This article was originally published in the Brand Finance Global 500 2024 report

Expectations for corporate sustainability action continue to build. A brand’s reputation for acting sustainably are core to its reputation. Assessing how sustainable brand are perceived to be is therefore a critical component of our flagship Global 500, which has just been launched at the World Economic Forum at Davos.

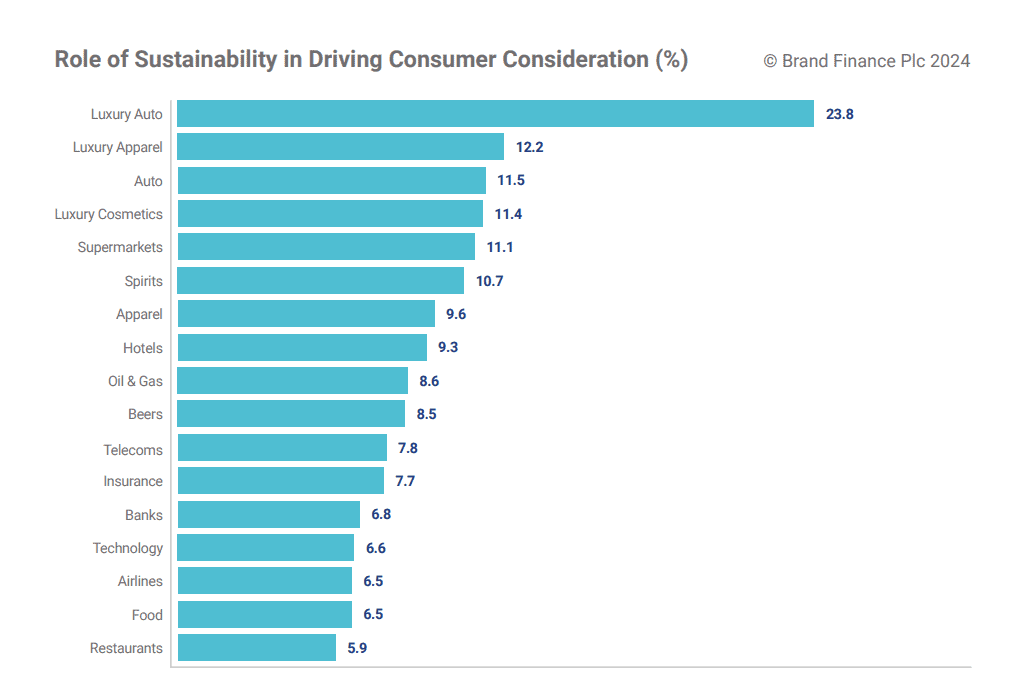

Role of Sustainability in Driving Consumer Consideration

To determine the role of sustainability, we conduct drivers analysis at the sector level, which involves running multiple correlation analyses between the consideration of usage of a brand, and the various brand attributes to determine how much explanatory value each attribute has.

We find a varying role for sustainability across sectors. For example, in fast food (restaurants) and Technology plays a less powerful role, where attributes like trustworthiness and customer service are more important. In contrast, in sectors like Supermarkets and Apparel, perceived sustainability is a stronger choice driver (11.1% and 9.6% respectively).

Perhaps the clearest trend indicated by our research however, is that there is a significantly enhanced role for sustainability in driving choice in the luxury / premium market segment. We conducted further analysis into the luxury segments of the auto, apparel and cosmetics industries, finding that sustainability driver scores are over 1.5 times higher than for the sector as a whole. How to explain this? There may be multiple effects at play, and when examining the implications of sustainability for your brand, exploring each can be important.

A brand’s sustainability commitments may imply a slight cost increase that necessitates a more premium positioning. Premium-segment consumers have a lower price sensitivity, choosing to deprioritize low prices in exchange for improvements on other attributes, including sustainability.

It is possible that the desire to purchase sustainable brands is similar across economic groups, but that more affluent consumers are more able to express this via purchase habits. However, there may be other situations in which affluence is correlated with greater awareness of and concern for sustainability related issues and how these map onto their purchases.

Further, at the premium / luxury end of many markets, brands increasingly become more than just a guarantee of attributes to the consumer, also acting as an expression of the purchaser’s status, taste, identity, or ethics to others. This is particularly true in luxury apparel and luxury auto, with driver scores of 12.2% and 23.8% respectively.

Tesla, which sits at the mass-premium to luxury end of the auto market, is a good illustration. More than any other brand, its value is underpinned by a reputation for sustainability - $17.8 billion of its $66 billion total brand value.

Purpose-driven Brands Resonate with Stakeholders

Sustainability is of course not a monolith. There are multiple, intersecting ways in which businesses can do harm or place themselves at risk. Equally there are ways that brands can actively do good. Our research this year goes further than ever before in exploring this complexity.

