Last year, the banking sector in Vietnam experienced significant growth, gaining over approximately USD11.5 billion in combined profits across its brands. However, this year’s economic headwinds arising from lower import and export demands bring challenges to the sector. Vietnam’s banking brands are up against slow credit growth due to low capital absorption influenced by lower demand for business growth, amidst the decline in worldwide trade and challenges in the local real estate market. However, Vietnamese banking brands continue to see remarkable developments.

Despite a challenging outlook, banking brands remain confident in overcoming the economic headwinds that lie ahead by investing in digitalisation as a key measure. This is prudent given that digital transformation is crucial for banks to attract increasing interest and adoption of digital payment transactions in the nation.

Vietnamese banking brands saw a combined increase of 47% in brand value

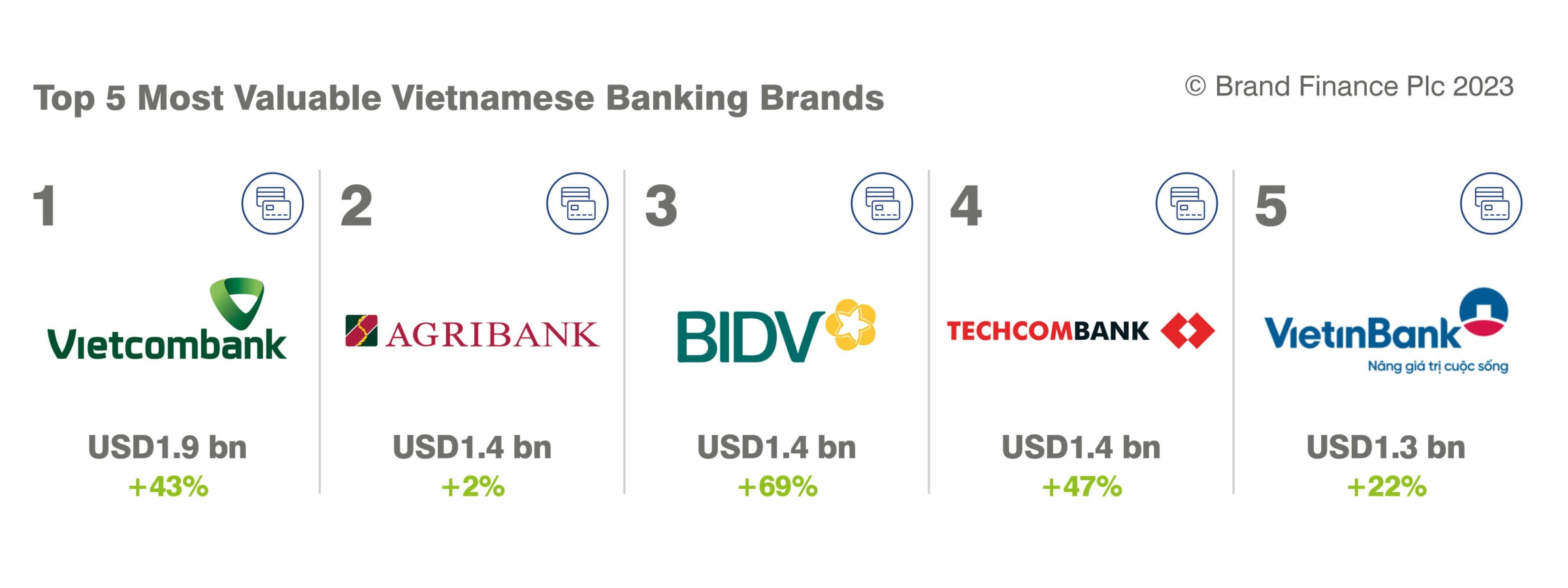

Banking brands are the second largest contributor to our Vietnam 100 2023 report rankings, with a combined brand value of USD12.5 billion. This makes up approximately 30% of the total value of all listed brands. Compared to their performance in 2022, the combined brand value of banking brands rose by 47%. The top five most valuable banking brands in our rankings are Vietcombank, Agribank, Bank for Investment and Development of Vietnam (BIDV), Techcombank and VietinBank.

In addition, nine banking brands made their first entry into our ranking of the top 100 most valuable Vietnam brands this year – TPBank, LPBank, Vietnam Maritime Commercial Joint Stock Bank, Southeast Asia Commercial Joint Stock Bank, Orient Commercial Joint Stock Bank, Eximbank, Kien Long Commercial Bank, Vietcap Securities Joint Stock Company and NCB.

