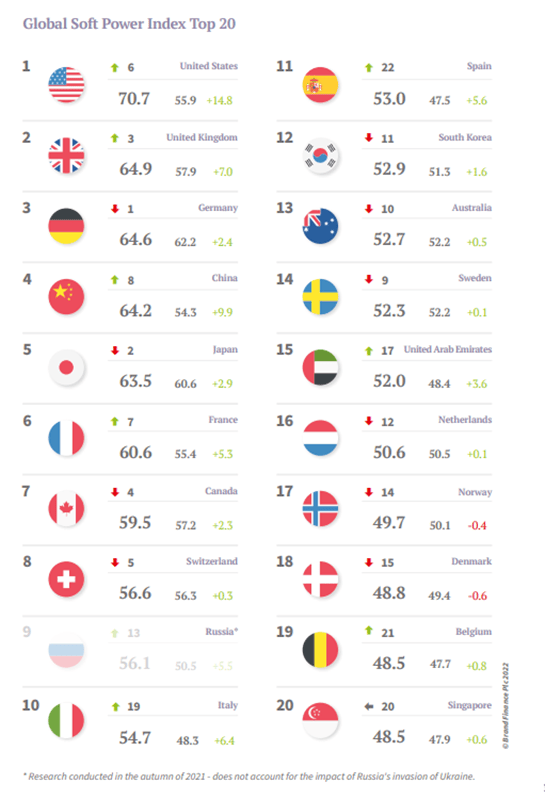

This article was originally published in the Global Soft Power Index 2022.

The composition of the Global Soft Power Index 2022 has been influenced by how well nations have managed their recovery from the COVID-19 pandemic just as much as last year’s study was impacted by the spread of the virus and its social, political, and economic consequences. The United States of America has bounced back to reclaim the top spot with a score of 70.7 out of 100, followed by the United Kingdom (64.9), Germany (64.6), and China (64.2) at the top of the ranking, as all four nations have been instrumental in lifting the world out of the health crisis through the development of vaccines. Across the ranking, perceptions of nation brands are largely recovering to their pre-pandemic levels, with Italy and Spain – both hit hard in the first wave of COVID-19 – seeing some of the most significant improvements this year. However, as we emerge from one devastating crisis, another is casting a shadow on the future. The world order is being challenged by the deployment of hard power, and with everyone’s eyes fixed on Russia and Ukraine, the need for Soft Power has never been more pressing.

USA Bounces Back Better to #1

The USA led the ranking at the start of 2020 but saw a major deterioration of its perceptions among the general public around the world later that year, resulting in a drop to 6th position at the start of 2021. A poor track record of its first response to the health crisis under President Donald Trump, a wave of civil unrest against police brutality towards the African American community, and a highly divisive presidential campaign all likely played a role. Now, following a mass vaccination effort and a general shift in international policy under President Joe Biden, the USA has seen the fastest year-on-year improvement across all 120 nation brands ranked in the Global Soft Power Index, recording +14.8 jump from a mere 55.9 in 2021 to 70.7 in 2022 – the highest score ever recorded in the Index.

The USA has seen improved ratings in all areas, but the key behind its comeback to the top of the ranking is the tremendous change in its COVID-19 Response score – from bottom of the table last year to a decent 26th position globally in 2022. The USA has also recorded a significant boost in Reputation (6th – up from 21st), Governance (8th – up from 20th), and People & Values (16th – up from 25th), all of which can be attributed to significantly more positive perceptions of President Biden’s administration, in contrast to President Trump’s alienating America First approach internationally and divisive politics domestically. Nevertheless, the USA’s scores for ‘safe and secure’ (41st) within Governance and ‘friendly’ (62nd) among the People & Values statements remain drastically low. Instances of violent gun crime on the one hand and police brutality against African Americans on the other appear to be affecting perceptions internationally, and are likely to remain an ongoing challenge to the USA’s nation brand until these issues are addressed at the root.

