The below text is the Executive Summary of this year's report, which you can also read in the complete edition of the Global Soft Power Index 2024.

Place Branding Director,

Brand Finance

Introduction

In 2023, Soft Power faced substantial challenges marked by events like the Israeli–Palestinian conflict, the escalation of the Ukrainian-Russian war, tensions between the United States and China, global warming and natural disasters. These events not only shaped international perceptions but also tested nations’ Soft Power capabilities.

The economic landscape witnessed significant transformations too, with high inflation and slow growth on one end and the launch of new AI initiatives on the other. AI is now shaping the trajectory of industries and influences business dynamics on a global scale. It may also fundamentally change how nations are perceived as they strategically navigate the opportunities and challenges presented by this new technology.

The continued growth of social media and the democratisation of news creation while stimulating for the public debate, have also raised critical questions about disinformation and interference in news feeds. As individuals become more cautious about their information consumption, the interplay between scepticism and the surge in content accessibility provoke new questions for the global community.

These developments set the contextual backdrop as Brand Finance conducted the research for this latest report.

“It's the economy, stupid”

In this global Soft Power landscape, the significance of Business & Trade perceptions is growing amid economic challenges and political instability. ‘Strong and stable economy’ emerged as the leading driver of both Reputation and Influence, with ‘products and brands the world loves’ and ‘easy to do business in and with’ also counting among the top 5 nation brand attributes in terms of their importance for shaping the Soft Power of nations this year.

This trend explains the continued dominance of the world’s largest economies like the USA and China as well as smaller developed economies like Switzerland and the United Arab Emirates at the top of the ranking. Dominant nation brands are recording faster Soft Power growth (average +3.1 points in the top 50) than the rest of the ranking (average -1.3 for those ranked 51-193).

The Global Soft Power Index, now in its fifth iteration with the 2024 edition, examines the perceptions of all 193 member states of the United Nations for the first time, realising the ambition we set ourselves when the study started. It is based on the most comprehensive and wide ranging fieldwork of its kind, with responses gathered from over 170,000 people across more than 100 markets.

The Soft Power Super Power

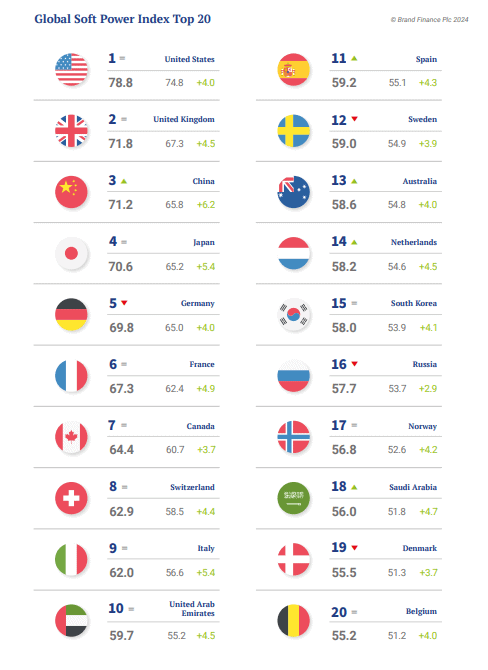

The United States leads the rankings with an all-time highest Global Soft Power Index score of 78.8, an increase from 74.8 in 2023. It earns the top spot for Familiarity and Influence, four out of the eight Soft Power pillars, and nine out of the 35 nation brand attributes, including ‘leader in science’, ‘influential in arts and entertainment’, ‘internationally admired leaders’, ‘helpful to countries in need’, and ‘supports global efforts to counter climate change’.

However, despite these strengths, internal security challenges around gun violence and police brutality as well as involvement in international conflicts seem to be undermining some of its nation brand perceptions, as evidenced by continued rank declines on ‘great place to visit’, ‘good relations with other countries’, ‘safe and secure’, and ‘friendly’ where the USA has dropped a further 9 places to 112th.

