• Green perceptions of banking brands have very little effect on customer acquisition among retail banking consumers.

• However, among small-to-medium sized businesses green perceptions are vital.

• Banking brands should focus on more important drivers of brand consideration to differentiate themselves in the market and improve customer acquisition.

A few days ago, the UK Advertising Standards Authority (ASA) – the UK advertising watchdog, banned a series of climate-orientated adverts by HSBC for misleading the public. The adverts were centred around the message, “climate change doesn’t do borders, neither do we” in reference to the bank’s tree planting and net zero financing goals. However, the watchdog concluded that the adverts failed to disclose material information regarding HSBC’s financing of projects that many experts argue contribute to the climate crisis.

Now, whether the adverts accurately portrayed reality, or indeed mislead the public is not for us to say. However, we can explore why HSBC - and other UK banks - are choosing to advertise around the theme of being green.

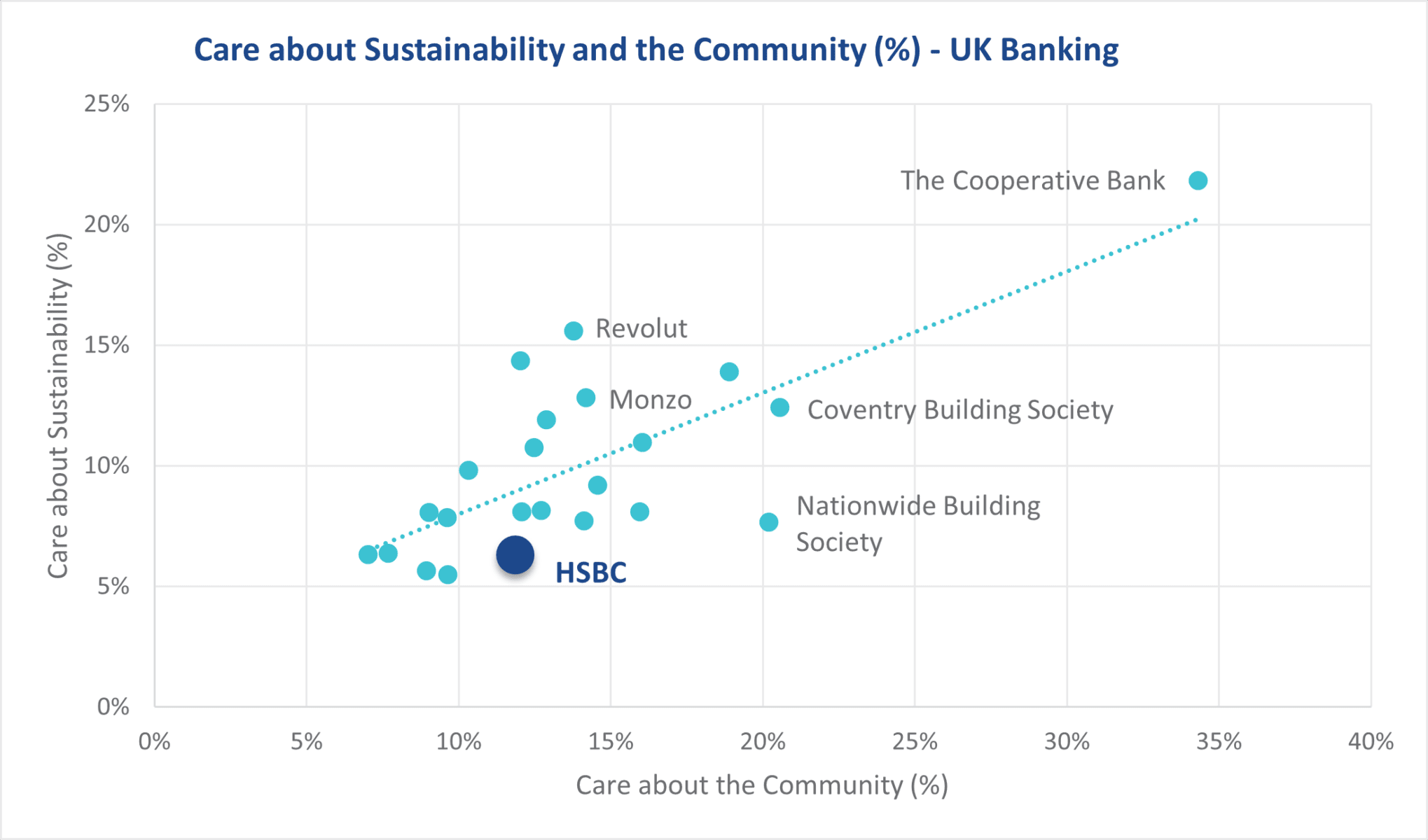

First, if we look at data from Brand Finance’s UK consumer banking survey, which includes 2 green metrics for banks:

Unsurprisingly there is a strong correlation between how brands are rated for “Caring about the Community” and “Caring about Sustainability.”

Interestingly, banks that position their offering around community (and not necessarily around being a traditional bank) such as The Cooperative Bank, Nationwide Building Society and Coventry Building Society are performing well in the community metric. Whereas Neo banks without the physical footprint and historic baggage of traditional banks are over indexing in the sustainability metric. HSBC is performing poorly in both metrics.

