This article was originally published in the Brand Finance GIFT™ 2021 report.

Brand Finance was set up in 1996 with the aim of bridging the gap between marketing and finance. A decade later, our analysts started conducting public studies on the most valuable and strongest brands in the world. Now, celebrating 25 years in business and 15 years of its brand rankings, Brand Finance performs more than 5,000 brand valuations a year, relying on ISO-certified methodology and insights from our original market research, and publishes nearly 100 reports annually which rank brands across all sectors and countries.

The Brand Finance Global 500 is our flagship report, explaining the dynamics shaping the industry-leading ranking of the world’s 500 most valuable and strongest brands. This year saw the publication of the 15th iteration of the study. The world has changed profoundly since its first issue and just a quick glance at the data proves just how different the brand landscape was at the start of 2007 compared to 2021.

Brand value growth over the years

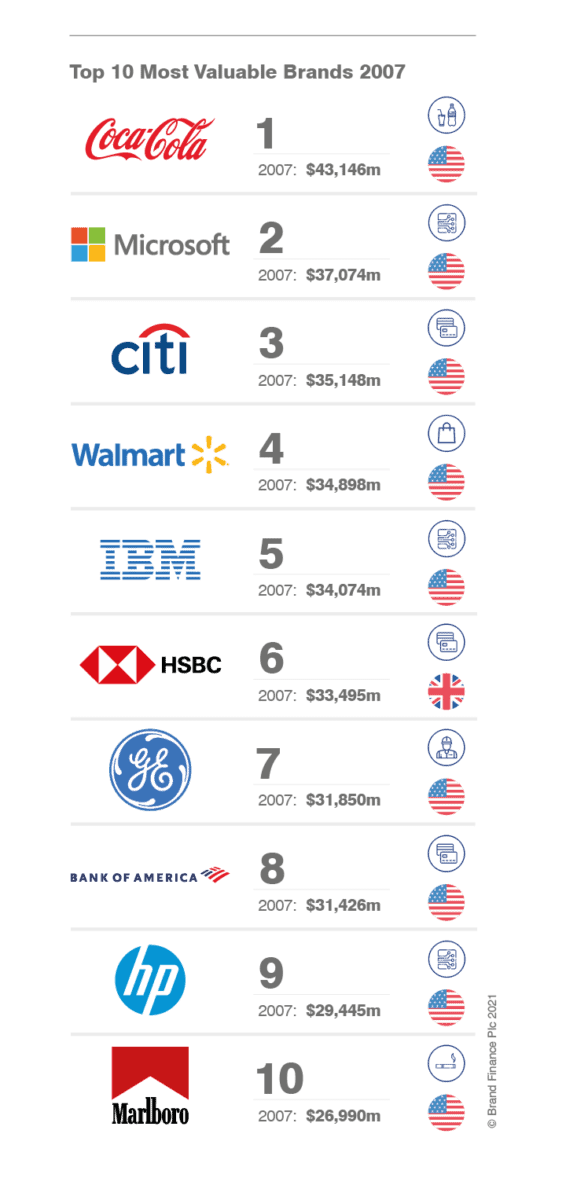

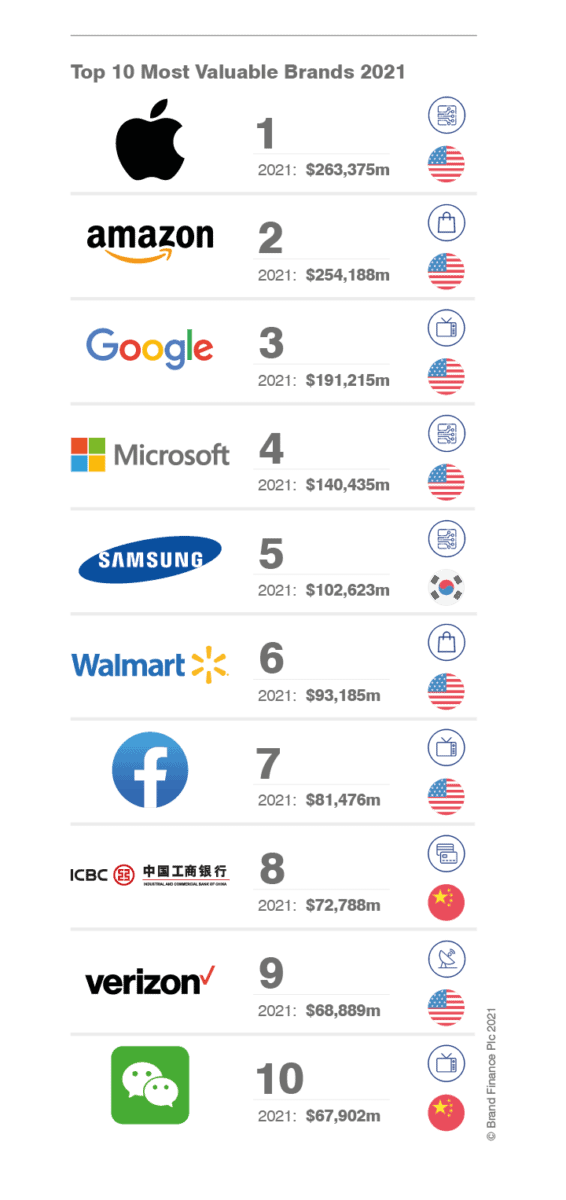

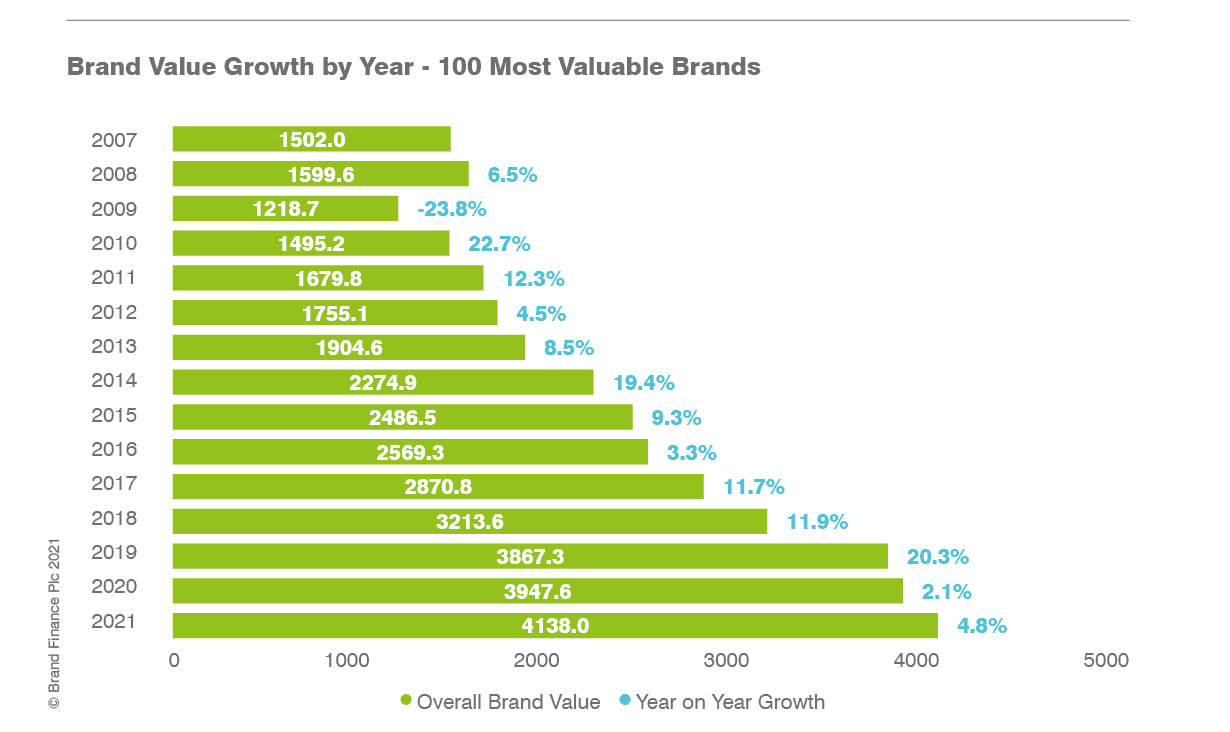

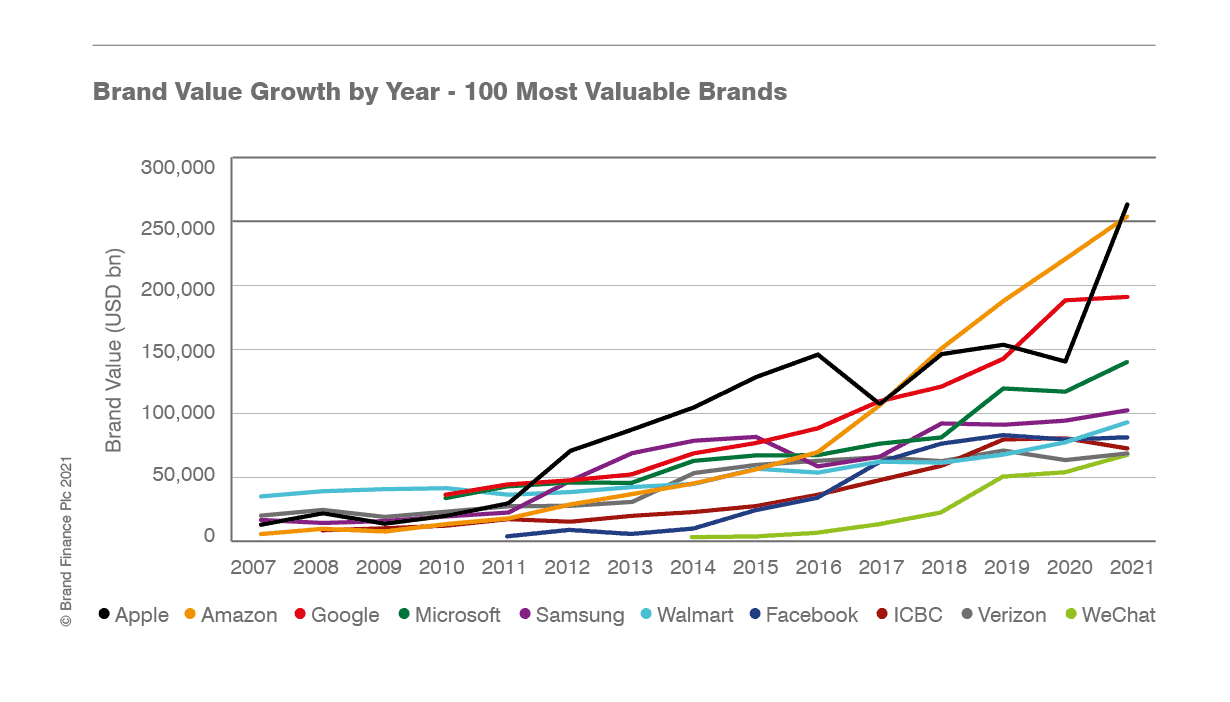

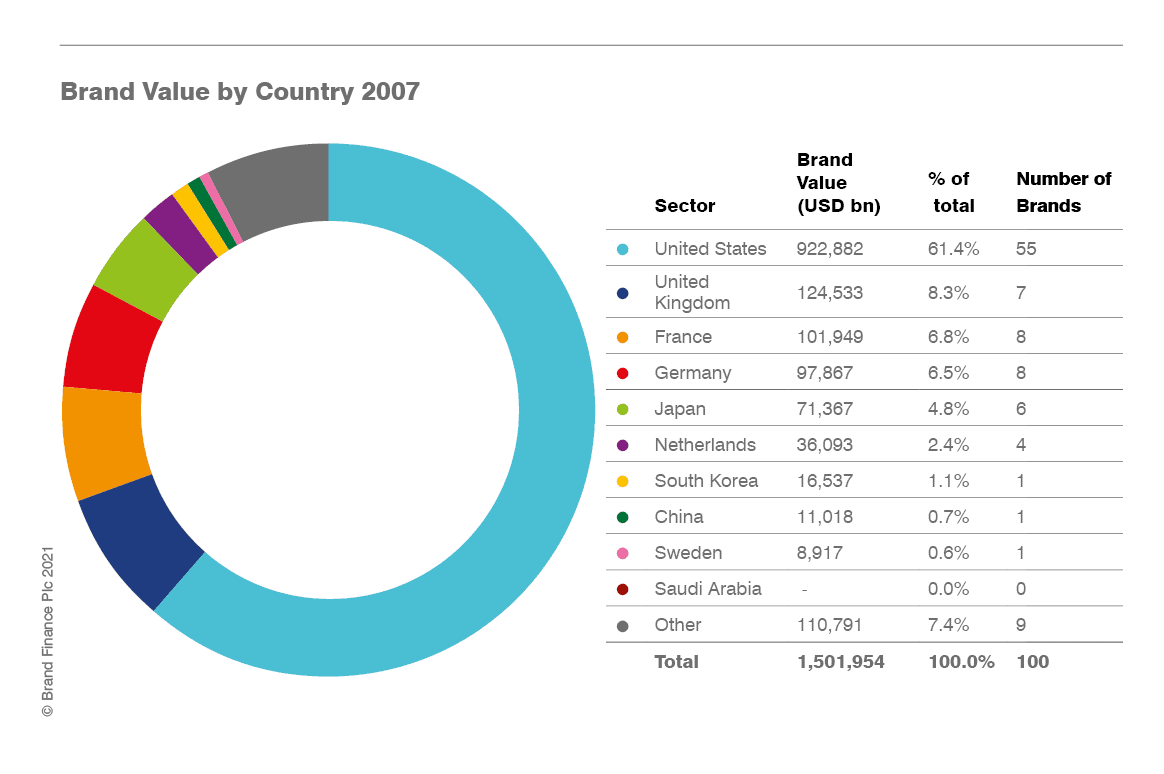

To start with, brands are immensely more important to businesses today, which is reflected in the growth of brand values over the years. At $263 billion, this year’s ranking leader – Apple is worth six times the value of 2007’s number #1 – Coca-Cola. The combined value of the world’s top 100 brands has increased threefold from $1.5 trillion to $4.1 trillion over the past 15 years.

Top 10 Most Valuable Brands 2007

Top 10 Most Valuable Brands 2021

