This article was first published in Emerging Europe's Investment Promotion Report 2024.

Place Branding Director,

Brand Finance

How can the countries of emerging Europe turn their perceived appeal into impact on the global stage?

Understanding the relationship between perceived investment attractiveness, the ability to leverage those perceptions to bring investors across the line, and finally the tangible results in terms of FDI inflows, is the foundation on which investment attraction agencies can chart impactful strategies.

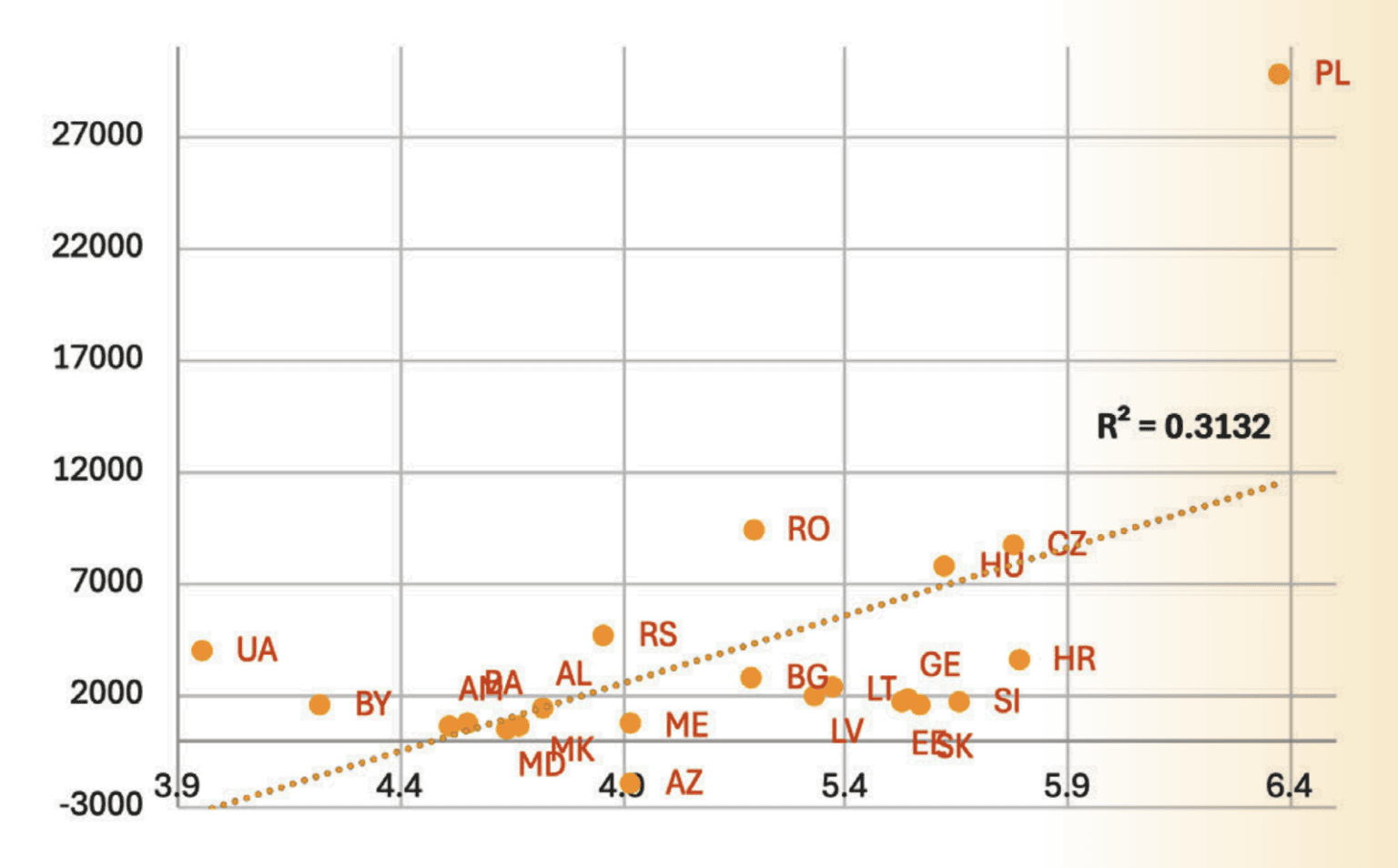

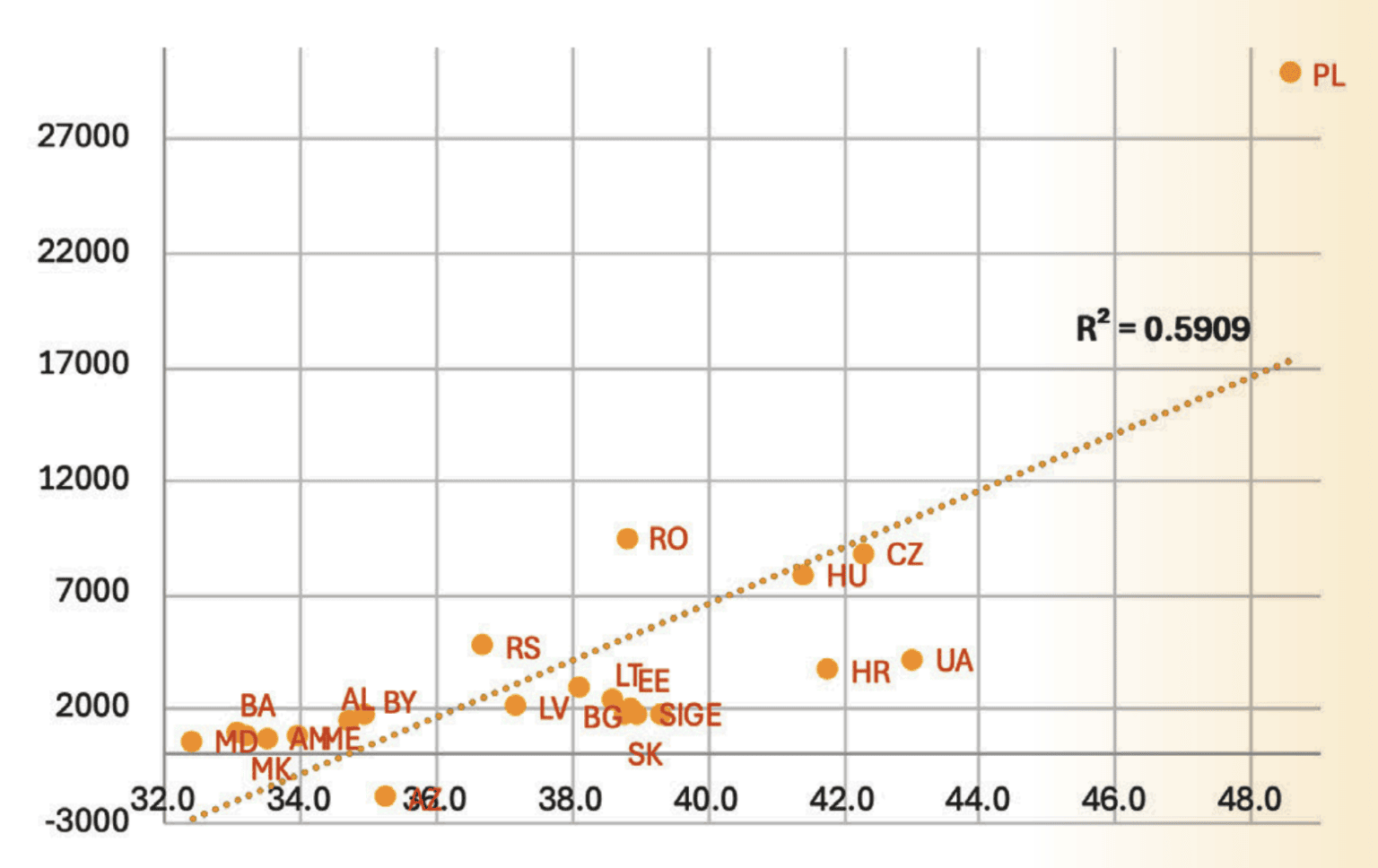

The graphs below provide a visual representation of the relationships between perceived investment attractiveness, Soft Power and an average of FDI inflows for the past three years (2021-2023) in US dollars (millions) for each of the 22 countries of emerging Europe in our analysis.

The strength of the relationship between these two indicators and FDI inflows can be quantified using the coefficient of determination, R2.

Investment attractiveness and FDI inflows

Graph 1 indicates that there is—naturally—a strong relationship between the perceived attractiveness as an investment destination and FDI inflows.

The R2 value for this graph indicates that 31 per cent of the variance in FDI inflows across emerging Europe can be explained by the willingness to recommend each of the 22 nations as destinations to invest in.

Poland (PL) leads as a significant outlier with a high recommendation score of 6.4 and substantial FDI inflows, accounting for over a third of the total for the region, but the scale of its lead over the rest of the pack points to other factors having a stake in its success, from its economic clout to its diplomatic influence.