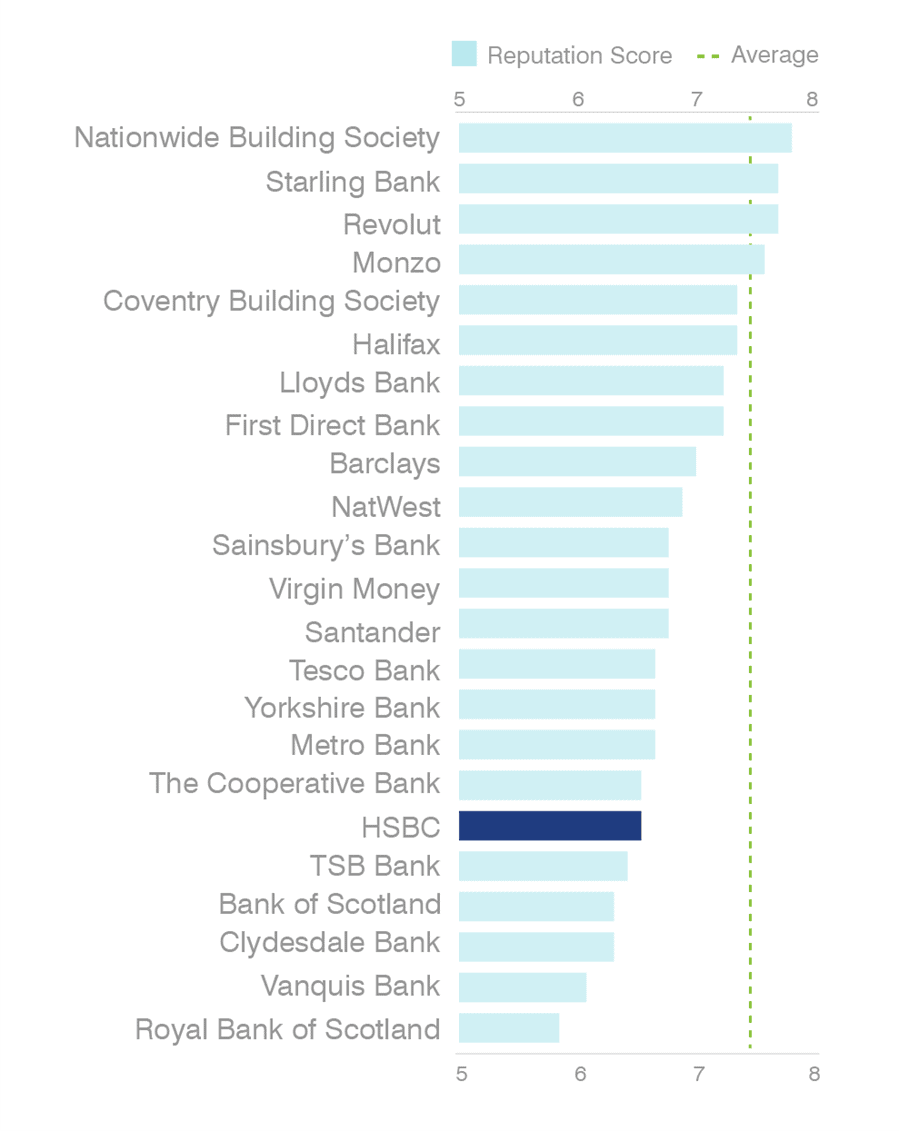

Some readers might look at the above data and think that it is not necessarily a significant issue that a bank scores poorly on certain green metrics given the nature of the services a bank provides. This contrasts with industries such as automobiles where emissions can be assessed directly by the consumer. However, if we look at Brand Reputation for UK banks among UK consumers, we see that green scores are correlated with overall reputation:

Reputation – UK Banking

HSBC is languishing in 18th place with an average reputation score of 6.2, whereas the likes of Nationwide, Starling, Revolut, Monzo and Coventry Building Society have the highest reputation scores among all banking brands. Therefore, it is no surprise that HSBC is attempting to rectify the situation by running advertising campaigns around green positioning (Although, the fact that The Cooperative Bank has a relatively poor reputation suggests there is something other than green perceptions driving reputation scores for that brand).

Anecdotally, there appears to be a connection between green perceptions and reputation. However, one must pose a more commercially minded question when it comes to green metrics – does a banking brand’s green efforts impact consumer choice and drive business performance? Is the commercial performance of the bank likely to be affected because it has low consumer perceptions around sustainability and community?

