After the dramatic fall of Silicon Valley Bank what is the future value of the SVB brand?

With the announcement that some of SVB’s assets – including its customer-facing brand – will be acquired by First Citizens Bank, brand valuation experts, Brand Finance, believe SVB has critical assets that could take flight to a brighter future if previous weaknesses can be mitigated. Despite the brand being valued at US$2.8 billion as recently as January, First Citizens Bank now has some serious work to do to restore faith and value in the SVB brand.

This will take skillful brand curatorship and some tough commercial decisions. However, SVB could still have a very significant brand value if taken into intensive care. Any rehabilitation must start by addressing the reputational trauma of recent weeks and understanding the critical levers that can support a relaunch.

Reputation describes the perceptions of a brand, which gives it power and drives its value. It is based on both real and perceived performance or products and services and affects all stakeholders’ perceptions and behaviours which could have material consequences for the brand in question.

Under accounting rules, reputation itself does not satisfy the criteria to be measured as an asset. And as such Brand Finance considers reputation a core component of Brand Strength and Brand Value. Therefore, changes in reputation, or rather the risk arising from negative perceptions of all stakeholders on the fundamental operations of a business, can and should be measured through its impact on the brand itself.

In the case of a serious reputational event, a fundamental question to ask for the owner of any brand is whether the brands reputation is damaged to such an extent that it would be better to discard it and start over with a new brand. Alternatively, if management believe that the brand is salvageable, then what steps are required to mitigate further brand erosion and rebuild trust and credibility among stakeholders. Drawing on the database valuations spanning 27 years, and a global market research program spanning multiple countries and industries, Brand Finance can observe actual changes to reputation, brand strength and brand value for several brands from a series of significant reputational events:

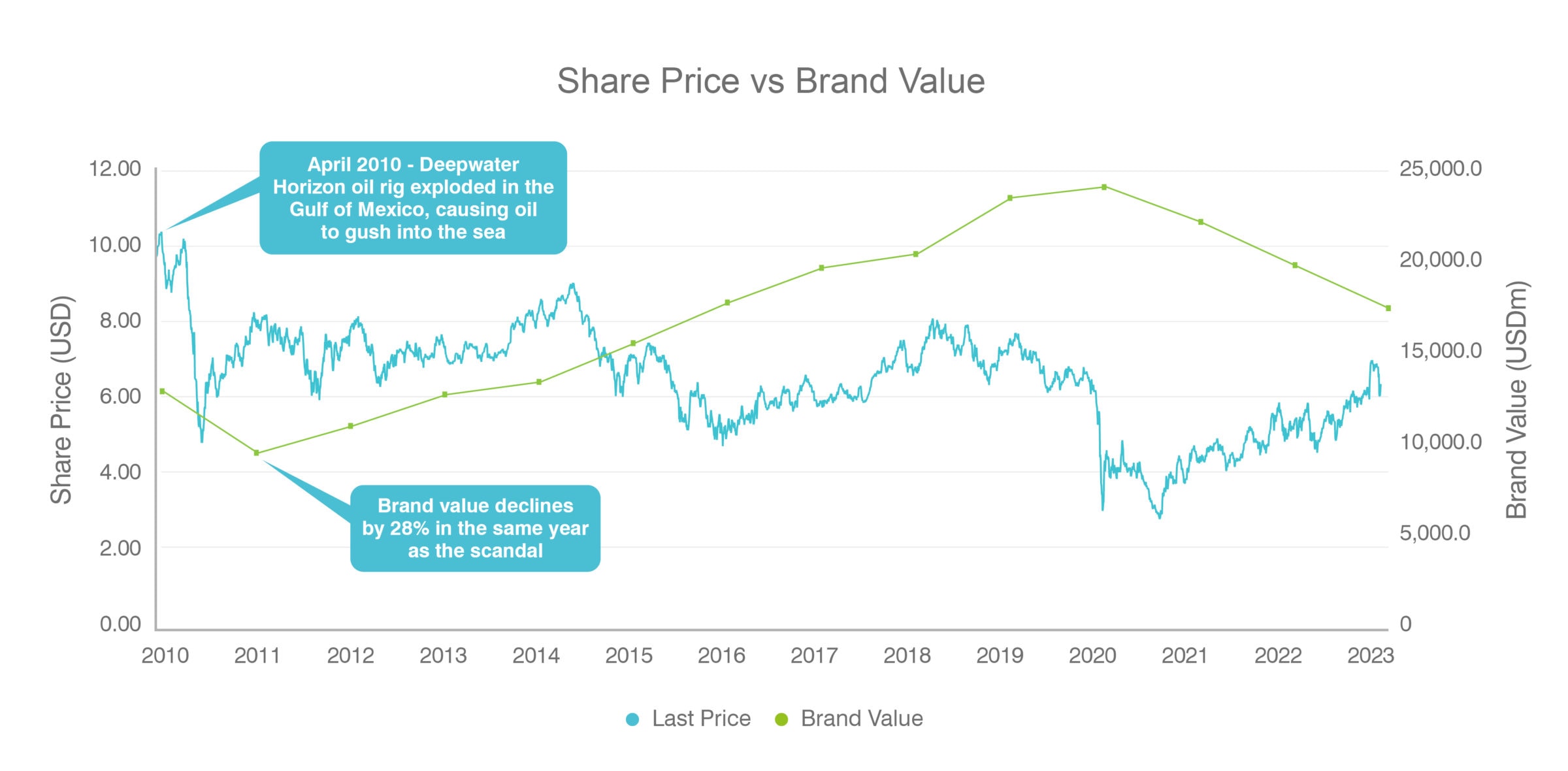

BP Deepwater Horizon (2010):

For example, most people are familiar with the Deepwater Horizon Oil Spill of 2010, for which Oil and Gas giant BP was responsible. The Deepwater Horizon oil rig exploded leaking nearly 5 million barrels of oil into the ocean – polluting water, destroying beaches, and killing wildlife. The spill is widely regarded as one the worst environmental disasters in US history. As a consequence, BP agreed to pay a record $19bn in fines, which remains the largest corporate settlement in US history. The total estimated clean up costs, charges, fines and penalties incurred by BP are estimated to have exceeded $65bn. In the immediate aftermath BP’s share price more than halved – and still has not recovered the share price value since. In the same year, at next valuation BP lost 30% of its total Brand Value.

Another interesting finding from the research Brand Finance conducts is that despite it being 12 years since the initial oil spill, BP has the lowest reputation of any Oil & Gas brand operating in the US market. This indicates that BP has failed to address its poor reputation, which arguably contributes to its suppressed share price performance since.

How to evaluate reputational risk and damage?

The following data is from a case study on reputational risk measurement for a banking client recently conducted by Brand Finance. For the sake of anonymity, we will be referring to this client as “Brand X”.

To answer the question of how to quantify and manage reputational risk for a brand, one first needs to establish a comprehensive evaluation and valuation of a brand from which to measure reputation events against. Brand Finance does this through a benchmarked scorecard framework called The Brand Strength Index ™, which in turn forms a key element in the Brand Valuation methodology.

The Brand Strength Index consists of a series of metrics that underpin a brand’s health across a range of stakeholders. These metrics include but are not limited to emotional and functional drivers of choice, familiarity, consideration, NPS, reputation, ESG, market share, volume, and price premium. These metrics are benchmarked by industry on a global basis (underpinned by a global market research programme) and condensed into one comprehensive score expressed out of 100.

