This article was originally published in the Brand Finance NFL 32 2025 report.

Manager, Sports Services,

Brand Finance

International expansion: Building a global footprint

The NFL’s ambition to become a truly global sport is evident in its Global Markets Program (GMP), which now includes all 32 teams across 21 international markets. This initiative grants franchises marketing rights in countries such as the UK, Germany, Mexico, Brazil, Canada, and emerging markets like Nigeria and Australia. Teams like the Los Angeles Rams have expanded into Asia, while the Miami Dolphins have targeted Latin America, including Argentina and Colombia.

International games are central to this strategy. In 2025, the NFL will host a record seven international games, including debut matchups in Madrid and Berlin, and the recently held first-ever game in Dublin. These events not only attract sold-out crowds but also generate significant economic impact for host cities—Munich’s inaugural game in 2022, for example, delivered over €70 million in local economic activity. Beyond Europe, the NFL staged its first game in Brazil in 2024 and is exploring future opportunities in Australia and the Middle East.

Grassroots development is another pillar of global growth. The league is investing in NFL FLAG football programs worldwide and supporting initiatives like the African Flag Football Championships in Egypt, aligning with the sport’s inclusion in the 2028 Olympic Games.

These efforts aim to cultivate the next generation of players and fans, ensuring sustainable international growth.

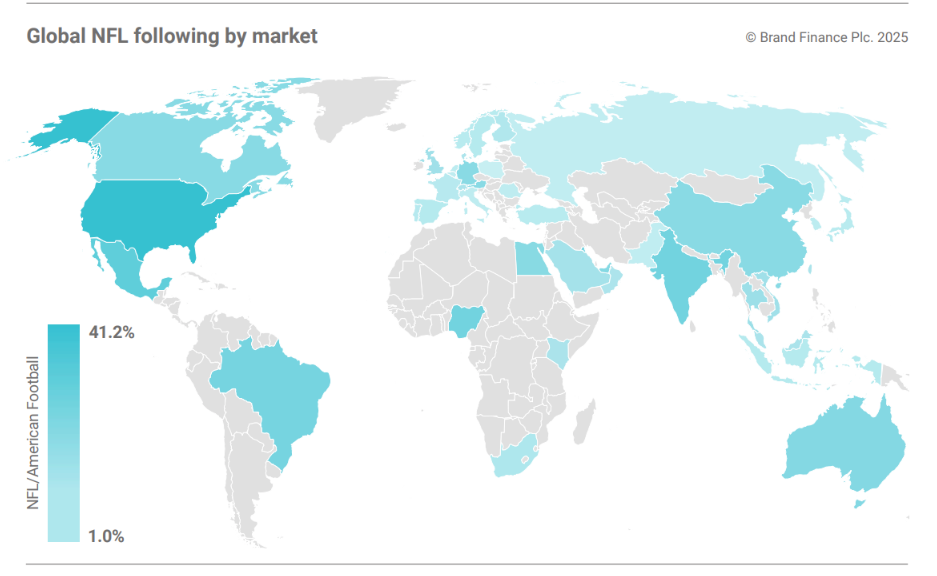

Global NFL following

The NFL’s internationalization efforts have translated into a strong following of NFL in markets around the world. Traditionally a one-nation sport, it has required the NFL to break with normal convention of home games in a home stadium, and host games abroad, to bring the game closer to new fans.

Unsurprisingly, the Americas account for the majority of NFL interest where almost all revenues are generated, although Europe is exhibiting sustained growth in interest, as well as emerging markets China and India.

Most engaged European Markets

Germany has the highest NFL following among European nations, with 8% of the population claiming to follow the sport either in-person, on TV or online. The UK and France follow closely behind, with 7% and 4% following, respectively. These are seen as key international growth markets for the NFL, underpinned by the staging of notable fixtures over the past years, expanding the reach of the sport beyond US borders.

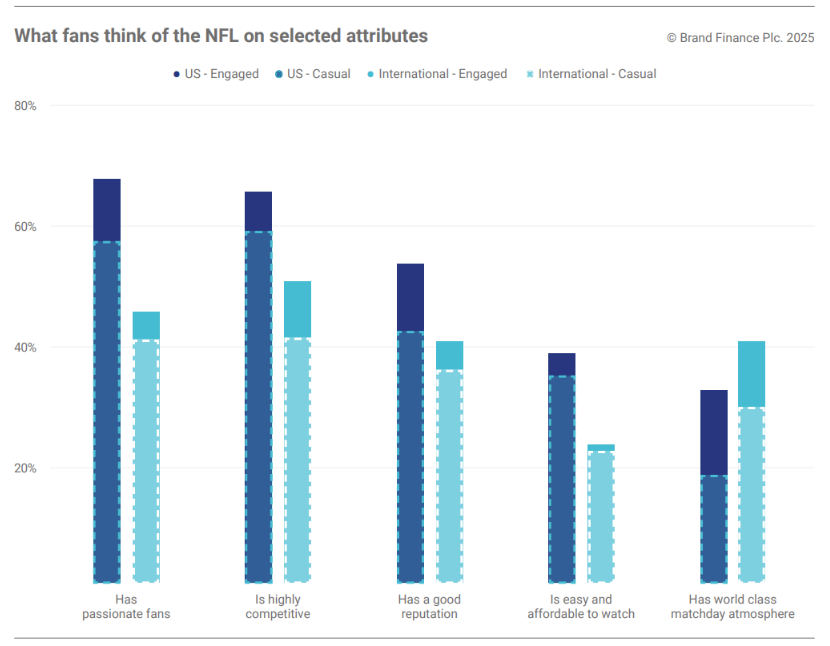

How do NFL fans abroad perceive the league?