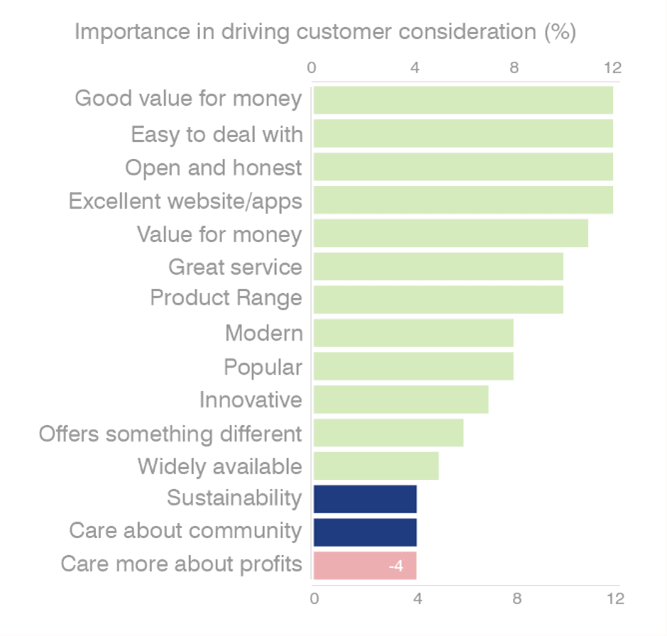

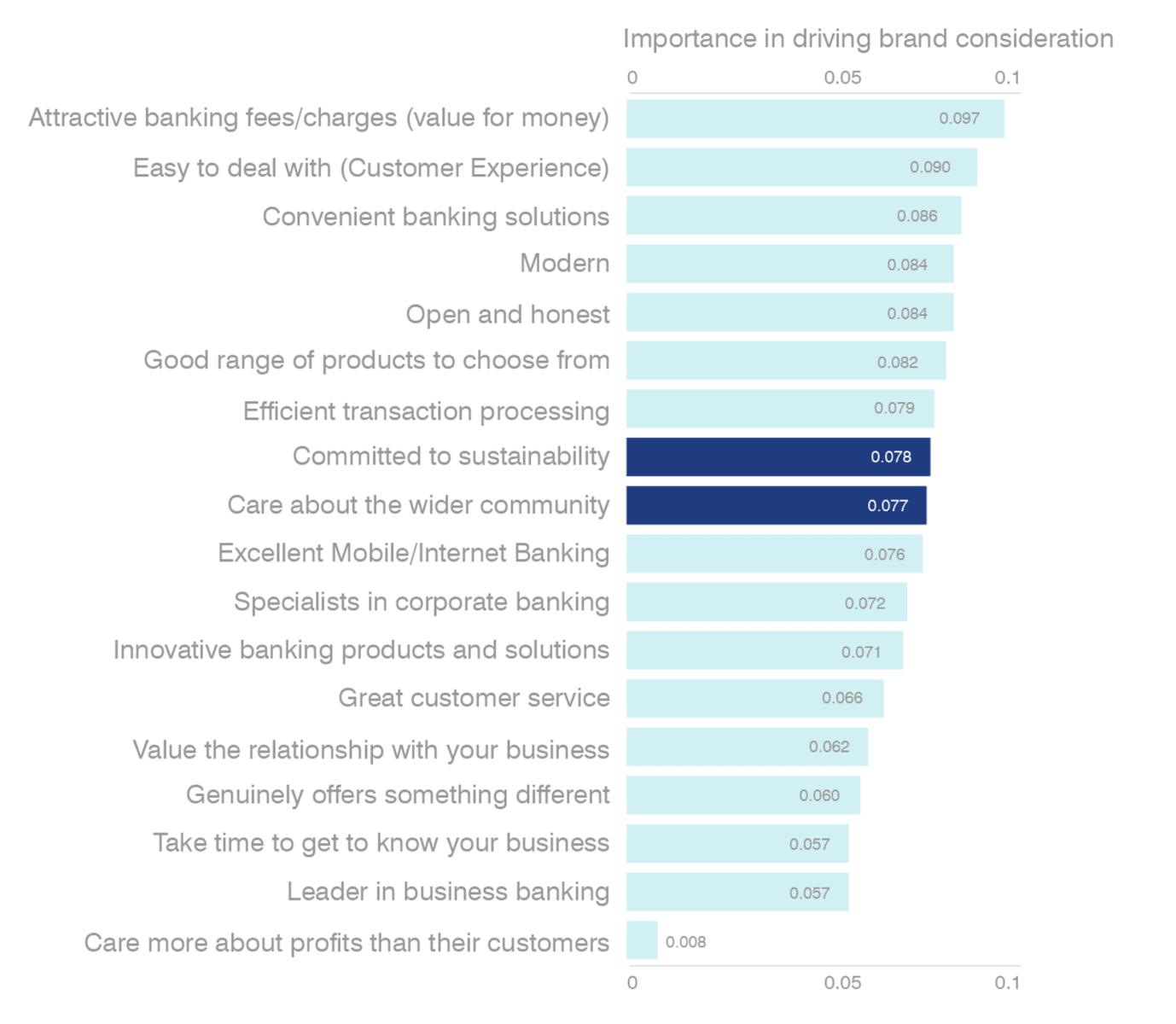

To answer that question, we can once again look at the data. Running a regression analysis, typically known as “Brand Drivers,” allows us to see which brand attributes are the most important in driving consumer consideration, and by extension customer acquisition.

Drivers of Brand Consideration - B2C banking

Given the role of banks in the Global Financial Crisis it is interesting that “open and honest” ranks third in attributes driving consumer choice, behind “good value for money,” and being “easy to deal with,” but ahead of having “excellent websites/apps” and “great service.” “Sustainability” and “community” are ranked 2nd and 3rd last respectively when it comes to correlation with brand consideration, only ahead of “caring more about profits than customers” which is negatively correlated with consideration. This then indicates that performance on green metrics is not necessarily driving consumers decision making when it comes to which brand to bank with.