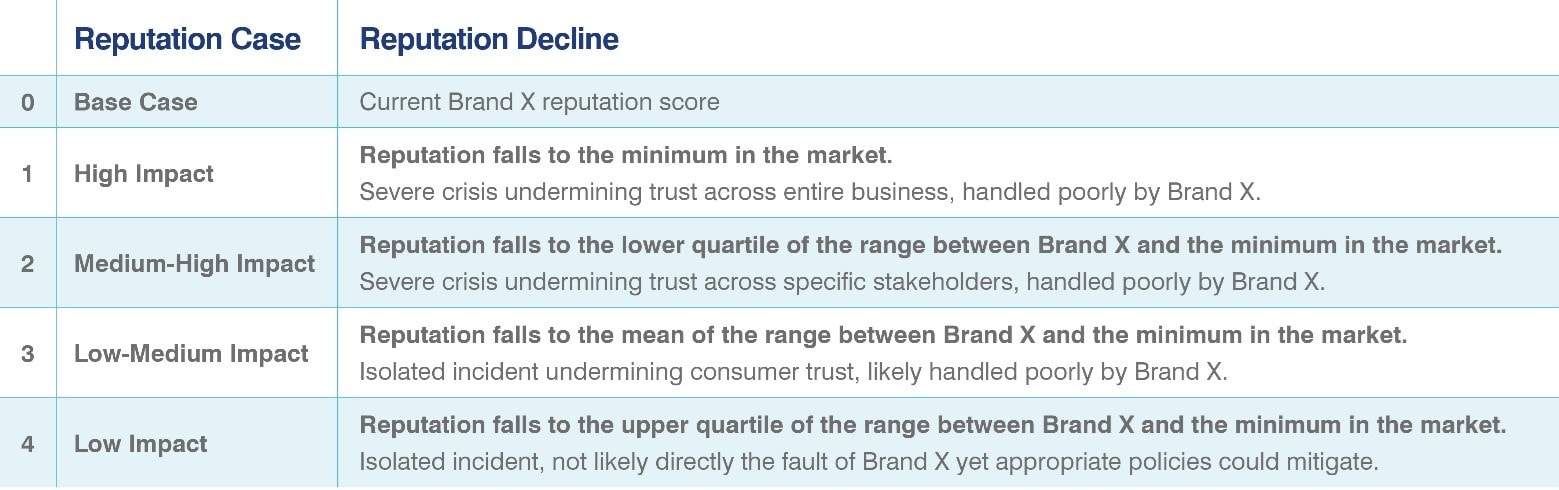

Once a base reputation score is established, a scenario analysis can be run, in which the extent of reputational damage can be estimated and modelled against other metrics within the Brand Strength Index and ultimately brand value:

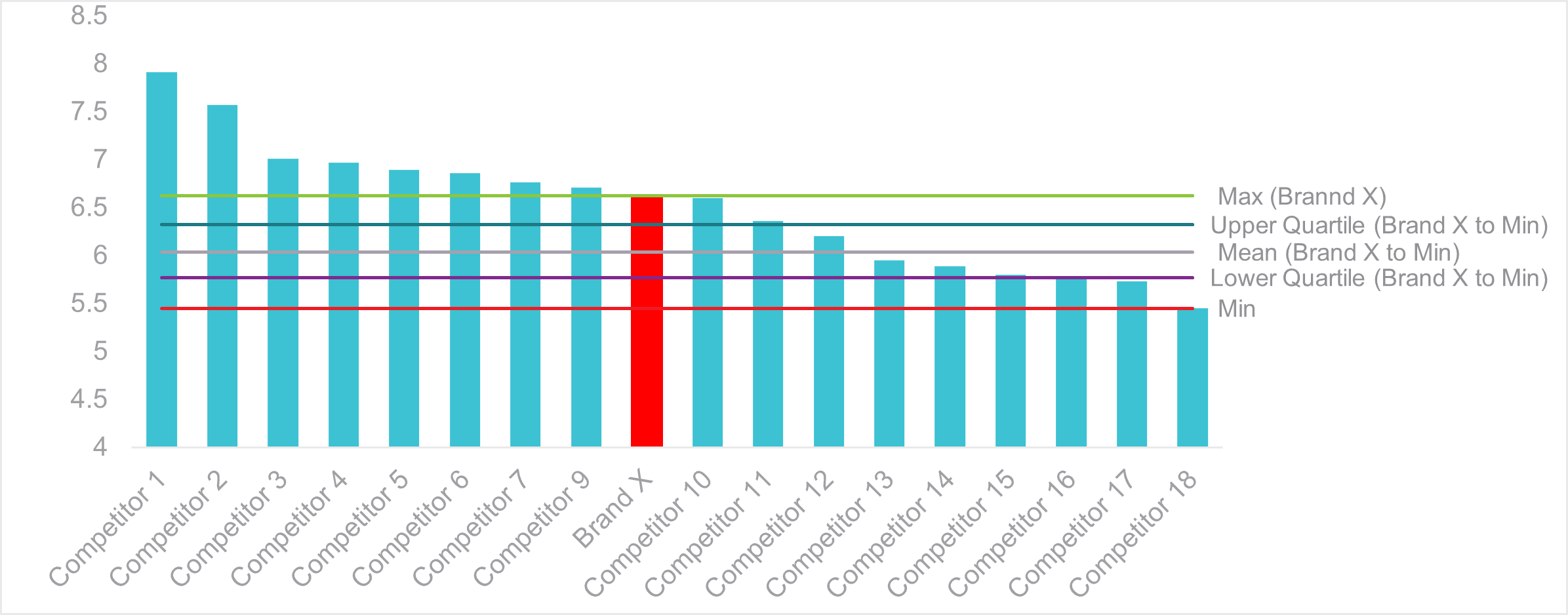

Reputation Scores (banking):

