This article was originally published in the Brand Finance Global Soft Power Index 2025

Chairman,

Brand Finance

2025 is a big year for China’s nation brand. China is now the second-most powerful nation in the world in terms of Soft Power, surpassing the United Kingdom and second only to the U.S. China’s second-place spot in the ranking is its highest performance since Brand Finance began researching perceptions of nation brands.

Their ascent is not due to luck; China has made deliberate and multifaceted efforts to address weaknesses in how the country is perceived. The data indicates the strategy is working, as China’s Reputation has climbed to 27th rank, up from 56th in 2021.

In the past year, China’s nation brand has experienced notable growth across six of eight Soft Power pillars and in two-thirds of measured attributes. This growth highlights how improved perceptions across a range of economic, cultural, and social metrics are driving China’s Soft Power.

In the meantime, the United Kingdom has stumbled. The UK is now ranked third in the Global Soft Power Index for the first time since the pandemic. While its scores and ranks have remained relatively stable year-on-year, there is a noticeable plateau in perceptions of its nation brand. Unlike China’s dynamic upward trajectory, the latest data indicates the UK may be losing momentum in shaping its global image. (Figure 1)

China's growing economic influence: Outpacing the UK in global business and trade?

Brand Finance research highlights that Business & Trade attributes are key indicators of a nation’s global influence, reflecting economic strength, innovation, and integration into the worldwide market.

Since Brand Finance began measuring the nation’s Soft Power in 2020, China has consistently outperformed the UK in the Business & Trade pillar. China has held the top spot globally for ‘ease of doing business since’ 2020, while the UK’s highest rank for this attribute was sixth in 2023.

In 2025, the UK has slipped to eighth place, now trailing significantly behind China. This growing gap reflects China’s sustained efforts to enhance its economic attractiveness and attract foreign investment, while the UK is struggling to stay competitive. In the 2025 Index, China ranks eighth for its ‘strong and stable economy,’ narrowly ahead of the UK, which holds the ninth spot, a drop of two ranks from 2024. This shift reflects China’s growing economic influence and ability to shape global economic stability perceptions. China has also ranked first for its ‘future growth potential’ since 2022, while the UK, which reached a concerningly low 86th in 2023, is struggling to keep up with China’s high growth, improving only to 37th place in 2025.

For the UK, this concerning stagnation highlights a need to reassess its strategies for maintaining economic relevance, especially as it continues to navigate post-Brexit realities, evolving trade dynamics, and domestic pressures. Staying competitive in this crucial pillar of Soft Power will require a renewed focus on innovation, trade relationships, and economic diplomacy.

Positive perceptions of China’s economic growth potential can be largely attributed to initiatives like the Belt and Road Initiative (BRI). The BRI has played a pivotal role in creating new markets for Chinese companies and strengthening economic ties with participating countries. By building infrastructure, enhancing trade routes, and fostering international partnerships, the BRI has positioned China as a key driver of global connectivity.

In terms of Soft Power, a nation’s ability to engage in trade, attract investment, and contribute to global economic development is instrumental in shaping perceptions and enhancing its standing on the world stage.

China's strategic use of initiatives like the BRI has bolstered its economic strength and reinforced its image as a collaborative partner in international development, reflected in a 24-rank jump for its ‘good relations with other countries.’ The UK, meanwhile, remains in 18th place for this attribute, showing no improvement from 2024.

The rise of Chinese brands: From domestic giants to global powerhouses

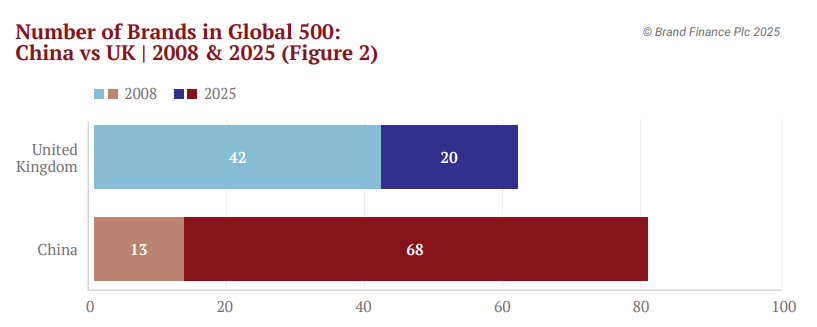

China’s strategic investments in brand building have significantly enhanced the recognition and influence of its brands globally, contributing to the nation’s growing Soft Power. In 2025, China ranks fifth globally for its ‘products and brands the world loves’, while the UK has remained in seventh position since 2021, signalling stagnation in this area. China’s rise in this attribute is largely due to the growing recognition and performance of Chinese brands domestically and globally. Over the past 17 years, the number of Chinese brands in the Brand Finance Global 500 has surged from 13 to 68, and their total brand value has increased by more than 23-fold to USD1.4 trillion. (Figure 2)

This jump in brand value reflects a shift from domestic dominance to global brand leadership, exemplified by the worldwide impact of Chinese brands like TikTok. With over 1 billion monthly users, TikTok has transformed the global media landscape, reshaping how people create, consume and share content on a massive scale.

Its global influence has likely contributed to China’s improved performance in the Media & Communication pillar, climbing 20 ranks for being perceived as ‘easy to communicate with,’ and 13 ranks for having ‘trustworthy media.’

Chinese brands are also at the forefront of global innovation, with China maintaining its position as second in the world for being ‘advanced in technology and innovation’ over the past three years, ahead of the UK in sixth rank.

This progress is powered by the rise of tech giants like Huawei, a leader in global telecommunications, and BYD, which is driving the rapid global shift toward electric vehicles. These advancements reflect China’s growing authority in innovative and high-tech industries and cement the global impact of Chinese brands.

Another standout example is the State Grid Corporation of China (SGCC), which has emerged as a global leader through its pivotal role in the BRI. By developing and operating critical energy infrastructure projects across participating countries, SGCC has not only strengthened China’s energy diplomacy but also bolstered its brand as a leader in energy innovation and sustainable development.

Reflecting this success, SGCC entered the top 10 most valuable global brands list in the Global 500 for the first time ever in 2025, following a 20% increase in its brand value to USD85.6 billion. This milestone underscores the company’s growing influence and impact of its strategic initiatives on the global stage.

Advancements in Culture and People & Values driving China’s Soft Power

China has made advancements in the People & Values pillar, recording rank increases across several attributes. This has contributed to its overall Reputation and nation brand perceptions. For example, China has risen 27 ranks for being perceived as ‘generous’, 25 ranks for being ‘friendly,’ 15 ranks for being ‘fun,’ and 12 ranks for being ‘trustworthy.’ Meanwhile, the UK has experienced a standstill or decline in most these attributes since 2024, highlighting China’s growing persuasion in this domain.

China has also risen six ranks for being considered as a ‘great place to visit,’ and seven ranks for its ‘appealing lifestyle.’ These gains have helped China rise to seventh place in the Culture & Heritage pillar, narrowing the gap with the UK, which now holds a one-rank lead, down from three in 2024.

China’s advancements in Culture & Heritage are closely aligned with the nation’s broader Soft Power strategy, as outlined in its 14th Five-Year Plan (2021-2025), which emphasises strengthening its cultural influence and cultivating a positive national image abroad.

This strategic focus is expected to further enhance China’s Soft Power in the coming years, while the UK will need to take proactive steps to maintain its competitiveness on the global stage. Creating the UK Soft Power Council is a welcome step in bolstering Britain’s potential as a global player.