Nation Brand Management

What specifically can and should governments do to assess and improve their brand strength and soft power credentials? A good understanding of existing reputation, brand equity, and the misperceptions which need to be corrected is the first step for effective brand-building and utilisation of a nation’s soft power. Therefore, the starting point is to use soft power measurement to diagnose a nation’s strengths and weaknesses. This in turn helps governments set priorities to improve global reputation and guide policy strategy.

Benchmarking and accountability are important to ensure projects deliver tangible returns. Another key application of soft power and nation brand strength data concerns communication and education. In some cases, soft power and nation brand strength may be constrained because of poor communication of a nation’s strengths and resources. However, this is often easily addressed with a communications strategy.

The UK’s GREAT campaign is a lauded example of a more integrated nation branding approach guided by an overarching marketing communications strategy. The campaign brought together over 20 government departments including the Department for International Trade, VisitBritain, and the Foreign & Commonwealth Office, with a clear overarching theme: that Britain is a dynamic, creative, and outward-looking nation which is open for business. A variety of different specific campaigns are run under the GREAT brand, promoting tourism, education, trade, and investment, across a diverse range of target audiences.

Brand Finance’s analysis placed a value of £217m on the GREAT campaign in 2017, with over £4bn of economic returns secured and a return on investment of 20:1. GREAT has been influential globally in demonstrating the value of an integrated nation brand, and this is the path taken by more and more nations in recent years.

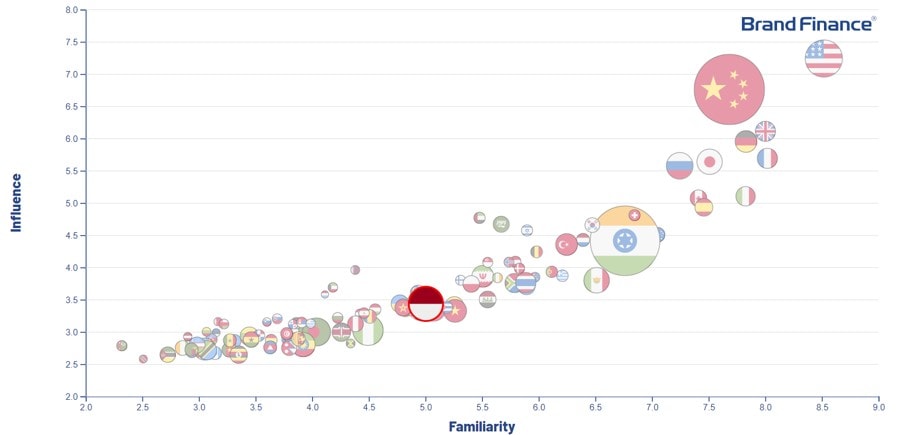

And the link between marketing a nation brand and growing its global impact is evidenced in the data. Our Global Soft Power Index research has shown a clear correlation between Familiarity and perceived Influence – the more familiar the public is with a nation brand, the more influential it is considered. The top 10 nations for Familiarity also make up the top 10 for Influence. Indonesia, for instance, comes mid-ranking for Familiarity (44th) and – similar to many other nations of which the public does not know enough – its potential to grow Influence from the current level (46th) remains constrained. Soft power rests on Familiarity and the easiest way to increase it is through informed, integrated, and targeted marketing communications.

To conclude, the relevance, importance, and impact of nation branding and soft power are impossible to ignore. Governments and corporates alike can use their understanding of how their nation brand is perceived to unlock its potential and seize opportunities otherwise missed. Leveraging such analysis to formulate an integrated marketing strategy can be expected to deliver tangible benefits to the country in tourism, trade, investment, and all other areas where nation brand plays a role.

About the Global Soft Power Index by Brand Finance

For over 15 years, Brand Finance has been publishing the annual Nation Brands report – a study into the world’s 100 most valuable and strongest nation brands. Focusing on the financial value and strength of nation brands, the Brand Finance Nation Brands study is based on publicly available information, including data compiled by third parties for other indices and rankings.