Scenario Analysis:

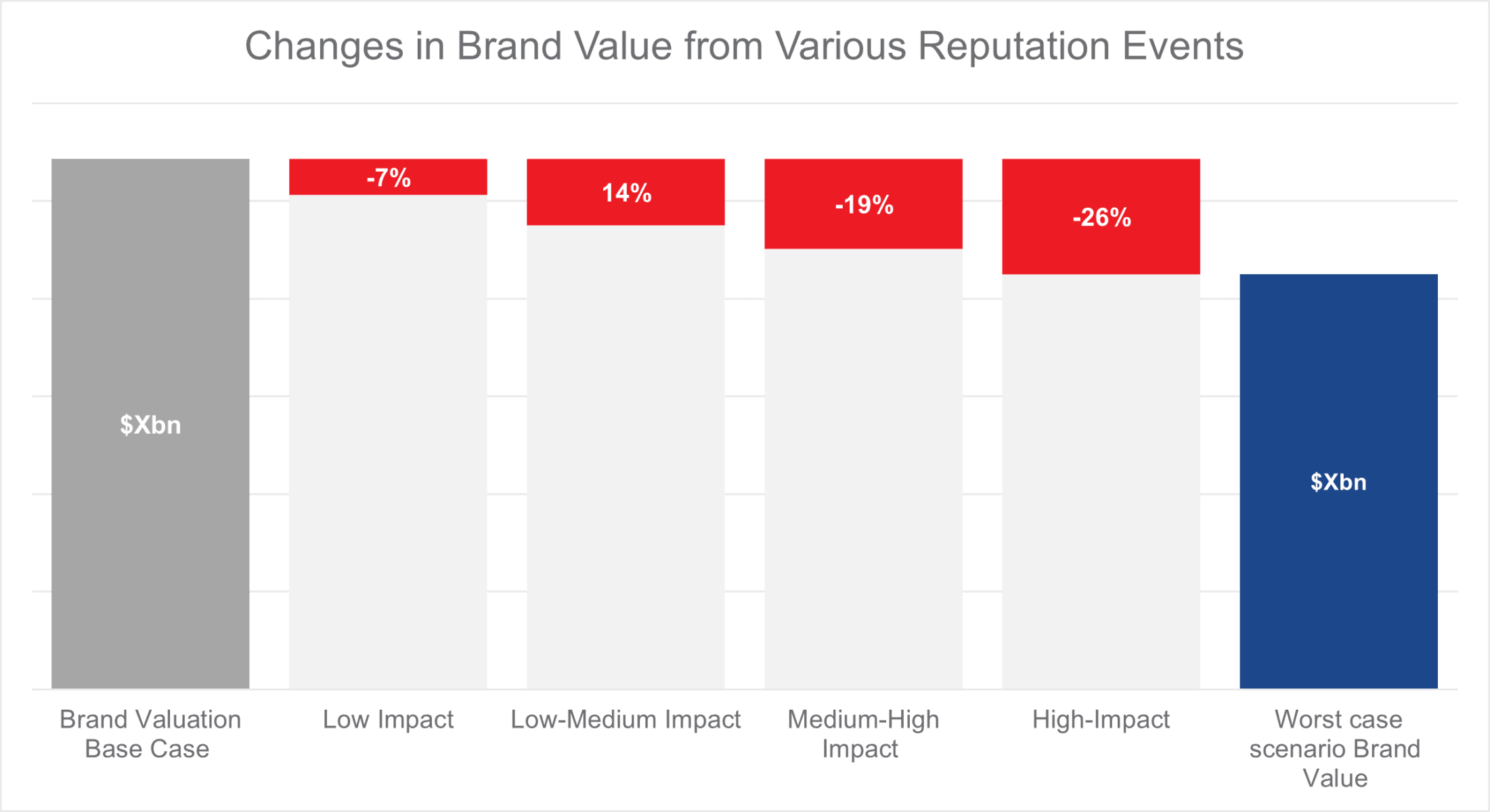

Results:

In the case of this specific bank in question. A scenario in which a severe reputation issue occurred, and the issue was subsequently handled poorly by the bank, a total decline in brand value of 26% was estimated.

