This article was originally published in the Brand Finance Global Soft Power Index 2026

The Trump Effect

Place Branding Director,

Brand Finance

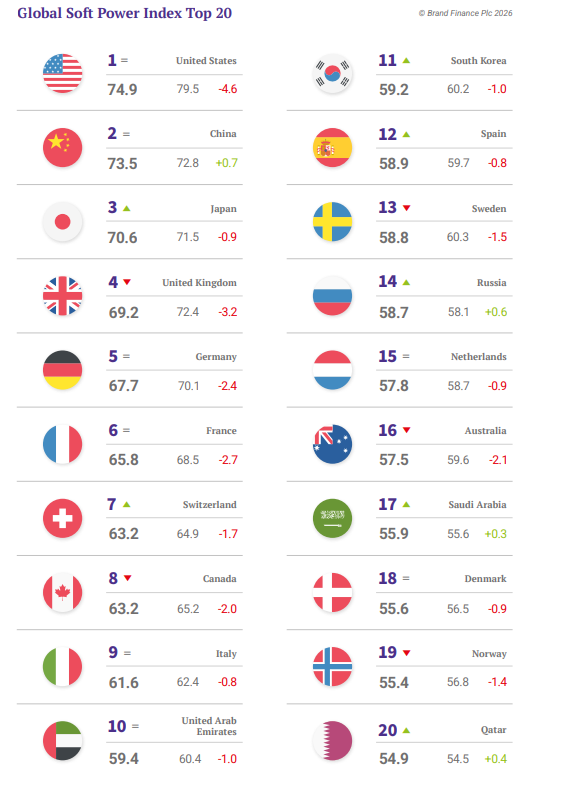

The United States keeps 1st position in the Global Soft Power Index, with a score of 74.9 out of 100. However, it is experiencing a significant erosion of its soft power across all metrics except Familiarity, as President Donald Trump redefines the paradigms of America’s engagement with the world.

The US records the sharpest decline out of all 193 nation brands in the entire ranking this year, down 4.6 points compared to last year. Perceptions of America’s Reputation fall -11 ranks to 26th, and the nation records declines across multiple key drivers of Reputation, with the steepest ones in the People & Values pillar (-48 ranks), demonstrating how a misalignment between traditional expectations of America’s nation brand and the new priorities of President Trump’s second term are impacting the mood among global audiences.

It is difficult not to make a connection between some of the ‘America First’ policies and the negative turn of the US perceptions internationally: on immigration and travel as the US drops -32 ranks in friendliness to 156th – its lowest rank on any metric ever; transactionalism and unilateralism in international affairs and a drop of -50 ranks in good relations with other countries to 99th; reductions in foreign aid and a drop of -68 ranks in generosity to 98th; imposition of trade tariffs and a drop of -21 ranks from 5th to 26th in ease of doing business; withdrawal from the Paris agreement and a drop of -16 ranks from 2nd to 18th in support for climate action.

The radicalism of these shifts and the process of implementing new policies are likely to have contributed to a steep decline in perceptions of trust (-24 ranks to 57th) and an erosion across the Governance indicators, such as respect for law and human rights (-10 ranks), safety and security (-9 ranks), political stability and good governance (-8 ranks), and ethical standards and low corruption (-4 ranks). What is more, the results point to a negative knock-on effect even on objectively unrelated areas as US scores soften across all metrics in the survey except Familiarity/

Nevertheless, the US retains competitive dominance across multiple soft power domains. Hollywood, sporting excellence, top brands from Apple to Coca-Cola, elite universities, Silicon Valley, and space missions all contribute to a global perception of the US as a hub of creativity, opportunity, and modernity. It maintains top positions in arts and entertainment (1st), sports (3rd), global brands (2nd), science (3rd), technology (3rd), and space exploration (1st).

