Brand Finance

Earlier this month, British American Tobacco (BAT) announced a USD31.5 billion impairment on the value of some of its US cigarette brands. The affected brands, including Newport, Camel, Pall Mall, and Natural American Spirit, will see their value on BAT's balance sheet adjusted to a finite lifetime of 30 years, resulting in a non-cash impairment charge. This signifies the first instance where a major global tobacco company has written off some of the value of its traditional cigarettes business in a significant market such as the United States.

BAT's substantial write-down highlights the challenges faced by traditional tobacco businesses in the wake of evolving industry dynamics. BAT attributes the move to economic challenges in the US, where inflation-weary consumers are shifting to cheaper brands, as well as the rise of illicit disposable vapes. Furthermore, intensifying regulatory environments and the heightened awareness of health risks have resulted in a decline in cigarette sales volumes in certain markets. These are predicted to continue to fall, with BAT adding that global tobacco industry sales volumes will be down around 3% in 2023.

Responding to change

The decision to write down the value of some of its brands was a bold step for BAT because despite the short-term pain, the reality is that the market for cigarettes is shrinking, and pretending otherwise would be irresponsible on the part of management.

In the past, failure to embrace change has decided the fate of several top brands. Blockbuster, a giant in the video rental industry with thousands of stores worldwide, failed to recognize the shift towards online streaming and mail-order DVD services. In 2010, Blockbuster filed for bankruptcy, unable to compete with the likes of Netflix. Kodak, which resisted the shift to digital cameras, suffered the consequences, filing for bankruptcy in 2012. Nokia, once a dominant force in the mobile phone industry, struggled to adapt to the rise of smartphones and the popularity of app ecosystems. Nokia's market share declined rapidly, and eventually, it sold its mobile phone business to Microsoft in 2014. These all serve as cautionary examples.

BAT's move is crucial in the context of the company consciously steering away from potential pitfalls, showcasing a commitment to survival and growth in new categories. The company is already investing heavily in alternative products, focused on vaping and oral nicotine, and wants 50% of its revenues to come from these by 2035.

Correlation between leadership tenure and impairments

Tadeu Marroco assumed the role of CEO in May 2023. Having previously served as BAT’s Finance Director, Marroco has played a crucial role in guiding the company through a transformative phase, emphasizing growth in emerging categories such as vapes and e-cigarettes.

