This article was originally published in the Brand Finance Global Soft Power Index 2025

Head of Research,

Brand Finance

What is Soft Power?

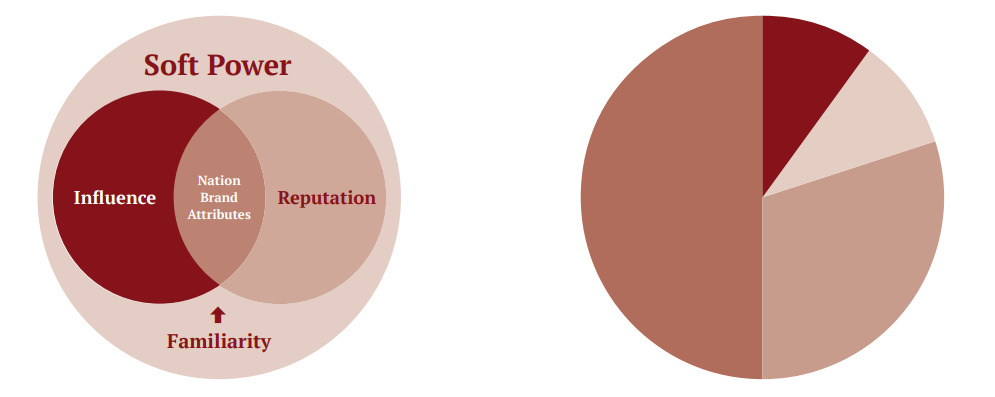

Soft Power is a nation’s ability to influence others through attraction and persuasion rather than coercion. This includes the means of culture, business, or diplomacy, rather than military force or economic sanctions. In practical terms, Soft Power is the power of perceptions which can be leveraged by nations to strengthen security as well as attract investment, trade, talent, and tourism, and in effect improve economic growth.

How is Soft Power measured?

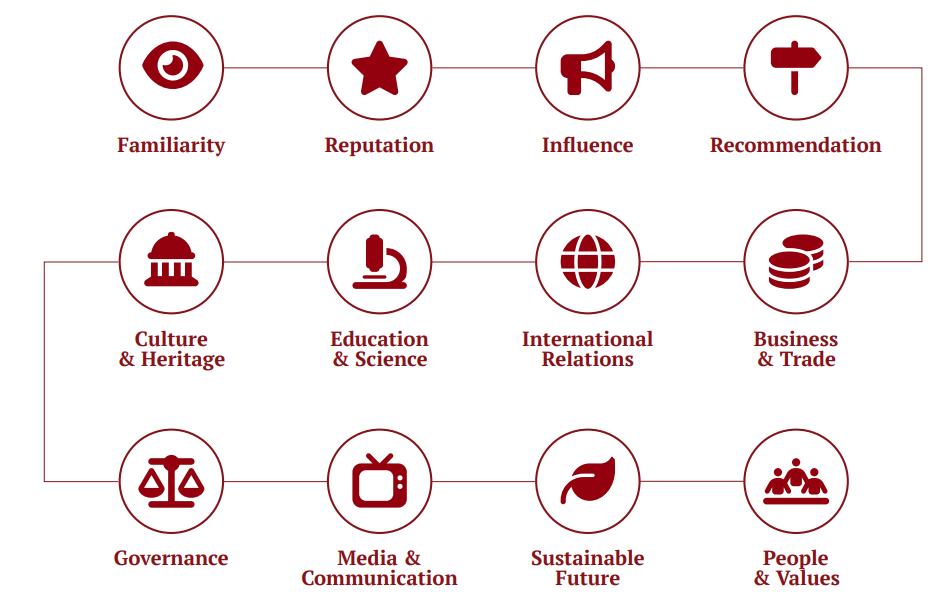

The Global Soft Power Index evaluates Soft Power through:

1. Key Performance Indicators (KPIs)

- Familiarity: how well a nation is known.

- Reputation: how positively a nation is regarded.

- Influence: how much a nation is perceived to influence other nations.

