View the full Brand Finance Banking 500 2023 report here

ICBC remains most valuable banking brand despite value falling 7% to US$69.5 billion

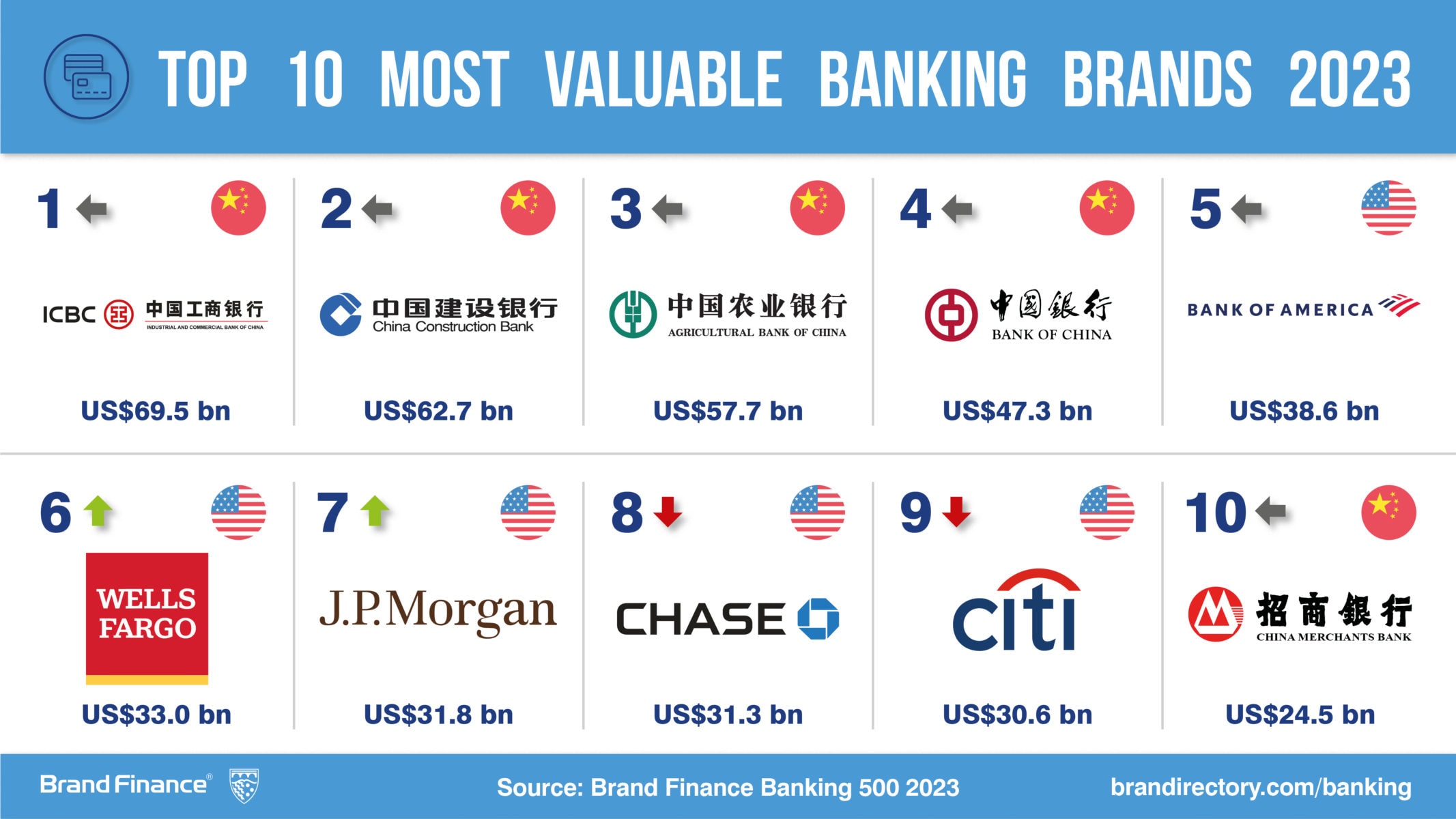

Chinese banking brands are subsiding in brand value with American brands quickly closing the gap. ICBC (brand value down 7% to US$69.5 billion) is the most valuable banking brand in the world, followed by China Construction Bank (brand value down 4% to US$62.7 billion) and Agricultural Bank of China (brand value down 7% to US$57.7 billion).

