This article was originally published in the Brand Finance Olympics Journal 2024

Sports Services Senior Consultant,

Brand Finance

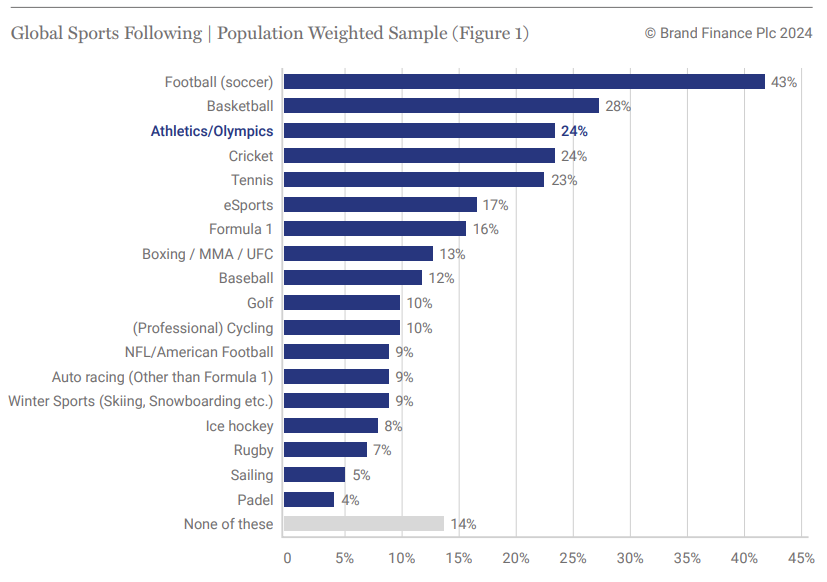

As short form video and the emergence of streaming services intensifies the competition for viewers’ precious time, the Olympics still captures public attention. Brand Finance research reveals that the Olympic games is the third most popular sporting competition in the world, trailing only football and basketball, with basketball propped up by hefty interest from populous US and China (Figure 1).

Around a quarter of the world’s adults were expected to tune into Paris 2024, either live or on-demand, making it a highly attractive sponsorable property for brands seeking global, mass brand exposure and awareness.

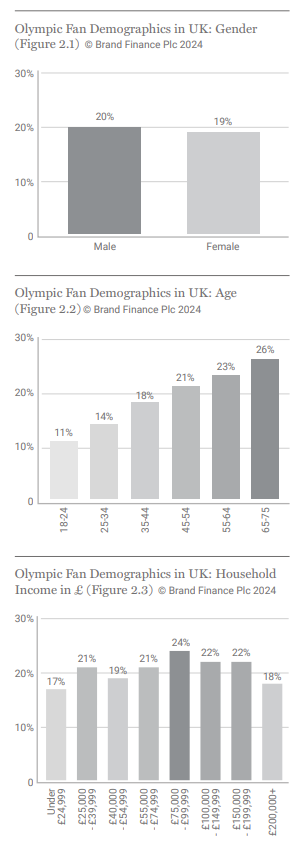

According to Brand Finance data, 20% of adults in the UK say they follow the Olympics, and this group generally skews older and more affluent (Figures 2.1, 2.2, 2.3).

The largest relative following comes from 65 – 75-year-old age group, where 26% claim to have an interest in the Olympics, as compared to only 11% of adults aged 18 - 24 who reported following the Games.

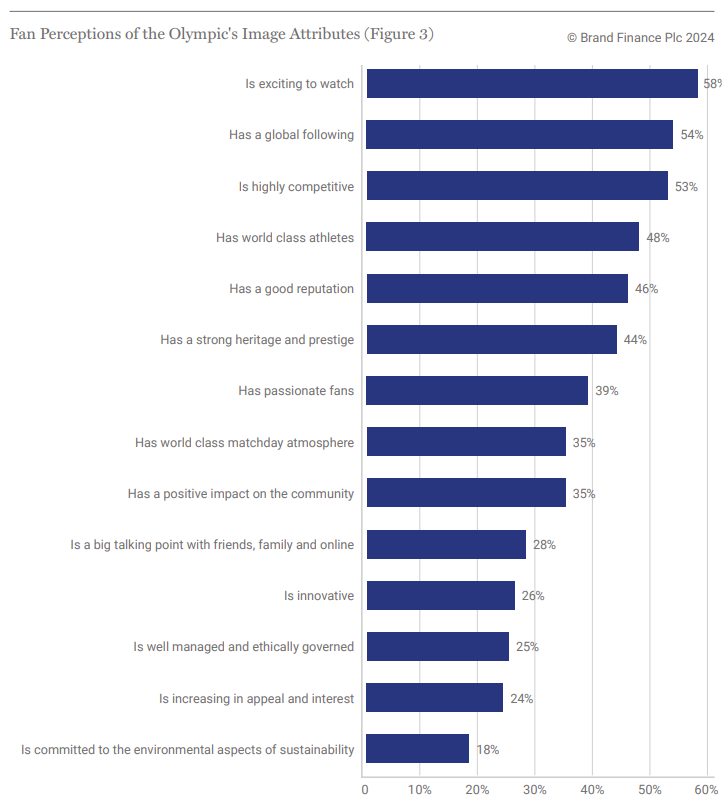

Globally, the Olympics are known for possessing strong reputational qualities (46%) and heritage attributes (44%). However, Brand Finance research shows that only 26% of respondents find that the Games are innovative, with even fewer (18%) finding them to be environmentally sustainable (Figure 3).