Croatia (HR) has the second-highest recommendation score of 5.8 but lower FDI inflows compared to its peers. This can be linked to its strong tourism sector, which enhances its nation brand but may deter investment in other sectors.

Ukraine (UA) scores lowest for recommendation to invest in, unsurprisingly so given the ongoing Russian aggression. At the same time, it still commands relatively high levels of FDI inflows compared to peers, demonstrating that negative perceptions can be challenged through a targeted strategy.

This shows that while the perceived investment climate is relevant, other factors significantly influence FDI inflows.

Among those, key roles are certainly played by policy factors, such as fiscal regime and bureaucratic processes, as well as by infrastructure factors, such as connectivity by road, rail, sea, and air.

Nevertheless, our analysis demonstrates that other factors connected to the country image—that go beyond investment attractiveness as such—are equally important.

Soft Power and FDI inflows

Brand Finance’s Global Soft Power Index is a complex scorecard based on an annual global survey of more than 170,000 respondents in more than 100 markets around the world, assessing nation brands across 55 metrics.

It takes into account perceptions of business, diplomacy, culture, governance, technology, and sustainability, among others, but - crucially - it goes beyond measuring reputation or attractiveness alone and asks respondents about perceived influence of nations around the world.

While still measuring nation brand perceptions, it is geared to quantify a nation’s ability to turn appeal into impact on the global stage and provide that missing link to understand the relationship between perception and performance.

Graph 2 illustrates the relationship between the Global Soft Power Index score and FDI inflows. The R2 value indicates that approximately 59 per cent of the variance in FDI inflows in emerging Europe can be explained by the nations’ Soft Power.

This is a relationship nearly twice as strong as that between perceived investment attractiveness and FDI inflows. It can therefore be inferred that perceived investment attractiveness is responsible for close to one-third of variance in FDI inflows in the emerging Europe region, with another nearly one-third explained by other aspects of the nation brand and its influence as captured by the concept of Soft Power, and the latter one-third down to factors unconnected to the nation brand.

So what?

While perceived investment attractiveness is relevant, it is not the sole determinant of FDI. There are more objective factors at play—such as policies and infrastructure.

However, there are also other aspects of the nation brand—which can be easily overlooked by investment promotion agencies as falling beyond their traditional remit—that also play vital roles.

Therefore, looking at your nation brand as a whole rather than at investment attractiveness alone, and understanding its Soft Power—perceived influence rather than only reputation, can really set you up apart from competitors and yield improved results.

This article was first published in Emerging Europe's Investment Promotion Report 2024.