This article was originally published in the Brand Finance Nation Brands 2022 report.

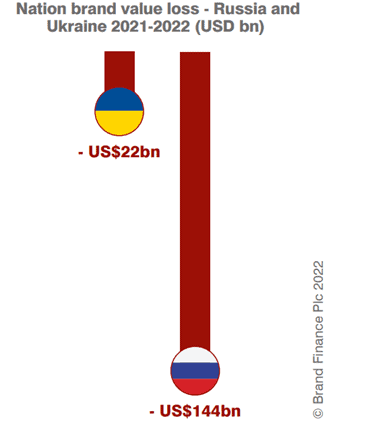

Following its invasion of Ukraine, Russia has recorded the largest fall in brand value among all the world’s nation brands this year, down US$144 billion or US$1,000 per person compared to 2021.

The decision to go to war appears to have undermined Russia’s economic standing, as evidenced by the stark nation brand value decline from US$786 billion last year to US$642 billion in 2022. This reflects the damage to commercial brands associated with Russia, to the country’s ability to access capital, as well as to its potential to influence perceptions across the world.

The widespread economic sanctions imposed on Russia have added to the health, social, and economic disruption caused by the COVID-19 crisis. Prior to the pandemic in 2019, Russia’s nation brand was valued at US$960 billion, but has since fallen by a third – placing it between much smaller Belgium (US$647 billion) and Austria (US$570 billion) at only 24th among the world’s top 100 most valuable brands.

At the same time, although the war has wrought catastrophic humanitarian and economic devastation on Ukraine, causing its brand value to drop by US$22 billion from US$107 billion to US$85 billion, the nation has successfully defended its independence and won the support of allies internationally, resulting in a significant increase in its brand strength.

In addition to calculating brand value, Brand Finance also determines the relative strength of nation brands through a balanced scorecard of metrics evaluating brand investment, brand perceptions, and brand performance.

Ukraine’s brand strength score has gone up by over 5 points year on year from 52.8 to 57.9 out of 100, driven mostly by a 15% increase in brand perceptions.

Research carried out by Brand Finance in March 2022 saw Ukraine increase in familiarity, reputation, and influence, in addition to other metrics such as respected leaders, rule of law and human rights, and trustworthy media.

USA brand value still #1, ahead of China

At the top of the ranking, the United States (brand value up 7% to US$26.5 trillion) has retained its position as the world’s most valuable nation brand, maintaining the lead ahead of 2nd ranked China (up 8% to US$21.5 trillion).

The USA and China are standout leaders in the Brand Finance Nation Brands 2022 ranking, with the combined brand value of the two equal to that of the remaining 98 nation brands in the top 100.

In 3rd place, Germany (up 4% to US$4.5 trillion), has overtaken Japan (down 3% to US$4.3 trillion). Although there are no other rank changes in the top 10, India has posted outstanding brand value growth this year, up 19% to US$2.6 trillion, cementing its 7th position in the ranking.

India’s GDP growth is one of the strongest among the largest economies of the world, as domestic demand and foreign investment are accelerating following the COVID-19 pandemic.

Forward-looking valuation of top 100 nation brands rises close to pre-pandemic levels

Across the world, the values of the world’s nation brands have substantially returned to their pre-pandemic values. Nation brand valuations are based on forward-looking macroeconomic forecasts and the positive outlook on recovery from COVID-19 is driving this year’s increases.

The total value of the world’s top 100 nation brands stands at US$97.2 trillion, up 7% year on year and only marginally behind the pre-pandemic value of US$98.0 trillion in 2019. While the combined value of the world’s top 100 nation brands has practically matched pre-pandemic levels, exactly 50 nation brands have increased in value over this period, while the other 50 remain below the valuation from before the COVID-19 crisis.

The United Kingdom is among the nation brands recording the best COVID-19 recovery, having seen the highest absolute brand value gain among all the nation brands bar China – up US$265 billion to US$4.1 trillion.