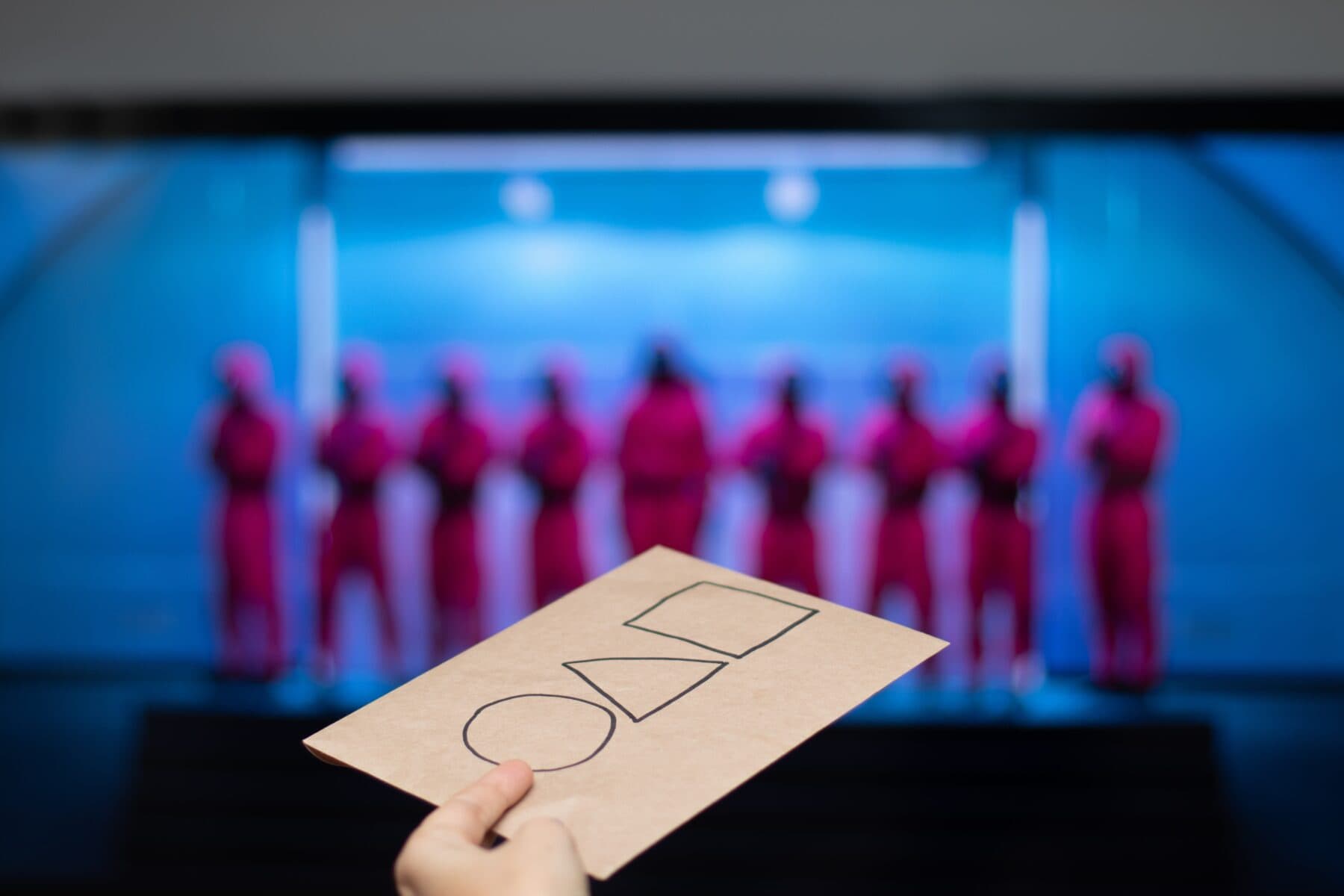

Culture & Heritage is one of the pillars of Soft Power where the USA has performed consistently well and ranks 1st in this year’s study. America is the world’s highest-grossing producer of popular culture, especially in the areas of film, television, and music. As a result of the COVID-19 reopening, perceptions of the USA as being ‘influential in arts and entertainment’ have grown even further, extending its already significant lead over other nation brands. Media platforms such as Netflix, Amazon, Disney, Google, and Apple are continuing to expand globally, enabling access to American culture but also becoming a key delivery channel for local cultural productions – from Squid Games (South Korea) to The Crown (UK).