EUS audiences who follow the NFL closely perceive the league much more favorably on key functional and emotional attributes that drive following and purchase behaviours, than international fans. This includes being easy and affordable to watch, having a good reputation and being highly competitive.

However, our data suggests that the staging of fixtures in markets outside the US is a hugely exciting proposition for international fans who want to experience an NFL game, and often for the first time. International fans who follow the NFL closely are much more likely to consider the NFL as having a “world class matchday atmosphere”. Although a relatively small proportion of overall amount of close followers of the NFL, these international audiences are highly engaged, and there is a clear demand to be brought closer to the action. This reinforces the NFL strategy to stage games outside the US – which also presents an ideal opportunity for new fans to be drawn into this passion.

Fan engagement: The engine of brand growth

Fan engagement remains the cornerstone of the NFL’s brand strategy. The league has evolved beyond traditional in-stadium experiences, embracing digital innovation to create year-round connections with fans.

For example, 36% of US NFL fans consider the league to make good use of technology to improve the fan experience throughout the season, compared to only 31% of UK Premier League fans on the same metric.

Social media platforms like TikTok, Instagram, and X (formerly Twitter) are leveraged for real-time interactions, behind-the-scenes content, and player-driven storytelling. Technology has also transformed the live game experience.

Mobile apps now offer instant replays, real-time stats, and augmented reality features, while cashless payments and in-app ordering streamline stadium visits.

Personalization is another key trend. Through data analytics, teams deliver tailored offers, exclusive content, and loyalty rewards, ensuring fans feel valued.

Community initiatives, from youth programs to social justice campaigns, further strengthen the emotional connection between teams and their supporters.

For example, whilst not causal, Brand Finance research shows that fans who rate the Kansas City Chiefs as community engaged are 20% more likely to buy merchandise from the team, and 4% more likely to attend a game.

NFL & Brand USA

The NFL’s marketing dominance is amplified by its flagship event, the Super Bowl, which remains one of the most-watched annual sporting events globally, and the most-watched single event in the USA.

Additionally, collaborations with tourism boards, such as Brand USA, have positioned the NFL as a cultural ambassador, driving both fan engagement and economic impact.

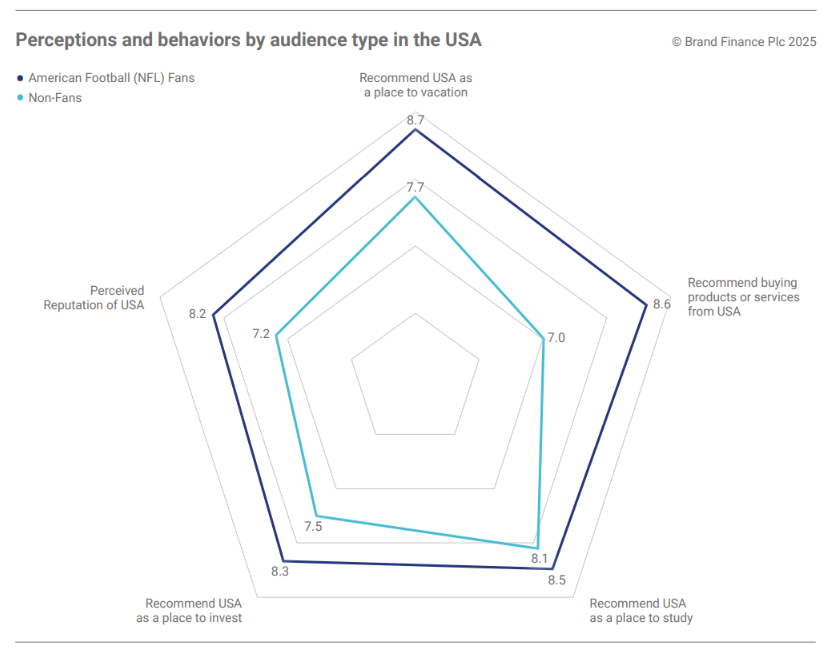

Brand Finance Global Soft Power data shows that followers of American Football (NFL) are much more likely to perceive the USA as having a greater reputation, and are more likely to recommend the USA as a place to visit, invest, study and buy products.

For city councils or tourism boards looking to attract or hold on to a franchise that’s liable to move, these improved positive behaviors are an important consideration when thinking about the return on investment of a stadium or sports infrastructure.

Conclusion

The NFL’s brand growth is no accident. It’s the result of a multi-pronged strategy combining digital innovation, personalized fan engagement, international expansion, and strategic marketing partnerships. As the league continues to globalize and diversify its offerings, it is poised to strengthen its share of voice in the global sports industry, setting the benchmark for brand-driven growth in professional sports.