Every year we value over 5,000 of the world's biggest and strongest brands. It is the largest and most comprehensive study of its kind. This is how we do it.

If we zoom out here, in general terms all our valuations follow a process flow. This process flow indicates how specific actions, taken by marketing and other corporate managers, result in changes to a brand's attributes (i.e. quality, availability, price, positioning, personality, etc.).

We then measure how much these actions affect the level of consideration for the brand, how increased consideration leads to stakeholder behavioural change, ultimately leading to a favourable financial uplift effect.

The process flow can be used in both directions. In one direction it explains the value of the subject brand. In the other, it explains what actions need to be taken by marketing and corporate managers to strengthen brands and add value. So, the process is both a comprehensive summary of the performance of marketing activities to this point and a highly actionable tool for brand guardians.

This is a very broad explanation, and we would be happy to spend all day talking through the nuances and applications of brand valuation. For now, though, we want to tackle some of the most common questions we asked around our annual valuation study.

How do we value brands that have not been bought, sold, or licensed?

We are lucky because there are real-world market examples of businesses buying, selling, and licensing brands. By using these real-world examples, we can build an accurate spectrum of what brands of certain sizes and strengths, within specific geographies, and sectors, are worth.

Through this process, we can then start to value brands (that have not been valued before) based on assumptions that are proven to exist in commercial reality. This is how we can perform robust valuations for brands that have never been valued as part of an auditing or balance sheet exercise.

To understand where to place a brand within this spectrum we look at two key areas: We look at the financial performance (revenues) of the business operating under a brand, and we also look at brand strength measures. It is very easy to compare revenues, it is a lot harder to measure one brand’s strength against another.

Measuring a brand’s strength is a key aspect of any brand valuation calculation. It is also probably the stage most familiar to brand, marketing, and insights teams. Everyone in some way or another is measuring the strength of their brand and tracking the changes of those strength metrics over time. For our valuations we conduct our Global Brand Equity Monitor to measure consumer perceptions of 5,000 brands in 30 countries across 14 industries and then include this in the Brand Strength.

Once we have conducted a ‘Brand Strength Assessment’ of brands with a sector, we then start to build out a relative understanding of how much brand is impacting overall business performance. Through measuring and benchmarking brand strength within a competitive set, we can identify the impact brand is having on the bottom line. From there it is relatively straightforward to then understand how much value the brand is bringing to the overall business.

In our valuations we are essentially combining the two disciplines of marketing and finance. We are translating marketing into finance, and vice versa. which informs the principle of our strapline – ‘Bridging the gap between marketing and finance’.

Brand Valuation 101

Our Vision for Improving Brand Valuation

6 Strategic Applications for Brand Valuation

Technical Reasons to Value Your Brand

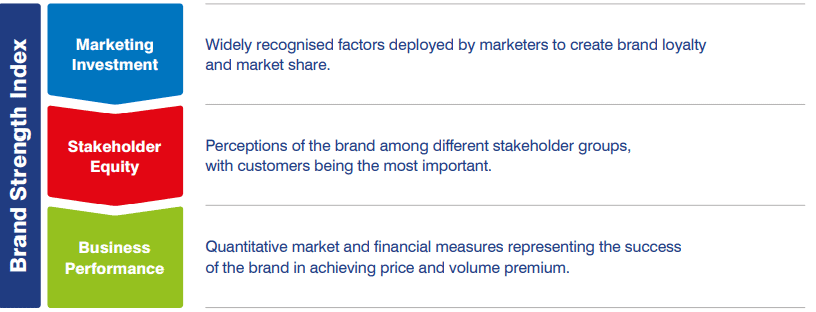

Measuring Brand Strength

One of the key questions that inevitably evolves from establishing a measure of brand strength is: what brand attributes should be included in my brand strength scorecard? The answer is quite straightforward in principle, but difficult in practice: a brand strength scorecard should aim to capture as many trackable brand attributes as necessary, but as few as possible.

We split our measurement of Brand Strength into three fundamental pillars: Brand Investment, Brand Equity, and Brand Performance.

We chose these pillars because they ask what any brand manager, owner, or potential licensee, should be considering when assessing the quality of a brand:

- Is management working to invest in the brand to grow and maintain it into the future?

- How does a variety of relevant stakeholders currently perceive the brand?

- Is the brand doing what it should be doing to bring value to the business?

Exactly how these three questions are answered will differ from industry to industry and even brand to brand.