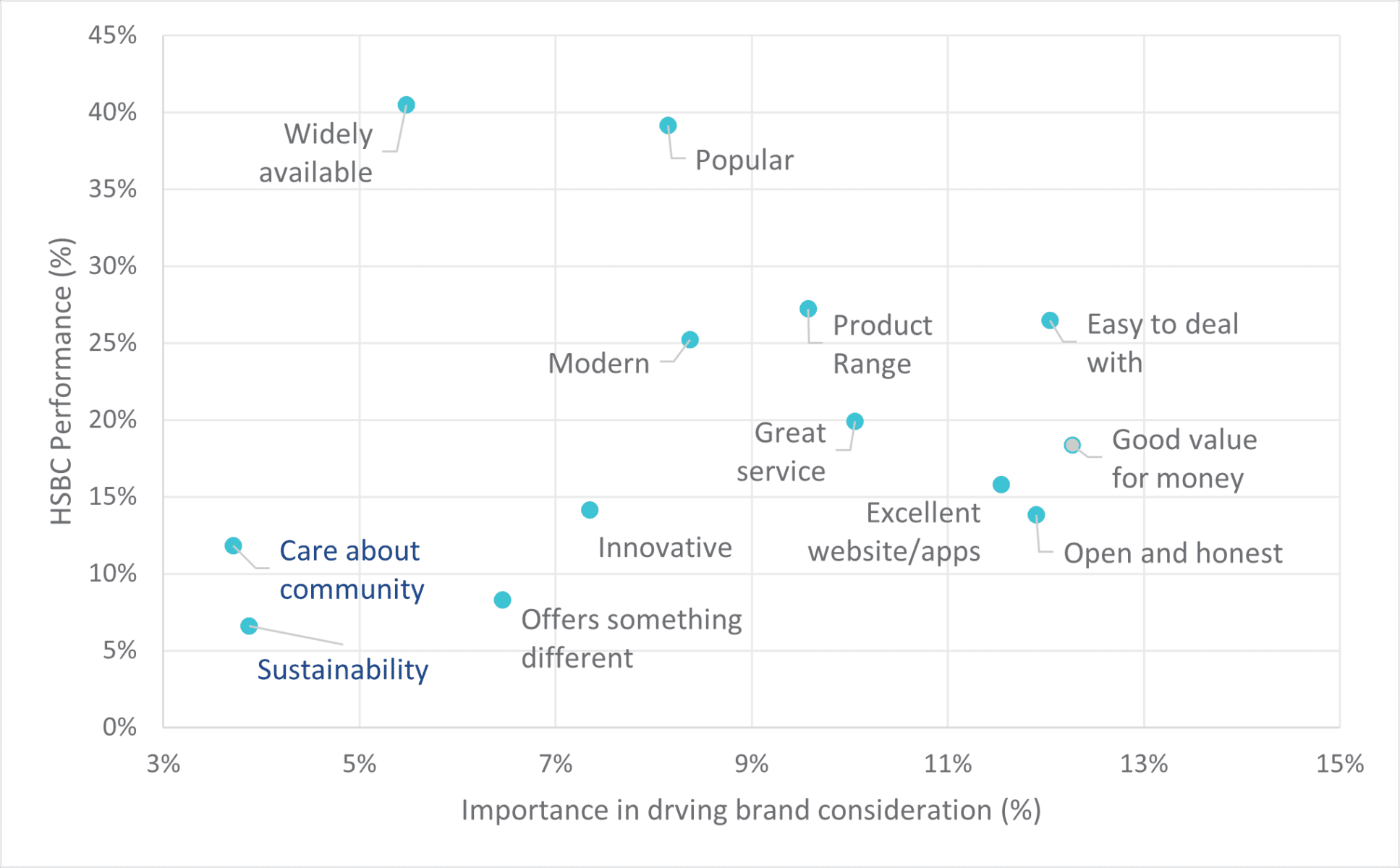

Finally, if we examine HSBC’s performance more extensively using an Importance vs Performance graph:

