This article was originally published in the Brand Finance Football Annual 2020.

What is the allure for foreign investment and why is football becoming the most lucrative choice for those looking to expand their portfolios? We look into recent deals that became key for the industry.

On the 27th of November 2019, The Abu Dhabi United Group announced they were selling a 10% stake in City Football Group (CFG) to US private equity firm Silver Lake Partners. The deal placed a value on the group at $4.8 billion (€ 4.4 billion).

The announcement of the deal highlighted two key trends in the world of football; firstly, the increasing appetite of foreign investors into European football clubs (particularly from US investors), and secondly, the financial viability of a football club as a sound investment. While the topic of foreign investment into Premier League football clubs is never far beneath the surface, after the recent announcement of the European Super League (ESL) and the subsequent backlash, the polarising debate of foreign ownership has raised its head once again as the foremost controversial subject in football.

Act with confidence. Make sponsorship and brand partnership decisions using hard data. See our Consulting Services for more information. Or contact us directly. We love to talk.

Foreign ownership can be a contentious subject for all stakeholders of a football club, but particularly so for football fans. The promise of investment into a club in the form of stadium expansion, improved training facilities and increased spending in the transfer market is a lucrative proposition. There is no greater proof of the benefits of a large investment from a foreign owner than that of Manchester City, who since being taken over by the Abu Dhabi Investment United Group have gone on to win five Premier League titles, two FA Cups and 6 League Cups. The benefits of the vast investments that foreign owners have the potential to make extend beyond the field of play too, with the Greater Manchester community benefitting from the gentrification of the area.

However, the counter argument for foreign ownership often cited is that the investors lack an in-depth understanding and respect for the traditions and history of a club, a lack of financial transparency, and poor relations with fans and other stakeholders. One needs only to look at the red half of Manchester to understand how potentially damaging a fractious relationship between foreign owners and fans of the club can be both on and off the pitch.

According to the latest UEFA club benchmarking report, 40% of Premier League clubs are majority owned by foreign investors, with an additional 35% of Premier League teams having foreign investors as minority stakeholders. This article will explore the financials of three clubs - Manchester City, Newcastle United, and Manchester United - to highlight why Premier clubs are so attractive to foreign owners and why in some cases the fans are not happy.

Manchester City

Focussing more closely on Manchester City’s latest financial results gives a good indication of the case for the successful investment into the club with increasing returns year-on-year.

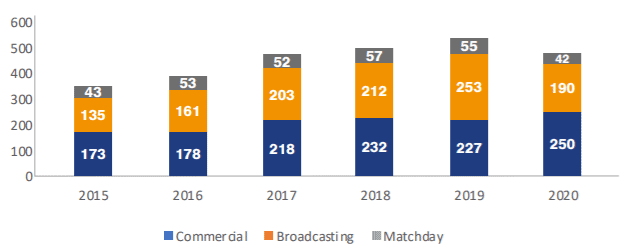

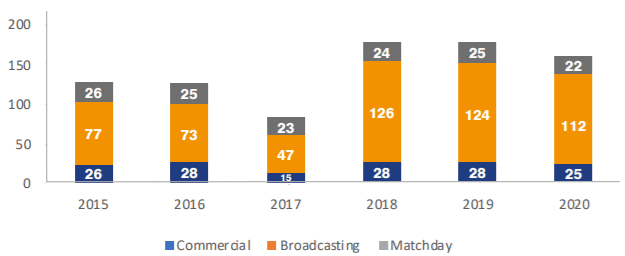

Since 2015, Manchester City has grown its revenues at a compound annual rate of 27%. 2019 was a record year in terms of revenue, with the club reporting total revenue of €590 million (£535 million). According to the latest available financial statements, which includes three months of COVID impacted football, City experienced an expected decline in revenues. Growth in revenue over the past 5-year term is largely attributable to excellent on field performances which generated a higher share of Premier League broadcasting revenue and has ultimately attracted better commercial deals from sponsors, such as the lucrative 10-year Puma deal with a reported £650 million.

