Shifting habits and emerging trends

The COVID-19 pandemic has had a profound impact on alcohol consumption habits throughout the United States and Canada, resulting in significant changes in preferences and consumption patterns. As social restrictions and the closure of establishments took effect, individuals turned to online shopping and delivery platforms as a convenient and accessible means of meeting their alcohol-related needs. This shift towards digital channels not only exemplifies the adaptability of the market, but also reflects its resilience in navigating challenging circumstances. Even as lockdown measures ceased and we fully returned to normality, this transformation has persisted, highlighting the influence of the pandemic on consumer behavior.

Aside from where people are drinking, what people are choosing to drink is also changing – most notably demonstrated in the growth of the ready-to-drink (RTD) segment across the US and Canada. This rising trend aligns with the generational disparities observed, with Millennials leading the charge in exploring a diverse range of alcoholic beverages compared to older generations. The Millennial demographic specifically seeks RTD offerings that not only offer captivating flavor profiles but also prioritize lower sugar content, reflecting their preferences for healthier options. Demand for low or no-alcohol alternatives has also surged, reflecting the changing attitudes towards alcohol consumption overall.

In Mexico, the alcohol industry has also experienced significant changes in recent years. The country is known for its rich heritage in producing traditional alcoholic beverages like tequila and mezcal. However, in addition to these iconic spirits, Mexican consumers are now exploring a wider variety of alcoholic beverages. Craft beer, for instance, has gained popularity among the younger generation, with an increasing number of microbreweries and beer festivals emerging across the country. Furthermore, Mexican wine production has been steadily growing, with vineyards in regions like Baja California producing high-quality wines that are gaining recognition both domestically and internationally. These developments in the Mexican alcohol sector reflect the evolving preferences and expanding market for alcoholic beverages in the country.

Declining beer and wine sales in Canada

The Canadian alcohol market has experienced a notable transformation in recent years, marking a departure from the longstanding dominance of beer as the preferred beverage of choice. While beer sales once enjoyed consistent growth, the past decade has witnessed a decline in its popularity, mirroring shifting consumer preferences. The volume of beer sold per person in the fiscal year ending March 2022, dropped to its lowest point since records began in 1949 (1). In parallel, the wine industry has faced challenges, also recording a downturn in sales. However, amid these changes, the market share of ciders and coolers has experienced an upward trajectory. These evolving dynamics underscore the need for industry players to adapt and respond to the changing landscape of consumer preferences in the Canadian alcohol market.

Despite the challenging sales landscape, the Canadian government has realized noteworthy revenue streams through the regulation and sale of alcohol. The government exercises control and distribution through provincial liquor boards, which serve as substantial revenue generators for the government. For the fiscal year ending March 2022, the Canadian government earned a total of CAD15.2 billion in revenue from the sale of alcohol and recreational cannabis, with CAD13.6 billion from alcohol sales alone (2).

The resilient whiskey market

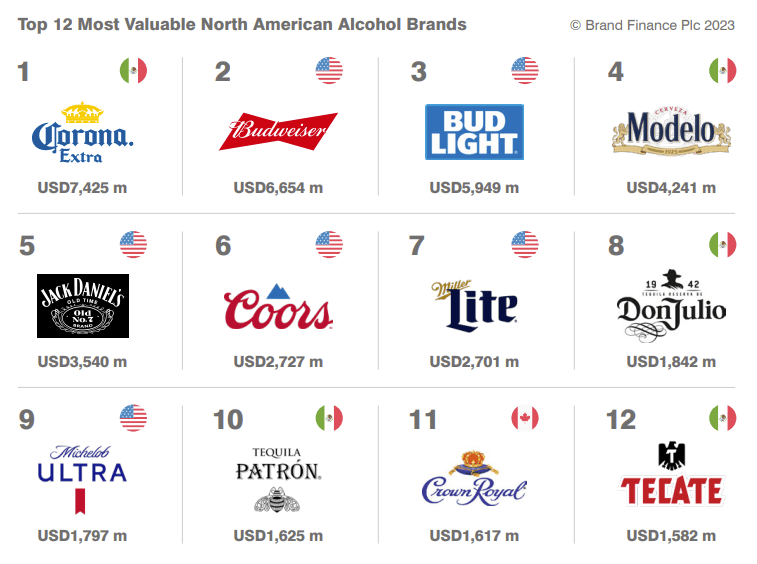

Whiskey holds a prominent place in American and Canadian culture, captivating consumers with its distinct characteristics and historical significance. As the whiskey market evolves, brands face the challenge of staying relevant amid new competitors and shifting preferences. Legacy brand Jack Daniel's has successfully navigated this changing landscape, reflected in its strong position as the 5th most valuable alcohol brand in North America with an impressive 21% increase in brand value this year to USD3.5 billion. Jack Daniel's embodies the enduring appeal and widespread admiration for American whiskey. Similarly, Canadian whiskey brand Crown Royal has made its mark, ranking 11th among the top 10 brands in the region, with a brand value of USD1.6 billion.

Factors such as the rise of premium cocktails, the influence of bartenders, and the popularity of American-inspired cuisine have contributed to whiskey's resurgence. American whiskey's accessibility, flavored variations, and presence in the craft movement have also propelled its mainstream success. Furthermore, the industry continues to adapt, honoring whiskey's rich heritage while embracing evolving consumer tastes.

[1] https://www150.statcan.gc.ca/n1/daily-quotidien/230224/dq230224a-eng.htm

[2] https://www150.statcan.gc.ca/n1/daily-quotidien/230224/dq230224a-eng.htm