Silicon Valley Bank:

With Silicon Valley Bank, Brand Finance conducts a brand evaluation and valuation on an annual basis. As of the 1st of January 2023, Brand Finance evaluated the SVB brand with a BSI score of 65/100. This is underpinned by market research conducted in the US. The BSI informed the final brand valuation figure of $2,769bn.

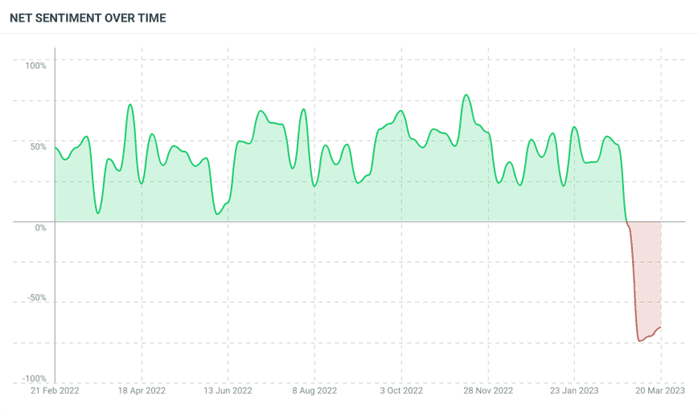

Having established a point of departure, we can now attempt to quantify the impact on reputation from the collapse of SVB. Given the uncertainty over whether the SVB brand itself has a future, Brand Finance is working on the assumption that immediately before the official closure of the bank, if the board has put in place adequate reputational risk governance procedures, then the brand would still have a future ahead of it. Without extensive market research across a wide range of stakeholders it is difficult to adequately quantify the extent of the reputational damage incurred due to poor governance. Therefore, certain tools can be utilised in place of market research to extrapolate reputational damage and measure the potential impact of a reputational event. Take social listening for example, the graph below displays net social sentiment online for SVB over the 12 months immediately prior to its collapse. Net sentiment refers to AI enabled opinion mining online, which analyses conversations to determine an emotional state. We can see that net sentiment declines significantly as the crisis unfolds in the mainstream media.

Extrapolating these results to metrics within the Brand Strength Index (such as reputation, governance, consideration, credit ratings etc.) can give a reasonable indication of the potential negative impact on brand health and on brand value. A conservative estimate has SVB declining in Brand Strength from 65 to 35 (-45%) and declining in Brand Value from $2,769bn to $1,214bn (-56%).

Reputational Red Flags that should have been assessed before the fact:

In the case of SVB, there was a myriad of red flags widely reported, which could and should have been assessed against through the lens of brand evaluation and valuation. All of these issues could have been modelled through the impact on the key metrics within the Brand Strength Index to determine potential impact on the SVB brand and business.

- SVB took customer deposits and invested in bonds with significant interest-rate risk. So, when interest rates increased, the value of their bond holdings declined.

- However, SVB and other financial institutions are not liable to report under fair value because the argument is that these losses are not realised until the bonds mature. They did disclose in a footnote a loss of $16bn (which is placed against common equity of only $11.5bn indicating the bank was in fact insolvent).

- Risky loans being offered / under reporting of loan loss provisions. SVB only reported allowances for credit losses of $636m on a loan portfolio of “$74bn, so under 1%. Many of the bank’s loans are too risky as they are with enterprises such as private equity firms, venture capital funds and start-ups.

- SVB operated without a Chief Risk Officer for 10 months in 2022.

- The Federal Deposit Insurance Corporation has a $250K insurance limit, of which a reported 90%+ of SVB’s deposits were sitting.

- The type of clientele that SVB were dealing with (venture capital funds, angel investors, start-ups and scale-ups) tend to be those that chase whatever is in vogue at any given time. In short, there is inherently significant risk of a downward spiral such as a bank run caused by word of mouth in the industry, as happened in the case of SVB.