Undoubtedly, some of its perceptual strengths are also reinforced by President Trump’s ability to set the international agenda and consequently dominate the news cycle. The US continues to rank 1st for both Familiarity and Influence and leads the rankings for the International Relations and Media & Communications pillars. It remains number #1 for influence in diplomacy, government leaders, influential media, and affairs I follow closely.

Global audiences increasingly perceive a disconnect between the image of America they are used to and the change in both direction and process from the new administration, causing reputational spillover even across domains seemingly unrelated to President Trump’s policies. At the same time, the US is able to maintain its premier spot in the Global Soft Power Index thanks to unmatched Familiarity and Influence, underpinned by traditional strengths in popular culture, sporting achievement, consumer exports, scientific advancement, technological innovation, space exploration, and newly reinforced by President Trump’s undeniable ability to set the global agenda and capture the global imagination.

China – a credible alternative

With America’s soft power eroding, China consolidates its 2nd position in the Index. As the only nation brand in the top 10 to increase its soft power score this year (+0.7 points up to 73.5), it has narrowed the gap to the US to less than 1.5 points.

Over the last few years, China has worked effectively to not only reinforce core strengths but also address historical weaknesses. Its soft power gains are underpinned by a long-term, policy-led programme, from the Belt and Road investments, scientific and technological advancement, sustainability reforms, to building global product brands and facilitating cultural engagement.

Starting with relative weaknesses, China’s Reputation has risen +9 ranks to 18th, overtaking that of the United States for the first time. This is supported by gains across key drivers of Reputation, such as People & Values (+22 ranks), Governance (+10 ranks), and Sustainable Future (+7 ranks), also in direct contrast to the trend of US results.

While still ranking relatively low in many of the underlying nation brand attributes, China has made visible improvements on perceptions of friendliness (+27 ranks), fun (+18 ranks), ease of communication (+14 ranks), generosity (+14 ranks), and lifestyle appeal (+8 ranks). In total, China now ranks higher than the US on 19 out of the 35 nation brand attributes.

These improvements illustrate that audiences now engage with China not only as a strategic actor but also as a country offering approachable experiences and cultural resonance. China’s tourism perceptions have strengthened too, increasing +5 positions this year to 36th, reflecting a growing attraction of Chinese cities, heritage, and leisure opportunities, aided by visa facilitation programmes and people-to-people exchanges.

Cultural phenomena such as Labubu, which gained global popularity in 2025, alongside strong recognition for brands like Huawei and Tik Tok, and the growing exports of electric vehicles, enhance China’s reach further.

At the same time, China continues to consolidate its core strengths, systematically reinforcing perceptions in Business & Trade (+2 to 2nd) and Education & Science (+2 to 1st) where it projects credibility and reliability. It now ranks 1st globally for not only ease of doing business and future growth potential, but also technology and innovation, and advanced science.

It has also risen to 3rd globally for perceptions of strong and stable economy (+5 ranks) – the single most influential driver of soft power among all the 35 nation brand attributes within the Global Soft Power Index.

By combining domestic development with structured international engagement, China is increasingly perceived as predictable, reliable, and capable of delivering tangible benefits, helping to sustain its high standing in Influence (2nd) and Familiarity (+1 to 4th).

By addressing key weaknesses and honing core strengths, China has built a credible alternative to US domination on the global stage. Its progress reflects a deliberate, multifaceted strategy combining policy coherence, economic expansion, technological advancement, and cultural engagement. Its sustained improvements across nearly all pillars demonstrate that soft power gains can be achieved through patient, structured, and consistent efforts.

A global mood shift

The Global Soft Power Index 2026 reveals a broader structural trend affecting nations worldwide: a widespread decline in international sentiment, reflecting a global mood shift driven by economic uncertainty, geopolitical tensions, and social pressures. This phenomenon is systemic rather than limited to individual countries. Across the survey, audiences are more cautious, less willing to express admiration, and more likely to scrutinise nations’ behaviour, reflecting concerns about disruptive security crises, cost-of-living pressures, and speculation about an AI bubble on the stock markets.

