This article was originally published in the Brand Finance Football 50 2022 report.

Why is tracking corporate sponsorship a critical management practice?

Brand Finance defines sponsorship as “the financial, or similar support, of any individual, company, team, activity, or event which is used primarily to achieve specific business goals through association with the rights holder. For a brand, these goals typically include building awareness and equity through positive association”.

Whilst sponsorship is by no means limited to sporting ventures, the sports sponsorship market alone was estimated to exceed to €55bn in 2021 and is expected to grow considerably over the next 5-years reaching approximately €100bn by 2027. With many corporates investing six-figures annually, the importance of rigorously managing and evaluating these sponsorships is simply a must. Yet, despite increased levels of sponsorship investment, one in four practitioners has no confidence at all in measuring business return from sponsorships whilst less than 10% said they were very confident. (Source: WARC)

To help instil confidence, and provide clear and concise structure to sponsorship tracking, Brand Finance has created a robust framework which links sponsorship activities to brand and business performance and identifies how sponsorship activities effect customer perception, acquisition and loyalty – and critically it assesses both non-financial and financial performance to provide a 360-degree view.

Setting up a sponsorship evaluation framework

Step one is to identify the core brand objectives and whether sponsorship can help achieve those objectives. Typically, this is done through mapping these objectives to brand equity measures so that performance can be tracked over time. For example, if brand awareness is the objective, putting your brand name on the shirt of a club like Real Madrid or Liverpool would certainly contribute to this result (but at what cost?).

Secondly, it’s important to have a base-line evaluation taken prior to key sponsorship activations so that there is a clear benchmark from which future performance and tracking can be measured.

Market research among the appropriate stakeholders can be used to assess successful activations and highlight where activation strategy can be adjusted to achieve the desired results. Through this, organisations can provide feedback to their brand partners to:

- Exhibit the impact of the brand partnership on fan perceptions of the partner

- Understand how sponsorship exposure affects different audiences

- Measure past activations and assist in planning and strategy for future activations

- Compare to the market and understand what works and what doesn’t

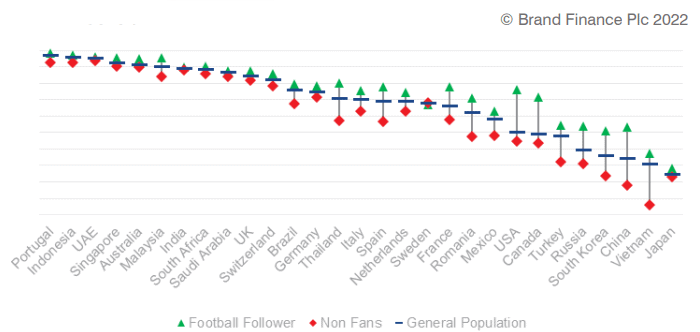

The below example examines the difference in brand consideration for Emirates, a brand that has been and remains associated with some of the biggest clubs in football. The results from our research exhibits higher levels of consideration in 28/29 markets for the airline among football fans than non-football fans.

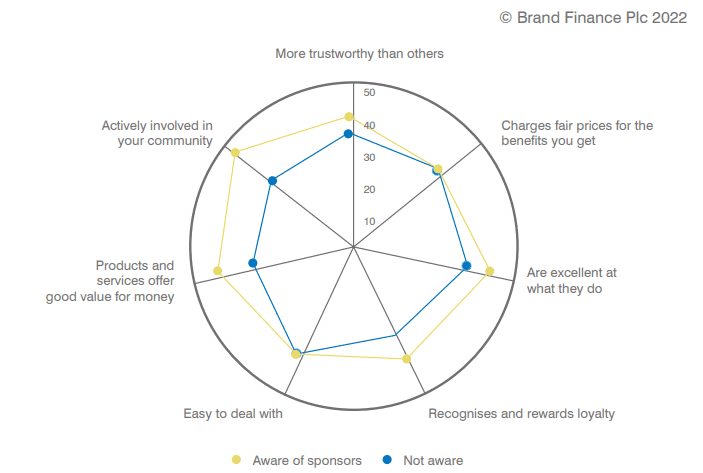

This analysis also allows brand owners and sponsorship managers to see the difference across other key brand perceptions or attributes which are often identified as key drivers of customer acquisition and loyalty.

The below example exhibits more favourable results in each attribute for a corporate brand which sits on the front of the shirt of a top-division team covered in our research.

Sponsorship uplift and return on investment

The next level of sponsorship analysis is to determine the financial return and uplift to business metrics resulting from the investment, and to be able to express this in a way that allows a brand team to communicate the partnership benefits to the CFO, CEO and Board. This requires determining the bottom-line effect, and asking the questions that would be asked if investing in a new factory or machinery asset:

- How does this investment pay back over the short and long term?

- Has this investment increased the value of the business for the shareholders?

- Are we getting good value for money?

A valuation-based approach to sponsorship evaluation provides a practical, logical, and commercially driven basis for assessment. Through an approach that establishes linkages between changes in brand equity, stakeholder behaviour and ultimately business and brand value, it provides a solid platform of insight to inform future sponsorship decision making.

There are typically two sides to this analysis:

1. Return on historic sponsorship

The return on historic sponsorship is calculated by determining whether the sponsorship has had a significant effect on consumer perceptions of the brand.

The perception changes are then used to estimate what the future customer numbers and costs would look like if the sponsorship had never taken place, all else being equal.

This can then be used to adjust the business valuation model of the partner to see how much more valuable the business is, having conducted the activities. This difference is the return on investment.

2. Future return on sponsorship renewal

Forecast customer numbers and revenue growth can be applied to a valuation model to reflect heightened consideration and perceptions associated with the sponsorship continuing.

The difference in business value with and without the sponsorship shows the future return on investment of renewing the sponsorship contract.

Building an appealing prospectus

For rights owners, packaging these key benefits derived from sponsorship into a prospectus offers a highly impactful toolkit which can be used to:

- Inform and impress existing sponsors

- Justify past and future investment

- Attract new sponsors.

To achieve this, Brand Finance focusses on the two key areas:

- Brand Evaluation – Communicating the unique attributes and brand strengths that complement the vision of a brand - How the sponsorship will improve important brand attributes.

- Value potential analysis – Quantifying the financial benefit possible from partnership – how will this impact revenue and business value?

In summary, without appropriate methodologies for sponsorship evaluation and valuation, properties are undersold by clubs, leagues and competitions, and brands are unable to appreciate the full suite of benefits that are possible from an engagement. Brand Finance has developed methodologies to express the return on sponsorship investment in a way that makes sense to both brand and financial audiences.