Recording just one year-on-year decline following the Global Financial Crisis of 2008, the top 100 brands saw a steady annual growth rate of 8% over the whole period, immune even to the effects of COVID-19. Although the pandemic wreaked havoc on the global economy and smaller brands saw considerable damage, the top 100 brands increased their values by 5% in the year leading to the 2021 valuations – adapting relatively quickly to new market conditions and reinforcing their reputation as a safe haven for capital in times of uncertainty.

Nevertheless, maintaining relevance proved to be a challenge for many brands that once topped our rankings. More than half of the brands that made up the top 100 in 2007 dropped out of it by 2021. 47 brands managed to defend their spots and 53 new entrants took the places of the brands that struggled to keep up with change.

The competition proved especially fierce at the very top – Microsoft and Walmart are the only brands from the original top 10 that remain in this elite club today. This year’s top 3 brands – Apple, Amazon, and Google – all started way out of the top 10 in 2007, while Facebook (7th) was still a private company and WeChat (10th) did not even exist. The two social media giants have seen the highest annual growth rates among the top 10, at 55% and 36% respectively, even though they both entered the race halfway through the competition. However, they lose to Amazon when it comes to overall brand value growth – the e-commerce giant has seen an astronomical 4527% brand value increase from $5 billion in 2007 to $254 billion this year.

In addition to measuring brand value, Brand Finance determines brand strength through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. According to these criteria, Coca-Cola is the only brand in the top 100 to retain its AAA+ rating 15 years on. It may have lost its position as the world’s most valuable brand, but it sure has remained the world’s favourite soda brand.