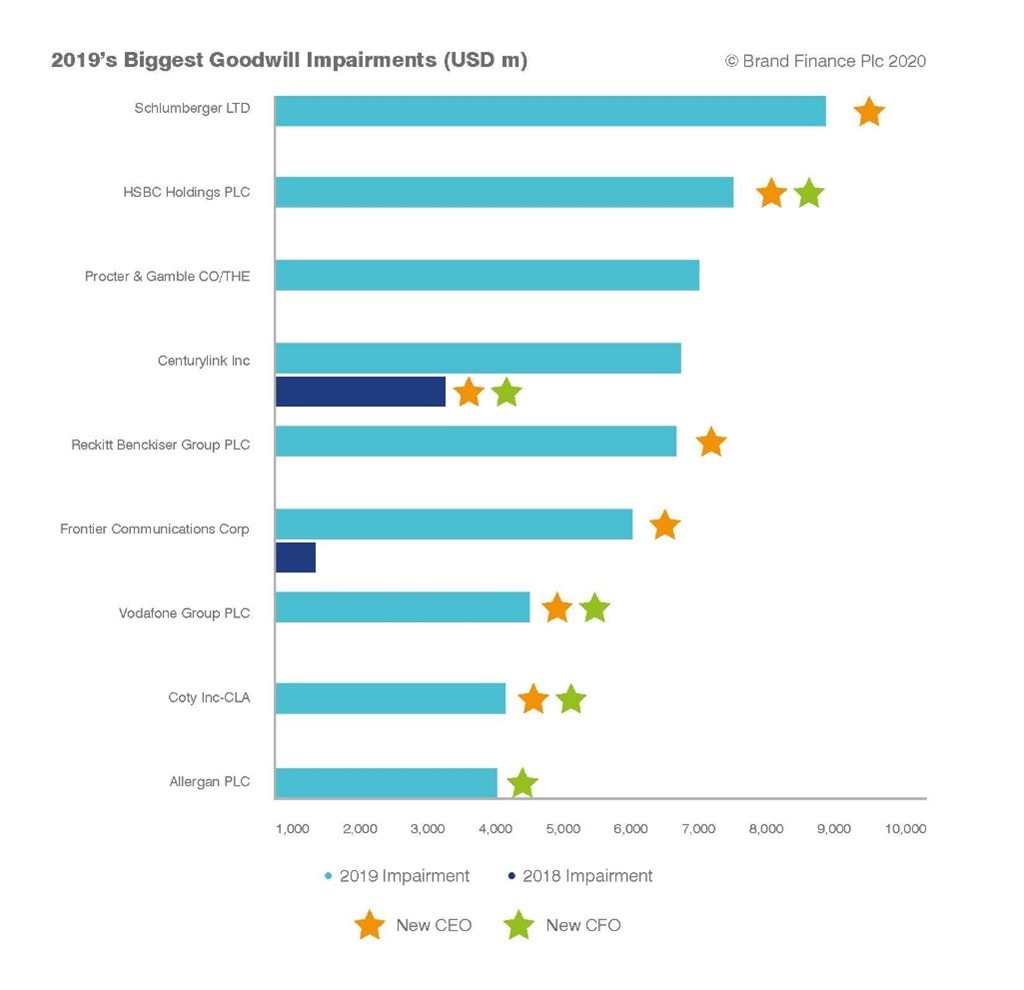

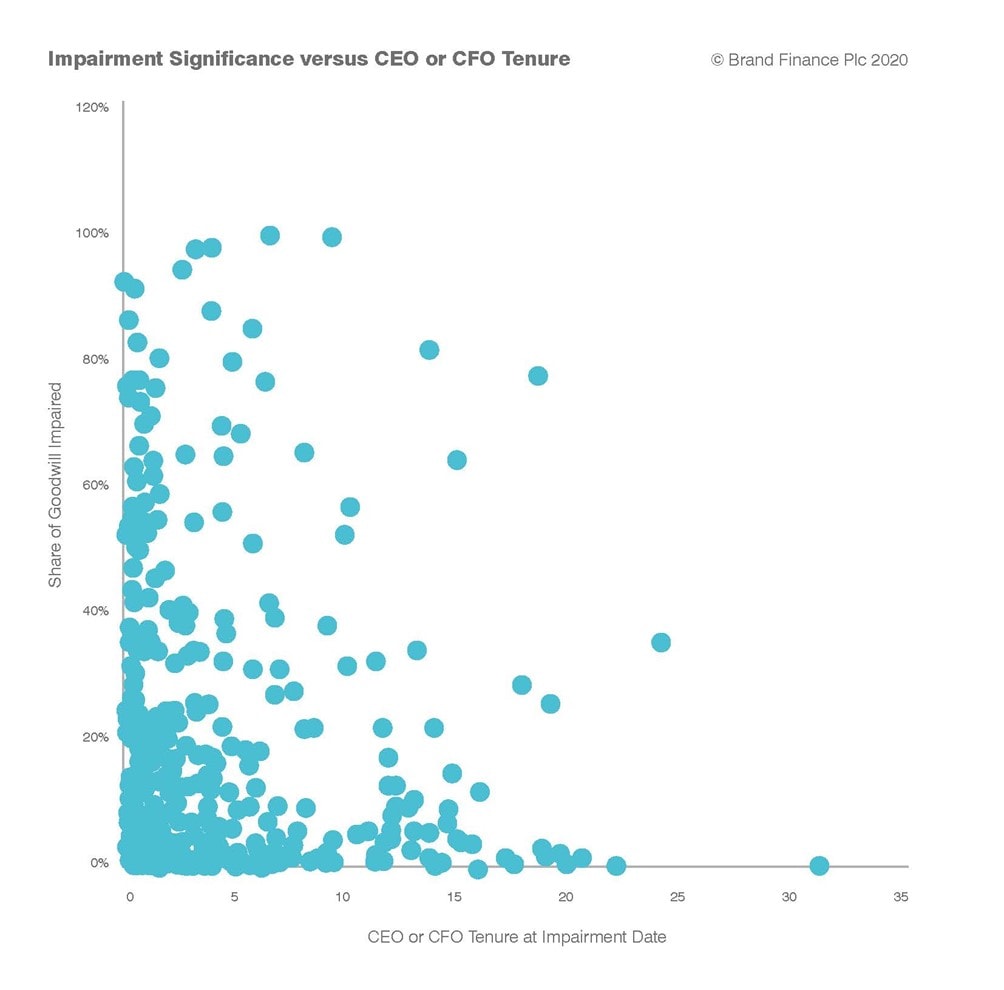

The correlation between tenure length and significant impairments is an interesting one to note. When assessing 2019's largest impairments, a common thread emerges: new leadership, as depicted in the charts below. In this context, BAT's decision is not an isolated incident but rather a strategic response to industry challenges, reflecting a broader pattern observed in companies experiencing changes in leadership.

When looking at 2019’s biggest goodwill impairments, except for Procter & Gamble and CenturyLink, all companies listed had either a new CEO, a new CFO or both in 2019. Most of these companies’ previous leaders decided to not take an impairment in 2018. CenturyLink did take an impairment in 2018, when it also had both a new CEO and CFO. Therefore, new leadership appears to have a significant impact on the likelihood a company will impair its goodwill. Among the entire sample, we found that 30% of all impairments occur within the first year of having a new CEO or CFO.

For larger impairments, where the impairment represents at least half of the goodwill carrying amount, 41% of these occur within the first year of new leadership. At best, this analysis suggests that goodwill impairment can be influenced by varying personal opinions of management personnel and their perceptions of outlook and risk. At the worst, this analysis suggests that there may be an ulterior motive within the decision to impair goodwill. By taking an impairment at the beginning of your tenure as a CEO or CFO, it helps you to a) set a precedent that suggests your predecessor was negligent/ overoptimistic about their acquisitions, or b) influence the share price to fall initially then rise throughout the rest of your tenure.

Given these insights, the timing of the impairment—just nine months into Marroco's tenure as CEO—aligns with broader trends observed in companies with leadership changes. Adding to the leadership transition, BAT has recently appointed a new Chief Financial Officer, scheduled to assume the role in April 2024.

Looking ahead

BAT's impairment announcement should be viewed as a positive and necessary step in the company's journey towards a resilient future. Rather than focusing solely on the financial implications, stakeholders should recognize the strategic foresight behind this decision.

However, the industry is consistently grappling with challenges. Plain packaging laws have notably evolved, gaining increased comprehensiveness in some countries. These regulations now extend their coverage from traditional tobacco products to encompass heated tobacco, tobacco accessories, and other nicotine-containing items. Adding to the recent developments, this month, the World Health Organization has shifted its focus to vaping, urging governments to apply tobacco-style control measures to address this emerging concern.

Therefore, BAT and other tobacco companies must proactively adapt their strategies, leveraging innovation and regulatory compliance, to navigate the evolving landscape and ensure long-term success in an industry marked by ever increasing health related safeguards and regulatory barriers.

Reprinted from Tobacco Reporter's website, original article can be found here

ENDS