As mentioned earlier, HSBC does not perform well in the community and sustainably metrics. But those metrics are not the most important when driving consumer choice, regardless of whether consumers might insist they care very much about “sustainability”. What the data does indicate, is that HSBC underperforms for the most important metrics in the eyes of the consumer: value for money, open and honest, Great service, and excellent websites and apps. It is under performance here that is leading to lower consideration and reputation for HSBC among UK consumers.

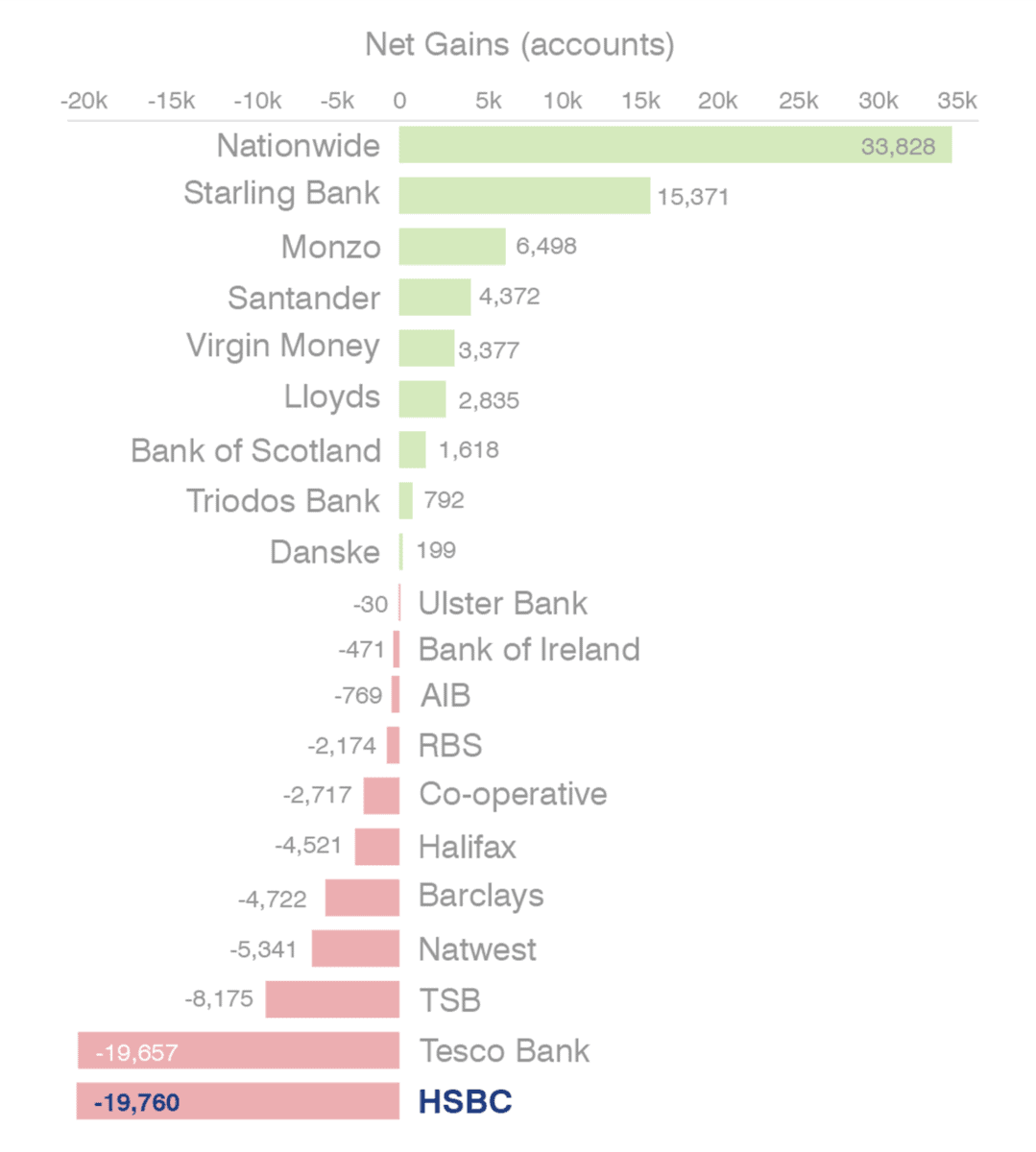

This data is a classic example of consumers stated good intentions to support causes like sustainability, being overtaken by more pragmatic concerns. When push comes to shove, a bank offering better rates, service or products will generally win greater market share. One may argue that there is often a gap between stated (or derived) importance and actual consumer behaviour. Fortunately, we have actual data supplied by the current account switching service in the UK, which tracked net current account gains over the same period of Brand Finance’s banking research (October – December 2021):

As you can see from the table, the brands the perform poorest in the derived importance metrics (HSBC) has the lowest net current account gain out of all participating banks. The banks the perform the best in the same attributes (and therefore have the highest brand consideration) – Nationwide, Starling, and Monzo, have the highest net current account gain.

What About Business Banking?

