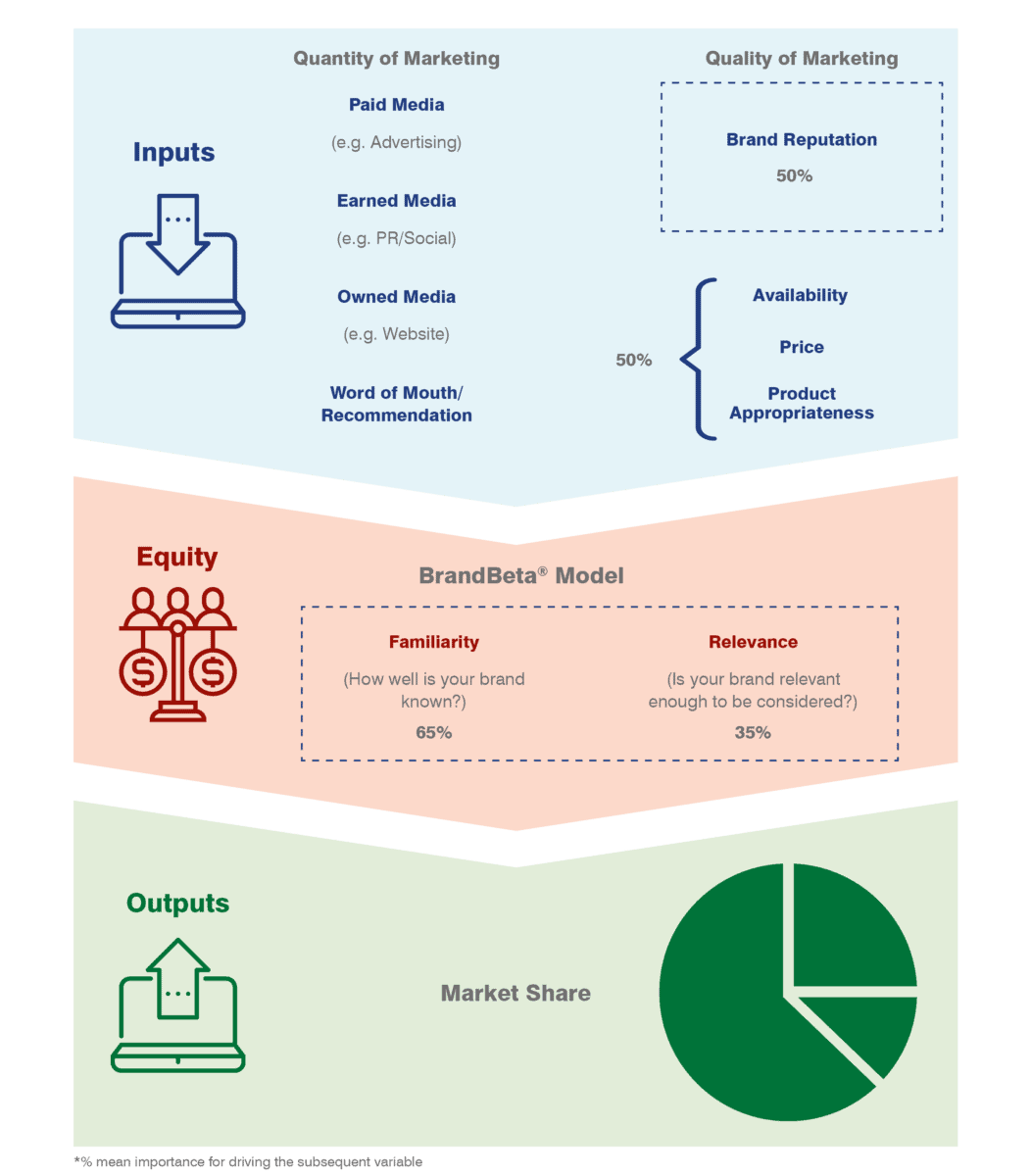

What makes a brand strong? Our brand valuation analyses attempt to predict the long-term effects of future brand strength. However, a key element within that assessment is working out how strong and effective the brand is today. In short, do perceptions of a brand help to make people choose it right at this moment?

In order to do that, we have developed a simple, market-research based measure used to calculate brand popularity and mental availability of brands, which can be used as a market share predictor. This concept is called the BrandBeta®, lending its name from the financial term Beta – a measure of financial return from company shares.

Understanding a brand’s popularity - or its BrandBeta® - is simple in that it contains only two measures: familiarity and relevance. Familiarity is a measure of the depth of awareness – to be familiar with a brand you must know of it and know what it does fairly well. Relevance is a measure of acceptance into a customer’s consideration set – to be relevant you must be considered by those familiar with your brand.

Our analysis shows that, when combined, familiarity and relevance explain over 80% of the variance in market share within the categories covered. That is across all countries and sectors. Analysing the impact of familiarity and relevance, we noted that familiarity explains approximately 65% of the variance in share, while relevance explains approximately 35%. BrandBeta® - measuring a brand’s popularity - is a combination of the two measures in the ratio (65:35). This combination creates a score out of 10 which our additional analysis shows can be used to predict market share growth. However, as well as this prediction of share we also need to understand the factors which drive relevance and familiarity. Brand attributes - such as quality, coolness, availability, and trust - will be influencing the likelihood to consider and should be researched.

Within our “Tier 1” sectors, these measures are researched. In the “Tier 2” sectors, additional research can be performed as necessary in order to give diagnostic detail on how to improve brand positioning and messaging to influence the likelihood to consider and therefore purchase.

However, this assessment should always be considered as one part of a full Brand Strength Index, which reviews inputs that are being performed to build BrandBeta® - or brand popularity -, combined with an analysis of behaviour and financial outputs - for example on market share and price.

The popularity of a brand, if tracked, can be used to quantify the benefits of brand-building as an investment. Connected to brand reputation and other explanatory brand attributes, it can be used to explain how to change your brand’s positioning, what to do about a brand portfolio you are having issues with, what position to take in a purchase or licencing negotiation, and many other applications.

Key takeaways:

1. Brands and their reputation drive business results.

We have found that over 80% of variation in market share across all sectors and markets is explained by these measures, and this level of explanation rises when looking at sectors and countries individually.

2. Brand reputation is important but not the only thing you should worry about.

Reputation explains only between 50% and 70% of the difference in Relevance. To be successful you also need to build familiarity, have the right products/services, available in the right places, at the right price.

3. Larger spend needs to be supported by a strong positioning and vice versa.

BrandBeta® - the measure of brand popularity - is a combination of familiarity and reputation as both are needed to drive changes in market share.

4. Purpose is pointless if you’re not selling what people want.

First and foremost, customers consider brands because they’ve heard of them and they think they can buy what they want from them for a reasonable price. Marketers should think carefully before putting all their faith in their purpose and reputation without getting the basics right first.