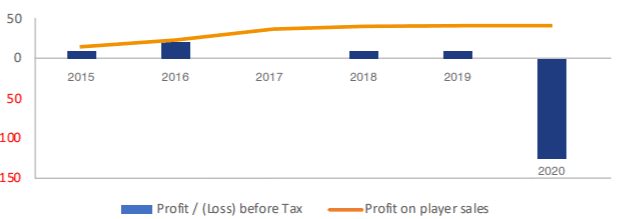

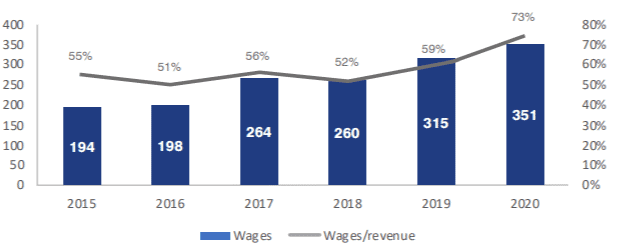

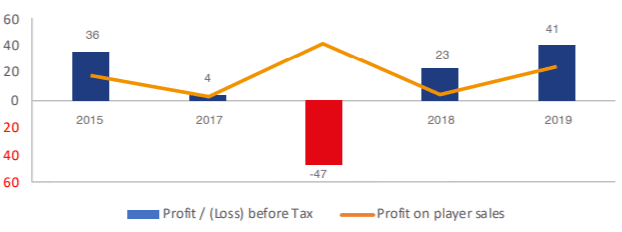

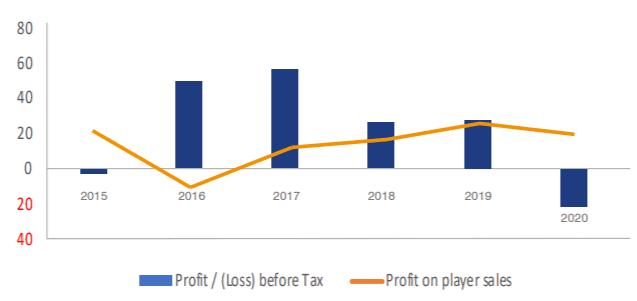

After initial sustained losses occurring at the onset of Sheik Mansour’s investment into the club, Manchester City enjoyed five straight years of profitability. However, in 2020 City swung from a £10m profit in 2019 to a £125m loss in 2020. Although the impacts of the pandemic have a large part to play in the significant loss incurred by City, the ever-increasing wage bill because of new signings, the extension of player contracts as well as large player bonus payments has not helped the case.

Expanded Opportunities

Silver Lake has a history of investments in both the technology and sporting sectors, having previously invested in the likes of Alibaba, Skype and the Ultimate Fighting Championship (UFC). The firm believes there is a strong convergence in entertainment, sport, and technology. It could leverage its involvement within technology and entertainment to potentially grow the Manchester City brand across various platforms and geographies, particularly in non-traditional markets such as the US and China. Undoubtedly the Abu Dhabi United Group found this prospect enticing when the agreement was made to part way with 10% of CFG.

Newcastle United

Another club that has been firmly in the media spotlight for a potential change of ownership is Newcastle United. The current owner, Mike Ashley, has had a tumultuous tenure since he acquired the club in 2007. Newcastle United fans have made no secret of the fact that they want Ashley gone, and Ashley has done himself no favours in improving his relationship with the fans; he once reportedly admitted to never having visited the club’s official website. Between late 2019 and the first half of 2020, rumours circulated of a potential deal with a Middle Eastern consortium led by the Public Investment Fund (PIF) of Saudi Arabia, that would value the club at between €330 million and €390 million. For reference, Brand Finance valued Newcastle United at the time at €457 million. However, in late 2020, the consortium officially withdrew its offer. A closer look at Newcastle United’s financials explains why the Middle Eastern investors had been interested in acquiring the club.

The club reported revenues of £159 million for the financial year ending June 2020. Over 70% of revenue earned is attributable to broadcasting income as a direct result of playing in the Premier League, which highlights the importance of Newcastle’s continued participation in England’s flagship league. Commercial revenue has been stagnant in recent years. A prolonged period playing Premier League football (and potentially challenging for European football as the club did in the late 90’s) could see renewed interest from commercial sponsors and partners, and further improve Newcastle’s revenue prospects and development in the future.

In 2020, Newcastle finished 13th in the Premier League, three places lower than the previous season. Yet, their profit before tax improved by £18 million. The year-on-year profit increase from 2018 to 2019 is largely attributable to the shrewd sale of players during the transfer window. Unfortunately, Newcastle United have yet to release the 2020 annual report, so it remains to be seen how severe the impact of COVID-19 has been on the financial state of the club. With the possible exception of a COVID impacted 2020 and a relegation impacted 2017, Newcastle have been consistently profitable over the last 5 years.

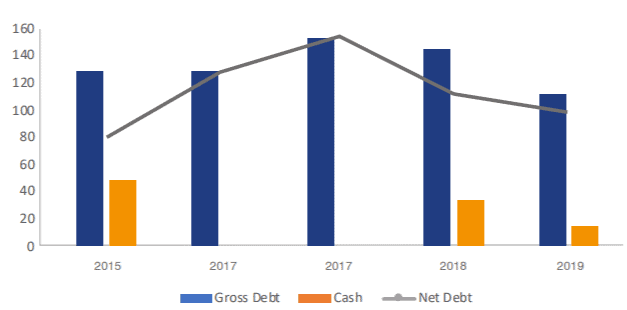

Newcastle have been slowly chipping away at the overall debt used to the fund the club, with net debt sitting at £98 million (considerably lower than the £152 million high in 2017). This could potentially mean a strong balance sheet from which to make inroads in the transfer market.

The Newcastle brand has arguably been underperforming relative to the stature and history of the club. The fractious relationship between Mike Ashley and the Newcastle fan base is proof that it is not just foreign owners that can cause angst among local football fans. An injection of money from the vast wealth of the PIF, or indeed another potential suitor which could be used to invest in the infrastructure of the club as well as bring in some world-class talent on the pitch, could prove to be a turning point in restoring Newcastle United to its former glory and prove to be a savvy investment simultaneously.