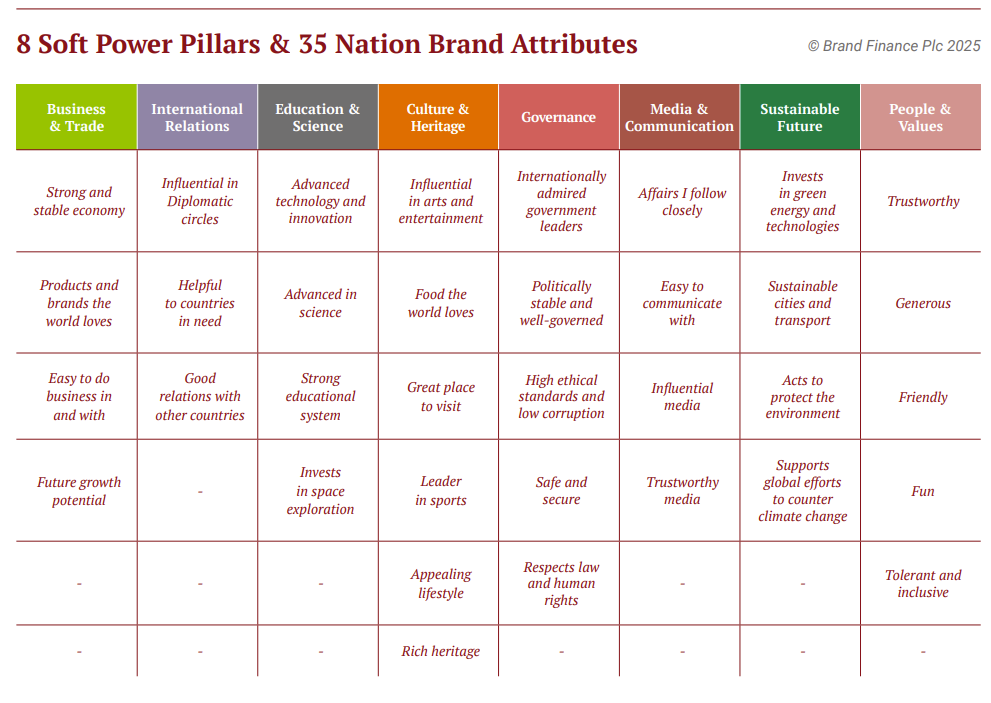

2. Eight Soft Power pillars & 35 Nation Brand attributes

Equally important are perceptions of the nation brand across key areas where Soft Power is developed and exercised. We use a comprehensive list of 35 Nation Brand Attributes divided between 8 Soft Power Pillars. A respondent-level statistical drivers analysis allows us to identify which Nation Brand Attributes are most important in shaping Reputation and Influence of nations and how perspectives differ between societies worldwide.

3. Recommendation measurement

The Global Soft Power Index survey also assesses a nation’s ability to attract investment, trade, talent, and tourism. Understanding to what extent a country would be recommended as a place to invest, trade, work, study, or visit complements the Global Soft Power Index metrics by providing a direct link between Soft Power and Nation Brand Performance in key sectors.

Evolution of the Global Soft Power Index

Now in its sixth year, the Global Soft Power Index has been appraised annually through expert consultation and data-driven analysis to ensure a robust and relevant measurement, while maintaining year-on-year comparability of results.

The Index framework was initially established with academic input from nation branding expert Dr Paul Temporal, University of Oxford, and through extensive consultation, involving qualitative interviews with over 50 practitioners and researchers of Soft Power worldwide and across several categories: academics, think-tank analysts, journalists, diplomats, nation brand managers, consultants, business leaders, artists, and sportspeople.

In the first two years, the survey covered the views of both the General Public and Specialist Audiences, such as market analysts, policymakers, and thought leaders. Given similar results across the two groups, since 2022, we have focused exclusively on the General Public, allowing for greater sample sizes and increased comparability across markets.

During the pandemic, the Index also temporarily included perceptions of national COVID-19 Response, assessing how nations navigated the global crisis. As the pandemic receded, this metric was discontinued to maintain long-term relevance of the Index.

New features for 2025

- Russia reintroduced into survey coverage

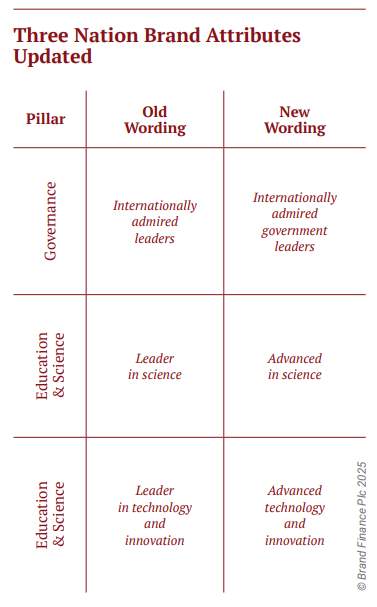

After pausing fieldwork in Russia for the 2023 and 2024 Index surveys, we have re-included the views of the Russian general public on nation brands in the 2025 survey. Undertaking opinion polling in Russia complements a holistic overview of nation brand perceptions accounting for all geographic perspectives, and provides a valuable insight into how perceptions of the outside world have changed in Russia three years on from its aggression against Ukraine. - Three Nation Brand Attributes updated

To encourage a more accurate response and a more nuanced score distribution for attribute perceptions surrounding leadership, science, and technological innovation, we made slight tweaks to the wording of three attributes. Before introducing the change, we piloted the edits in three geographically and culturally distinct markets.

