View the full Brand Finance Beers 50 report here

Corona is the most valuable beer brand in the world, valued at US$7.0 billion

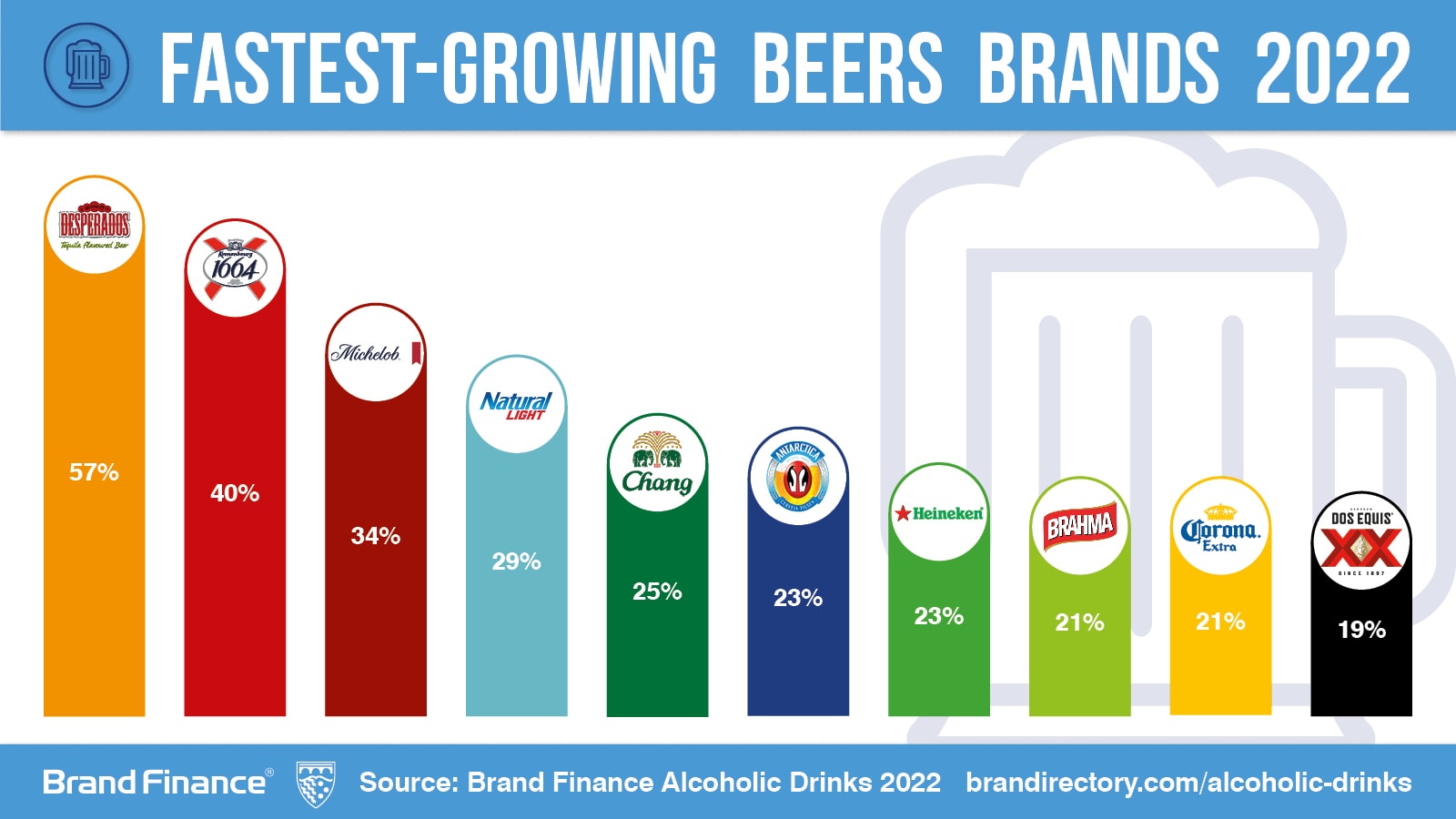

Corona (brand value up 21% to US$7.0 billion) retains its top position as the world’s most valuable beer brand, according to a new report from the world’s leading brand valuation consultancy, Brand Finance. Despite the pandemic causing many bars and restaurants to shut, and more recent supply chain constraints, the brand remains the most valuable beer brand in the world, giving the Mexican beer brand a slim margin ahead of second ranked Heineken (brand value up 23% to US$6.9 billion).