The upcoming presidential election in November 2024 will be momentous in terms of future direction for the USA and how the nation is perceived globally. Donald Trump’s confrontational politics – both domestically and internationally – caused a serious erosion of the nation’s Soft Power in his final year in office, reflected in the United States temporarily losing its 1st rank in the 2021 Index, since recovered under the Biden administration.

Britannia back on course

The United Kingdom defends 2nd position with a Global Soft Power Index score of 71.8, improving on 67.3 in the previous year.

Maintaining its standing in the top 3 for Familiarity and Influence, and this year also achieving an all-time high of 4th rank in Reputation, the United Kingdom consistently demonstrates a round profile.

It also continues to dominate in ‘strong educational system’ and ‘respects law and human rights’ and ascends to the top in ‘easy to communicate with’ and ‘trustworthy media’ attributes, proving an edge in specific perceptions around its universities, constitution, and journalism. For more than a decade, the UK's strengths have been successfully promoted by the GREAT Britain and Northern Ireland Campaign – one of the world’s longest running and most impactful nation branding and marketing initiatives.

This year, the UK has also overcome a Soft Power risk from temporary instability in late 2022, resulting from tumultuous government changes and the passing of Queen Elizabeth II. This year, the UK ranks 7th in ‘strong and stable economy’ compared to last year’s 12th and improves on ‘politically stable and well governed’ up to 12th from last year’s 16th. Like the USA, as the UK is set for a general election this year, it will be interesting to see how the results impact its Soft Power.

The Year of the Dragon

China solidifies its global standing, replacing Germany at the 3rd position in the Global Soft Power Index, having achieved the most substantial improvement in the overall Soft Power score this year (+6.2 points) among all nation brands in the ranking. The marked progress across nearly all pillars reflects China’s rising global reach.

China’s particularly strong and improving perceptions across key drivers of Soft Power in the Business & Trade (3rd) and Education & Science (3rd) pillars are the main factors behind the scale of the nation’s rise this year. Despite these achievements, there is a need to urgently focus on enhancing likeability, as China scores disproportionately low on People & Values attributes such as ‘friendly’ and ‘fun,’ ranking 122nd in both categories. This signals potential areas for improvement in the realm of cultural perceptions and social appeal, as these attributes, though not key drivers of Influence, are crucial for building Reputation—an essential component of Soft Power.

Replaced by China and overtaken by Japan too, Germany fell to 5th position in the Global Soft Power Index, after earning top ranking in 2021, and 3rd place in both 2022 and 2023.

Germany has experienced stagnation and in many cases erosion in perceptions across the board this year, with a substantial drop of 14 positions in 'good relations with other countries' compared to 2023, along with decreases in 'helpful to countries in need' and measures of trustworthiness.

Nevertheless, Germany achieved the top rank in Governance and, despite some score declines, remains among the leaders in the pursuit of a Sustainable Future.

An intentional approach strengthens Soft Power

While China makes significant growth in Soft Power this year, the greatest improvements in the ranking over the past five iterations of the Global Soft Power Index have been recorded by the United Arab Emirates (+13.8 points and 8 ranks to 10th), Saudi Arabia (+14.1 and 8 ranks to 18th), Qatar (+16.0 and 10 ranks to 21st), and Türkiye (+14.3 and 5 ranks to 25th).

All four are characterised by conscious efforts to grow their Soft Power through nation branding projects, diplomatic initiatives, and by hosting major events.

The Gulf nations especially, are seeing enhanced Influence and Reputation as well as strengthening International Relations and Business & Trade credentials, with the United Arab Emirates receiving 10/10 marks and top position globally on the key ‘strong and stable economy’ attribute this year.

The United Arab Emirates has successfully staged the high-profile EXPO 2020 and COP28. Qatar’s improvement follows the 2022 football world cup, which FIFA president Gianni Infantino called the best in history.

Similarly, Saudi Arabia is seeing stronger perceptions following significant investments in tourism and football which have earned global media attention. Türkiye has during the same time officially changed its name and took on the role of a mediator leveraging Soft Power to facilitate diplomatic dialogue from Eastern Europe to the Middle East.