UK leapfrogs last year’s leader, Germany

The United Kingdom has rebounded strongly from the tumultuous environment that COVID-19 and Brexit had created in recent years. The country’s Global Soft Power Index score now stands at 64.9, +7.0 year-on-year increase from 57.9 in 2021, which has seen it move up one place from 3rd to 2nd.

Whilst the long-term impact of the UK’s withdrawal from the European Union is still to be seen, the immediate result has been that of finally introducing some clarity and stability to the political and economic situation following years of conflict and uncertainty.

The UK has seen a rank improvement in the Governance pillar, from 9th to 4th, particularly attributable to the positive change in the ‘politically stable and well-governed’ metric. Despite scoring well here in this year’s Index, it must be noted that Brand Finance’s research was conducted prior to the lockdown parties scandal that has since engulfed the British government, and we may well see perceptions on Governance fall next year.

At the same time, an area where the UK has suffered as a result of Brexit is the ‘friendly’ metric, where it is now ranked 47th, compared to 27th last year, and 8th in 2020. This can be partly attributed to the emotional fallout of the separation with the EU, which many have viewed as an insular and alienating action.

Elsewhere, the UK has seen improvements in the Familiarity and COVID-19 Response pillars, thanks to the country’s contribution to the development of the Oxford AstraZeneca vaccine and the effective immunisation programme rolled out by the government. However, the UK government’s recent announcement of the removal of free testing and the requirement to isolate has thrown caution to the wind, which could impact the perception of its handling of the pandemic over time.

Last year’s top-ranked country, Germany, has also seen its Global Soft Power Index score rise to 64.6, but the stronger performances of the US and UK have caused it to fall to 3rd in the ranking. Germany has long acted as a beacon of strength and stability with a grand coalition government under Angela Merkel’s leadership. Now, leading a new red-green-yellow coalition, Chancellor Olaf Scholz has a big task ahead of him to manage the expectations and maintain the standards that have been set. After a cautious start, he has resolved to overhaul the nation’s foreign and defence policy in the light of the Russia Ukraine crisis, which is likely to affect attitudes to Germany next year.

China up to its highest position ever

China has seen its best ever performance in the Global Soft Power Index, with the nation brand recording improvements across all of the pillars in the Index. China has seen its Global Soft Power Index score increase by +9.9 to 64.2, moving it up from 8th to 4th in the overall ranking. Though China’s performance may be a surprise to some in the Western world, it will have been expected across many developing countries.

Globally, China ranks 4th for Familiarity, 2nd for Influence, and this year has seen its Reputation score climb back to 2020 levels after last year’s dip. China has also performed particularly well in the Business & Trade pillar, where it now ranks 1st, jumping above the US, Germany, and Japan in the process. China’s economy grew by 8.1% in 2021 and its exports increased by 30% to reach record levels as demand for Chinese goods boomed.

China tackled the pandemic by implementing a zero-COVID policy, which has seen the continuation of lockdowns and isolation policies, and a robust mass testing and vaccination programme. The response has proven to be successful in China, and its COVID score improved by +1.7 as a result, raising it from 30th to 19th place. The second year of the pandemic also provided China with an opportunity to improve its perceptions on the global stage through vaccine diplomacy. China offered aid to countries across the world in the form of donated personal protective equipment and vaccinations – which undoubtedly has helped it move from 52nd to 28th in the ‘generous’ metric of the People & Values pillar.

Providing China with an opportunity to showcase itself to the world, the Beijing 2022 Winter Olympics are likely to give a boost to its soft power in next year’s Index. Understanding how a nation brand is perceived in granular detail is key to developing Soft Power, and large-scale events can be successfully leveraged to serve a well-planned marketing and communications strategy. The Olympics can result in improvement on metrics directly related to its organisation such as ‘a leader in sports’ or ‘fun’, but equally allow to present the country as ‘a great place to visit’ and to advertise its ‘products and brands the world loves’.