Reputation Risk Management:

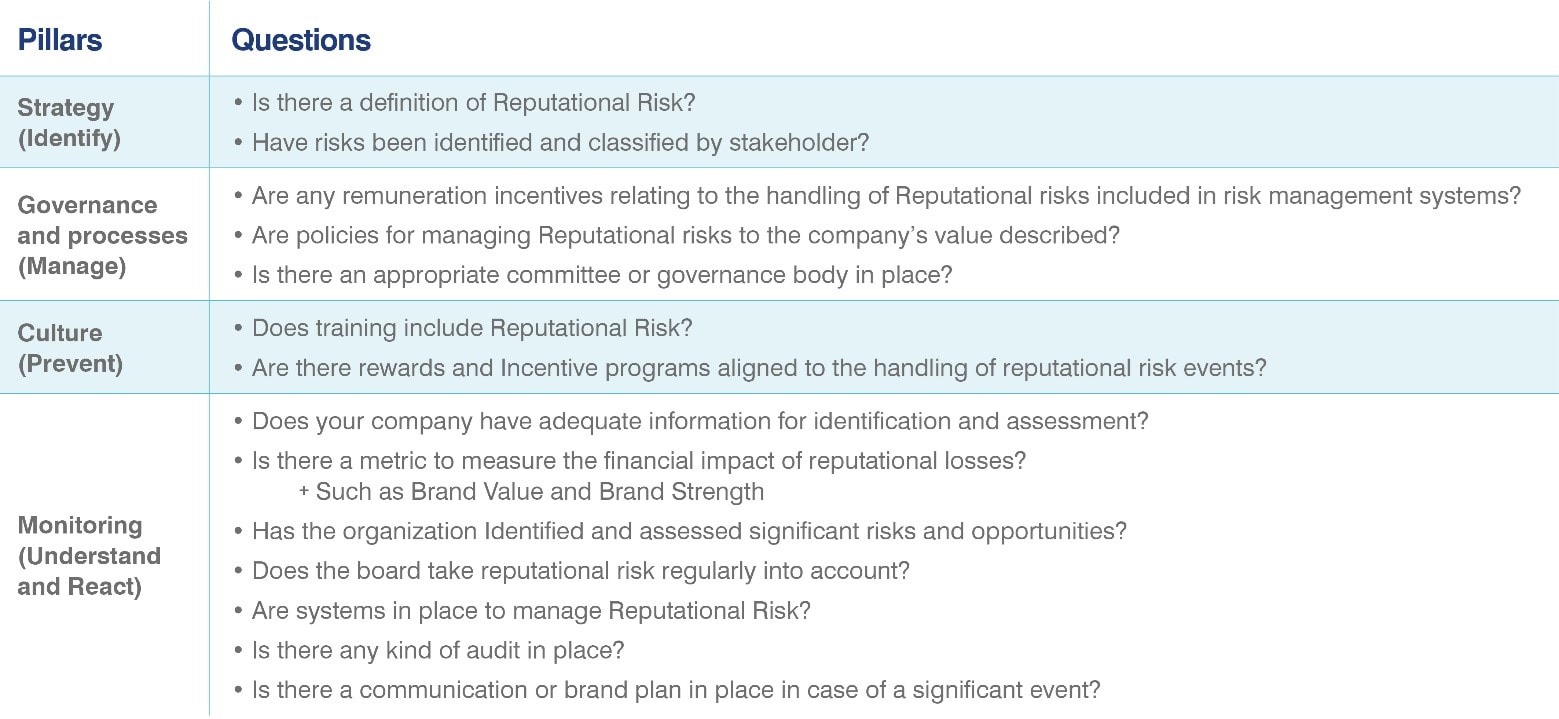

Ultimately reputation risk events can be mitigated with appropriate governance in place. Good governance will also account for appropriate responses once a reputational risk is identified. The following 4 pillars of reputational risk management (and associated questions) can help an organisation manage and mitigate reputation risk effectively:

Reputation for the banking industry hit an all time low after the global financial crisis, and banks have largely taken good measures to regain public trust since then. However, when compared to other industries, banking reputation still lags significantly. Recent events threaten to run further, and banks need to carefully research and measure how vulnerable they are to reputation risk, which may not be merited by the facts but could still lead to panic among customers and investors leading to existential risk.