Building on this experience, Brand Finance has now produced the Global Soft Power Index – the world’s most comprehensive research study on perceptions of 100 nation brands from around the world. The Global Soft Power Index is based on the most wide-ranging fieldwork of its kind, surveying the general public as well as specialist audiences, with responses gathered from over 75,000 people across more than 100 countries. The Global Soft Power Index 2021 report is the second iteration of this study, which Brand Finance hopes to conduct annually.

In autumn 2020, two surveys were conducted, both global in scope:

- General Public – a survey of public opinion covering more than 75,000 residents of 102 countries representing all continents and regions of the world;

- Specialist Audiences – the views of more than 750 experts from 47 countries – representing categories identified as likely targets and conduits for soft power: business leaders, market analysts, politicians, academics, think-tanks and NGOs, and journalists.

The Global Soft Power Index incorporates a broad range of measures, which in combination provide a balanced and holistic assessment of nations’ soft power on the world stage. These include:

• Familiarity: nation brands which people know, and have mental availability of, have greater soft power

• Reputation: is this country deemed to have a strong and positive reputation globally?

• Influence: the degree to which a nation is seen to have influence in the respondent’s country as well as on the world’s stage

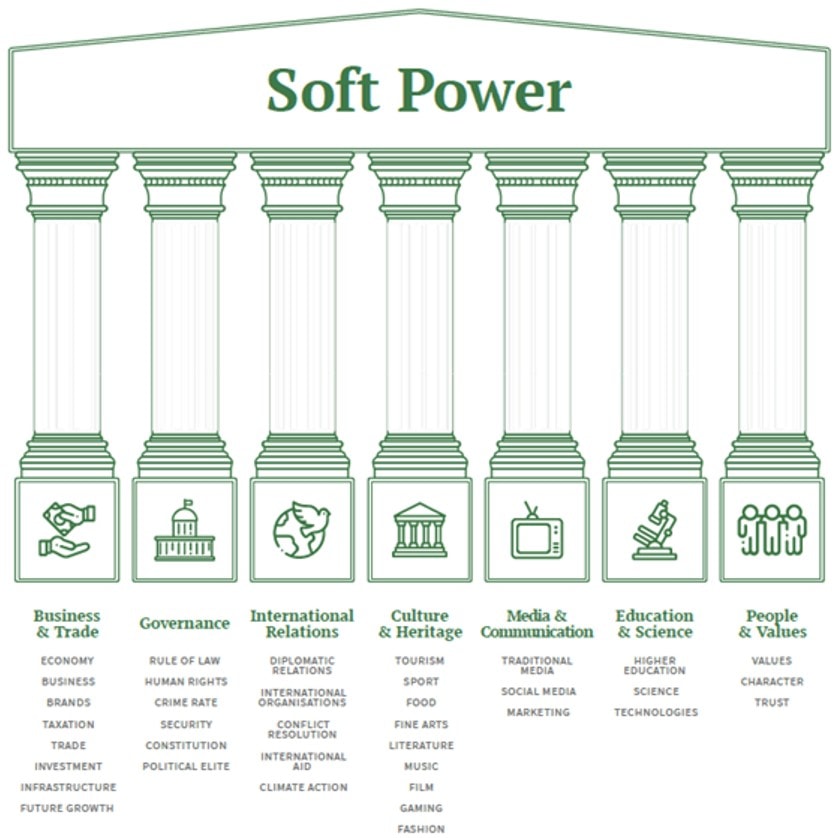

• Performance on the core 7 Soft Power Pillars (Business & Trade, Governance, International Relations, Culture & Heritage, Media & Communication, Education & Science, People & Values)

• Performance in tackling the COVID-19 pandemic (on three pillars: Economy, Health & Wellbeing, International Aid & Cooperation). These measures were included in the Index for the first time this year

The Index gives a 90% weighting to the views of the General Public and 10% to those of Specialist Audiences. The weightings given to each measure within the Index were based on a combination of expert opinion, coming from an extensive literature review and expert consultation process, and statistical analysis assessing the degree to which pillar performance correlates with Influence.

This article was originally published in the UK-Indonesia Soft Power Forum 2021 report and the Brand Finance Nation Brands 2021 report.