As with any brand, nations want to know that the long-term outlook for their nation brand is positive. Hence the views of younger people are especially important in providing signals of possible longer-term shifts in global perceptions – as well as shedding light on whether younger people generally have different perceptions of nation brand characteristics.

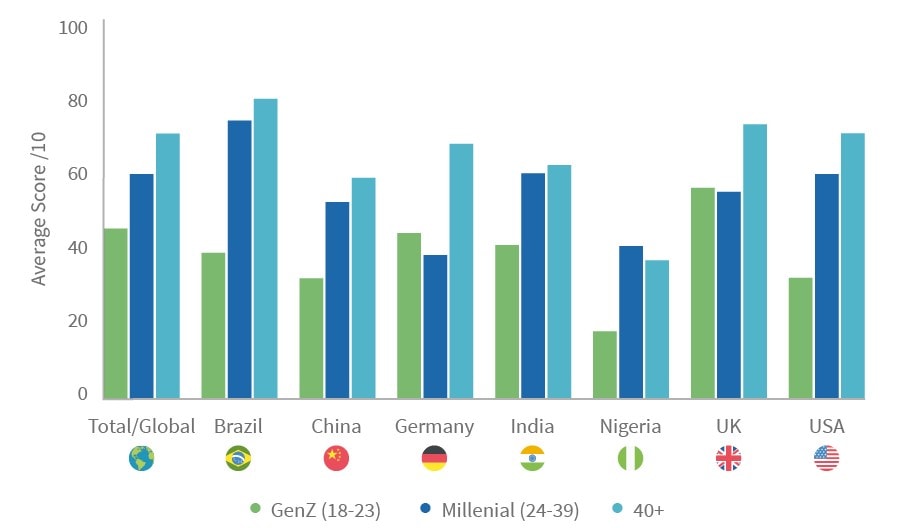

In aggregate, younger people do view nations differently simply because a much higher percentage of Gen Z and Millennial people live in regions such as Sub-Saharan Africa and South Asia. Global age cohort analysis is skewed by this of course, and for this analysis we have also assessed patterns within key countries such as the UK, Germany, the US, Nigeria, India, and China.

Familiarity comes with experience, with Gen Z people typically less familiar with other nations compared with their older peers. In many countries, the Gen Z age group has had fewer opportunities to travel, but also their innate interest in international and world affairs is lower. Millennials, on the other hand, display a higher thirst for knowledge of other countries and cultures, combined with great maturity and (often) the ability to travel. The net result is that in countries such as Brazil, China, India, and the US the Millennial cohort displays the highest Familiarity levels. Nations might consider targeting this group rather than Gen Z, even with youth-orientated cultural or tech-led initiatives.

As an example, in India, Millennials are significantly more Familiar with a number of nations, often those in the second tier of countries on this measure (whereas virtually all Indians are familiar with the US, Pakistan, etc.):