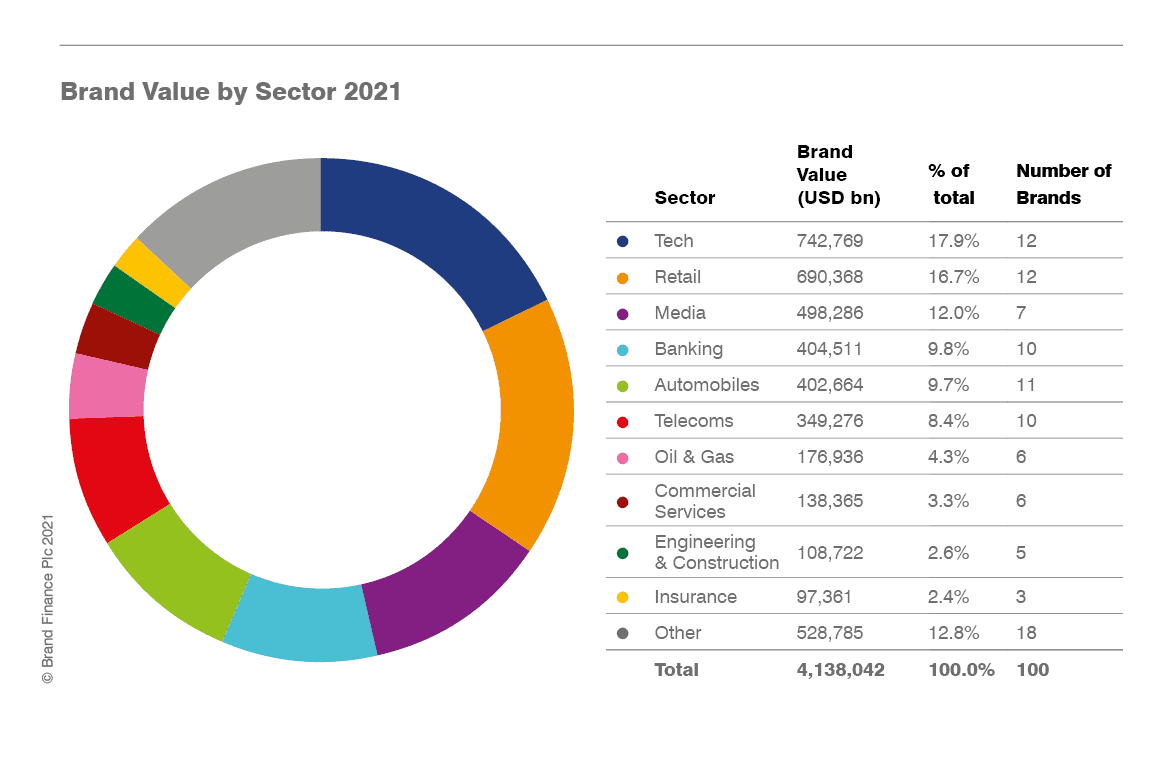

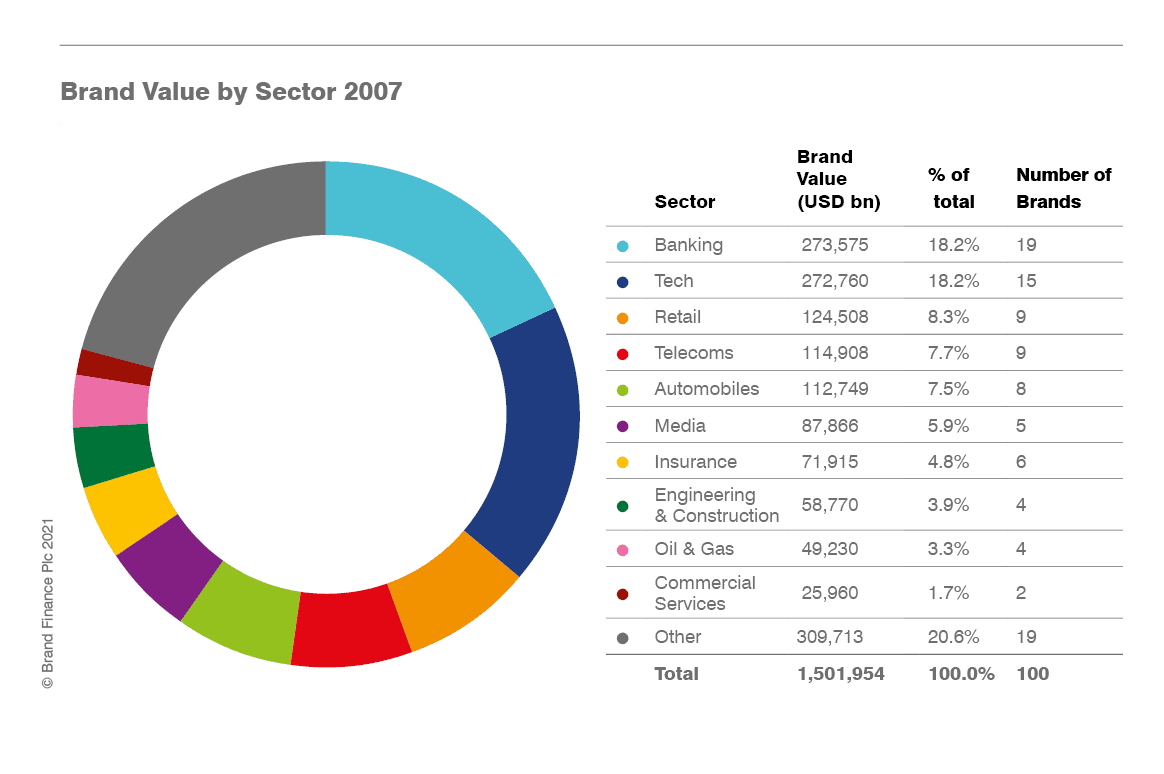

Brand value growth by sector

Indeed, while brands in many traditional sectors have hit their capacity in terms of growing brand value, for others sky is the limit as they capitalise on innovation – in terms of both latest technological solutions and adapting to customer needs faster than ever before.

In light of this, Tech is unsurprisingly the most valuable sector, accounting for 18% of total value among the world’s top 100 brands today. But it is the sectors revolutionised by technological innovation – Retail and Media – that really dazzle with their performance over the past 15 years. The two industries, ranking 2nd and 3rd behind Tech, have seen the fastest brand value growth in the top 100 among all large sectors of the economy at 454% and 467% respectively, as they benefit from the boom of e-commerce and the ascent of digital media. Oil & Gas and Automobiles have also seen solid growth (259% and 257%) as they continue to enjoy high demand and gradually address the challenge and opportunity of energy transition.

The case of Banking, which was the top industry in 2007, tells a different story. Today, still recovering from reputational damage incurred in the Global Financial Crisis and undermined by low interest rates as the global economy aims to bounce back from lockdowns, it accounts for merely 10% of total brand value and ranks 4th, soon to be overtaken by 5th-ranked Automobiles. Banking has 9 brands fewer in the top 100 than 15 years ago – the worst result across all industries, and the lowest overall growth (48%) bar Insurance (35%). As Banking and Insurance brands stagnated, another financial services sector has boomed – Commercial Services have gained 4 brands in the top 100 and increased in value by 433%, testament to the conscious efforts of both B2C payment services and B2B professional services companies to invest in their brands over the years.