The mood shift is reminiscent of perception declines during the COVID-19 pandemic, when global audiences reassessed trust, governance, and alignment between values and action across the majority of nation brands. The negative effect is compounded as the US, alongside the United Kingdom, Germany, and France, record sharper-than-average declines to their soft power scores. Ranked at the top of the Index, these nation brands have historically served as reference points to the survey respondents: their governance models, economic stability, and global engagement establish the benchmarks against which others are assessed. When audiences perceive these ranking leaders as underperforming, the reference point for soft power globally shifts downwards, creating a cascading deflation across all nation brands.

Looking beyond the ranking leaders, Western nations more generally account for a disproportionate share of the declines. Many are struggling to cope with the ripple effects of President Trump’s new approach to European allies; many have to deal with issues of their own, as their governments are increasingly seen to underdeliver on longstanding brand promises of stability, prosperity, and moral leadership.

The United Kingdom exemplifies this dynamic, recording this year the entire ranking’s second-steepest drop in soft power after the US (-3.2 points down to 69.2). Having already declined to 3rd place in 2025, the UK falls further to 4th in 2026 – its lowest position in the Index’s history. Reputation crucially declines to 6th. While beyond substantial rank declines in the People & Values pillar, the UK largely retains its place on other metrics, its scores soften in all 35 nation brand attributes.

Although Familiarity (2nd) remains high, relevance is weakening. After six years of ranking 2nd, the UK now ranks 6th on the attribute affairs I follow closely, signalling a loss of its agenda-setting power. Against a backdrop of sustained underinvestment in the nation brand and soft power strategy, control over the UK’s image is increasingly slipping away. Social media are dominated by persistent negative narratives fuelled by both genuine discontent as well as disinformation around post-Brexit trade frictions, migration pressures and backlash, alleged high crime rates, and supposed freedom of speech limitations, crowding out positive stories and reinforcing largely undeserved perceptions of Britain’s twilight.

Similarly, the example of Germany (5th, -2.4 points down to 67.7) illustrates how economic and diplomatic credibility can erode simultaneously. It records its largest score declines on perceptions of a strong and stable economy (-0.7 points) as well as leadership in science (-0.8 points) and technology (-0.6 points), indicating that news of Germany’s economic slowdown coupled with a less prominent role in the AI race are undermining its global standing. Steeper declines are also evident in perceptions of diplomatic influence (-0.7 points) and government leaders (-0.6 points), reflecting a transitional period as Chancellor Friedrich Merz, having taken office mid-year, has yet to establish the authority and stature once associated with Angela Merkel’s international leadership.

A similar pattern is visible across several other Western nation brands, including France (6th, = rank, -2.7 points), Canada (8th, -1 rank, -2.0 points), Sweden (13th, -2 ranks, -1.5 points), and Australia (16th, -2 ranks, -2.1 points).

Against this background, Switzerland (7th, +1 rank, -1.7 points) declines more slowly, enabling it to rise relative to peers despite overall softening. While it also records declines in line with the broader trend, its nation brand remains among the most resilient in the Index. This resilience is underpinned by exceptionally high Reputation, where it ranks 1st in the world, alongside top rankings for key drivers of Reputation, including trust, governance, and economic stability.

Switzerland ranks number #1 on more metrics than any other nation brand in the Index, scoring 17 golds and topping the soft power medal table yet Executive Summary again this year. Together, these strengths allow Switzerland to hold its ground, illustrating how deeply embedded brand credibility can cushion against periods of global skepticism. This translates into tangible economic impact of soft power as Switzerland ranks either 1st or 2nd on all five dimensions of Recommendation which capture destination appeal across the key sectors of investment, trade, talent, education, and tourism.

The negative shift in the global mood highlights a critical lesson about soft power in 2026. Publics are increasingly sensitive to the alignment of values, actions, and outcomes. Countries that fail to demonstrate reliability, credibility, and impact face erosion not only in specific domains but also in broader international reputation and relevance. Soft Power is not solely about visibility or size; it is about perception that a nation is delivering on promises implicit in its brand. Nations failing to uphold these promises are penalised by global audiences.

