Brand Finance conducts global research on the total intangible value of publicly listed companies through our “Global Intangible Finance Tracker” (or GIFT) report. We build on this research to analyse the value of marketing intangibles as part of our other research.

Brand Finance conducts this research because valuation of intangibles is one of the most intractable problems with IP financing and our studies are meant to be part of the solution of finding reliable, replicable valuations that can be used to understand the source of a company’s financial success and therefore provide information on how to finance it.

We use the phrase “intangible assets” to refer to a wide variety of identifiable resources under the control of a business that will bring economic benefits to the company but that are non-monetary and do not take physical form. According to the international financial reporting standards, these assets are identifiable when they are separable from the business or identified within contractual and/or legal rights. They tend to fit largely within five classes – Marketing, Contractual, Customer, Artistic or Technological intangibles – plus goodwill which arises from “synergies” – or multiplicative benefits – related to their combined use.

One challenge with intangible assets is that they are not very conducive to debt financing. Because they are non-rival goods which are often difficult to collateralise, it is often easier to finance investments in intangible assets through equity.

Many people point to the growing importance and value of intangible assets through an oft-quoted statistic that the value of intangible assets has risen from 17% of the value of the S&P 500 in 1975 to around 90% now in 2022. While it is true that in some highly developed countries, intangibles assets are becoming much more important and valuable, this is sometimes held out to be representative of the world’s economy. But much of the world has not benefited from an equivalent growth in value of intangible assets.

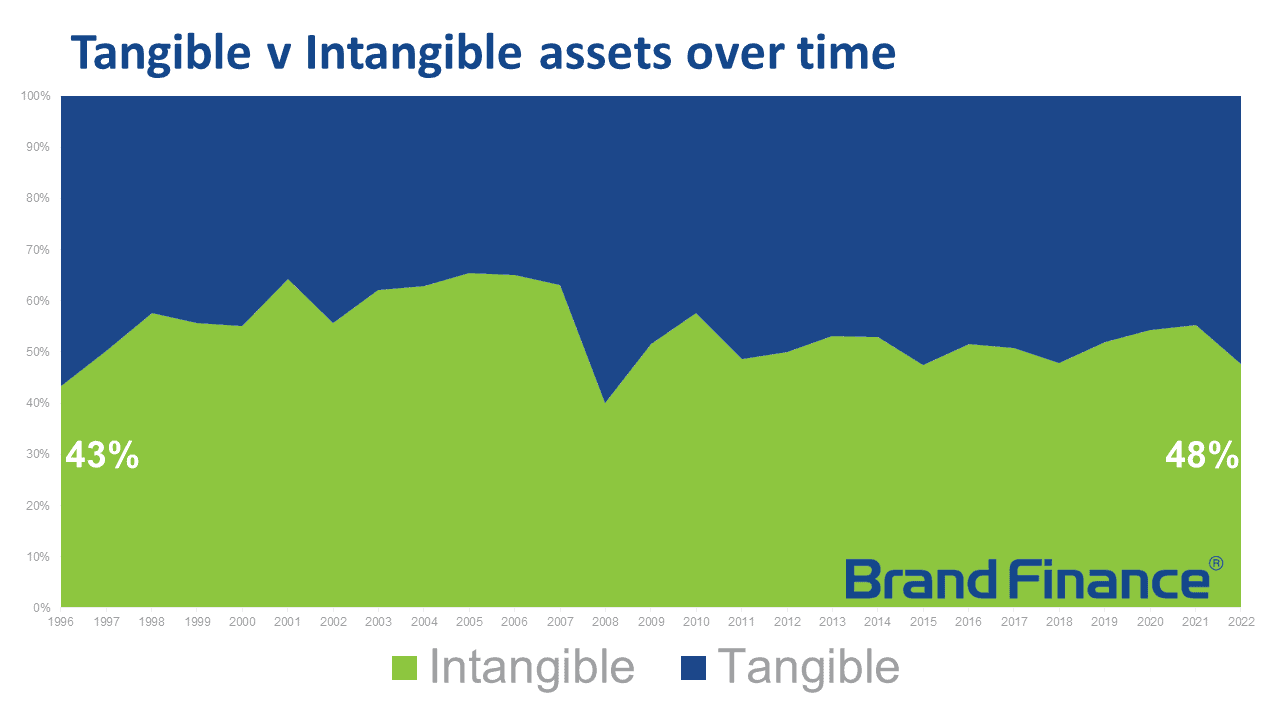

Our latest GIFT study shows that about 48% of the world’s stock market value is derived from intangible assets, a long way behind the US’s 90%. That figure has changed very little since we started measuring in 1996. We do note that there has been a slightly higher proportion of booked intangibles since 2003 when purchased intangibles were required to be booked on balance sheets but the progression has been slow.

For even publicly listed US stocks in total (including those outside the S&P 500), much less than 90% of the listed value comes from intangible assets. For the US public market as a whole, we find that only 73% of total asset value is accounted for by intangible assets – a number that is likely lower when considering the vast majority of privately held small and micro businesses.

While the US features a number of large, high-value, multi-national corporations which have successfully grown and financed their intellectual property, it is not always so easy in other countries and with smaller companies.

Deep equity markets, with a sophisticated and knowledgeable network of investors, high levels of understanding of intangible asset development, the best universities in the world and a market that makes it relatively easy to roll-out technology across a large market size means that many big companies are able to finance investment in intangibles relatively easily. Big and liquid equity markets are ideal for funding such intangible assets.

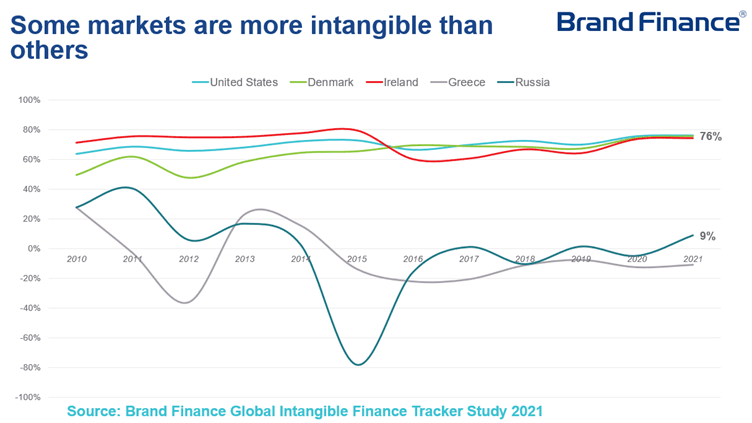

For smaller US companies and for those in other countries without those advantages – or at least with those resources in less abundance – we find much lower intangible asset values. Spain and Italy for example having only a little over 50% intangible value each. Elsewhere, in Greece and Russia, the figure is closer to 0% as the value of business is less than even the net tangible assets. Even before the recent Russian invasion of Ukraine, the value of the Moscow Stock Exchange was less than 3% of the New York Stock Exchange, a reflection of the relatively tiny size of public capital markets in that jurisdiction.

That being said, in many countries, like the USA, Denmark and Ireland as you can see on the graph as well as many other developed countries, the proportion of intangible value in companies is increasing significantly and needs to be sustained. The countries of the Anglo-sphere and the core European Union nations benefit from substantially more developed capital markets.