This article was originally published in the Brand Finance Global City Index 2024.

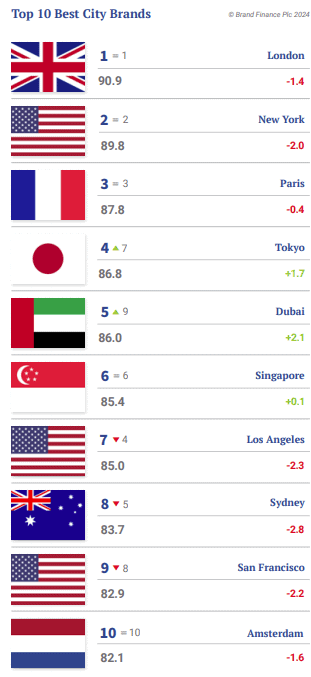

- London, Paris, and New York City retain top 3 spots in second annual Brand Finance Global City Index

- Tokyo and Dubai ascend to 4th and 5th positions among top 100 city brands, respectively, driven by improved Reputation perceptions

- European cities dominate Culture & Heritage pillar, claiming 17 out of 20 top spots

Place Branding Director,

Brand Finance

This second iteration of the Brand Finance Global City Index marks its transition to an annual publication. The study is the world’s most comprehensive global survey of city perceptions, collecting opinions from over 15,000 respondents across 20 countries. In addition to its global focus, the study has also expanded into regional analysis, with the inaugural Brand Finance US City Index launched in May 2024.

The result is a clear picture of perceptions of the world’s best city brands which provides a baseline for strategies to attract residents, workers, remote workers, students, pensioners, visitors, and investors.

To arrive at a comprehensive assessment of the top 100 city brands in the ranking, the survey asked the respondents about their perceptions of Familiarity, Reputation, and their personal Consideration of each city as a place to work locally, work remotely, invest, retire, study, live and visit.

This distinctive methodology can help each city ranked in the Index understand its key strengths and weaknesses against peers while offering robust insights to guide the brand positioning of any city with an international outlook - big or small.

TOP 5 CITIES

No 1: London Calling

London has again topped the Brand Finance Global City Index, boasting an impressive score of 90.9 out of 100. The British capital secures 3rd place in two Key Performance Indicators: Familiarity and Reputation, exemplifying its strong international profile and appeal. That said, its overall Consideration ranking is less robust, sitting in 19th place, despite strong performances in the consideration to visit (2nd) and consideration to study (6th) categories.

Reflecting its strong appeal for studying, London shines in 2nd place globally in the Education & Science pillar. Ranked 1st for its great universities, London is home to prestigious and world-renowned institutions such as Imperial College London, University College London, King's College London, and the London School of Economics, all of which consistently feature among the global top 50 universities. The city’s status as a financial and cultural hub provides students with abundant internship and employment opportunities, attracting students from across the globe.

London also ranks 1st for its great private schools, although it falls to 18th for publicly funded schools. It falls even further to 21st position for being a leader in tech and innovation, lagging behind other European cities such as Geneva, Zurich, and Stockholm for this attribute. This lower ranking suggests potential challenges in keeping pace with global advancements, which could hinder London’s ability to maintain its reputation as a leading educational hub going forward.

Bolstering its strong consideration to visit score, London also ranks an impressive 3rd place in the Culture & Heritage pillar. London excels with top rankings in attributes such as great museums, art galleries, and great theatres and music venues. Additional factors influencing its high visit ranking include being 1st for speaks a language I understand, 2nd for diverse/ multicultural and 1st for easy to get around by public transport.

Despite its strengths, London faces challenges in several key areas. The city ranks between 25th and 40th in consideration for living, working, retiring, and investing, with particularly weak perceptions among respondents from Japan, Germany, Canada, Australia, South Korea, France, and China. These unfavourable views reflect a global scepticism towards London's affordability and long-term liveability, especially compared to other major cities.

Historically perceived as a business epicentre, London ranks in 9th place in the Business & Investment pillar. This is largely supported by its 3rd place ranking for being perceived as a city of global significance, alongside a respectable 9th place for easy to find employment. London also ranks a notable 9th for its strong and stable economy, highlighting its economic resilience in the post-Brexit landscape. However, London ranks considerably lower in other key economic attributes, including 35th for its future growth potential, and 57th for its attractive personal taxation. These lower score raises questions about the city’s competitiveness compared to other leading global cities like Dubai and Zurich.

