This article was originally published in the Brand Finance Banking 500 2024 report

Strategy & Sustainability

Director,

Brand Finance

Strategy & Sustainability Consultant,

Brand Finance

A commitment to sustainability is increasingly seen as a business imperative, with stakeholders expecting environmental, social, and governance (ESG) action. Brand Finance's Sustainability Perceptions Index quantifies the value of sustainability perceptions and the risks that can arise from a gap between those perceptions and actual performance.

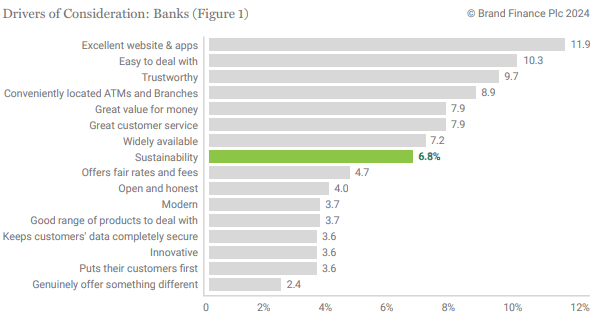

Sustainability as a Driver of Consideration

In retail banking, our research shows that sustainability drives 6.8% of brand consideration, relative to other attributes. Globally, it is the eighth most important attribute, as shown in Figure 1.

Though not the most important factor, this clearly underscores that sustainability plays a powerful role that can make the difference to consumer choice on the margin for most, and in a fundamental way for many. When there are millions of customers in the market, the 6.8% choice driver can amount to hundreds of millions of dollars of revenue at stake. In addition, trustworthiness, which reflects perceptions of the governance dimension of sustainability, was ranked third at 9.7%.

Regionally, sustainability’s importance in driving consideration ranges from 3.3% up to nearly 10% in regions like Middle East and North Africa and Oceania.

Certain aspects of sustainability matter more to some stakeholder groups than others. For example, banking brands generally communicate to business-to-business audiences about how they enable achievement of client ESG goals. Climate tends to be a top priority. Banks therefore may dedicate a proportion of their portfolios to climate-focused ventures. BMO (Canada) is viewed as a pioneer in this space for its client partnerships to advance net-zero transitions (World Benchmarking Alliance). By 2025, it plans to channel $239 billion in capital to clients pursuing sustainable outcomes, through a mix of environmentally and socially sustainable lending, underwriting, advisory services, and investment.

In retail banking, the link between a bank’s day to day operations and social sustainability may be easier to communicate. For example, Santander (Spain) and Scotiabank (Canada) are among banks working to remove barriers to service access, entrepreneurship, and credit. Whilst this is positioned as a sustainability/CSR initiative, these programmes assist in building a larger and loyal customer base.

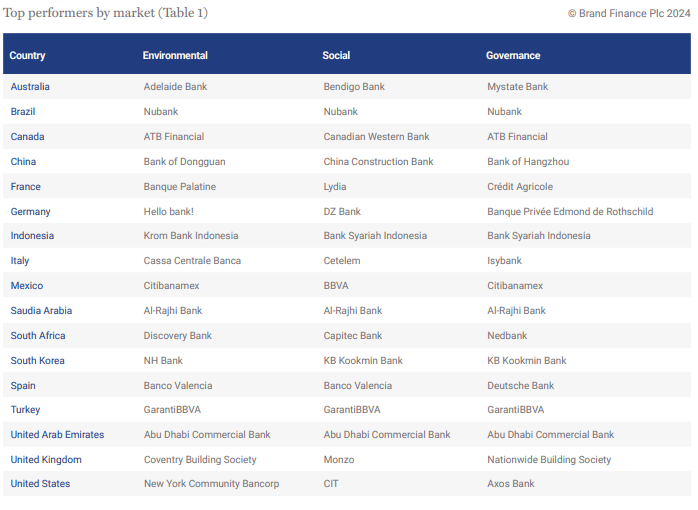

Leaders in Perceived Sustainability

The leaders in our perceptual results above have developed a clear brand positioning around aspects of sustainability. DZ Bank (Germany) anchors its messaging on sustainability as an extension of trust and transparency with its corporate and institutional clients.

Banco Valencia, now merged with Caixabank (Spain) is similarly positioned as stakeholder-centric, stating a vision to offer “banking at the service of social challenges.” NH Bank (South Korea) builds its perceptions through business touchpoints linked to environmental sustainability as an agricultural bank. It works to increase the welfare of agricultural areas and reach underserved low-income and rural segments. Connecting environmental sustainability to livelihood and economic outcomes demonstrates an integrative approach to sustainability communications.

Worth noting in these results is the presence of digital banking platforms, emerging to offer a seamless and accessible banking experience to all. These platforms—such as Nubank (Brazil), Lydia (France), Hello bank! (France), Cetelem (France), Isybank (Italy), and Monzo (UK)— take top ranks in all dimensions of sustainability perceptions.

On environment, perhaps the lack of physical presence shapes consumer perceptions of a digital bank’s lower climate impact. Social sustainability is most apparent from the business model that uses digitisation to remove barriers to financial services. Perceptions of adequate data security through online platforms would support the governance dimension.

The Sustainability Perception-Performance Gap

Perceptions need to be backed by actual sustainability performance if a brand hopes to maintain credibility. In quantifying both, we place a financial value on the value to gain or value at risk—a gap—based on relative brand sustainability perceptions and performance. When performance exceeds perception, there is an opportunity to capture value by improved sustainability-related communication. Conversely, perception exceeding performance indicates a reputational risk as observed with greenwashing, where value is at risk without sufficient action to manage performance. A positive sustainability gap value indicates that there is still room to communicate more consistently and clearly about brand sustainability efforts.

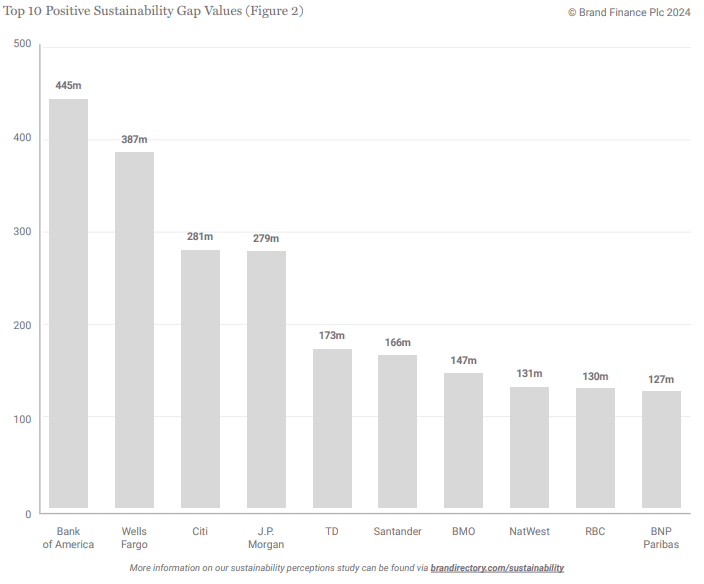

Figure 2 depicts the top 10 largest positive gap values for banking brands in the latest Sustainability Perceptions Index.

On environmental sustainability, Bank of America (US) is notable for its above-average performance, but perceptions in this dimension are below average. The company’s net-zero target for 2050 reflects best practice by encompassing not only its operational emissions, but its financing and supply chain. Bank of America also has committed to deploy $1.5 trillion of sustainable finance by 2030 jointly addressing environment and inclusive social development. The bank is also among national corporate leaders in issuing ESG-themed bonds. It may be the case that, perceptually, these efforts are less visible or relevant to a consumer audience.