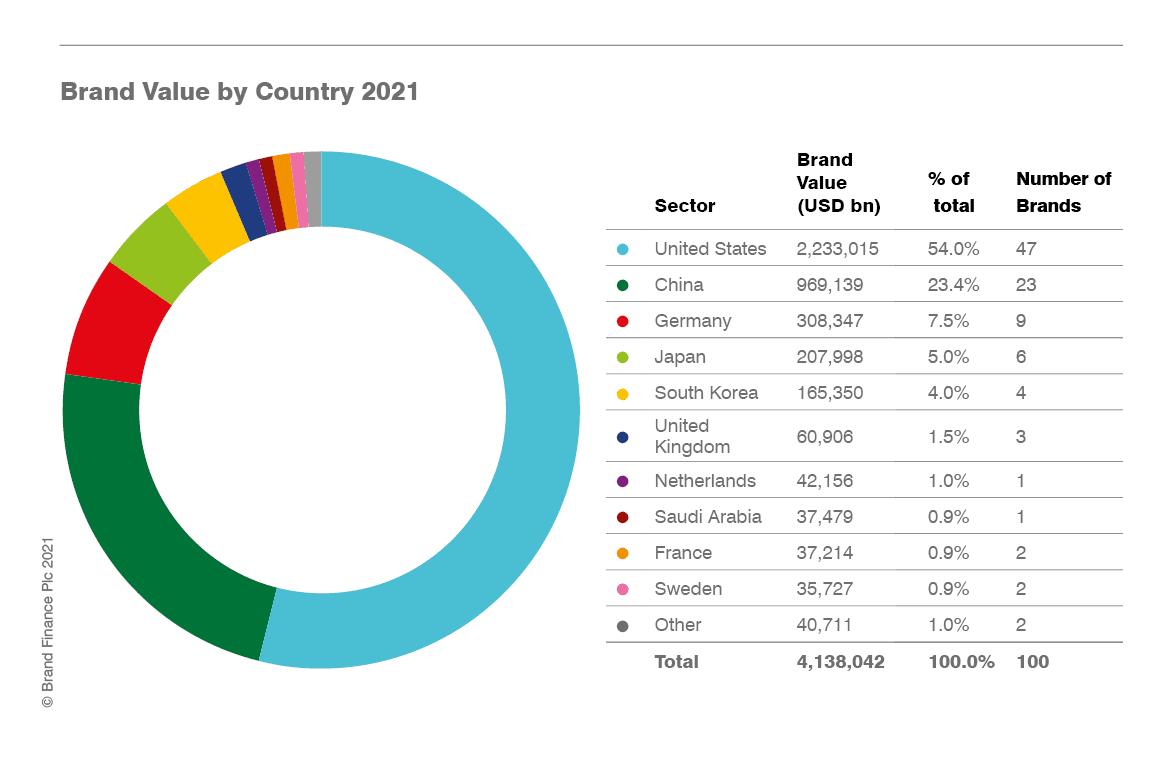

Brand value growth by country

A perfect example of a country, in turn, that has undertaken specific efforts to invest in brands is China. From barely any presence among the world’s top 100 brands in 2007, China has seen a staggering 8696% growth and now accounts for nearly a quarter of the top 100’s total brand value. Chinese authorities and industry associations actively support the creation and development of brands and the country has made considerable efforts in building a whole intangible asset accountability and best-practice ecosystem through the adoption of new standards and regulations, not to mention the introduction of the National Brand Day celebrated annually on 10th May.

Although in competition with China’s growing potential, the United States has very much held its own over the past 15 years and still accounts for over half of the total brand value among the world’s top 100 brands. America’s economy remains the world’s largest and healthy competition regulated by the free market alone has created a perfect environment for innovation and brand development, which made the rise of the global tech giants such as Apple, Amazon, Google, Microsoft, or Facebook possible.

Other developed economies have seen mixed fortunes. Germany’s and Japan’s brand value within the top 100 has tripled over the past 15 years, but the UK’s presence has halved and France’s diminished to just one-third of what it was in 2007.

From the rise of tech and decline of financial services, to the rise of China and stagnation in the West, the last 15 years brought a revolution in the brand value landscape. With the challenge of reviving the global economy after the COVID-19 pandemic, growing inequalities within and between societies, and the irreversible impact of the climate crisis casting a shadow over our tomorrow, brands have an important role to play beyond value creation and it is their response to these issues that will determine their future. -

Richard Haigh, Managing Director, Brand Finance