The 2024 data suggests that London is also facing challenges related to perceptions of its Liveability and Governance. The city ranks a concerning 59th for low crime and terrorism, 73rd for low bureaucracy, and 83rd for ease of obtaining a visa. The city faces a significant challenge regarding affordability, ranking a concerning 97th. As the cost-of-living crisis continues, many people find it increasingly challenging to afford life in iconic cities like London, New York, and Paris, all of which rank in the bottom 10 for affordability.

Beyond London

Beyond the capital, Manchester ranks 26th overall, with its highest score coming in 2nd place for famous sports teams and clubs. Being home to Manchester City and Manchester United has put the city on the map also outside the sporting world. This year, however, Manchester City was narrowly edged out by Real Madrid for the title of the world’s most valuable football club brand in the annual Brand Finance Football 50 ranking. Mirroring that, Madrid claims the top spot over Manchester in the Brand Finance Global City Index for famous sports teams and clubs, underscoring both the clubs’ and the cities’ unparalleled dominance in the sports world.

Liverpool ranks 38th in the overall Index and, like Manchester, is globally renowned for its rich sporting and cultural history. Bolstered by its iconic football club, Liverpool FC, the city ranks 3rd for its famous sports teams and clubs. The city is also the birthplace of The Beatles, widely regarded as one of the most influential bands in music history. That said, Liverpool's rich cultural heritage is less recognised outside Europe, especially in metrics related to theatres and music venues or cultural festivals.

Scotland’s capital, Edinburgh, ranks 47th overall and is the 3rd city in the world for green spaces and recreation. Landmarks like Arthur’s Seat and Princes Street Gardens, along with its proximity to the Scottish Highlands, make the city a vibrant destination for outdoor enthusiasts, offering a perfect blend of natural beauty and urban life.

No 2: New York, New York

New York City retains its 2nd place ranking in the Brand Finance Global City Index, achieving an impressive 89.8 out of 100 score. Renowned worldwide, it stands as the second most Familiar city globally. Its frequent visibility on the global stage fosters positive perceptions, significantly enhancing its international standing, particularly in areas of culture, economic strength, and influence.

On the other hand, domestically, perceptions of New York reveal a striking contrast. In Brand Finance’s US City Index - which captures only US residents' views - New York ranks 11th overall, with Governance issues significantly impacting its standing. While international respondents may overlook or forgive these challenges due to New York’s cultural and economic influence, domestic respondents are less forgiving. US audiences rated New York 47th for law enforcement, ethical standards, and corruption, 49th for low crime and violence, and last for trustworthiness, viewing these Governance concerns as genuine obstacles to the city’s appeal and Reputation.

On a global level, Governance also stands out as New York City's greatest challenge, with the city ranking 65th in this pillar. Perceptions are particularly low in Japan, Australia, Saudi Arabia, Canada, China, and the UK, likely undermined by recent political scandals. Mayor Eric Adams's involvement in a major corruption case, which resulted in his indictment on federal bribery charges, has further eroded trust in the city's leadership. This decline in Governance perceptions can undermine New York's broader appeal as a well-governed international powerhouse, potentially impacting its ability to attract investment and maintain its international influence.

These Governance issues do not seem to significantly affect tourism, with visitors drawn to the city's culture, landmarks, and lifestyle. The city ranks 6th globally for consideration to visit, 1st for great shopping, restaurants, and nightlife, and 4th for great theatres and music venues. New York also remains a leading global hub for business. It ranks 4th globally for Business & Investment, 1st for global significance, and 2nd for ease of business. Home to the New York Stock Exchange and NASDAQ, as well as influential companies like JPMorgan Chase and Goldman Sachs, New York retains its Reputation as a financial powerhouse.

Two further American cities feature in the top 10

Two more American cities are in the top 10: Los Angeles (7th) and San Francisco (9th). Los Angeles ranks 2nd for perceptions as fun, although its overall ranking has slipped to 7th, dropping out of the top 5. This fall is primarily due to the impressive rise of Tokyo and Dubai, which have surged up the Index this year, but also reflects a decrease in Consideration in key markets, including Japan, Spain, Germany, and Canada.

San Francisco secures 3rd place for being great for start-ups and innovations, bolstered by its proximity to Silicon Valley, which continues to be a global hub for technology and entrepreneurial ventures. Miami (16th in the overall Index) stands out as the top city for Liveability and 2nd for consideration to retire, renowned for its stunning beaches, vibrant cultural scene, and year-round warm weather. Additionally, Texas’s economic powerhouses, Houston (35th) and Dallas (40th), are noteworthy for both climbing five places in the Index and scoring particularly high for consideration to invest in and consideration to work in. Both cities are part of the Texan triangle, positioning themselves as significant economic players in the US. Houston ranks 2nd globally for easy to find employment and 9th for attractive corporate taxation, contributing to its 13th place ranking in the Business & Investment pillar. Similarly, Dallas performs well in economic attributes, ranking 4th globally for easy to find employment.

