This article was originally published in the Brand Finance Banking 500 2025 report

Managing Director, Brand Finance Americas

Strategy & Valuation Director, Brand Finance Americas

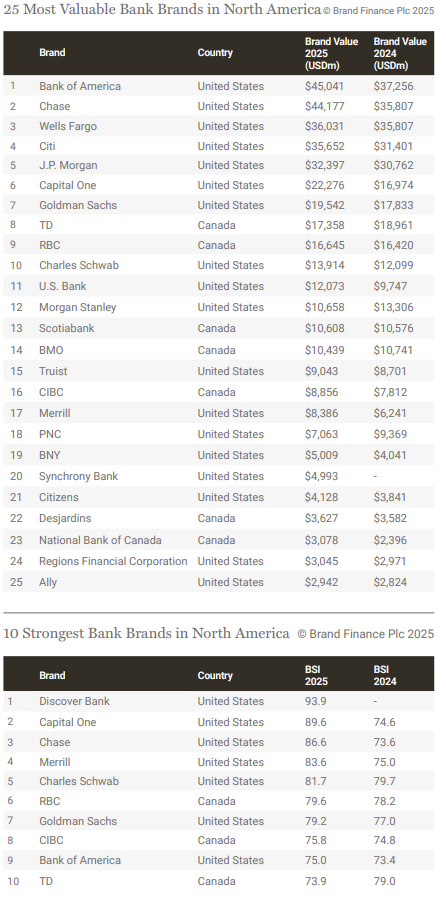

North America’s banking sector remains a global leader, but brand growth has lagged behind other regions. While total brand value in Brand Finance’s 2025 Banking 500 increased by 7% year-on-year, this falls short of the 13% growth across the global ranking. The average brand value growth of North American banks is just 3%, barely outpacing the US economy’s 2.8% expansion in 2024.

Some of the region’s largest bank brands are thriving. Bank of America (up 21% to USD45 billion), Chase (up 23% to USD44.2 billion), and Capital One (up 31% to USD22.3 billion) have all recorded strong double-digit increases. These brand value gains are concentrated among a few major players as smaller regional banks struggle to keep pace.

In Canada, TD (down 8% to USD17.4 billion), RBC (up 1% to USD16.6 billion), Scotiabank (unchanged at USD10.6 billion), BMO (down 3% to USD10.4 billion), and CIBC (up 13% to USD8.9 billion) continue to dominate the market, all securing spots in the top 20 most valuable banking brands in North America and the top 50 globally. Canadian brand values have remained relatively steady, especially in comparison to the aggressive growth of their US counterparts.

In Mexico, Banorte (up 31% to USD2.4 billion), Inbursa (down 7% to USD372 million), Banco Azteca (brand value USD356 million) and Compartamos Banco (down 24% to USD272 million) are the only four banks that feature.

The average brand value of a North American bank in the Banking 500 is USD5 billion, significantly higher than USD2.4 billion in Europe and USD3.9 billion in Asia-Pacific.

THE TRUST DIVIDE

North America remains a financial powerhouse, but the concentration of brand value among a few top institutions highlights deeper challenges in trust and competitiveness at the regional level.

Confidence in smaller banks is deteriorating, particularly among those heavily exposed to commercial real estate loans. The decline in office property values has led to stock price volatility, while businesses and depositors are shifting funds to larger institutions, putting liquidity pressure on regional banks. This limits their ability to invest in product innovation and customer engagement, further widening the gap between national giants and regional players.

The failures of Silicon Valley Bank and First Republic Bank in 2023 intensified scrutiny of mid-sized banks, raising concerns over liquidity risks and regulatory gaps. Policymakers remain divided on whether to reinstate capital requirements rolled back in 2018. Regulators arguing for tighter oversight to prevent further instability, while bank leadership warns that excessive regulation could stifle lending and economic growth.

Canada’s banks have avoided similar volatility thanks to stricter regulatory frameworks, but frustration is growing among consumers who feel that high interest rates and slow innovation make traditional banks less competitive compared to fintech disruptors.

WHAT DRIVES NORTH AMERICAN BANKING CONSIDERATION?

In North America, brand assurance (a bank’s reputation combined with how it “meets customer needs”) is primarily driven by customer service and being easy to deal with, rather than branch networks or product variety.

When it comes to brand consideration - what influences a customer’s choice of bank - ease of use is the clear priority. Consumers expect their banks to offer the same speed and efficiency as e-commerce and tech giants, reinforcing the “Amazon Prime effect” - a demand for fast, seamless, and frictionless service.

Beyond ease of use, top factors driving consideration in North America:

- Trustworthiness – 32% of North American consumers rating banks as trustworthy. RBC ranks as the most trusted bank in the region.

- Great customer service – 24% of North American consumers recognise banks for excellent service. TD Bank stands out as the top bank for customer service, according to our research.

These drivers are different from other global markets. For example, in China - home to the four most valuable banking brands in the world - consumers place greater importance on a bank’s support for causes they care about, advanced digital banking services and the availability of ATMs and branches.

ADAPTING TO A CHANGING LANDSCAPE

Digital-first and fintech-driven banking models are reshaping the industry, with younger consumers prioritizing low fees, seamless app experiences, and tailored financial products.

The rapid rise of online banking is evident in the 159% increase in global brand value for online banks from 2024 to 2025.

To remain competitive, established banks must go beyond brand recognition and actively embrace digital innovation, strategic acquisitions, and fintech partnerships. Legacy institutions that fail to adapt risk losing relevance as a new generation of tech-savvy consumers demands speed, personalisation, and seamless financial experiences.