Italy and Spain resurge after COVID Italy (54.7) and Spain (53.0) have observed a significantly improved performance in the Global Soft Power Index this year, with perceptions of both nations resurging following a battering by the COVID-19 pandemic the year before.

Italy and Spain resurge after COVID

Italy (54.7) and Spain (53.0) have observed a significantly improved performance in the Global Soft Power Index this year, with perceptions of both nations resurging following a battering by the COVID-19 pandemic the year before.

Initially, both nations suffered overwhelming consequences of the virus, with death tolls among the highest in the world. The vivid media coverage of this health crisis influenced perceptions of the two nations across the globe. During the second year of the pandemic, both Italy and Spain rolled out a successful vaccination programme, with much less hesitancy and pushback than many of their neighbouring nations. The rapid vaccination rates have consequently improved Italy and Spain’s COVID-19 Response scores, which enjoyed +2.1 and +2.2 increases respectively.

As the intense media spotlight on negative news eased, traditional perceptions of both Italy and Spain as holiday destinations have been able to resurface and have come through in this year’s Index results. Both Italy and Spain have performed well across all metrics, with Italy jumping nine spots to 10th position and Spain close behind in 11th, having ranked 22nd last year. Both nations were particularly commended in Culture & Heritage, where Italy ranked 2nd and Spain 5th. They also scored highly in People & Values, with Italy 4th and Spain 9th. Known for being popular tourist destinations with a rich heritage and pleasant climate, both nations are regarded as ‘great places to visit’ with ‘fun’ and ‘friendly’ people, with Italy additionally ranking top of the table for the ‘food the world loves’ for the third year running.

Looking to the future, perceptions of Spain and Italy’s Soft Power are likely to continue to improve in the coming year, particularly within these key metrics. As we navigate towards a world where the virus will become endemic, both nations are set to enjoy a boom in their tourism industries, driving perceptions up as their physical and mental availability grows.

Eyes of the world on Russia and Ukraine

At the time of writing this report, Russia has invaded Ukraine, following months of rising international tensions, but the result of the conflict is not yet clear. The global perceptions of both nations, as captured in the Global Soft Power Index 2022 research last autumn, are more than likely to have been affected already and will continue to be impacted more than any other nation’s in the study over the coming months.

Especially in Europe and North America, perceptions of Russia, which had ranked 9th before the invasion of Ukraine, are likely to deteriorate across the board, although its score for Influence may rise due to the increased pressure that the conflict is exerting on politics and the global economy. Ranked 51st, Ukraine will likely see improvements in its perceptions abroad, especially for Familiarity, Reputation, People & Values, Media & Communication, as well as particular metrics across other pillars such as ‘internationally admired leaders’ as President Volodymyr Zelenskyy’s courage continues to impress leaders and publics alike, or ‘influential in diplomatic circles’ as the tremendous efforts of the country’s diplomats to build an international coalition of support have brought tangible results. However, the nation’s scores for Business & Trade are almost certain to deteriorate, as wartime destruction and the ongoing humanitarian crisis have already caused enormous damage to Ukraine’s economy.

Although from a Western perspective this conflict marks a clear watershed in international relations, general publics in many countries and regions – from China and India to the Middle East and Sub-Saharan Africa – may not see as dramatic a shift in their perceptions of Russia. Moreover, in some of those markets, it may be the perceptions of Western nations that will deteriorate because of their entanglement in the conflict. Soft power of a nation varies from country to country and only the analysis of both global and multiple local standings can offer the full picture.

REGIONAL LEADERS

Australia and New Zealand cope with COVID-19 aftermath

In Oceania, both Australia and New Zealand have seen their ranks in the Global Soft Power Index return to their 2020 standing. Following the first year of the COVID-19 pandemic, both countries garnered a lot of praise for their effective responses, driving their perceptions upwards. This year, they have been overtaken by other nations which rolled out their vaccination programmes quicker and opened their borders earlier. In addition, their COVID-induced retreat from the interconnectedness of the modern world has taken a toll on their perceptions in other areas of key significance to Soft Power.