Brand Britain has bounced back as a large share of the population was promptly vaccinated and restrictions on economic activity were progressively eased. This strong performance can also be explained by a recovery from the market uncertainty caused by Brexit in the years preceding the pandemic.

Although brand perceptions are likely to increase following a period of unprecedented global attention as a result of Queen Elizabeth II’s passing, the looming recession and the drop in the value of sterling – if sustained – may undermine the UK’s brand value in future.

Vietnam has seen the third highest brand value gain over the course of the pandemic in absolute terms – up US$184 billion to US$431 billion in 2022 – but the world’s fastest growth in relative terms, up 74% compared to 2019.

Vietnam has gained momentum as an attractive destination for foreign investment thanks to successful fiscal and monetary policies and investments in human capital, but also amid trade disruptions from China’s lockdowns and continued tensions between Beijing and Washington.

Leaders of nation brand value growth in 2022

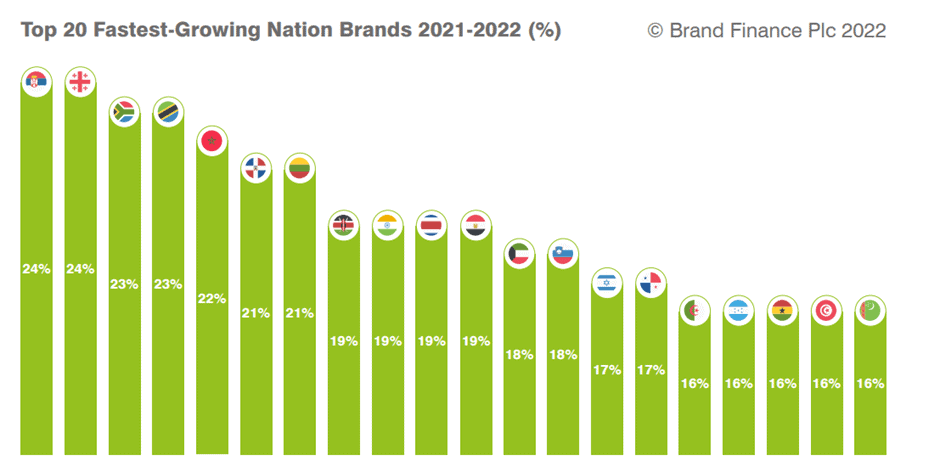

Looking at year-on-year nation brand value growth from 2021, Serbia (US$59 billion) and Georgia (US$18 billion) are the fastest growing in the Brand Finance Nation Brands 2022 ranking, each posting a 24% increase as they attract Russian businesses displaced by international sanctions.

Fellow Central and Eastern European nation brands Lithuania (up 21% to US$67 billion) and Slovenia (up 18% to US$87 billion) also feature among the top 20 fastest-growing nation brands this year.

Sub-Saharan Africa is strongly represented among the top 20 fastest-growing nation brands too, led by South Africa (up 23% to US$216 billion) and Tanzania (up 23% to US$41 billion) as the world’s 3rd and 4th fastest-growing this year, followed by Kenya (up 19% to US$80 billion) and Ghana (up 16% to US$57 billion).

South Africa’s strong results indicate that the nation brand is increasingly able to live up to its resilient reputation. In the face of many obstacles to economic growth (such as unemployment, high levels of crime, and widespread electricity shutdowns across the country), South Africa has performed incredibly well and increased its brand value.

South Africa shares many features with more developed economies, such as advanced financial and manufacturing sectors, and is rich in mineral resources. With its pleasant climate, naturally beautiful landscape, and city-break destinations such as Cape Town, the country remains a strong tourist attraction, which has always contributed significantly to its economy.

South Africa’s response to the COVID-19 pandemic was also internationally praised, with the nation leveraging its experience from HIV/AIDS and Tuberculosis epidemics and with President Cyril Ramaphosa’s firm promotion of a science-based approach to the health crisis.