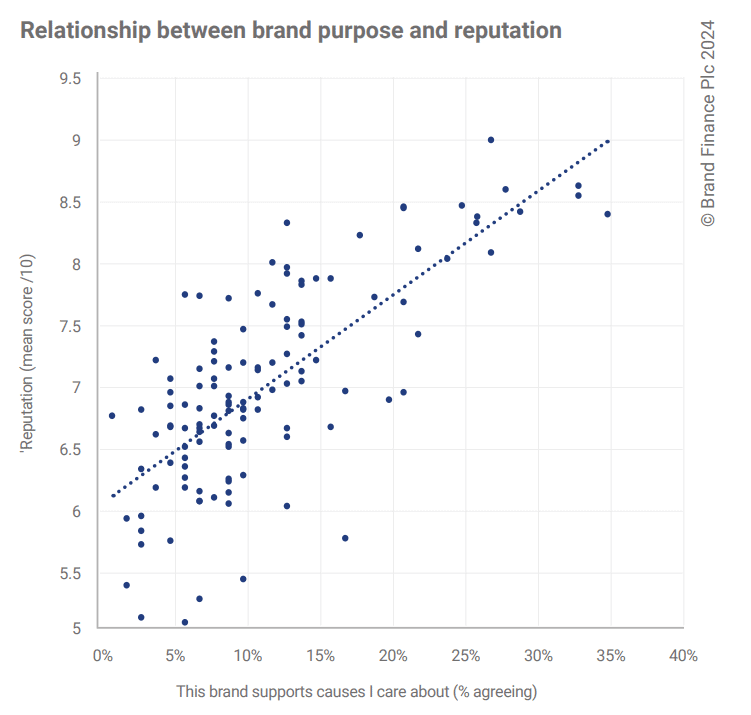

Firstly, we are able to capture the difference between brand purpose and harm reduction. In assessing purpose, we ask respondents to state whether they feel that a brand supports the causes respondents care about. Our research finds a clear correlation between this attribute and reputation. We also see a positive correlation for the avoidance and reduction of harm, however purpose appears to be a much more powerful differentiator.

Assessing the Components of ESG

As well as the distinction between proactive, purpose-led sustainability and damage mitigation, sustainability can also be broken down by thematic topic area. Our Global Brand Equity Monitor allows us to determine the relative importance of the environmental, social and governance (ESG) aspects of sustainability. This reveals significant variations from one sector to another. For example, as one might expect, the growing urgency of calls for action on climate change, and longer standing concerns about spillage (such as during the Deepwater Horizon event), mean that the environmental dimension is the most important contributor to the sustainability driver in Oil & Gas, whereas in Insurance, where fair dealing and prudent management are valued, ‘governance’ is the more important.

Tesla again serves as a good example. Our latest data shows Tesla continuing to top the table for perceived environmental sustainability in several national markets, including the US and the UK. The importance of environmental sustainability in the luxury auto market means that Tesla’s overall reputation for sustainability is high, despite the fact that in several markets, it has some of the lowest scores for the governance strand of ESG of any brand worldwide.

Despite a spectrum of values for all ESG attributes, social sustainability was had the smallest effect on consumer consideration across all sectors this year. The urgent necessity for action on climate change has meant the ESG efforts and hiring practices of many businesses have been focused strongly in that direction, to the point where many business stakeholders regard sustainability as exclusively environmental (despite the UN Sustainable Development Goals clearly spanning many social and governance topics). Governance, to combat financial misdeeds in particular, has been a priority for many years, arguably long before sustainability became a recognized term. The emergence of generative AI and its potential for misuse creates even more urgency. The resulting ‘crowding out’ of social sustainability is a concern of both sustainability professionals and community-related stakeholder groups.

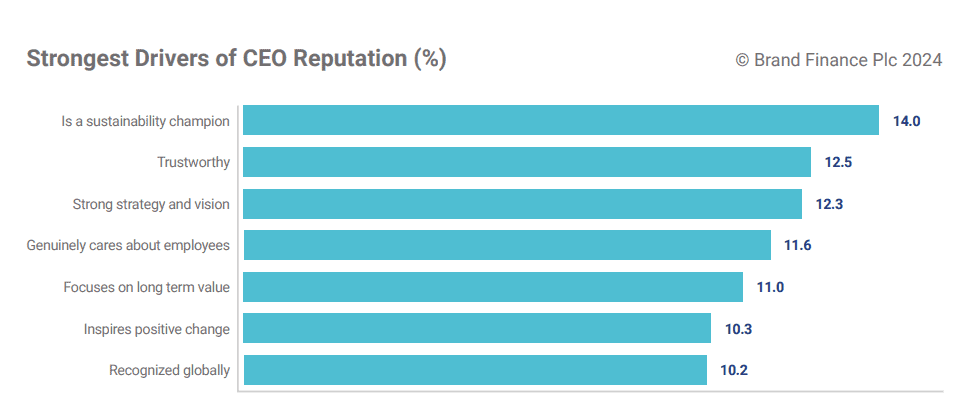

Sustainability Drives CEO Reputation

In addition to capturing consumer views and sentiments, Brand Finance also consults an expert analyst and journalist community for their views on brands and the CEOs that lead them. Amongst this well-informed stakeholder set, an even more powerful role for sustainability is apparent. Our latest Brand Guardianship Index, netting perceptions of leading CEOs, found that sustainability was the top driver of CEO reputation.

Many CEOs assume the role of sustainability champions for their organizations, utilizing their platform to drive change on select causes. In this vein, Microsoft CEO Satya Nadella fared well in the Index for net positive media coverage and perceived reputability, a position he’s built in part based on his advocacy for sustainability topics like accessible technology and mobilizing AI towards climate action. The brand overall is seen as visionary for its ESG leadership and quiet, consistent, progressive achievement. Last year’s Brand Finance Sustainability Perceptions Index found that Microsoft’s sustainability performance exceeded its perceptions. This means there is significant room for Microsoft to communicate more clearly and consistently about the good progress it has made to add value.

Our full sustainability insights on corporate brands, covering perceptions and their gap with true sustainability performance, will be available when our 2024 Sustainability Perceptions Index launches on February 19th.