Survey design

The Global Soft Power Index is the world’s most comprehensive research study on perceptions of nation brands. Based on a global sample of 170,000+ respondents across 100+ markets, the Index ranks all 193 member states of the United Nations.

The Index measures international perceptions of nation brands. Participants’ home nation perceptions are also captured and available but are not included in the Soft Power Score calculation.

Data collection

- Total respondents: 173,602

The main sample collection was conducted online between 19th September and 22nd November, with targeted market top-ups taking place from 25th November to 9th December 2024 to ensure robust global coverage and scores for all nation brands. - Markets surveyed: 102

Our sample is representative of the population of each of the 102 markets surveyed. Key markets with the largest populations and whose perspectives are of greatest interest to Index users (e.g. China, United States, India etc.) were prioritised, with samples in excess of 3,000 respondents in each market. However, samples in all markets included at least 650 respondents, with 72 of the 102 markets surveyed having a sample of at least 1000. - Nation brands assessed: 193

Similarly, in order to manage respondent workload, key nation brands were prioritised to ensure a greater number of ratings from participants for a robust understanding of perceptions. In action, this means that global powerhouses such as China, would have more exposure in the survey than a slightly smaller nation such as Ireland (i.e. nearly twice the number of ratings at the Nation Brand Attribute level within a market.

Fieldwork approach

- Developed markets - data collected via established online research panels (managed by Savanta).

- Emerging and hard-to-reach markets - data collected using digital advertising-based sampling (managed by Bolt Insight).

- Quota controls - age, gender, and geographical region - age, gender, and geographical region within each market to ensure representative samples.

Survey questionnaire

Surveys were conducted in 54 languages to ensure accessibility across markets. Each respondent was asked about a random subset of the 193 nation brands in the Index:

- Familiarity:

Is the respondent unaware of, aware of, or familiar with this nation? KPI rated on a scale (from ‘I’ve never heard of it’ to ‘I know it well’)

Only those respondents familiar with a given nation brand (‘I know this country well’ / ‘I know this country a little’) answer further perception questions in the survey:

- Reputation:

Overall, does the respondent rate the nation as having a positive or negative reputation? KPI rated on a scale (0-10: ‘Extremely negative’ to ‘Extremely positive’) - Influence:

How influential does the respondent believe the nation to be in their country? KPI rated on a scale (0-5: ‘No influence at all’ to ‘Extremely influential’) - 35 Nation Brand Attributes across the 8 Soft Power Pillars: Which attributes does the respondent associate with this nation? Score dependent on the number of attribute selections by respondents in a given market (respondents can select all that in their opinion apply)

Included in the survey, but not part of the calculated Soft Power Score:

- Recommendation: How likely is a respondent to recommend the nation as a place to invest, work, study, visit, or purchase from? KPI rated on a scale (0-5: ‘Would not recommend at all’ to ‘Would definitely recommend’)

Understanding the scores

Each nation receives a Soft Power Score, reflecting its perceptions © Brand Finance Plc 2025 across:

- Familiarity

- Reputation

- Influence

- 35 Nation Brand Attributes across the 8 Soft Power pillars

Introduced in 2024, the Recommendation measures provide additional context when analysing nation brand results but are not included in calculating the Soft Power Score.

Higher scores = More international impact and stronger perceptions.

Lower scores = Less international impact and weaker perceptions.

Weighting the scores

Each nation brand’s Soft Power Score is determined by a balanced weighting system across both market and metric inputs.

The market inputs are weighted in a way that ensures global representation while accounting for real-world influence:

- 50% – “one country, one vote” rule (ensuring sovereign equality between all markets)

- 50% – overall country population (larger markets contribute proportionally more to global scores)

- Familiarity modifier (markets with greater Familiarity with the nation brand account for a greater weight than others)

The metric weights are split equally between KPIs and Nation Brand Attributes, with each accounting for 50%:

- Among KPIs, Influence (30%) carries greater weight than Familiarity or Reputation (10% each), reflecting the action-oriented definition of Soft Power that we adopted, focused on its role in strengthening security and improving economic growth.

- Weightings given to each attribute within the Index are based on statistical drivers analysis assessing the degree to which attribute perceptions impact Influence and Reputation. This is determined annually through regression analysis on respondent-level data across key global regions.