Strategies for nation brand success

In the current soft power landscape, characterised by widespread sentiment deflation and increasing scrutiny of nation brands, the capacity to maintain soft power is closely linked to adaptability and the strategic alignment of policy, impact, and narrative. Countries that hold ground amid declines do so by consciously consolidating strengths, maintaining credibility, and leveraging economic, diplomatic, and cultural assets to reinforce perceptions.

Japan is a good example of a nation brand focusing on building soft power through a direct experience of the nation brand. Although absolute score has softened slightly (-0.9 points to 70.6), Japan rises to 3rd place, overtaking the UK.

Alongside established strengths in Business & Trade (1st), Sustainable Future (1st), Education & Science (2nd), and Governance (2nd), over the past year Japan has solidified perceptions across People & Values (1st, +2 ranks) and Culture & Heritage (3rd, +2 ranks) thanks to its growing popularity as a travel destination.

The tourism boom has seen Japan gain in Familiarity (6th, +1 rank) as well as related attributes such as great place to visit (8th, +3 ranks), appealing lifestyle (4th, +9 ranks), friendly (7th, +12 ranks), and fun (21st, +15 ranks). Understanding experiential drivers of soft power is as key as perceptual drivers for any nation brand strategy (see article in the Insights section).

Italy offers a complementary example of narrative alignment in a polarised media environment to sustain soft power. Among the top 10 nation brands in the Index, it records the smallest decline (9th, -0.8 points down to 61.6), reflecting an ability to shield its popularity from the storm by positioning itself in line with dominant global discourses.

Prime Minister Giorgia Meloni’s right-wing government has proved adept at maintaining traditional alliances and partnerships, while engaging populist narratives that currently command disproportionate attention in international media, resonating with key audiences and influential figures, including aligning with the new US administration.

This has helped Italy sustain relevance and limit reputational erosion despite broader declines among Western peers. Similarly, Argentina achieves its highest ever ranking at 37th, a climb of +5 positions, the biggest gain among all the top 50 nations this year, reflecting the appeal of President Javier Milei’s politics among key global audiences.

The United Arab Emirates, in turn, exemplifies a balanced strategy of persuasion through demonstrating impact and promoting engagement. The UAE retains 10th place overall with a score of 59.4, holding steady despite a minor adjustment of -1.0 point, while major Western nations in the top 10 average declines of -2.5 points.

The nation brand defends or improves its ranks across all KPIs and pillars. It solidifies its Influence (8th) by connecting Europe, Asia, and Africa in both diplomatic and business terms, as illustrated by its strengths in International Relations (9th) and Business & Trade (10th). Communicating about progress towards energy transition and promoting immigration-friendly policies have helped achieve notable +4 rank improvements for both the Sustainable Future and Governance pillars – key drivers of Reputation which in itself also saw an improvement (+1 rank). With that base, it comes as no surprise that the UAE now ranks as the world’s 7th most preferred destination for investment.

However, the UAE has also been inviting global audiences to engage more with its authentic core, resulting in improved Familiarity (+3 ranks). The nation brand has recorded notable increases across perceptions of friendliness (+17), fun (+7 places), and arts and entertainment (+5 ranks). The UAE now ranks 2nd in the world for generosity too.

The UAE continues to follow a balanced, forward-looking approach, illustrating how success in business, diplomacy, governance, innovation, and sustainability, coupled with authentic engagement across global audiences, can solidify soft power and protect a nation brand in an uncertain world.

Saudi Arabia (17th, + 3 ranks) and Qatar (20th, +2 ranks) also perform strongly, growing soft power through proactive diplomacy, economic diversification, and new efforts across culture, tourism, and sports. Gulf nations illustrate that practical impact and proactive engagement are a recipe for success, particularly in volatile regions.