Many retail banking brands in the UK, HSBC included, have not yet worked out how to credibly differentiate themselves on sustainability. However, this does not mean they have not been trying. HSBC for example conducted an extensive worldwide study in 2021, with the firm Mintel, to uncover insights and deliver green banking products to consumers. HSBC say that the study led to new products being launched and future products being put into development.

One could argue that HSBC's recent adverts were focussed on the brand’s B2B services – highlighting for example how the bank had committed to investing $1 trillion in helping clients transition to Net-Zero. So perhaps green positioning is important in the B2B space?

Drivers of Brand Consideration – B2B Banking

According to research conducted by Brand Finance (and supported by further qualitative research) B2B customers are much more concerned about a banking brand’s credibility in green metrics. The B2B space perhaps provides more credible ways a brand can demonstrate green credentials (funding of green projects or underwriting green bonds for example) than in the consumer space, which is why we see greater importance placed on green metrics among B2B customers. There are other stakeholders for the business of course, which should not be ignored. Attracting and retaining good talent and adhering to the requirements of the investor community are all reasons to take part in sustainable projects and market your credentials.

However, perhaps more focus should be placed on the green credentials of the actual products and the banks in question, rather than those of the bank’s customers. For example, many banking brands continuously refer to net-zero financing goals or the issuance of green bonds, but this is aimed at the activities of the project being funded or of the specific client in question, and not at the green credentials of the bank themselves.

What about the profitability of the banks?