Canada’s highest-ranked city is Toronto, 14th, down from 11th in 2023. Toronto notably ranks 5th for consideration to live, study, work locally, and work remotely, reflecting its strong appeal among residents and professionals. Further down the Index, Vancouver ranks a respectable 29th globally, while Montreal takes 44th place.

No 3: Paris - Cultural Capital, Practical Challenges

Paris retains 3rd spot with a score of 87.8 out of 100 and excels in Familiarity (1st) and Reputation (14th) but struggles in overall Consideration, ranking 38th. Despite this, it performs strongly in consideration to visit, placing 3rd, largely due to its unparalleled cultural and heritage offerings and the global attention brought by hosting the 2024 Olympics.

Paris is unrivalled in Culture & Heritage, ranking 1st for great museums and art galleries, such as the Louvre, the Musée d’Orsay, and the Pompidou Centre. It also ranks 2nd for beautiful architecture, including iconic landmarks like Notre Dame, the Arc de Triomphe, and the Eiffel Tower, as well as great theatres and music venues. The city’s rich history, exceptional shopping, vibrant dining, and lively nightlife have likely reinforced its global reputation as a cultural hub.

However, Paris’s poor scores in other Consideration categories affect its overall performance. Apart from consideration to visit, it ranks between 30th and 50th, particularly struggling among respondents from Germany, the UK, Australia, and South Korea. The city’s strong standing for business and living is marred by slow economic growth, ranking 48th in the Business & Investment pillar. Paris ranks particularly poorly for personal and corporate taxation (81st for both), future growth potential (70th), ease of doing business (66th), and ease of both finding employment (65th) and skilled workforce (64th).

While the city is 2nd for its appealing lifestyle, it fares poorly in practical evaluations like affordability (92nd), low crime and terrorism threat (71st), and low bureaucracy (58th). These contrasts suggest that while Paris is seen as a desirable city for its lifestyle and culture, it is also viewed as unaffordable and challenging for day-to-day life, a reflection of the idealised yet often unrealistic perceptions of iconic cities.

Looking ahead, Paris aims to further enhance its global reputation through an environmental transformation focused on initiatives like reducing traffic and expanding its green spaces. This initiative could improve the city’s standing in the Sustainability & Transport pillar, where it currently ranks 34th.

No 4: Tokyo Rising

Tokyo ranks 4th overall in the Index, climbing three spots from 7th in 2023. The city’s Reputation has jumped significantly year-on-year, to 13th in 2024. Additionally, its Familiarity remains strong in 6th. This year, Tokyo sees improvements across the majority of attributes and in consideration to visit. This shift in perception could be attributed to arising trend of travellers, particularly among Gen Z and Millennials, choosing Tokyo as their destination this year.

The city also particularly excels in economic metrics. The Japanese capital ranks 7th for Business & Investment supported by its access to skilled workforce (1st) and strong and stable economy (3rd). Tokyo also holds 3rd place for future growth potential, further cementing its reputation as a global hub for innovation and opportunity.

Outside the capital, Osaka ranks 39th overall, with much lower Familiarity compared to Tokyo, ranking 44th. The city is set to host the upcoming Expo, however, which could boost its visibility on the global stage. It also scores well for Governance (10th) and 5th for accessibility to the elderly and people with disabilities, demonstrating its effective response to Japan's ageing population challenge.

No 5: Dubai - The Gateway to Global Business

Dubai has climbed four spots in the Index this year, now ranking as the world’s 5th best city brand. Notably, the brand ranks 1st globally for Reputation (up from 7th in 2023), ahead of Sydney and London in 2nd and 3rd. The city has also achieved impressive gains for consideration for working locally (up from 16th to 8th) and consideration to work remotely (up from 24th to 4th).

Dubai has been recognised as the 2nd best city of global significance, surpassing traditional heavyweight London (3rd). Its strong and stable economy, ranked 2nd globally, is underpinned by its strategic role as a hub for international trade, supported by world-class logistics infrastructure and its advantageous position bridging the East and West. This combination of factors positions Dubai as a compelling choice for residents, businesses, and global investors alike.

The emirate is a hotspot for innovation and start-ups, with initiatives like the Dubai Future Foundation contributing to its 1st place ranking for future growth potential. Additionally, its number three ranking for attractive corporate taxation further solidifies Dubai's status as a prime location for investment, making it the number one city for consideration to invest.