Last but not least, South Korea provides a case study of effective investment in cultural salience in order to boost soft power. Rising to 11th place, the country offsets declines in Governance (25th, -5 ranks), linked to the recent constitutional crisis, with gains in Familiarity (15th, +2 ranks) and Influence (15th, +2 ranks), driven largely by globally successful content industries, including K-pop, K-dramas, and K-beauty.

Cultural salience has become a defensive asset, enabling nations to maintain visibility and affinity even when reputational indicators experience a temporary decline. In the case of South Korea, this is supported by significant government investments: KOCCA’s annual budget exceeds $400 million, complemented by the 2023 $620 million support package for content, tourism, and language education, and the 2024 K-Content Fund of $420 million. This level of commitment leaves no room for surprise at South Korea’s leading positions in the arts and entertainment (7th) and influential media (7th) metrics.

Soft Power vs Hard Power

In contrast to these strategic approaches to soft power, in some cases, countries can achieve gains in international perception not because of broader governance, cultural, or economic strengths, but because respondents may perceive them as effective.

This phenomenon is amplified especially given the backdrop of a credibility crisis for Western nation brands observed in this year’s Index. Sometimes – and particularly for authoritarian states – visibility, assertiveness, and tightly controlled narratives can create an impression of influence, authority, or salience. While these gains are often underpinned by mass propaganda rather than substantive soft power assets, they can temporarily boost recognition.

Russia exemplifies these dynamics very well. Rising to 14th place this year (+2 ranks), the country leverages military visibility, assertive foreign policy, and intensive propaganda to increase global attention. These actions amplify perceptions of influence and political weight, even as Russia’s regard for international law, human rights, or economic development is simply not there.

We must also be aware of regional differences in perspective and how the resonance of certain narratives might be stronger in some parts of the world than in Executive Summary others. Russia’s increase is influenced in particular by high perceptions in China and rising perceptions in key markets across Asia and Latin America, including in India, Indonesia, Vietnam, Thailand, and Brazil.

Similarly benefitting from global visibility of its hard power, after joining Russian’s invasion of Ukraine, North Korea (63rd) records the fastest growth in the top 100 ranking this year, in both score (+2.4 points) and rank (+12 ranks). Strong shifts in perception are driven by respondents in Russia, Indonesia, Pakistan, and Egypt. Even in markets that consider North Korea an adversary, such as the United States, perceptions of its Influence have increased.

Burkina Faso (143rd) provides another striking example. Its score increased by +4.3 points, driving a +23-rank jump, making it the Index’s fastest-growing nation brand this year. This rise is closely linked to the increased prominence of Ibrahim Traoré, whose leadership style, public visibility, and decisive messaging can be associated with sharp gains in Burkina Faso’s perceptions in Governance (+95 ranks to 67th) and Media & Communication (+64 ranks to 106th).

However, the durability of these gains remains uncertain. Perceptions of cultural appeal (165th), business attractiveness (162nd), and education and science (156th) continue to lag, highlighting the limits of hard power and visibility alone as drivers of sustained long-term soft power.

Unlike among authoritarian regimes, deployment of hard power by countries claiming to adhere to liberal democratic values is likely to create a discord which damages rather than boosts perceptions.

Israel is a prime example, recording the steepest rank decline among the top 50 nation brands this year, -6 positions down to 39th, and third-strongest score decline in the entire Index (-3.0 points), behind only the US (-4.6 points) and the UK (-3.2 points). Following two years of its military campaign in Gaza and settler expansion in the West Bank, global sympathies are shifting towards Palestine, and Israel now ranks among the bottom five nations for having a perceived net negative impact on the world.

Similarly, universally believed to be stoking civil war in the Democratic Republic of the Congo, Rwanda drops -13 positions to 122nd this year, recording the sharpest rank decline in the Index aside from microstates, whose perceptions can be more volatile year on year due to low Familiarity.