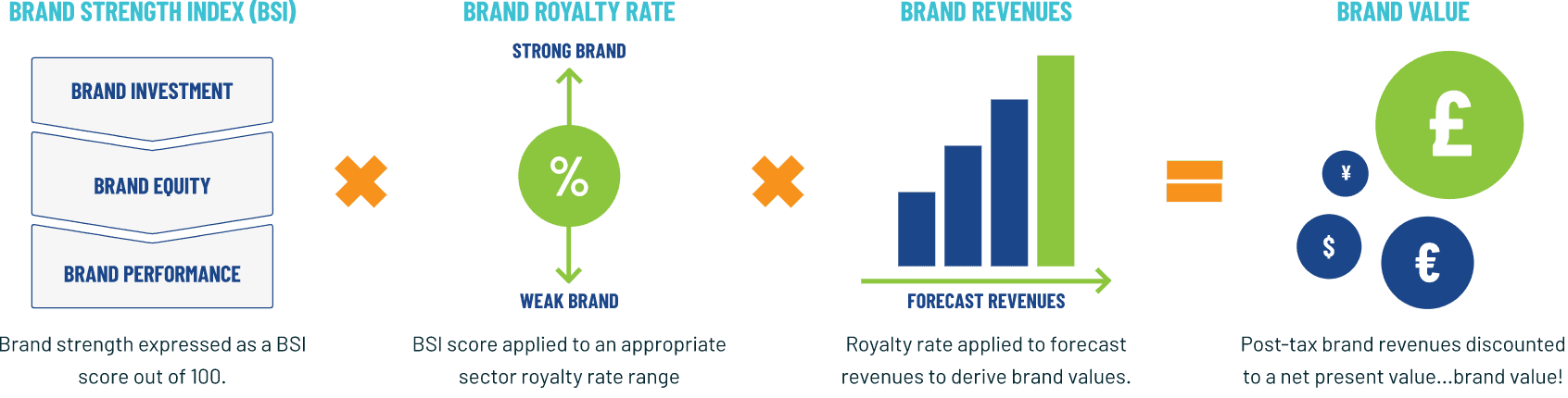

How we value brands in our annual rankings

In the case of our rankings, we use the real-world examples of licensing agreements as a basis for our valuations, using a methodology called the Royalty Relief Methodology, or Relief from Royalty Method. The method determines the value a company would be willing to pay to license its brand as if it did not own it. This approach involves estimating the future revenue attributable to a brand and calculating a royalty rate that would be charged for the use of the brand.

As this is purely hypothetical, and for the most part the brands in our Global 500 are owned, rather than licensed, these brands are relieved from paying these royalties on their revenues. Hence the name royalty relief.

The steps in this process are as follows:

- Calculate brand strength on a scale of 0 to 100 based using a balanced scorecard of a number of relevant attributes such as emotional connection, financial performance and sustainability, among others. This score is known as the Brand Strength Index.

- Determine the royalty rate range for the respective brand sectors. This is done by reviewing comparable licensing agreements sourced from our own extensive database of real world license agreements, as well as and other online databases.

- Calculate royalty rate. The brand strength score is applied to the royalty rate range to arrive at a royalty rate. For example, if the royalty rate range in a brand’s sector is 0-5% and a brand has a brand strength score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

- Determine brand specific revenues estimating a proportion of parent company revenues attributable to each specific brand and industry sector.

- Determine forecast brand specific revenues using a function of historic revenues, equity analyst forecasts and economic growth rates.

- Apply the royalty rate to the forecast revenues to derive the implied royalty charge for use of the brand.

- The forecast royalties are discounted post-tax to a net present value which represents current value of the future income attributable to the brand asset.

Brand Valuation Calculation Visualisation

The Royalty Relief Method is not our own proprietary methodology; it is just one of many that are outlined in ISO:10668. The reason why we use the method, is that it is favoured by tax authorities and the courts because it calculates brand values by reference to documented third-party transactions.

It can also be done based on publicly available financial information, and it is compliant with the requirement under the International Valuation Standards Authority and ISO 10668 to determine the fair market value of brands. For these reasons, the royalty relief method is used in over 80% of all brand valuations.

The role of brand research in our valuations

The thing which we have stressed most over the 25 years is that to value a brand well is a holistic exercise. It is not just a financial spreadsheet which spits out a financial number. We practice this by following four principles:

- Context: Our financial brand valuation opinions must be driven by high quality insight and analytics of the sector trends driving the markets in which the brands operate.

- Stakeholder Impact: We need to understand and predict how stakeholder opinion will drive demand and other economic and financial benefits underpinning the valuation.

- Transparency: we have always felt that all assumptions in the valuation need to be disclosed in full so that they can be challenged.

- Due Diligence: We always apply financial sensitivity analysis so that we can evaluate brand value scenarios.

Holistic connection is baked into our approach. We have always considered stakeholder research, particularly customer and consumer research to be a central requirement of high-quality brand valuations. Brand Finance has occasionally been characterised as purely financial, with no understanding of demand and of brand value drivers. However, stakeholder insight has been part of our DNA since inception in 1996.

Since 1996 we have commissioned original research or reused existing client research in client brand valuations. But as we have grown to become the leading global provider of brand valuations produced speculatively each year, using publicly available data, we have commissioned our own global research to underpin our brand valuation tables.

We now conduct research in 31 countries and over 23 sectors. Our research includes brand funnel measures such as Awareness, Familiarity, Consideration, Trial, Loyalty, and Recommendation. We also research key attributes which drive the funnel measures. Taken together we are able to use statistical analysis to predict customer and consumer behaviour leading into the forecast demand and revenue in our models.

Conclusion

Brand Valuation is ultimately a financial discipline, but unlike all other financial disciplines, it requires an intuitive and well-researched understanding of stakeholder perceptions, motivations, and behaviours. Nowadays this is often referred to as Behavioural Economics by many marketers. But really this is what we referred to when we coined the term Brand Economics back in 1999.

More than ever before, Brand Finance can help brands understand how they tick and help them work better for all their Stakeholders.