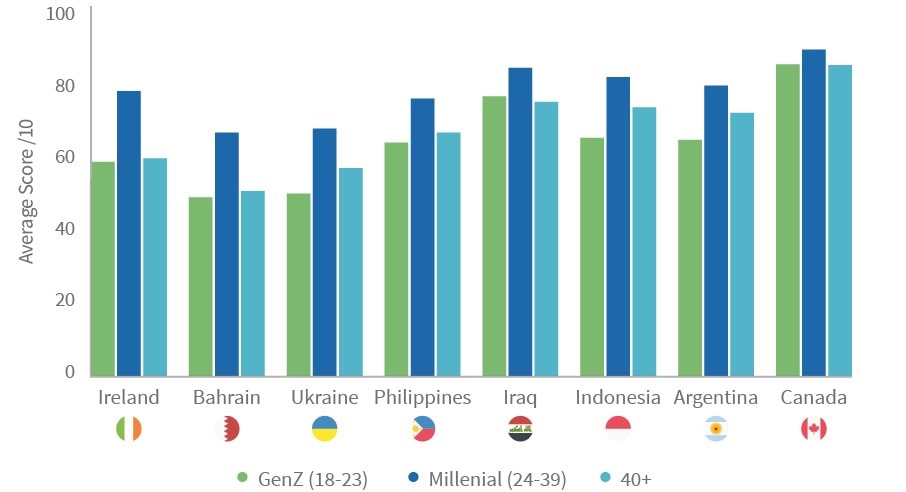

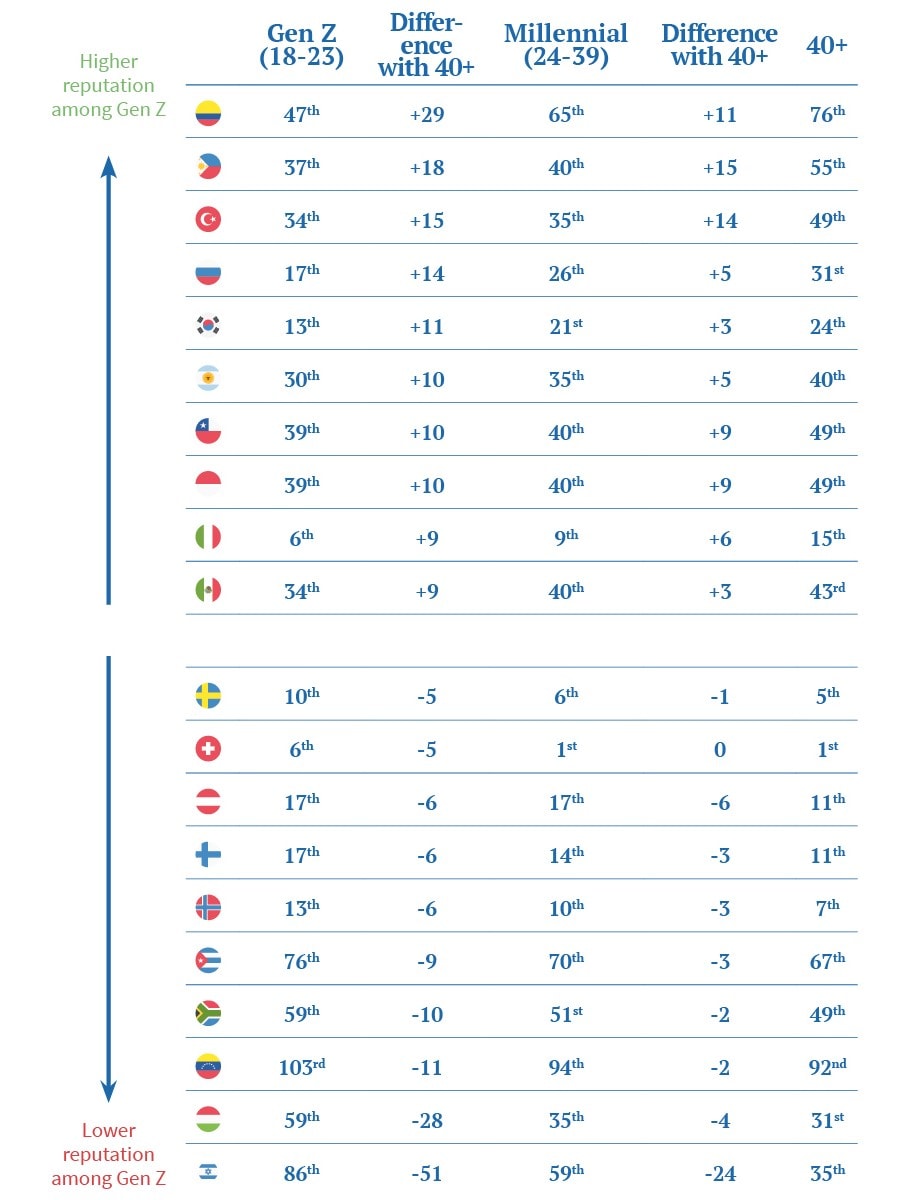

Familiarity improves Reputation; hence Millennials also tend to be more positive about different countries in rating their reputations. More notably, certain countries rank significantly higher or lower globally among younger cohorts:

Notably, younger cohorts are somewhat less positive about smaller liberal nations such as Sweden and Switzerland. Conversely, Gen Z and Millennial respondents tended to rate the reputations of countries such as Russia, Turkey, and the Philippines more highly than their older peers.

While geography is partly at play (older Europeans tend to rate Nordic countries highly), the Gen Z cohort does appear more positive towards countries whose reputations are more mixed. For example, the Reputation ranking of Russia in Brazil and Germany is significantly higher among Gen Zs (and this is the general pattern across many key markets).

Ratings for whether a country’s impact and influence are a positive or negative force show a similar pattern. Liberal European nations are struggling to convince some younger people globally that they are attractive and influential. Perceptions of Denmark, for example, are not quite so strong among younger people:

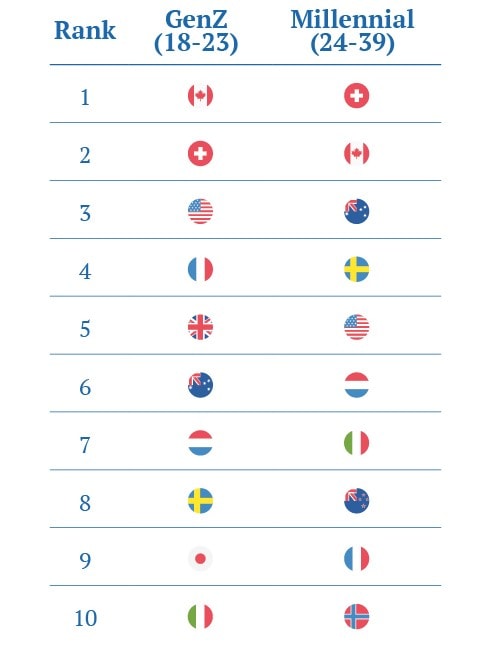

But young people the world over do acknowledge the highly desirable lifestyles of Western countries. Global rankings for ‘An appealing lifestyle’ show a clear preference.

Hence, while Gen Z and Millennials are undoubtedly more favourable towards countries such as Russia, China, and Turkey, the more established soft power leadership demonstrated by Western powers still holds considerable appeal – and suggests that these countries will not give up their high overall rankings in the Global Soft Power Index easily or quickly.