One reason fewer young adults follow the Olympics could be the event’s perceived harm to the environment. Although Paris 2024 aims to offset 100% of the emissions produced in the infrastructure development of the Games since 2021, it is still expected that 1.75 million tonnes of CO2 will be produced, according to the World Economic Forum.

As younger generations become increasingly environmentally conscious, major sporting rightsholders must factor in the importance of ESG credentials in the development and hosting of sporting mega-events, or risk alienating certain fan groups.

- It is a big talking point with friends, family and online

- It has a global following

- Has a positive impact on the community

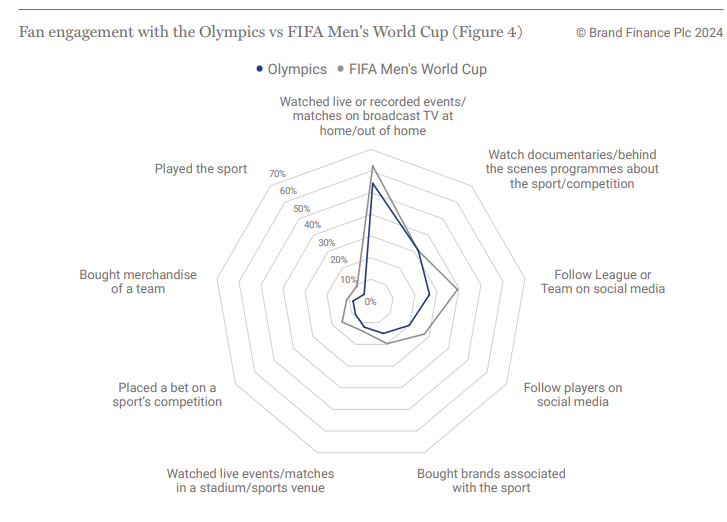

As one of the most popular sporting events globally, Olympic fans possess similar engagement behaviours to other mega-sporting events, such as the most viewed sporting competition globally, the FIFA Men’s World Cup (FMWC). Whilst live attendance at Olympic events is unsurprisingly very low (11%) due to significant global demand and limited capacity, more than 55% of Olympic fans around the world claim to watch live or recorded events, reflecting the need for extensive broadcasting services (Figure 4).

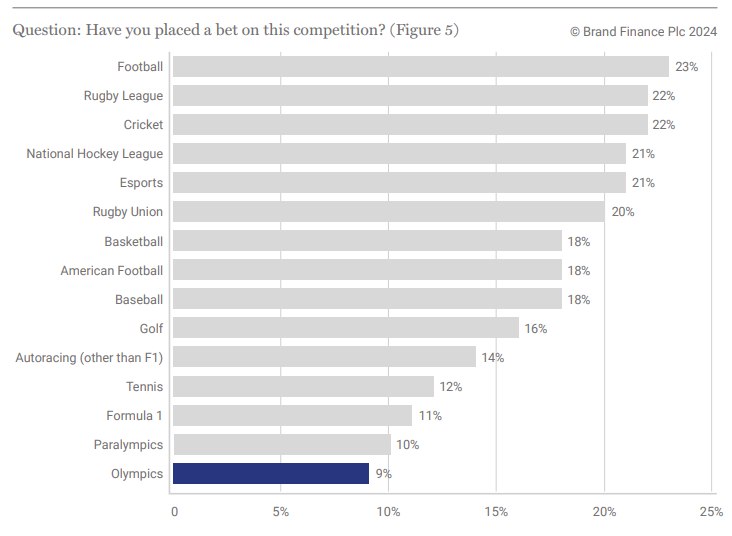

The biggest discrepancy in attributes between the Olympics and the FMWC is the athletes’ and teams’ ability to attract a steady social media following. Football players and clubs appear year-round both on and off the pitch, the 4-year cycle of the Olympics results in much less visibility for the competing athletes during non-Games years. Notable stars such as UK diver Tom Daley have become household names, but most of these athletes are unknown to Olympics fans until they make their event appearances or receive media coverage in the lead up to or during the games. The Olympics are far more popular to watch than to wager. Brand Finance Data reveals fans are least likely to bet on Olympic events than any other sporting events or league included in the research (Figure 5), with only 9% of respondents saying they’ve placed a bet in who gets the gold.

There are several reasons why the Olympics are unpopular for gambling, for instance, none of the IOC’s TOP Sponsors are betting companies. This is aligned with the previous point that the Olympics’ reputation for wholesomeness is a draw, and distance from gambling may very well be a conscious decision by event organisers to preserve the perception of purity and integrity. Although most betting operators do offer Olympic betting markets, fans appear more inclined to recline and watch the sporting excellence unfold.