended games, 42% have bought merchandise, and another 42% have purchased from sponsors associated with the league. Across American sports audiences, the NFL ranks only behind the Olympics for providing a world-class gameday atmosphere (24% vs. 23%) and holds third place for perceived global following, just after the Winter Olympics and the Summer Olympics (38%, 36%, and 35% respectively).

What the NFL demonstrates is the power of aligning perception, engagement, and commercial value. In 2024, the combined sponsorship revenue of NFL teams hit a record USD2.5 billion5 , far surpassing the MLB’s USD1.9 billion6 and the MLS’s USD665 million7 , which despite recent growth still trails behind legacy leagues. For leagues other than the NFL, long-term growth depends on closing the gap between how they are seen and how they are experienced. That may mean modernizing legacy brands to make them more relevant and distinctive, or building trust and reputation from the ground up to remain relevant in the future of American sports.

1 WNBA regular season hits 27-year viewership high - SportsPro

2 WNBA leads online search growth in Global Sports Properties 2025 SportOnSocial report - SportsPro

3 WNBA Revenue: How much money does the league generate?

4 PGA Tour sees massive viewership gains in 2025

5 NFL team sponsorships hit record $2.5 billion in 2024

6 MLB team sponsorship revenue rises 20% to US$1.9bn - SportsPro

7 MLS sponsorship hits record $665m in 2024 - Inside World Football