Similarly, four North African nation brands feature among the top 20 fastest growing. They are led by Morocco (up 22% to US$80 billion), as the world’s 5th fastest-growing nation brand this year, closely followed by Egypt (up 19% to US$214 billion), both of which saw brand value increases due to the strength of their diversified economies, strong manufacturing sectors, and high tourism appeal. In addition, in the case of the former, the exceptional performance of Morocco’s agricultural sector in 2021, following almost two consecutive years of drought, growth in exports and remittances, as well as momentum behind investment attraction, have given the nation’s brand value an extra boost.

Algeria, a country largely dependent on its natural resources, also saw a growth in its brand value (up 16% to US$87 billion). As did Tunisia (up 16% to US$25 billion) which has seen a revitalisation of its tourism sector post-COVID.

Another group of nation brands among the top 20 fastest growing in 2022 comes from Central America led by the island nation of the Dominican Republic (up 21% to US$74 billion), and followed closely by Costa Rica (up 19% to US$30 billion), Panama (up 17% to US$60 billion), and Honduras (up 16% to US$20 billion). All have been increasingly active in the nation branding space in recent years.

In September 2021, the Dominican government launched its nation brand strategy in the United States based on five pillars: Investment, Exports, Tourism, Culture, and Citizenship, with which the Dominican Republic presents itself as a preferred destination for business and investment as well as tourism.

Costa Rica, for its part, with its slogan "Essential Costa Rica" seeks to promote the nation's positive reputation for sustainability and tourism. Panama's new tourism brand anchored on the slogan "Vive por Más" is also based on sustainable tourism.

Large economies return to top of brand strength ranking, with Canada claiming #1, but performance still below pre-pandemic levels as global interactions suffer

Canada has claimed the title of this year’s strongest nation brand with an overall brand strength score of 81.8 out of 100, supplanting last year’s leader Switzerland (80.7). Alongside GDP forecasts, nation brand strength is an important driver of nation brand value.

Canada boasts one of the highest brand perceptions scores, with excellent marks across both international and domestic audiences.

With a stable economy and one of the highest standards of living in the world, Canada has a strong advantage in brand investment, and its brand performance has remained relatively high thanks to flexible COVID-19 policies.

Brand Finance’s brand perceptions research, originally published in the Global Soft Power Index 2022, has evidenced a recovery of the reputations of the world’s largest economies over the past year, compared to the first year of the pandemic.

While in 2020 leading nation brands including China, Italy, and the USA were seen to have suffered significantly from the first wave of COVID-19 infections, in 2021 they were seen to have successfully rolled out vaccinations and managed the virus.

In this way, the USA, France, UK, and Japan all make a comeback to the top 10 brand strength ranking after the extraordinary one-year decline in their international perceptions caused by the COVID-19 pandemic. Similarly, China enters the top 20 for the first time, claiming 15th place, and Italy and Spain return to the top 25.

Brand performance held back by COVID-19, with United Arab Emirates

positive exception

While nation brand perceptions have largely recovered over the course of the past year, brand performance has not yet returned to its pre-pandemic levels for most nation brands in the ranking.

With global interactions in the crucial areas of trade, investment, tourism, and talent attraction down across the board throughout 2021, most brand strength scores remain held back by the legacy of the COVID-19 pandemic.

A positive exception, the United Arab Emirates, ranks highest globally in brand performance, with a score of 80.5 out of 100.

The United Arab Emirates has attracted a higher volume of trade, investment, tourism, and talent than other nation brands. A successful COVID-19 response, which allowed the United Arab Emirates to open for business sooner than many other destinations, is one of the key drivers of the United Arab Emirates’s impressive results this year.

Thanks to maintaining a higher brand performance score and improving its brand perceptions, the United Arab Emirates has defended its position as the strongest (76.7 out of 100) as well as most valuable (US$773 billion) nation brand in the Middle East and Africa.