Manchester United

The high-profile takeover of Manchester United by the Glazer family in 2005 was not without controversy, particularly among some factions of the fan base. However, despite recent on-field performance struggles, the club has unquestionably been the predominant financial power in English football.

Being one of only two publicly listed football clubs operating in England, Manchester United’s enterprise value is currently valued at £2.3 billion by the wider market. However, the share price has experienced declines due the impact of COVID and the recent ESL scandal. Brand Finance currently calculates Manchester United’s Enterprise Value at £2.7 billion within the latest Brand Finance Football 50 2021 ranking.

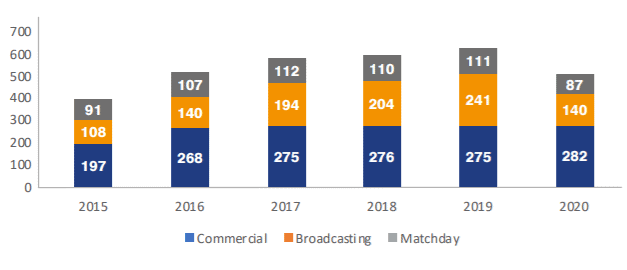

Despite finishing 6th in the 2019-20 season, Manchester United became the first Premier League club to report revenues in excess of £600 million, generating £627 million in total. Revenue growth was largely driven by an 18% increase in broadcasting revenue generated through the new European broadcasting agreement. However, as a direct result of the impact of COVID, United has experienced a 19% decline in overall revenue down to £509 million. Closed door matches, and broadcast revenue rebates were the main drivers behind the fall in revenue.

Manchester United has managed to maintain a healthy level of profit, except for the COVID affected 2020 financial year end. This can largely be attributed to the significant revenue generating capabilities of the brand and a relatively in-check wage/revenue ratio (49%).

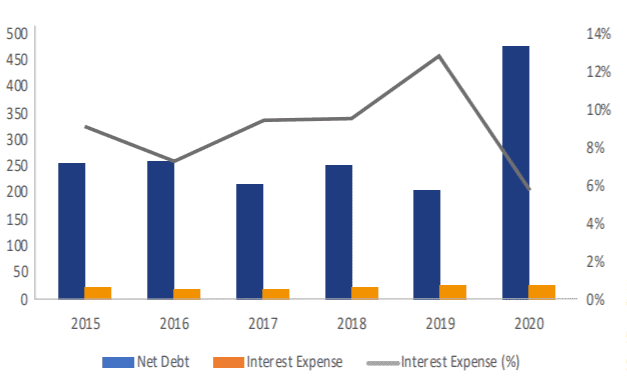

However, this figure is greatly reduced when accounting for the interest payments made on the large amount of debt incurred because of the takeover by the Glazers. In fact, a large reason for the angst felt by many Manchester United fans is the way the Glazers took control of Manchester United in 2005, using a leverage buyout to purchase the club.

A leveraged buyout involves using debt to purchase the club and then placing that debt on the balance sheet, which incurs an interest cost each year. On average over the last five years, interest expense on net debt has been 9%, which is a significant figure. In fact, since 2010, Manchester United has paid a total of £565m in interest expenses.

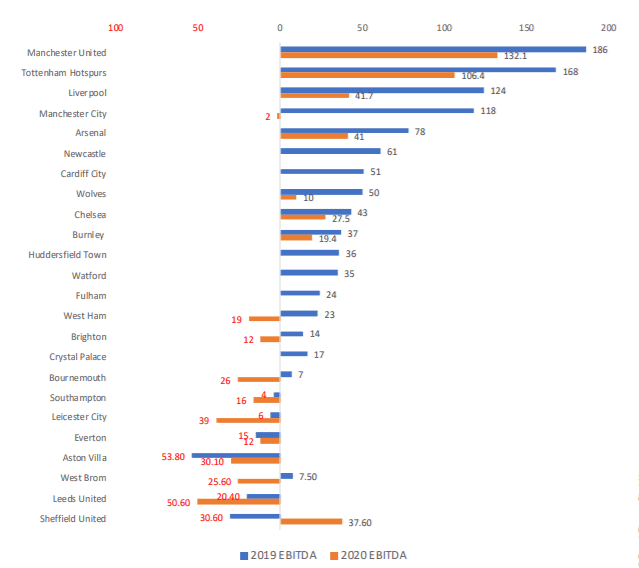

Manchester United has the highest EBITDA of any team in the Premier League, which serves as a testimony to the value of the Manchester United brand and the club’s ability to leverage that to generate ever increasing commercial partnership fees all over the world.

This ultimately is what keeps the Glazers, and indeed any other potential future investors, extremely interested. The general perception of football clubs is that they are a volatile business, and one in which investors should be weary of. Indeed, according to activity around publicly traded football clubs, the share price can fluctuate substantially based on short-term on field performances or transfer market activity.

However, the likes of Manchester City, Liverpool, and Manchester United are indicative of the fact that a long-term investment at the right price can yield excellent financial returns for those willing to take the

In the past couple of years, our sports services team have expanded their coverage to study the perceptions of football fans. You can find the latest insights into how clubs and corporate brands can use this information to generate value for their brands and businesses here.