In spite of economic challenges, banking brands in Vietnam have promoted digitalisation and achieved outstanding growth in our rankings this year. Vietcombank launched several digital initiatives at the end of 2022, such as pre-payment authentication services and low-value cross-border payments with SWIFT (SWIFT GO). Agribank developed many banking services on digital channels and cashless payment services. These include opening electronic know-your customer (eKYC) online accounts, non-physical cards, contactless chip cards, codes electronic pin ePIN, payment by VietQR code and multi-function ATM (CDM). Meanwhile, ACB’s customer base grew rapidly with the 2022 launch of its mobile banking application – ACB One – whilst leveraging eKYC capabilities. Similarly, VIB launched its MyVIB 2.0 digital banking application last year, utilising multi-cloud computing technology to cater to customer needs. As a result, the brand pulled in 700,000 new customers and consolidated a total of 5.2 million customers by the end of 2022.

In addition to these initiatives, banks also focused on incentives and campaigns to encourage the use of their digital services. For instance, Vietcombank rolled out incentive campaigns to encourage customers to use its digital banking services. For example, it introduced the “Open online account – Super promotions” programme, which encouraged customer use of its eKYC solutions when opening online banking accounts. Similarly, Techcombank launched its “Mèo Đại Cát” mega campaign last year, drawing over two million customers to its app-based lucky draw.

Through these initiatives, we see banking brands’ commitment to digitalisation and enhancing customer service paying off.

BIDV – a spectacular breakthrough by the oldest bank in Vietnam

Notably, BIDV is Vietnam’s fastest growing brand in this year’s rankings, with an exponential surge in brand value by 69% to USD1.4 billion and an improvement in brand strength rating from AA+ to AAA-. BIDV’s impressive performance is attributed to its brand strength, as it embarks on a digital transformation journey to enhance customer experience on top of other strategic business initiatives in 2022.

Determining digital transformation as one of its three main pillars for the period of 2022 to 2025 and vision for 2030, BIDV aims to be “the leading financial institution in Southeast Asia, with the best digital platform in Vietnam”. To achieve this, BIDV has been focusing its resources to accelerate comprehensive digital transformation in all aspects of its operations.

BIDV’s digital products and services are designed not just by bringing physical processes to the digital space but are based on an understanding of customer behavior and their online habits. Thanks to these well-designed digital products and services, along with a diverse ecosystem, BIDV has created breakthroughs in providing “more than banking” services to customers. The banking brand continues to keep up with trends and lead new markets, meeting the changing needs of customers.

One of BIDV’s outstanding digital products is “BIDV SmartBanking Thế hệ mới” (the new generation of BIDV SmartBanking), which impressed millions of customers and received praise from professionals and experts. BIDV SmartBanking offers seamless user experiences on all devices. It is an “all in one” application with innovative features such as: eKYC, applying for quick loans online (QuickLoan) and allowing for the use of QR codes to withdraw cash at ATMs.

With “comprehensive digitisation and optimisation of organisational customer experience” as one of its strategic operational goals, BIDV deployed its new Omni BIDV iBank system for corporate customers. This is a multi-channel digital banking system combining digital banking products and services with a consistent and seamless experience on the web and mobile devices.

At the same time, BIDV is actively implementing measures to enhance its tech infrastructure in line with its mission to become the best digital bank in Vietnam. These measures include improving and enhancing the performance of service APIs provided on its ERP platform, through the completion of its integration architecture model to provide Open APIs for appropriate devices while actively expanding its existing customer base. In September 2023, BIDV achieved a milestone with the successful transformation of its core banking system. Core banking is considered the ‘heart’ of information technology systems in banking. Transforming core banking promises to create a breakthrough in BIDV operations in many areas. For instance, with the launch of high-tech products and services, enhanced system autonomy, open architecture, as well as ease of connection and integration with other systems.

In addition to its digital transformation efforts, 2023 also witnessed BIDV’s brand identity transformation. All 190 branches with 895 transaction offices across Vietnam underwent an emerald-green revamp to align with its refreshed logo. Such brand identity transformation demonstrates BIDV’s dynamic and agile spirit, alongside a desire for sustainable development of its brand.

Our past research has emphasised the importance of digitalisation in various sectors. This swift adoption of digitalisation we see in BIDV and other Vietnamese banking brands not only ensures resilience in the face of economic challenges, but also precedes an increasingly efficient, accessible and innovative financial landscape for the nation’s growth.