Australia is now back to 13th position in the ranking with a Global Soft Power Index score of 52.7, following a year-long stint in the top 10. State wide lockdowns were enforced, which led to a restriction of movement and impacted the economy negatively. Internationally, Australia witnessed a decrease in scores across Reputation and People & Values, as the nation sealed itself off from the outside world.

Australia only opened its international borders for travel as late as the first quarter of 2022 for the first time since the pandemic hit in 2020. According to the Global Soft Power Index 2021, the nation was ranked 1st as ‘a great place to visit’, now it ranks 4th. The nation brand lost points on a number of other metrics in the Culture & Heritage pillar in the 2022 ranking too. For a place that had been widely recognised for its vibrant tourism industry, the legacy of a screeching halt to international visits will present a challenge that needs to be addressed.

Neighbouring New Zealand claims 21st position globally with an overall Global Soft Power Index score of 48.4 out of 100, down 5 places year on year, and sees a similar performance to Australia.

In 2021, New Zealand was hailed as a global success story as a result of its approach to the pandemic, ranking 1st in the Global Soft Power Index for its COVID-19 Response. However, economic activity waned due to stringent lockdown measures and travel restrictions. The tourism sector was impacted with a dramatic drop in hotel bookings and retail sales. New Zealand’s COVID-19 Response continues to be recognised as exemplary, but the decline of the nation’s mental and physical availability around the world has caused its scores to fall in other areas.

UAE leads in Middle East and North Africa

The United Arab Emirates has achieved a Global Soft Power Index score of 52.0 this year, earning it 15th place in the ranking, up two spots from 17th in 2021. This is the highest position for any nation brand in the Middle East and North Africa, much ahead of Israel (23rd) and Saudi Arabia (24th).

The UAE has performed best on the Business & Trade pillar, counting among the global top 10. Its best metric overall is the ‘easy to do business in and with’ where it comes 4th, followed by ‘strong and stable economy’ where it ranks 8th. The UAE is emerging from the COVID-19 pandemic strong, with its trade and investment prowess underscored by the success of the EXPO 2020 exhibition in Dubai. Aligning the working week with the majority of the world to Monday-Friday is likely to solidify positive perceptions of the UAE as a business-friendly nation in the next Global Soft Power Index survey, but the introduction of federal corporate tax from 2023 may moderate that impact in the following years.

Another key metric in the Index where the UAE ranks within the top 10 is Influence. The signing and implementation of the Abraham Accords is likely to be the key reason behind the nation’s improvement here as well as in the International Relations pillar, where it claims 11th spot. The UAE has moved up on the ‘good relations with other countries’ statement to 23rd and on ‘helpful to countries in need’ it now ranks 11th, which can be attributed to donations of protective equipment and vaccines over the course of the pandemic. The UAE has also improved its COVID-19 Response score, ranking 12th compared to last year’s 15th.

Nevertheless, the UAE’s fastest improvement this year has been recorded in the Education & Science pillar, where the nation has gained +1.0 since 2021. Its focus on high-tech economy and specialised education as well as the bold venture into space exploration with the Emirates Mars Mission have no doubt influenced perceptions of the UAE’s capabilities in this field.

Brazil and South Africa – regional ranking leaders

With a Global Soft Power Index score of 43.4 out of 100, Brazil leads the charge as the highest-ranked nation in Latin America, jumping 7 spots to 28th position in the ranking.

Despite a slight dip in the Culture & Heritage score, it has remained Brazil’s strongest pillar. The nation ranked 9th on this metric, as it continues to be perceived as ‘leaders in sports’ and ‘influential in arts and entertainment’ as well as offering ‘food the world loves’. The largest contribution to its overall score improvement, however, comes from increased Familiarity (+0.7) and the knock-on effect that it has had on almost all metrics across the board. Larger nations are gaining in salience, and Brazil is a clear example of this trend.