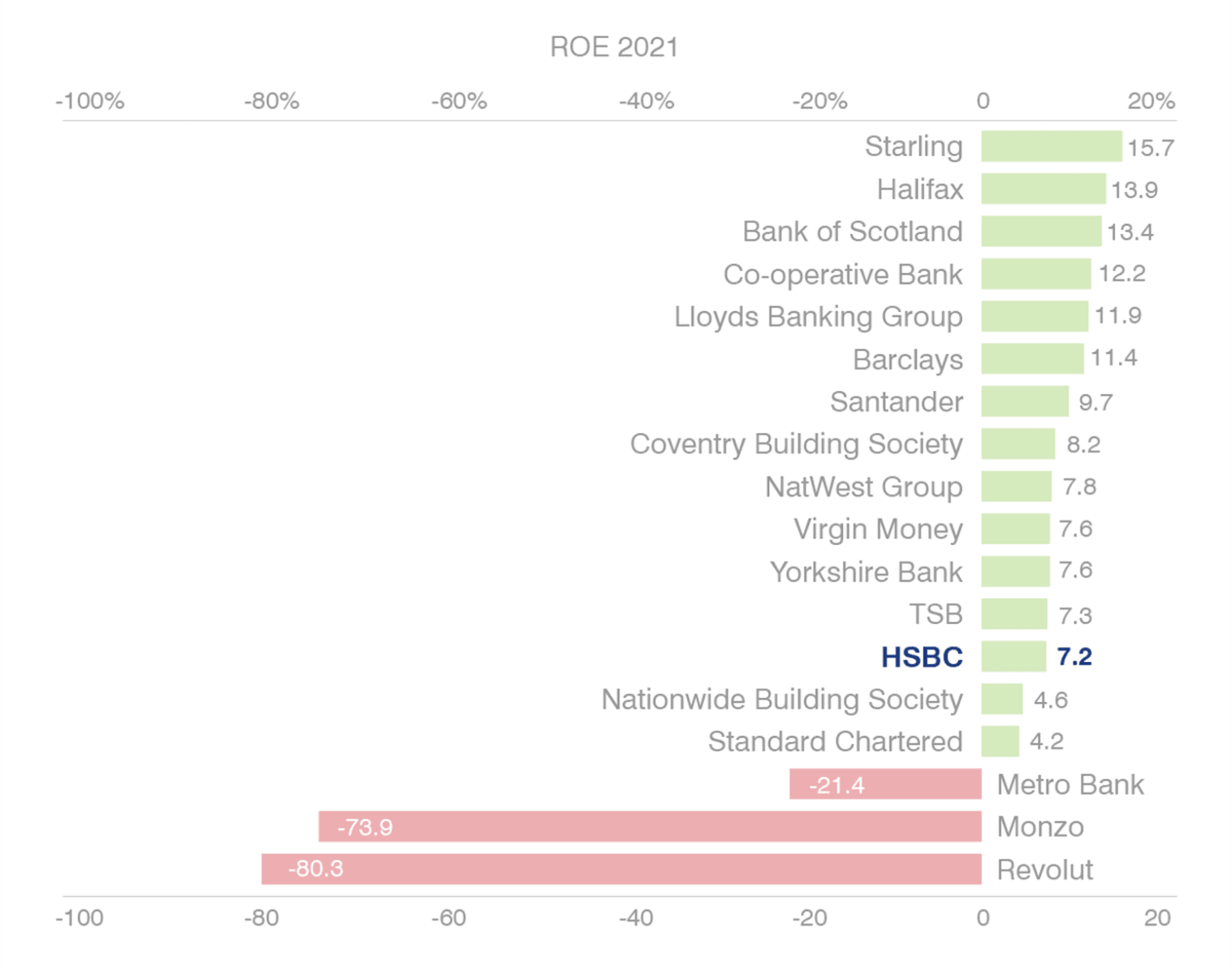

Finally, the true motivating factor for a bank on whether to pursue sustainable practices or not is surely driven by profits. If we look at the Return on Equity (ROE) of UK banks in the 2021 fiscal year:

Profitability appears to indicate mixed results when it comes to sustainability perceptions. For example, HSBC is more profitable than Nationwide – despite Nationwide having the best reputation in the market, as well as the highest net account acquisitions. Whereas the likes of Starling, Halifax and Co-operative bank are highly reputable and highly profitable. HSBC themselves are unlikely to be too concerned about the volume of accounts switching away from the bank, as the hypothesis here is that these are very low value customers, with low deposits and uncomplicated banking needs (and so are not a priority for them). These results would advocate for why the importance of strong governance and regulation is necessary to enforce good sustainability practices in the UK banking industry.

Ultimately, brand-building needs to focus at the intersection of emotional advocacy and rational proof points. Too little emotional advocacy and the brand is under leveraging the power of good advertising, but not enough rational proof points and a brand might be viewed as inauthentic by the customer (not to mention other key stakeholders). What the above analysis does confirm is that there is an opportunity for all banking brands in both the B2C and B2B space to credibly show their credentials in the green space and differentiate their brands products and services from those of their competitors.