The top 5s for score and rank improvement are rounded off by Italy gaining a +12.7 score increase and Spain climbing 5 ranks since 2020. Both nations effectively balance tourism attraction and economic strength, and successfully rebounded from COVID-19 over the past few years. Italy in particular, secures 2nd position in ‘great place to visit’ and 3rd in ‘products and brands the world loves’, demonstrating that positive perceptions in culture and business can go hand in hand.

Regional leaders

Large regional powers India, Brazil, and South Africa are struggling with the challenge of fully realising their Soft Power potential. While all three exhibit high levels of Familiarity and Influence, particularly within their home regions, they face difficulties in building a truly global Reputation. All three are often scored high for their Culture & Heritage yet encounter limitations in crucial metrics such as Business & Trade.

The observed increase in Soft Power scores this year has not translated into significant advancements in rankings for India, Brazil, and South Africa. While strengthening economic perceptions would be the quickest way to enhance their Soft Power, these nations might also benefit from focusing their efforts on International Relations and Culture & Heritage, drawing inspiration from Türkiye's successful strategy.

India, despite fast economic growth, has seen its rank drop one spot to 29th. However, its more active position on the international stage, evident by its hosting of the G20 Summit, economic progress, investment in space, and sports initiatives like the launch of the Indian Women’s Premier League in cricket, signals a shift towards a less Western-dominated world order.

This is reflected in the enhancement of some Soft Power scores, gaining 34 positions in the Media & Communication pillar and improving on a number of key attributes in Education & Science.

Brazil, the highest-ranked Latin American nation brand, stagnates at 31st place. The country faced political instability in January-February 2023, suggesting a potential focus on political polarisation that may have impacted its Soft Power standing.

Despite recent achievements such as the Rugby World Cup victory and hosting the 2023 BRICS summit, South Africa, leading in the Sub-Saharan Africa ranking, reaches an all-time lowest spot at 43rd.

However, a significant 20-position rebound in Reputation signals a transformative 2023, marked by the G21 integration of the African Union and important diplomatic interventions in both the Russia/Ukraine and Israel/Palestine conflicts.

Hard Power undermines Soft Power

Countries engaged in armed conflict experience declines in their Soft Power this year. Down 3 ranks, Russia reaches an unprecedented low at 16th place, primarily due to negative perceptions surrounding its aggression against Ukraine.

Despite this, it records a minor Reputation recovery as the war is becoming increasingly normalised, marked by a change of +0.3 and a 30-rank advancement to 75th place.

Striving to maintain international support, Ukraine experiences a 7-rank decline to 44th place, although remaining higher in the ranking than pre-invasion.

Despite retaining significant Familiarity gained from its heroic defence against Russian aggression since 2022, Ukraine loses 4 ranks in Influence due to slower improvement compared to other nations.

This calls for the development of innovative routes to achieve strategic goals in both Hard Power and Soft Power battlefields. Positioned at 76th in Reputation, Ukraine's spot just below Russia reveals the deep-seated differences in global perspectives on the conflict.

Israel’s Soft Power has declined significantly, down 5 ranks to an all-time low of 32nd following its invasion of Gaza.

Despite initial widespread international support after terrorist attacks by Hamas, the Global Soft Power Index survey results show that the decision to retaliate with full force has negatively impacted Israel's global perceptions.

Its Reputation saw a decrease of -0.3, causing a drop of 18 ranks to 79th, with a negative knock-on effect on the nation brand more broadly, as Israel’s scores decline in 34 out of 35 attributes.

All 193 United Nations member states ranked

This year’s inclusion of 72 new entrants marks a significant development of the Brand Finance research as all 193 member states of the United Nations are ranked for the first time.

Monaco enters the Global Soft Power Index strongly, claiming 42nd position. Ranked among the top 20 in attributes like ‘appealing lifestyle’, ‘politically stable and well-governed’, and ‘safe and secure’, Monaco punches much above its tiny weight. While ranking lower on Familiarity (73rd) and understandably Influence (104th), Monaco’s Reputation (28th) places it within the global top 30, making this Soft Power debut hopeful for next year’s rankings.

Most other new entrants find themselves towards the bottom of the table, with small Pacific island nations Vanuatu (191st), Nauru (192nd).