Another regional Soft Power leader, South Africa has climbed 3 spots in the ranking to 34th position this year, consistently outperforming its neighbours in Sub-Saharan Africa.

South Africa’s scores have increased across nearly all metrics, resulting in an impressive +3.1 Global Soft Power Index score gain to 40.2 out of 100. Similarly to Brazil, South Africa has increased its Familiarity as salience of larger nations grows, ushering in score improvements in Soft Power pillars, especially Media & Communication, Education & Science, and Business & Trade. Within the latter, the nation continues to be regarded as holding a lot of ‘future growth potential’, ranking 4th globally – its strongest performance across all statements. South Africa has experienced rapid economic development over the last decade, becoming an attractive location for investment. However, the nation’s Governance scores remained low, with scepticism surrounding its political stability, track record on corruption, rule of law, and security.

Global Soft Power Index welcomes 15 nations to 2022 ranking

15 nations are added to the Global Soft Power Index 2022 ranking, but none of them make it to the top 50. Highest- ranking Maldives claims 52nd position, thanks to its top score globally for a ‘great place to visit’. The country also ranks high on a number of other metrics, especially ‘good relations with other countries’, with the 7th highest ranking in the world.

The national tourism office of Maldives launched the Visit Maldives campaign to maintain interest in the islands as a popular tourist attraction, showcasing the attractiveness of major locations. The country is being promoted as the ideal destination for the hybrid and virtual workforce in order to foster consumer demand after COVID-induced contractions in tourism inflows.

In addition, Maldives’ efforts in ‘acting to protect the environment’ have not gone unnoticed, resulting in 16th position for this statement. The nation prioritises international environmental activism due to its precarious geographical attributes which put it at high risk to climate change factors.

The low-lying archipelago is also fighting climate change by implementing holistic solutions on the ground. Maldives is to phase out single-use plastic by 2023 and to introduce a net-zero energy policy which implies making the switch from diesel to solar power.

In contrast to the performance of Maldives, three other tropical island new entrants to the Global Soft Power Index 2022 – Mauritius, Seychelles, and Barbados – have not been as successful in seizing the same perception-building opportunities around tourism and climate action, claiming much lower ranks.

Mauritius is at 71st position with a Global Soft Power Index score of 31.9 out of 100. The nation ranks well with regard to Reputation and COVID-19 Response. Mauritius opened its borders internationally to visitors early in October 2021 to bolster the tourism sector, having introduced precautions and contact tracing to restrict the spread of the virus.

With low scores for Familiarity and Influence in particular, Seychelles has scope for improvement, ranking 90th in the Global Soft Power Index. Despite 60% of the population being vaccinated for COVID, cases in Seychelles still increased widely. The reason for the spike in cases was the premature opening up of borders for tourists without any quarantine regulations. The surge in cases reflected lack of medical infrastructure and the urgent need to enforce stronger precautionary measures and guidelines for travel.

Barbados sits in 93rd position of the Global Soft Power Index 2022 with a score of 29.7 out of 100. The country ranks high on the People & Values, Culture & Heritage, and Governance pillars. Towards the end of 2021, Barbados was declared the world’s newest republic after Queen Elizabeth II was officially removed from the head of state position. This significant decision will help the country develop a distinct identity around the world in the coming years.

The results of the European new entrants into the Global Soft Power Index 2022 make a strong case for the importance of nation brand marketing to improve perceptions and reputation globally. Increasingly popular destinations for tourism and investment, Georgia (57th) and Cyprus (58th) rank as high as in the top 60 in the overall ranking. Following these nation brands are Malta (65th) and Bosnia and Herzegovina (72nd) that lie in the middle of the table. Trailing behind them are Montenegro (97th) and Albania (104th) both ranking around the top 100 mark, despite having undoubtedly as much to offer to tourists and investors as Georgia or Cyprus. The range of difference between these nations’ performances in the Index sheds light on the need for nation brands to shape their perceptions internationally by investing in marketing campaigns that promote their key Soft Power assets effectively.