Every year, leading brand valuation consultancy Brand Finance puts thousands of the world’s biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 500 most valuable and strongest brands in the banking industry are included in the annual Brand Finance Banking 500 2023 ranking.

The Brand Finance Banking 2023 report finds several key trends in the banking industry. Rising interest rates in many markets have led to short term increases in net revenues and profitability and in addition to this, brand equity research metrics have improved, with the average reputation for the sector increasing by 0.1 points year-on-year.

Another important trend in the sector is that neo/digital banks, such as Revolut (brand value up 57% to US$194 million), have made a significant impact in the industry, entering the top 500 most valuable banking brands for the first time, with a brand value increase of 57% year-on-year.

Declan Ahern, Director of Brand Finance commented:

“Banking brands across the globe have continued to recover significantly post COVID-19. There has been an improvement in digital banking services, government stimulus measures have been relatively successful, and the rise of mobile banking and online platforms have contributed to the sectors positive performance. Accelerated by the strict global lockdowns, banking and fintech brands have innovated to create user friendly mobile application-based banking services that have led to an increase in customer satisfaction and acquisition.”

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 150,000 respondents in 38 countries and across 31 sectors. It is worth highlighting that four of the top ten strongest banking brands in the Brand Finance Banking 500 2023 report are from the African continent.

First National Bank (brand value down 3% to US$1.5 billion) is the strongest banking brand in the global ranking with a Brand Strength Index (BSI) score of 93 out of 100 and a corresponding AAA+ rating. It is one of the oldest and largest banks in South Africa, with a history dating back to 1838. FNB has a strong presence in South Africa, with branches and ATMs in many cities and towns across the country. FNB has also been recognized for its sustainable practices, receiving awards for its environmental, social and governance performance. The bank has also been consistently ranked among the top banks in on the continent in terms of innovation, customer service and trust.

First National Bank is closely followed by fellow South African banking brand, Capitec Bank (brand value down 1% to US$620,4 million) is the second strongest brand in the ranking with a Brand Strength Index (BSI) score of 93 out of 100 and a corresponding AAA+ rating. The brand offers its customers an affordable price point for online banking services making it stand out among its competitors. The brand has also strengthened its position in the sector with partnerships with established brands including a new partnership with Samsung Pay in South Africa which gives its customers access to convenient contactless payments.

Jeremy Sampson, Managing Director of Brand Finance South Africa:

“The fact that two South African banks top the global Brand Strength Index (BSI) is something for great celebration and reflects extremely well on the local banking sector”.

Nigerian banking brand Access Bank (brand value up 22% to US$462.5 million) is the most valuable brand in Nigeria. Access Holdings is making strides into the global market with plans to expand in international markets including France, Hong Kong, India, China, and UAE among others. In the African continent, the brand is expanding its cross-border banking capabilities to cater to the broader East African market.

Kenyan banking brands in the ranking Equity Bank (brand value up 37% to US$531.7 million) and Kenya Commercial Bank (brand value up 13% to US$380 million) perform well in the Brand Strength Index scores, ranking in 4th and 6th position respectively. Both banking brands have achieved growth in their brand value in 2022 and continue to grow their customer base nationally and internationally by offering new mobile banking services.

View the full Brand Finance Banking 500 2023 report here

ENDS

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance for more than 25 years, Brand Finance evaluates the strength of brands and quantifies their financial value to help organizations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes over 100 reports which rank brands across all sectors and countries.

Brand Finance also operates the Global Brand Equity Monitor, conducting original market research annually on over 5,000 brands, surveying more than 150,000 respondents across 38 countries and 31 industry sectors. Combining perceptual data from the Global Brand Equity Monitor with data from its valuation database enables Brand Finance to arm brand leaders with the data and analytics they need to enhance brand and business value.

Brand Finance is a regulated accountancy firm, leading the standardization of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671 and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.