This article was originally published in the Brand Finance Global Soft Power Index 2025

Strategy & Sustainability Director,

Brand Finance

Senior Strategy & Sustainability Consultant,

Brand Finance

The actions a nation chooses to take (or doesn’t) on topics like climate change, social inequality, and overseeing digital transformation are a key part of what shapes its Soft Power.

Brand Finance’s Global Soft Power Index captures this link with the Sustainable Future pillar, which evaluates nation brands on four key aspects of environmental sustainability: cities and transport, support for global action on climate change, green energy and technologies, and environmental protection.

Once again, we observe a strong correlation between a nation’s performance in the Sustainable Future pillar and its Reputation score, at r=0.90. We also find a correlation of r=0.97 between a nation’s Sustainable Future pillar score and influence in Business and Trade, and a correlation of r=0.92 with strength in International Relations.

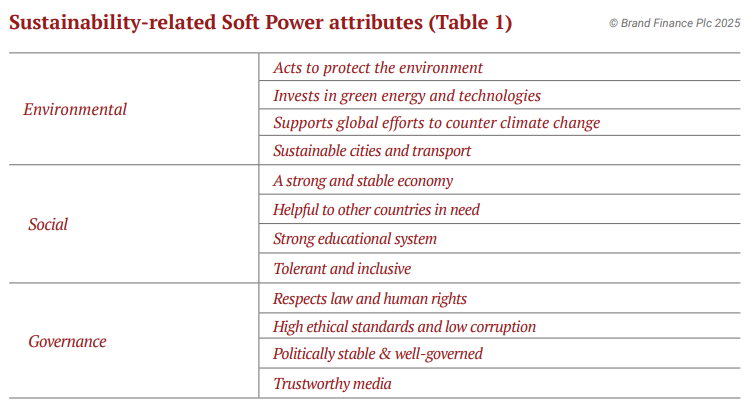

Sustainability goes beyond environmental concerns to encompass social and governance factors, too. In total, 12 attributes which contribute to sustainability (Table 1), are responsible for driving 37% of a nation’s Reputation in the 2025 Index according to regression analysis.

Sustainability perceptions leaders

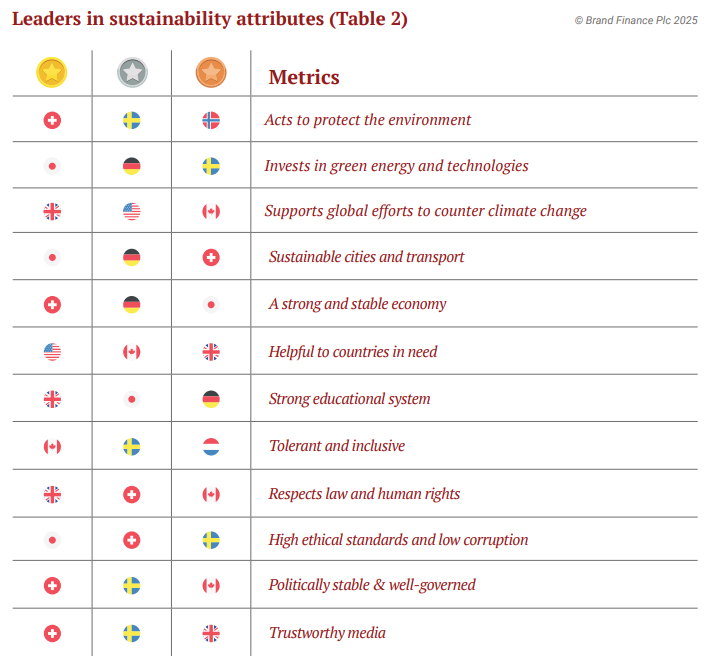

Nordic nations and Western Europe feature heavily in the rankings on sustainability attributes, along with Japan, Canada, the United States, and the United Kingdom (Table 2).

Mapping perceptions against sustainability performance

A strong reputation for sustainability is not always matched by real action. For example, the nations listed above that have the strongest sustainability perceptions have disproportionately high carbon emissions relative to many less economically developed nations. This disparity can create a reputational risk. Conversely, national actions to address sustainability do not always translate into improved perception, which is a missed opportunity to generate Soft Power.

To illustrate this, we have conducted additional analysis using the UN Sustainable Development Goals Index to quantify the divergence between sustainability perceptions and performance. The analysis highlights that many nations are not currently receiving the recognition and Soft Power benefits that they deserve based on their progress against the UN Sustainable Development Goals (SDGs).

Central and Eastern Europe as well as the Caribbean countries outperform public perception in sustainability performance. Among the top 10 are Finland, Cuba, Ukraine, Croatia, Latvia, Slovenia, and Jamaica.

These nations collectively are making strides towards the ideals of the UN SDGs, particularly in social equality, educational attainment, environmental protection, and economic growth, relative to their levels of consumption. Effectively communicating a strong sustainability position presents a significant opportunity to enhance and leverage Soft Power.

Where sustainability performance lags perception, a reputational risk exists. This mismatch is common in the many of the most economically developed nations.

These are among the nations taking the most extensive, formal steps to address sustainability. They actively communicate these efforts and have big platforms to do so.

In addition, they tend to have larger budgets to communicate the natural beauty of their landscapes to promote tourism. This creates very strong sustainability perceptions, yet their high levels of consumption and only limited real progress on environmental SDGs means that perceptions outrun progress, leading to a reputational risk.

The outlook for sustainability and Soft Power

Nations and global businesses attend the annual UN Conference of Parties (COP) in attempt to make joint commitments, share their achievements, and project themselves to the world as key players in international sustainability.

COP29 was hosted in Baku, Azerbaijan in late 2024, and while it had a bold agenda for mobilising finance to developing nations and eliciting voluntary contributions from fossil fuel-producing countries, outcomes were incremental.

Overall, the appetite for productive COPs in the years after the 2015 Paris Agreement seems to have declined, against a backdrop of increased environmental degradation, carbon emissions, and damage to infrastructure and human health from climate change.

This comes as governmental change, most notably in the US, seems to be draining enthusiasm for multilateral cooperation on sustainability.

The United States’ exit from the Paris Agreement is likely to lessen public trust in its accountability and the strength of the agreement for the other signing parties. Similarly, intentions to repeal the Inflation Reduction Act would disincentivize investment into the nation’s renewable energy markets.

In contrast, the EU continues to lead the charge on sustainability data disclosure, carbon emissions trading, and human rights due diligence. Our research underlines the fact that European countries may receive a Soft Power dividend for this continued commitment.

However, as other major nations pull away, will Europe (and many other smaller and island states) sustain their support for sustainability?