This article was originally published in the Brand Finance Africa 200 2025 report

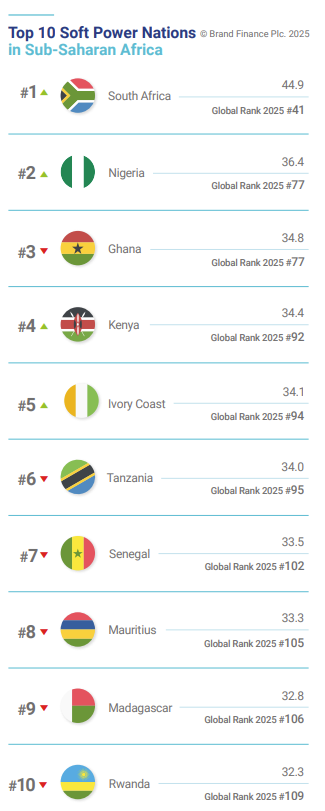

Brand Finance defines Soft Power as a nation’s ability to influence others through attraction and persuasion, rather than coercion. In the 2025 Global Soft Power Index, 49 nations from Sub-Saharan Africa feature, but only six nations rank in the top 100. South Africa leads in 41st position, followed by Nigeria, (77th), Ghana, (90th), Kenya (92nd), the Ivory Coast (94th), and Tanzania (95th).

In the 2025 Index, few have made statistically significant gains, while the concentration of lower rankings reflects the ongoing challenges many Sub-Saharan nations face in projecting a strong global image. A recent study by Africa No Filter and Africa Practice1 underscores how negative media portrayals of African nations can deter foreign direct investment, limit tourism, and potentially reduce development aid, ultimately hampering their economic growth.

The study highlights the urgent need to move beyond harmful stereotypes in reporting on Africa. Now is the time for African nations to shape their own narratives and strengthen their Soft Power. By developing comprehensive nation branding strategies - grounded in data and delivered through effective communication - these nations have the potential to enhance their global image and expand their international influence.

South Africa: Sub Saharan Africa's most influential Soft Power player

South Africa has recorded the highest rank overall among Sub-Saharan nations and entered the top 30 globally for Familiarity and Influence, highlighting its growing recognition and salience. The nation has seen strong growth in terms of Soft Power this year and has made notable progress in in five key pillars, including Business & Trade and International Relations, highlighting its multifaceted efforts to strengthen international standing and bolster global appeal.

In 2025, South Africa climbed five places in the ranking for its ‘strong and stable economy’ and 11 places for ‘products and brands the world loves,’ underscoring the growing appeal and competitiveness of South African products on the global stage. According to Brand Finance data, the total value of South Africa’s top 100 most valuable brands rose by 3% to ZAR689 billion in 2025, highlighting the continued resilience and rising consumer confidence in the nation’s leading brands.

When comparing South Africa's education system to those of other developing nations in sub-Saharan Africa, global respondents view South Africa as a regional leader in Education & Science. South Africa ranks 55th globally for its ‘strong educational system’ followed by Mauritius in 92nd, Namibia in 96th, and Kenya in 98th.

However, domestic respondents have a less favourable view, ranking South Africa lower at 68th for its ‘strong educational system,’ reflecting weaker perceptions within the country. This difference highlights that South Africans are more acutely aware of the system’s challenges, such as overcrowded classrooms, teacher shortages, delays in student registrations, and insufficient funding – issues that are affecting the quality of education across the country. Domestic respondents experience these issues firsthand, leading to a more critical perception.

Continued investment and reform as well as strong media stories about this progress will be key to bolstering perceptions in this pillar.

African sports leadership

One key cultural attribute where Sub-Saharan African nations stand out is in global perceptions of sports leadership. In the ‘leader in sports’ attribute, Cameroon ranks highest at 19th globally, followed closely by Ivory Coast (20th), South Africa (21st), Kenya (22nd), Senegal (23rd), and Nigeria (24th), reflecting the continent’s strong reputation for athletic excellence.

Brand Finance’s research indicates that sport can correlate strongly with perceived Familiarity and Influence of a nation. For example, South Africa, winners of the 2023 Rugby World Cup, rank 12th in Familiarity and 13th for Influence among New Zealanders, compared to 29th for both KPIs respectively among the global sample.

This example suggests that major sporting achievements, especially in globally followed sports like rugby, can enhance a country's international profile and prestige, particularly in markets where the sport is culturally significant.

Potential in tourism appeal

Introduced in the 2024 Index, the Recommendation measures offer added context to nation brand results, though they do not impact the overall Soft Power score. They reveal how likely a country is to be recommended for investment, trade, work, study, or tourism - linking Soft Power perceptions directly to performance in key sectors.

In the ‘recommendation to visit’ metric, Madagascar, Mauritius and Seychelles lead among sub-Saharan African nations and perform comparatively strongly on a global scale relative to their overall rankings in the Familiarity and Influence pillars.

The same three nations also rank the highest in the region for the attribute ‘great place to visit’. Correlation between ‘great place to visit’ and Recommendation to visit unsurprisingly holds at 98%. However, the attribute correlates nearly equally high with overall Reputation - at a rate of 92%, highlighting the close relationship between appeal as a destination and global regard. This relationship underlines that tourism remains a key Soft Power asset for the region, which could offer significant potential for further economic and reputational growth in the coming years.

Lower Reputation as a barrier to Soft Power

According to Brand Finance data, key drivers of Reputation – principally Business & Trade and Governance – remain areas of relative weakness for many sub-Saharan African nations.

Nigeria, for instance, sees its overall Reputation score limited by weaker performance in critical economic and governance indicators, ranking 155th for ‘high ethical standards and low corruption,’ and 172nd for being perceived as ‘safe and secure.’

Even higher-performing nations overall, suchas South Africa, face similar challenges. Despite its strong standing in other areas, South Africa ranks 140th for ‘safe and secure,’ while Kenya follows at 142nd. These rankings highlight that improving perceptions of safety remains a pressing priority for many sub-Saharan African nations aiming to strengthen their Soft Power.

The 2025 Global Soft Power Index highlights encouraging progress for several Sub-Saharan African nations, with South Africa spearheading this progress.

However, with over a third of Sub-Saharan countries ranking below 150, the region’s marginal status in terms of Soft Power is evident.

That said, there are signs of forward momentum: six nations feature in the top 30 for ‘future growth potential,’ with South Africa ranking ninth, signalling a growing foundation for future economic influence. In the years ahead, strategic nation branding will be key to helping these countries leverage their strengths, counter persistent stereotypes, and strengthen their international standing.