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the world’s biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. The world’s top 50 most valuable and strongest beer brands are included in the annual Brand Finance Beers 50 ranking.

Over the course of the pandemic, the Corona brand faced some challenges, particularly in the United States, as some consumers were initially hesitant to purchase its products due to its similarity in name to coronavirus. Despite the association between the beer brand’s name and a pandemic which has killed tens of millions of people, Corona has achieved 21% growth in brand value and continues to be the world’s most valuable beer brand.

Alex Haigh, Managing Director, Brand Finance, commented:

“Over the course of the pandemic, alcoholic brands have been faced with difficult conditions including fluctuating demand due to national lockdowns across the world. The reopening of the economy has driven major growth in the sector with beer brands growing by 7% year-on-year.”

Heineken narrows gap as ‘EverGreen’ brand encompasses visual identity and ESG

While Corona leads the industry as the most valuable beer brand, second-ranked Heineken has narrowed the lead with 23% brand value growth this year. Heineken’s brand is now valued at US$6.9 billion, with a rebound in the brand value of Heineken very closely correlated with the recovery of on-premises sales at bars, pubs, events and other social spaces.

Visually, the Heineken brand has long used a green label on a green bottle (with a red star and white lettering). The brand’s new ‘EverGreen’ brand strategy seeks to extend the reach of the ‘green’ connotation to include an improved brand commitment to environmental sustainability.

Brahma is the strongest beer brand with an elite AAA+ brand rating

In addition to brand value, Brand Finance determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors. Brahma (brand value up 21% to US$1.7 billion) is the strongest brand in the ranking with a Brand Strength Index (BSI) score of 93 out of 100 and a corresponding brand rating of AAA+.

Brahma is an established brand in the alcoholic drinks sector since the late 1880s and is now owned by Belgian-based brewing company Anheuser-Busch InBev. The brand is a part of a larger network including brands including Budweiser, Hoegaarden, and Stella Artois. The brand has carved a niche for itself with its distinctive creamy malt texture and fruit aroma. Additionally, the brand is strengthening its Brazilian identity by a partnering with Brazilian meat brand Wessel for a recent advertising campaign to promote the pairing of Brazilian barbeque and Brahma.

Brahma’s brand strength kept it ahead of Corona, with the Mexican beer brand has also secured the second position in the Brand Strength Index (BSI) evaluation. Corona climbed 4 ranks from 2021 to be the second-strongest beer brand in the world with a Brand Strength Index (BSI) score 89.8 out of 100 and a corresponding AAA+ brand rating.

Desperados is up 57% as fastest-growing beer brand

Desperados (brand value up 57% to US$564 million) is the fastest-growing beer brand this year, with very strong growth across Europe, and expansions into various African markets. The Desperados brand is being supported by the development of non-alcoholic versions (Desperados Virgin 0.0) and various online platforms such as Rave to Save and Go Desperados.

Further product launches with innovative products such as Desperados Florida Sunrise and Desperados Virgin Mojito are particularly popular in European markets, where the brand is targeted at a younger demographic than other brands in the Heineken portfolio.

New entrant Kronenbourg achieves brand value growth of 40%

Kronenbourg (brand value up 40% to US$601 million) is one of the fastest-growing beer brands in the world with a 40% increase in brand value this year. Remarkably for a very fast-growing brand, Kronenbourg is not a new challenger brand: it has a strong legacy of over 350 years and continues to innovate with its product offering and marketing.

Kronenbourg’s brand value growth is correlated with the introduction of new vegan and non-alcoholic options to increase the number of product offerings and to build the value of its brand through wider product diversification. The brand is increasing its scale worldwide by positioning itself as a premium French product in various promotional campaigns. The brand is building a strong partnership with sporting events, with its non-alcoholic beer Tourtel Twist being selected as the official supplier for the Tour de France until 2025.

View the full Brand Finance Beers 50 report here

ENDS

Note to Editors

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s top 50 most valuable and strongest beer brands are included in the Brand Finance Beers 50 ranking.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors.

The full ranking, additional insights, charts, more information about the methodology, and definitions of key terms are available in the Brand Finance Beers 50 report.

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.